When Donald Trump first weaponised tariffs during his presidency, few in the gambling industry paid much attention. After all, trade wars were about steel, semiconductors, and soybeans and not sportsbooks, right?

But in 2025, with Trump’s return to the political spotlight and talk of sweeping new tariffs gaining momentum, the iGaming sector may no longer have the luxury of staying on the sidelines. This time, the target list hits closer to home. We are talking about hardware imports, offshore software development, cloud infrastructure, and even cross-border digital services, all of which quietly underpin the daily operations of American gambling platforms.

This isn’t about politics; it’s about preparedness. If tariffs once again become a primary economic tool, US-licensed online sportsbooks and casinos, along with the international suppliers that support them, could face rising costs, unexpected compliance headaches, and sudden disruptions to the fragile web of integrations that keep platforms live and profitable.

And yet, almost no one in the industry is talking about it. That silence may be the biggest risk of all.

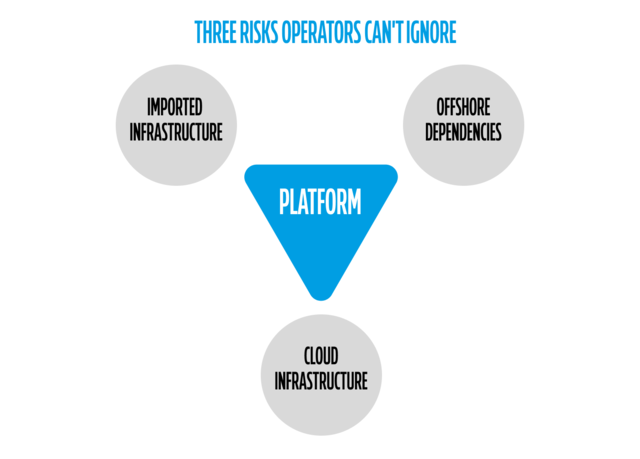

Three Risks Operators Can’t Ignore

So, what does a trade war have to do with sportsbooks and online casinos?

More than most operators might think. The iGaming sector may live in the digital domain, but its infrastructure is grounded in physical hardware, third-party tech partnerships, and cross-border services that don’t exist in a vacuum. Here’s where tariffs could start to bite - and fast.

1. Imported Infrastructure - Hardware and Rising Costs

While much of the front-end gambling experience is digital, the back end still runs on physical machines. Servers, routers, firewalls, and the networking gear that powers everything from in-play betting to identity verification are included. And let’s not forget that a significant portion of that hardware originates from countries on Washington’s tariff radar.

If new tariffs target components from China, Taiwan, or South Korea - all major producers of critical iGaming technology - operators may see a spike in infrastructure costs. While it is true that these aren’t always headline-grabbing figures, they do add up quickly across data centres and platform hosting environments. A 20–30% increase in equipment or maintenance costs can pressure tech budgets and delay feature rollouts.

Let’s be clear. In an industry where uptime equals revenue and speed drives retention, even a minor delay in replacing or upgrading equipment can lead to measurable operational setbacks.

2. Offshore Dependencies - A Third-Party Risk Nobody’s Pricing In

US-facing iGaming platforms often rely on a vast network of offshore partners - from sportsbook feed providers in Europe to casino content developers in Asia and cloud development teams across Latam and eastern Europe.

Tariffs may not directly target software, but if Trump’s administration expands duties on digital services or restricts cross-border data flow agreements, operators working with international partners could face steep compliance costs, contract renegotiations, or even the sudden loss of essential integrations.

A sportsbook platform might function normally on the surface, with odds feeds syncing and markets opening on time, but many of those services rely on real-time APIs delivered from overseas. If tariffs or legal disputes interrupt that flow, the fallout could be immediate. In state-regulated markets like New Jersey or Michigan, any prolonged service disruption could quickly turn into a regulatory concern.

3. Cloud Infrastructure - The Overlooked Trade War Risk

One of the least discussed but potentially most disruptive areas of impact is cloud infrastructure. Many US-licensed operators rely on third-party cloud services hosted or supported outside the country, particularly in scaling, analytics, risk management, or user interface components.

If retaliatory actions by foreign governments target American companies in response, operators could find themselves locked out of core functionality or absorbing sudden cost hikes on services they assumed were secure.

Digital trade wars are notoriously unpredictable. Just as the EU has moved to tax large US digital firms - a notable example is France’s 3% Digital Services Tax on companies like Google, Amazon, and Facebook - there is growing speculation that the US could respond in kind. This would cause gambling platforms to become involved in a global standoff over cloud access, SaaS taxes, and data control.

Why The Silence on Tariffs?

Despite the potential implications, most of the US gambling industry remains publicly silent on the issue of tariffs. While other sectors, from tech to automotive, have already begun mapping out risk strategies, few iGaming stakeholders appear to be asking the harder questions.

Trade policy typically falls outside the scope of daily operational concerns for online sportsbook and casino operators. But that doesn’t mean it should be ignored. From supplier contracts to data hosting agreements, the threads that hold gambling platforms together are far more exposed to international volatility than many are willing to admit.

Even the American Gaming Association (AGA), known for its strong advocacy on taxation and federal regulation, has yet to comment meaningfully on how a new wave of tariffs could affect gambling operations or, indeed, the suppliers who support them.

That absence of dialogue may be because many operators assume digital services will remain untouched by trade policy. Or perhaps it reflects something deeper - that the industry has become highly sophisticated in marketing and compliance but remains underprepared for broader geopolitical risk. Either way, it’s a gap worth paying attention to and addressing.

The Compliance Gap Hiding in Plain Sight

When operators think about tariffs, compliance isn’t usually the first concern that comes to mind. But perhaps it should be.

In tightly regulated US markets, operators must adhere to detailed licensing conditions covering everything from server location to third-party software integrations. Many of these platforms depend on international vendors for RNG certification, fraud detection systems, or real-time betting feeds, and any sudden disruption could put an operator at risk of non-compliance.

Take New Jersey, for instance. The Division of Gaming Enforcement (DGE) requires operators to submit all platform changes, including third-party integrations, for approval. If a tariff-related service disruption forces a vendor swap or a hasty workaround, there’s no guarantee the regulator will look kindly on that. In Pennsylvania, the Gaming Control Board requires live testing and certification for all backend changes. It’s a process that can’t be rushed, even in emergencies.

These aren’t just bureaucratic hurdles. Failure to meet regulatory standards, even when caused by external economic policy, can result in fines, public warnings, or even temporary suspensions. And while compliance teams are well-versed in handling cyber incidents and tech outages, very few have contingency plans for tariff-driven disruptions.

There is, therefore, a genuine risk that a perfectly legal trade policy decision made in Washington or Beijing could trigger a cascade of technical failures that result in real regulatory consequences at the state level. It’s a blind spot that operators and their compliance officers can no longer afford to ignore.

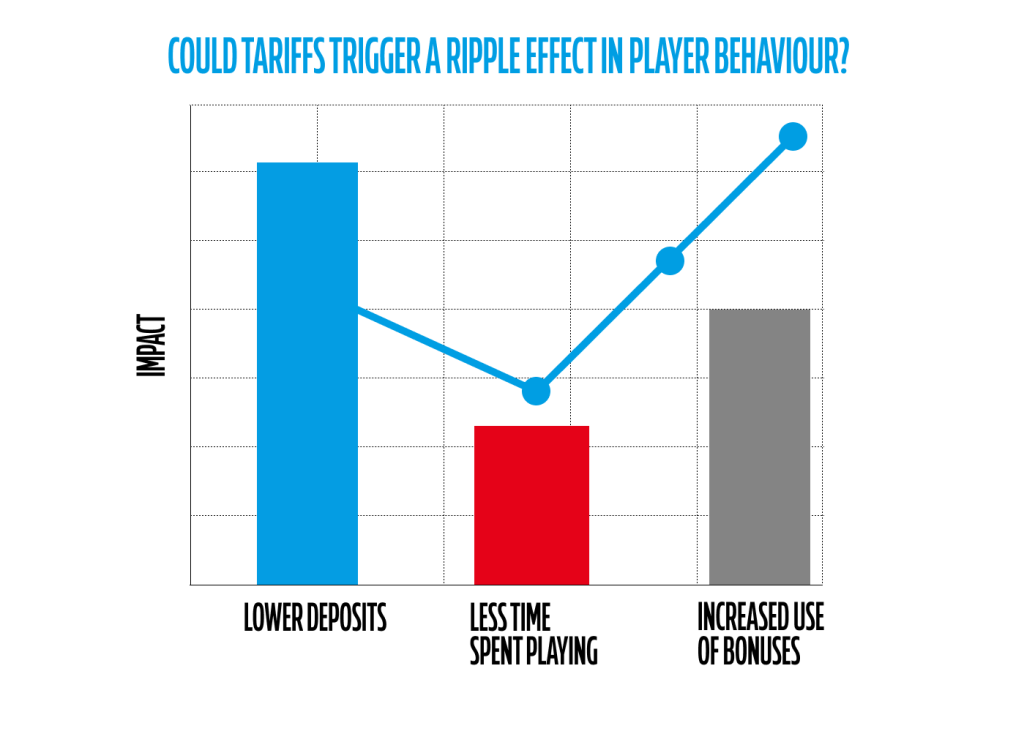

Could Tariffs Trigger a Ripple Effect in Player Behaviour?

Tariffs might not show up in a player’s wallet overnight, but their effects can ripple through the economy in subtle yet lasting ways.

Should increased import duties raise the cost of goods, services, or infrastructure, they risk fueling inflationary pressure. And when inflation climbs, discretionary spending, including online betting and casino play, is often one of the first things to tighten. Operators may not see a sudden drop in GGR, but they might notice slower deposit cycles, reduced session lengths, or increased bonus redemption rates.

To compensate, many will likely lean harder on promotional spending in the form of larger free bet offers, more frequent reload bonuses, extended loyalty incentives, and so on, designed to maintain engagement. But here’s the problem. That strategy only works while margins hold. If tariffs are already inflating tech and supplier costs behind the scenes, ramping up player incentives can start to erode profitability from both ends.

Brand perception plays a role here, too. During periods of reduced disposable income, players tend to gravitate toward platforms that offer stability, value, and trust. This creates an opening for well-capitalised operators to consolidate market share, but it also pressures smaller brands to overspend in order to stay visible.

In short, tariffs may not directly target the gambling industry, but their economic effects can change how players spend, how often they log in, and how much it costs to keep them loyal. That’s not just a retention problem. It’s margin erosion in real time.

What International Operators Need to Watch

For international operators partnering with or expanding into US markets, tariffs may feel like a domestic policy issue. But they’re not. Any cross-border service relationship tied to the American gambling industry could be exposed.

A large number of platform providers, payment processors, and odds feed suppliers supporting US sportsbooks operate out of Europe and Asia, regions where development is often faster, more cost-effective, and backed by years of technical expertise. If the US introduces new tariffs on digital services or supporting technologies, those relationships could become harder to manage and more expensive to maintain.

There’s also the legal layer to consider. Many US states require local server infrastructure or regulator-approved vendors. If a tariff dispute restricts the use of international software components, operators might find themselves scrambling to localise systems or renegotiate contracts under pressure.

The takeaway for international businesses supplying the US market is simple. Now is the time to audit exposure, revisit data agreements, and be ready to adjust strategy if trade conditions change. Call it operational insurance.

Preparing for a Tariff-Tense Future

Regardless of location, operators can no longer afford to treat global trade policy as a distant concern. The growing complexity of international supply chains and the unpredictability of political decision-making means that risk can arrive from directions few are monitoring closely.

Tariffs don’t need to directly target the gambling sector to disrupt it. As platforms become more reliant on global technology and international service providers, trade policy becomes part of operational planning whether senior decision-makers like it or not.

For many operators, the smart move now is scenario planning. Start by identifying which third-party systems, services, or contracts depend on international supply chains, including those tied to non-US hosting, offshore development teams, or foreign-owned software vendors. If any of those points were cut off, penalised, or inflated in cost, could the platform continue to run at full regulatory strength?

Then there’s contract resilience. Many supplier agreements were written without trade issues in mind. Do they include force majeure clauses that cover tariffs? Can pricing structures or SLAs withstand sudden cost movements caused by geopolitical events? If not, it may be time to renegotiate from a position of foresight rather than urgency.

Infrastructure localisation is another step worth exploring. Operators that can shift more of their core systems onshore or develop US-based redundancy plans may be better insulated from rapid policy changes.

Finally, there’s the matter of policy outreach. Lobbying doesn’t begin after the damage is done. Whether through trade bodies like the AGA or direct engagement with regulators, now is the moment to raise awareness of how digital gambling operations intersect with global trade. If exemptions or carve-outs are ever needed, it helps to have already made the case.

With that said, here’s what really matters. A tariff-heavy future may not be a certainty, but it’s no longer far-fetched. The operators who treat it as a risk worth managing now will be the ones best positioned to thrive if (or when) tariff pressures arrive.

5 Snap Facts iGaming Operators Should Know About Tariffs

-

US iGaming platforms depend heavily on overseas tech and service providers.

-

Trump has proposed tariffs of up to 60% on Chinese imports, and digital goods are not off the table.

-

Cross-border data flows, and SaaS models could be pulled into future trade disputes.

-

Most US state regulators don’t offer leniency for tariff-related service disruptions.

-

Now’s the time to reassess cross-border contracts and tighten compliance planning.