Asia isn’t just leading the charge in global eGaming. At this point, it’s rewriting the rules. With average bet sizes that dwarf those in Europe and Latam, and a market on track to double by 2030, this region is quickly becoming the epicentre of digital betting strategy. But the opportunity isn’t one-size-fits-all. From regulatory grey zones to escalating eSports demand, Asia’s rise in prominence is anything but uniform. So, where’s the smart money going? Let’s begin with the data that’s turning heads across the industry.

The Expansion of eGaming Betting in Asia

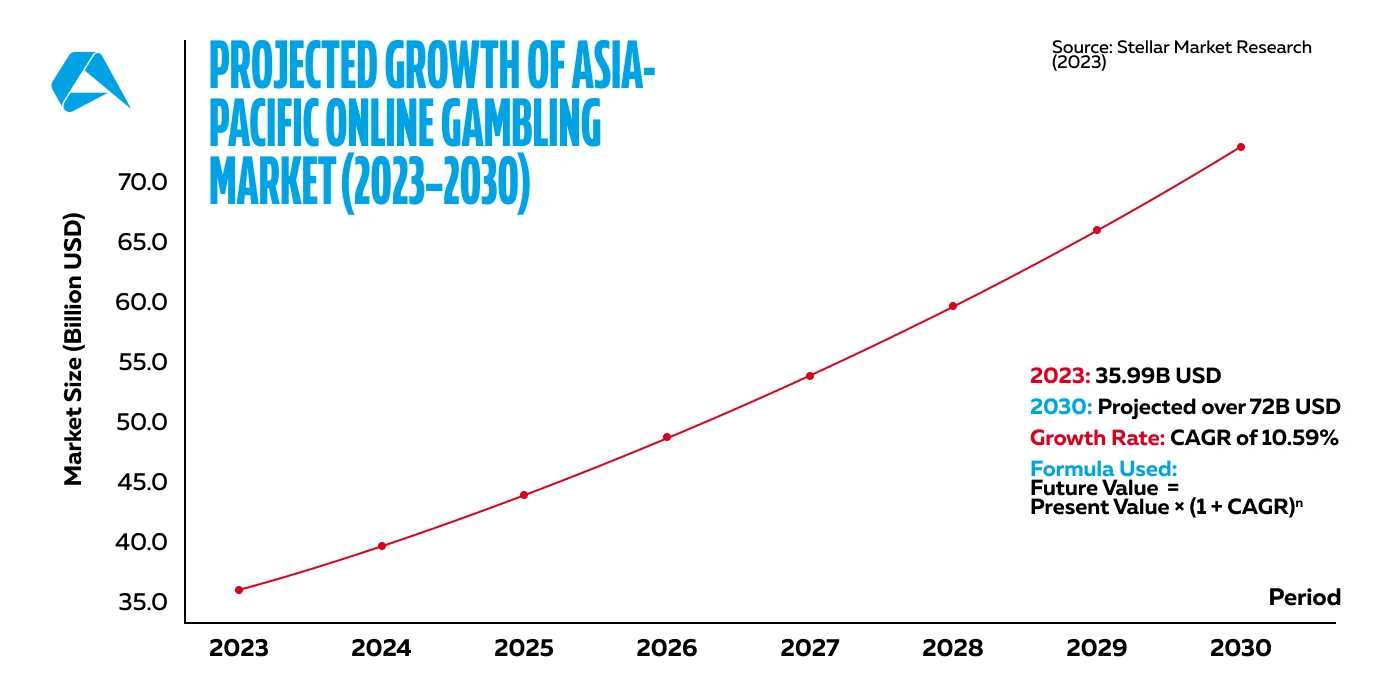

Asia’s eGaming sector is accelerating at a remarkable pace, outstripping global averages and drawing significant attention from operators worldwide. In 2023, the Asia-Pacific online gambling market was valued at approximately US$35.99 billion, with projections indicating a surge to US$72.81 billion by 2030, reflecting a compound annual growth rate (CAGR) of 10.59% over the period, according to Stellar Market Research.

This growth trajectory builds on several consecutive years of upward movement, suggesting that Asia’s digital betting sector is not only expanding but also maturing at speed. The valuation includes a broad spectrum of verticals, spanning online casino platforms, sportsbook operations, live dealer experiences, and a fast-developing esports betting segment. Together, these components reflect the scale and diversification of the market, where product variety continues to deepen alongside user demand.

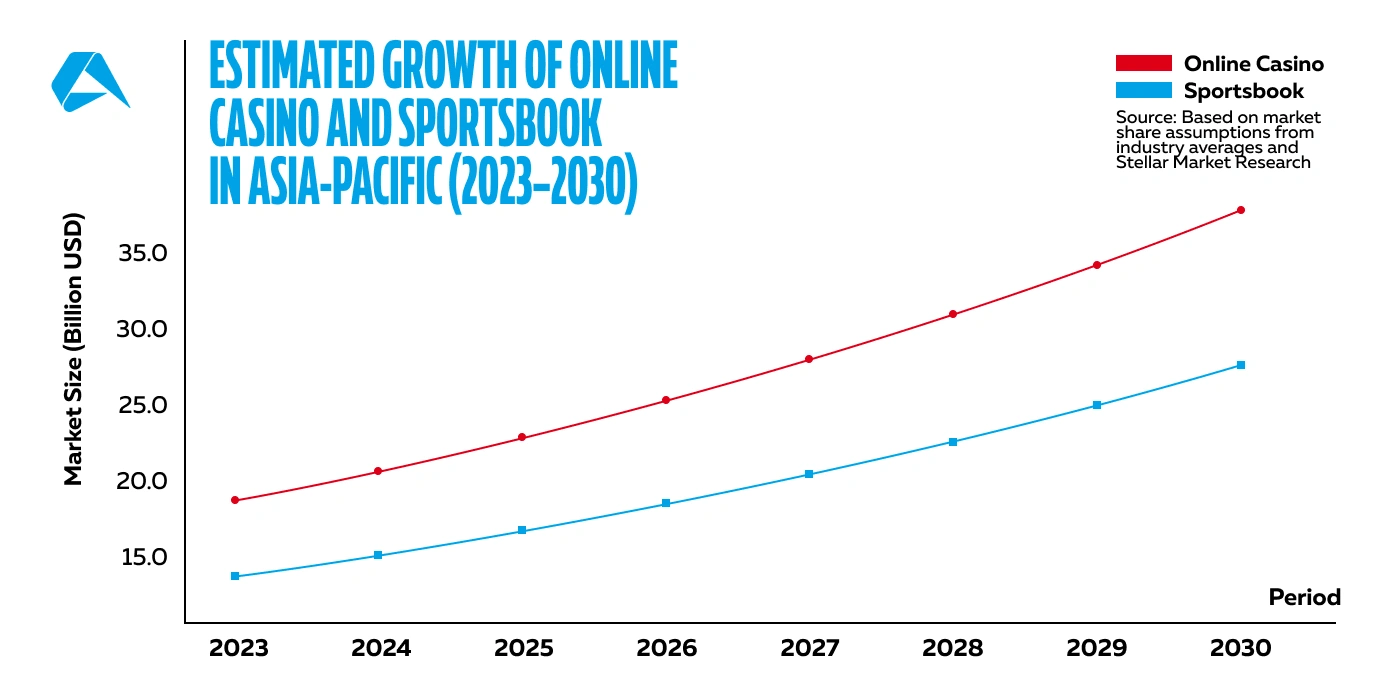

Nowhere is this diversification more apparent than in the rise of online casino and sportsbook verticals, which have become core drivers of digital betting revenues across the region. Unsurprisingly, these segments are significant revenue drivers within Asia’s digital betting sector, with operators reporting steady year-on-year gains for both. Live casino formats, in particular, have surged in popularity. At the same time, sportsbook growth has been fuelled by demand for mobile-first, in-play betting experiences, especially around high-volume regional fixtures and international football events.

Factors Driving Growth

Asia’s eGaming ascent is underpinned by a powerful combination of digital readiness, content demand, and shifting regulatory attitudes. The foundation begins with infrastructure. Mobile internet penetration across Asia-Pacific has surged past 70%, with smartphone usage central to how consumers access betting platforms. Operators optimising for mobile-first experiences are reaping the rewards in both acquisition and retention.

At the content level, esports remains a defining force. According to Uplatform, Asia now contributes approximately 54% of global esports betting revenue, far outpacing other regions. This popularity has fuelled demand for event-specific markets, live betting formats, and regionally relevant game titles, particularly in markets like South Korea, Vietnam, and the Philippines.

This momentum, however, runs parallel to a legal environment that remains anything but uniform. Regulation remains uneven across the region, but that has not deterred activity. Some markets, like the Philippines, offer licensing structures, while others operate in legal grey zones, creating equal complexity and opportunity.

Regional Opportunities

For operators willing to think long term and adapt fast, Asia offers more than just scale. It offers future-proof potential. Following years of sustained digital expansion, a clear window now exists to develop locally-adapted products built around mobile betting, live-stream functionality, and esports-driven engagement. Platforms supporting agile content delivery and lightweight performance are well-placed in high-volume, mobile-dependent markets.

At the same time, several emerging economies across South and Southeast Asia remain underdeveloped in terms of regulated online gambling infrastructure, yet internet and smartphone uptake continue to rise sharply. This signals a longer-term opportunity to establish brand presence now, ahead of future legal clarity.

According to Stellar Market Research, these conditions are fuelling steady investment, especially from operators looking to diversify away from increasingly saturated western markets. Asia, in short, is where the long game is being played.

Comparative Analysis: Asia vs Europe vs Latam

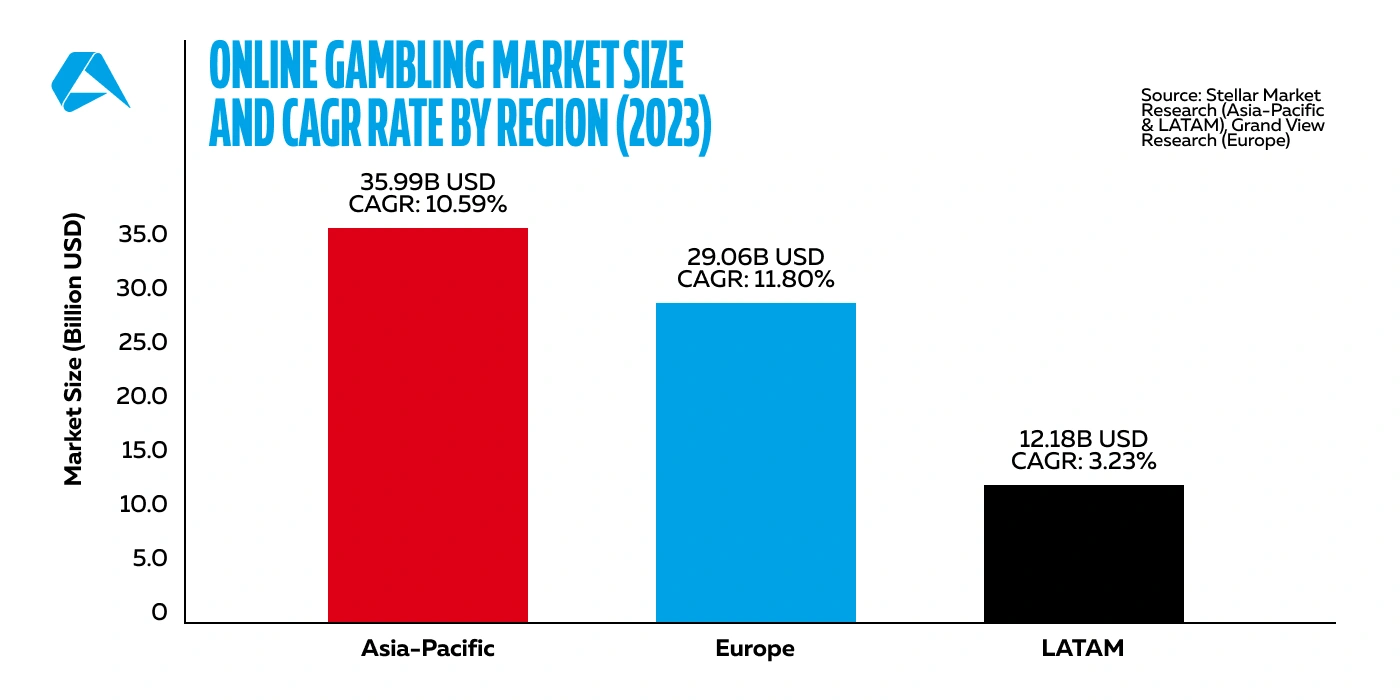

While Asia currently leads in scale, growth trends across regions highlight divergent trajectories worth closer analysis. As mentioned earlier, Asia-Pacific’s online gambling market reached US$35.99 billion in 2023, with a projected CAGR of 10.59% through 2030, highlighting both its size and sustained momentum.

Europe, by comparison, posted US$29.06 billion in online gambling revenue in 2023, but is forecast to grow slightly faster, at 11.8% CAGR to 2030, according to Grand View Research. This higher rate reflects incremental gains in an already mature and highly regulated market, where growth is being driven more by innovation and product refinement than new user acquisition.

In Latam, the story is different again. In 2023, the Latin American online gambling market was valued at approximately USD 12.18 billion and is projected to reach USD 15.21 billion by 2030, reflecting a compound annual growth rate (CAGR) of just 3.23% from 2024 to 2030. This slower growth trajectory is primarily due to persistent regulatory uncertainty, infrastructure disparities, and uneven adoption of formal licensing frameworks across the region.

While major markets like Brazil, Colombia, and Peru have made significant progress, others remain legally ambiguous or commercially undeveloped. Compared to Asia’s rapid digital acceleration and Europe’s regulatory maturity, Latam’s momentum has been restrained by fragmentation and delayed legal reform. Nonetheless, mobile expansion and local demand signal untapped potential if more cohesive frameworks emerge.

In real terms, Asia remains the most commercially significant global growth hub, combining scale and acceleration.

Betting Big: Asia’s Players Outspend the Rest

Beyond sheer volume and rapid growth, Asia’s digital betting economy is defined by something else entirely - the size of the average wager. According to Asia Gaming Brief, the average bet placed by an Asian user is 2.5 times larger than in Europe and more than four times higher than in Latam. This elevated spend per player reflects not only a higher tolerance for risk but also a fundamentally different approach to betting behaviour, one that prioritises larger stakes and more immediate outcomes.

For operators, this shift in value per user significantly alters acquisition and retention models. Success isn’t just about onboarding volume. It’s about sustaining high-value users who treat betting as entertainment with real monetary intent. In a market where fewer users can drive more substantial GGR, odds delivery and trust become performance levers.

Key Growth Markets within Asia

The most promising and accessible Asian markets share three common traits: digital maturity, consumer appetite for real-money play, and regulatory frameworks, however imperfect, that allow commercial momentum. For operators with long-term vision, here are the top four Asian markets to keep an eye on:

Philippines

The Philippines stands out as a regulated eGaming hub in Asia, with the Philippine Amusement and Gaming Corporation (PAGCOR) overseeing licensing and operations. In 2024, the country's gambling industry achieved a record GGR of PHP 410.5 billion (≈ USD 7.16 billion), a 25% increase from the previous year. Projections for 2025 estimate revenues to reach between PHP 450 billion and PHP 480 billion (USD 7.8 billion to USD 8.3 billion), driven by growth in electronic gaming and integrated resorts.

The Philippines' comparatively liberal gambling laws and strong regulatory framework make it an attractive market for operators seeking stability and growth.

India

India's online gambling market is another Asian jurisdiction experiencing rapid growth, driven by increased smartphone and internet penetration. The market was valued at USD 6.91 billion in 2024 and is projected to reach USD 16.83 billion by 2033, exhibiting a CAGR of 7.1%. However, operators should note that the regulatory environment is complex, with laws varying across states. While some states have legalised certain forms of online gambling, others maintain strict prohibitions.

Despite these challenges, India's large, highly connected, tech-literate population presents significant opportunities for operators, particularly in skill-based games and fantasy sports.

Japan

Japan's online gambling market is currently on an upward trajectory, valued at USD 8.1 billion in 2024 and expected to reach USD 12.9 billion by 2033, growing at a CAGR of 5.3%. The country's high internet penetration and cultural affinity for gaming contribute substantially to this growth. While traditional gambling is heavily regulated, recent legislative changes have opened avenues for integrated resorts and potential online gambling expansion.

Operators entering the Japanese market must navigate a complex regulatory landscape but can tap into a consumer base with a strong interest in gaming and technology.

South Korea

South Korea's online gambling market is projected to grow at a CAGR of 8.16% from 2024 to 2032. The country's advanced technological infrastructure and high smartphone penetration are central to online gambling activities within the nation. While most forms of gambling are restricted, the government operates Sports Toto, a legal sports betting platform. Operators should also consider that South Korea is one of Asia’s foremost esports hubs, generating substantial betting activity around competitive gaming, particularly among younger audiences.

However, strict regulations and enforcement against illegal gambling activities require operators to guarantee compliance and adapt to the current legal framework.

Future Outlook and Limitations

In many respects, Asia isn’t a future opportunity waiting to mature. It’s already a central hub where strategies are being tested in real time. For sportsbook and casino operators, the region has shifted from long-term ambition to immediate battleground. So what’s fuelling that shift? A combination of high-stakes spending behaviour, improving tax incentives in select markets, and the slow but steady move from prohibition to regulation.

The Asian online gambling market is projected to more than double over the next several years. But it's not just scale, it’s the shape of growth that matters most. Mobile betting, crypto transactions, and esports drive new user engagement across mature and frontier markets. Tax environments are also becoming more operator-friendly. In the Philippines, for example, PAGCOR reduced licence fees for online gaming revenue to 25%, a move expected to stimulate further investment in regulated offerings.

Still, entry remains uneven. Jurisdictions like India, South Korea, and Japan impose tight controls or state monopolies, while others operate in legal grey zones. As Altenar’s team noted during their 2024 market review:

Asia rewards patience and precision, and success comes to those who tailor their product to regulation, not the other way around

While the legal picture remains patchy, momentum is building. More governments are signalling readiness to formalise licensing frameworks. In the years ahead, regulation will continue to open, but only selectively. For operators eyeing a long-term position, now is the time to build trust, understand regional variance, and prepare for a market where growth doesn’t always follow a straight line.

Betting in Asia isn’t just about reach - it’s about relevance. Discover how Altenar’s modular eGaming platform equips you to go local with global stability. Book your personalised software demonstration today and start building for tomorrow’s markets.