Illinois is presented as one of the more progressive jurisdictions for gambling operators in the United States, providing a detailed overview of its legal, regulatory, and operational landscape. The state's gambling history reflects a significant evolution, from early informal activities to the legalisation of state-run lotteries in 1974, riverboat casinos in 1990, and more recently, video gaming terminals (VGTs) in 2009 and sports betting in 2019.

Currently, Illinois is a comprehensive hub for regulated gaming activities, boasting both retail and mobile sports betting platforms, overseen by the Illinois Gaming Board (IGB). It also features numerous land-based casinos and one of the most expansive VGT networks in the US, with over 44,000 VGTs in more than 8,000 locations, significantly contributing to state and local revenues.

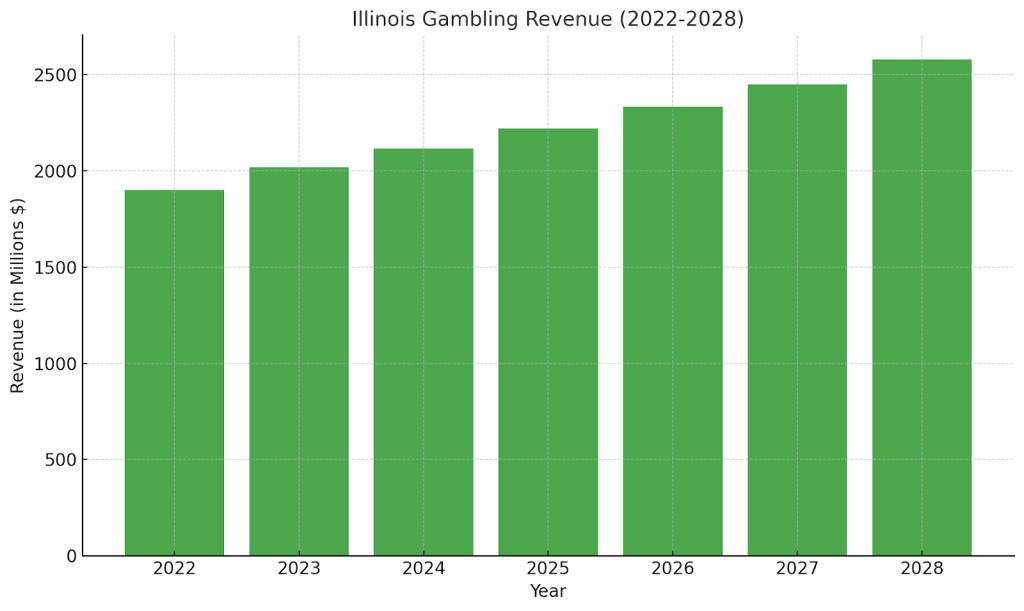

A notable point is that online casino gaming and online poker are not yet legal in Illinois, despite ongoing discussions, although there is anticipation for future legalisation due to its potential to generate substantial revenue. In July 2024, the state introduced a progressive tax structure for sports betting, with rates ranging from 20% to 40% based on adjusted gross receipts, placing it among states with higher tax rates. Operators looking to enter must navigate stringent licensing requirements, including significant fees and ongoing compliance costs. With state tax revenues exceeding $2 billion in fiscal year 2024, Illinois offers a sizable and enthusiastic market with notable opportunities.

Illinois represents one of the more progressive jurisdictions for gambling operators looking to enter and expand in the United States.

This guide offers an in-depth examination of the legal, regulatory and operational requirements for market entry, as well as the costs involved and the history of gambling in Illinois.

The Rich History of Gambling in Illinois

The history of gambling in Illinois reflects societal attitudes, economic needs and legislative actions. Gambling was a popular pastime among early state settlers. In the 19th century, urban centres like Chicago emerged as hubs for gambling activity, hosting everything from card games and dice to betting on horse races. These activities thrived informally, often alongside political influence and organised crime.

Public attitudes towards gambling have shifted significantly over the years. Early 20th-century reform movements aimed to curb gambling, associating it with vice and corruption. However, as social perspectives evolved, Illinois began to embrace gambling as a legitimate form of entertainment and a potential revenue stream. The legalisation of state-run lotteries and the introduction of riverboat casinos marked the beginning of regulated gambling in the state. These developments not only legitimised the industry but also underscored its role as a contributor to public finances.

In more recent times, Illinois has taken significant steps to modernise its gambling framework, recognising the growing demand for diverse options. This includes introducing video gaming terminals in local establishments and legalising sports betting. The expansion into online platforms has further cemented Illinois as a leader in the gambling sector, offering residents and visitors a broad spectrum of regulated gaming experiences.

Timeline of Gambling Legislation and Events

Illinois's gambling history is closely tied to legislative milestones that have defined its current framework. Below is a timeline of key events and the associated legal regulations:

1818: Gambling begins during statehood formation

1920s: Chicago becomes a gambling hotspot

1974: Illinois Lottery Act Law establishes state lottery

1990: The Riverboat Gambling Act allows riverboat casinos

1991: First riverboat casino launches in Alton

1999: Amendment to Riverboat Gambling Act permits dockside casinos

2009: Video Gaming Act legalises video gaming terminals (VGTs)

2012: Lottery Internet Pilot Program permits online lottery ticket sales

2018: Supreme Court strikes down PASPA, and Illinois moves forward to explore sports betting opportunities within the state

2019: Illinois Gambling Expansion Bill (formally the Public Act 101-0031) legalises sports betting and authorises new casinos

2020: Illinois Sports Wagering Act launches retail betting

2021: Remote Registration Removal allows account registration via online betting platforms

The Current Situation for iGaming

Building upon its rich gambling history, Illinois has become a comprehensive hub for regulated gaming activities. In 2025, the state presents a mature and regulated gambling environment with numerous land-based and online sports betting options. Its cautious approach to online casino gaming reflects a deliberate strategy to balance market growth with regulatory oversight.

Sports Betting

Sports betting is well-established in Illinois, with both retail sportsbooks located at casinos and racetracks and mobile wagering platforms available statewide. The Illinois Gaming Board (IGB) regulates these activities, ensuring compliance with state laws.

Land-Based Gambling Activity

Illinois hosts many land-based casinos, including riverboat establishments and the anticipated Chicago casino, which is scheduled to open in 2026. These venues offer various gaming options, such as slot machines, table games and poker rooms, and operate under the IGB's oversight. In addition, the state lottery, established in 1974, continues to be a significant revenue source, providing residents with various draw games and instant tickets.

Online Casino Gaming and Poker

At the start of 2025, Illinois has not legalised online casino gaming or online poker. Despite discussions and legislative proposals, concerns regarding market saturation and potential impacts on existing gaming revenue streams have delayed the adoption of iGaming. Industry stakeholders remain observant of possible future developments in this area.

Market Comparison with Other States

Illinois offers a wide range of gambling options compared to other states. However, its absence of legalised online casino gaming and poker puts it behind states like New Jersey and Pennsylvania, which have embraced iGaming. Nonetheless, Illinois's comprehensive sports betting framework and land-based casino offerings make it a competitive market in the national gambling landscape.

Legal Framework for State Gambling

Illinois has a comprehensive legal framework for gambling, including casino gaming, video gaming and sports wagering. A distinctive feature of this approach is its extensive video gaming terminal (VGT) network. Unlike many states, Illinois permits VGTs in licensed establishments such as bars and restaurants, which contribute significantly to state and local revenues.

Sports wagering is also legal in Illinois, and both retail and online platforms are available. The state initially required in-person registration for online sports betting accounts, but this stipulation has since been lifted, streamlining access for bettors. However, legislative efforts to legalise internet gaming have faced opposition, particularly from stakeholders in the video gaming sector.

The state's blend of permissive video gaming laws, evolving sports betting regulations, and a conservative stance on online casinos presents a distinctive environment compared to other US jurisdictions.

Video Gaming Terminal Network

Illinois hosts one of the most expansive VGT networks in the United States, with over 44,000 VGTs operating across more than 8,000 locations. There is also speculation that VGTs could someday integrate with self-service betting terminals, combining traditional video gaming with sports betting functionality.

VGTs, regulated by the IGB, are permitted in licensed establishments such as bars, restaurants and truck stops. Each licensed establishment can host up to six VGTs. They complement Illinois’s land-based casinos and retail sportsbooks to promote localised gaming experiences. In 2023, VGTs contributed significantly to the state’s gambling tax revenue, emphasising their economic importance.

Online and Offline Sports Betting

The Illinois Sports Wagering Act, which was legalised in 2019, regulates sports wagering in Illinois. The framework permits both online and retail sportsbooks regulated by the IGB. Initially requiring in-person registration, the law now allows fully remote account creation, considerably boosting market accessibility for sports betting experiences.

Retail sportsbooks can be found at casinos, racetracks, and select sports venues, while online platforms include leading operators such as BetMGM, FanDuel, DraftKings, ESPN Bet, and now bet365, among other top brands. This balanced approach offers flexibility for bettors and opportunities for operators.

For operators or individuals looking for further information, the Illinois Gaming Board provides comprehensive details on sports wagering regulations.

Online Casino Gaming and Poker

Illinois prohibits online casino gaming and poker. Despite ongoing discussions among legislators, efforts to legalise these activities have faced stern resistance. However, the success of online sports betting and its significant contribution to state revenue has reignited interest in expanding the local iGaming sector. Future legislative changes could open opportunities for operators as the state evaluates the potential economic benefits of legalising online casino gaming.

Licence and Operational Costs

In Illinois, gambling operators must obtain specific licenses based on their activities, each with associated fees. Casino operations are regulated, and a maximum of 16 are permitted. Ten are in operation, and six new casinos are authorised under Section 7 of the Illinois Gambling Act. Under the Gambling Act and Gambling Regulations, the state’s racetracks are also eligible to offer slot machines and table games.

Sports wagering operators must secure a Master Sports Wagering Licence.

Initial licence fees for a master sports wagering licence in Illinois depend on the operator type and licensing date. Casinos and racetracks licensed before June 28, 2019, pay 5% of their 2018 revenue or handle, capped at $10 million. Post-2019 licensees face a $5 million minimum fee or 5% of first-year revenue, whichever is greater. Online sports wagering operators and lottery providers incur a $20 million fee, while sports arenas pay $10 million.

There are a total of 30 available master sports wagering licenses. The Sports Wagering Act also allows the IGB to issue three licenses to online-only sports wagering operators through a tender process (section 25-45, Illinois Sports Wagering Act).

Licence Renewal

Gambling licences must be renewed periodically to remain valid. All casinos, race tracks, sports arenas, and online operators must renew their licenses every four years at a cost of $1m (Sections 25-30, 25-35, and 25-40 of the Illinois Sports Wagering Act). Operators must adhere to the strict renewal timelines the IGB sets to avoid penalties or operational disruptions.

Ongoing Costs of Maintaining a Licence

Maintaining a valid gambling licence in Illinois involves ongoing expenses beyond initial licensing and renewal fees. Operators must undergo regular game testing and certification to ensure compliance with legal standards. Independent testing labs approved by the IGB perform these evaluations, and operators bear the associated costs.

Annual financial audits are also mandatory. Compliance monitoring, including responsible gambling programs and anti-money laundering (AML) measures, also incurs ongoing operational costs. Sports wagering operators may incur additional expenses for system upgrades, security checks and employee training to comply with state-mandated guidelines.

The costs associated with game testing and audits for gambling operators can vary based on several factors, including the type of gaming activity and the specific requirements set by the IGB. While it mandates that all gaming equipment undergo rigorous testing and certification to ensure compliance with state regulations, the exact fees for these services are not standardised and can differ depending on the independent testing laboratories used and the complexity of the games or systems being tested.

Tax Considerations

A unique aspect of Illinois's legal framework is its progressive tax structure for sports betting. In July 2024, the state implemented a tiered tax system, with rates ranging from 20% to 40% based on adjusted gross sports wagering receipts. This positions Illinois among the states with higher tax rates for sports betting.

In addition, according to the Internal Revenue Service (IRS), sports wagering is subject to a federal excise tax of 0.25% on the amount wagered for bets authorised under state law. This tax does not apply to wagers offered by state lotteries.

While operators are directly responsible for these taxes, bettors should know that significant winnings are subject to federal and state income taxes. Bettors should consult tax professionals to understand their obligations.

Regulatory Oversight

From casino operations, sports wagering and video gaming to horse racing and lotteries, the following agencies enforce stringent compliance standards and collaborate with operators to ensure adherence to state laws.

Illinois Gaming Board

The Illinois Gaming Board is the state’s primary regulatory and law enforcement agency. It oversees all licensed casino gambling, video gaming, and sports wagering. Its responsibilities encompass licensing, monitoring, and enforcing state laws to ensure fair and legal gambling activities. IGB approval is essential for market entry and ongoing operator compliance, making it a key player in the state’s gambling framework.

The IGB collaborates with federal agencies to enforce AML protocols, adhering to the Illinois Compiled Statutes on Money Laundering. In addition, it regulates advertising practices to prevent misleading promotions and protect consumers.

Illinois Racing Board

The Illinois Racing Board (IRB) regulates horse racing and pari-mutuel wagering, ensuring integrity and compliance within the industry. Established under the Illinois Horse Racing Act of 1975, the IRB oversees participant licensing, monitors racetrack operations and enforces betting regulations. Operators in this niche rely on the IRB for licensing and regulatory compliance, making it indispensable for maintaining operational legitimacy.

The IRB ensures accurate collections and expenditures by conducting audits and employing pari-mutuel auditors at each racetrack, maintaining public confidence in the sport. Its collaboration with other agencies and strict adherence to state laws make it indispensable for operators seeking legitimacy in Illinois's horse racing sector.

Illinois Lottery Division

Responsible for overseeing the Illinois State Lottery, this division ensures fair play, administers revenue collection and funds public services through lottery proceeds. The Illinois Lottery generates significant revenue and remains a high-profile component of the state’s gaming sector. In fiscal year 2023, the Lottery transferred $883 million to the state's Common School Fund, supporting public education.

Operators involved in lottery-related technology or services must coordinate with this division, ensuring compliance with state laws and public expectations.

Opportunities and Outlook for State Gambling

Illinois's gambling market has continued to show impressive growth. State tax revenues exceeded $2 billion in the fiscal year ending June 2024, a 4.8% increase from the previous year. This reflects the state's well-established position as a key player in the US gambling sector, offering significant opportunities for online sportsbook and casino operators considering market entry.

With a population exceeding 12.8 million, Illinois presents a sizable and enthusiastic market for iGaming. Sports betting, in particular, has seen a marked rise in participation, driven by the widespread availability of retail and online platforms. Moreover, the tax environment offers operators a stable and predictable framework to build their operations.

The Illinois Gaming Board enforces stringent compliance measures to ensure fair play and protect consumers. While these requirements can pose initial hurdles for operators entering the market, like always, they establish a reliable and transparent environment that breeds trust among players and stakeholders.

Looking to the future, there is growing anticipation around the potential legalisation of online casino gaming in Illinois. Governor J.B. Pritzker has indicated that this proposal could be introduced in the upcoming budget cycle, recognising its potential to generate significant revenue. Early projections suggest that it could generate as much as $450 million in tax revenue during its first year of implementation, highlighting its economic appeal.

Despite these opportunities, operators must navigate certain challenges, including increasing market competition and the potential for higher tax rates following trends observed in other states. In 2024, Pritzker proposed increasing the sports betting tax rate from 15% to a progressive scale ranging from 20% to 40%, aiming to generate an additional $200 million in revenue. He defended the move by comparing Illinois's rates to other markets, stating:

We had a much lower tax rate than many of the largest of those markets. And we're just kind of bringing ourselves more in line, but at a lower rate.

Pros and Cons of Market Entry

Illinois offers significant opportunities for gambling operators, balanced by regulatory challenges and limited iGaming options, highlighting the importance of strategic planning as a necessity for success in the state's gambling sector.

Market Advantages

-

Expanding Player Base: A large population of 12.8 million with increasing enthusiasm for online gambling.

-

Strong Regulatory Framework: The Illinois Gaming Board ensures transparency and market stability.

-

Revenue Growth Potential: Steady rise in gambling tax revenues, exceeding $2 billion annually.

-

Diverse Gambling Options: Legalised sports betting, lottery, and land-based casinos attract varied audiences.

-

Urban Opportunities: Chicago’s economic hub creates demand for premium gaming experiences.

-

Tech-Ready Infrastructure: High internet penetration supports online gambling operations.

Market Disadvantages

-

Regulatory Barriers: Stringent compliance standards require significant preparation and resources.

-

Limited iGaming Options: Online casinos and poker remain illegal, restricting potential offerings.

Licensing requirements for operators

Entering the Illinois sports betting market requires operators to meet stringent criteria set by the IGB. The primary challenge is navigating the comprehensive regulatory framework to ensure full compliance.

Adherence to the following requirements is vital for operators aiming to establish a successful presence in Illinois's regulated sports betting market. Key requirements include:

Licensing and Application

Operators must obtain a Master Sports Wagering License, which involves submitting detailed applications, including business disclosures and key personnel information. The application process is thorough, ensuring only qualified entities are approved.

Physical Presence

A physical presence within Illinois is mandatory. As online-only operators are limited, this includes establishing partnerships with existing casinos or racetracks. Such collaborations necessitate significant investment in local infrastructure.

Server Location

All servers supporting online gambling activities must be located within Illinois. This ensures jurisdictional compliance and facilitates regulatory oversight.

Technical Standards

Compliance with IGB's technical standards is essential. This encompasses system integrity, security protocols, and ensuring all betting platforms meet rigorous testing requirements to maintain operational reliability.

Responsible Gambling Measures

Operators must implement strict responsible gambling measures, including self-exclusion programs and tools to prevent problem gambling, aligning with state-mandated guidelines.

Financial Stability

Another fundamental requirement is demonstrating financial stability. Operators must provide evidence of sufficient capital and financial health to support operations and withstand market fluctuations.

Employee Licensing

Key employees, including executives and operational staff, must obtain individual licences from the IGB.

Advertising Restrictions

Operators must follow strict advertising guidelines, as outlined by the IGB, and avoid misleading promotions or targeting underage individuals.

Tax Reporting and Payments

Operators in Illinois must report and remit gambling-related taxes to the Illinois Department of Revenue (IDOR) every month. Detailed revenue reports must include gross receipts, taxable amounts, and deductions, ensuring transparency and compliance with state laws. Payments and reports are submitted electronically through the IDOR's online portal.

The reporting deadline typically falls on the 20th of each month, covering revenues from the previous calendar month. Operators are required to maintain precise financial records to support these filings and to prepare for potential audits by the IGB or IDOR. Late filings or underreported amounts can result in penalties and interest charges, making timely and accurate reporting a critical aspect of compliance.

AML and KYC Compliance

Anti-money laundering (AML) protocols and Know Your Customer (KYC) processes must be implemented to verify player identities and prevent illicit activities that align with state and federal regulations.

How to Apply for a Licence

Securing a gambling license in Illinois necessitates a comprehensive understanding of the IGB’s structured application process. Prospective operators should meticulously prepare to meet the state's stringent regulatory standards, ensuring all prerequisites are satisfied before submission.

Basic Steps to Apply for a Gambling Licence in Illinois

-

Determine Licence Type: Identify the specific gambling licence required for your operations - casino, video gaming, or sports wagering.

-

Review Eligibility Criteria: Ensure compliance with the IGB's qualifications, including financial stability and integrity assessment

-

Complete Application Forms: Accurately fill out the relevant application forms corresponding to your chosen gambling activity - sports wagering, video gaming or casino gambling.

-

Submit Required Documentation: Provide all necessary supporting documents, such as financial records, organisational structure, and personal disclosures.

-

Pay Application Fees: Remit the non-refundable application fee as specified for the selected licence type.

-

Undergo Background Checks: Consent is required for comprehensive background investigations conducted by the IGB.

-

Await IGB Review and Decision: The IGB will evaluate your application and notify you of their decision.

For detailed information and access to application forms, visit the IGB's official website: https://igb.illinois.gov/

Illinois Gaming Made Smarter

Why just comply when you can excel? Illinois's gaming market is evolving, and so should your technology. Book a demonstration of Altenar’s innovative sportsbook software and self-service betting terminals today.

Disclaimer

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice and Altenar does not accept any liability concerning its use.