Overview The US Sports Betting Boom: Which States Are Setting the Pace in 2025

The US sports betting market is booming, processing tens of billions in wagers in 2024 and demonstrating significant year-on-year growth. This expanding digital entertainment market is uneven, meaning opportunity depends on regulatory frameworks as much as player demand. Operators are focused on which states are truly setting the pace, ranking them by Handle, Growth, Market Access, and Environment metrics. For private operators, success hinges on finding a balanced blend of scale, growth, and profitability. States like New York (51% tax) and Pennsylvania (36% tax) pose major challenges despite high volumes.

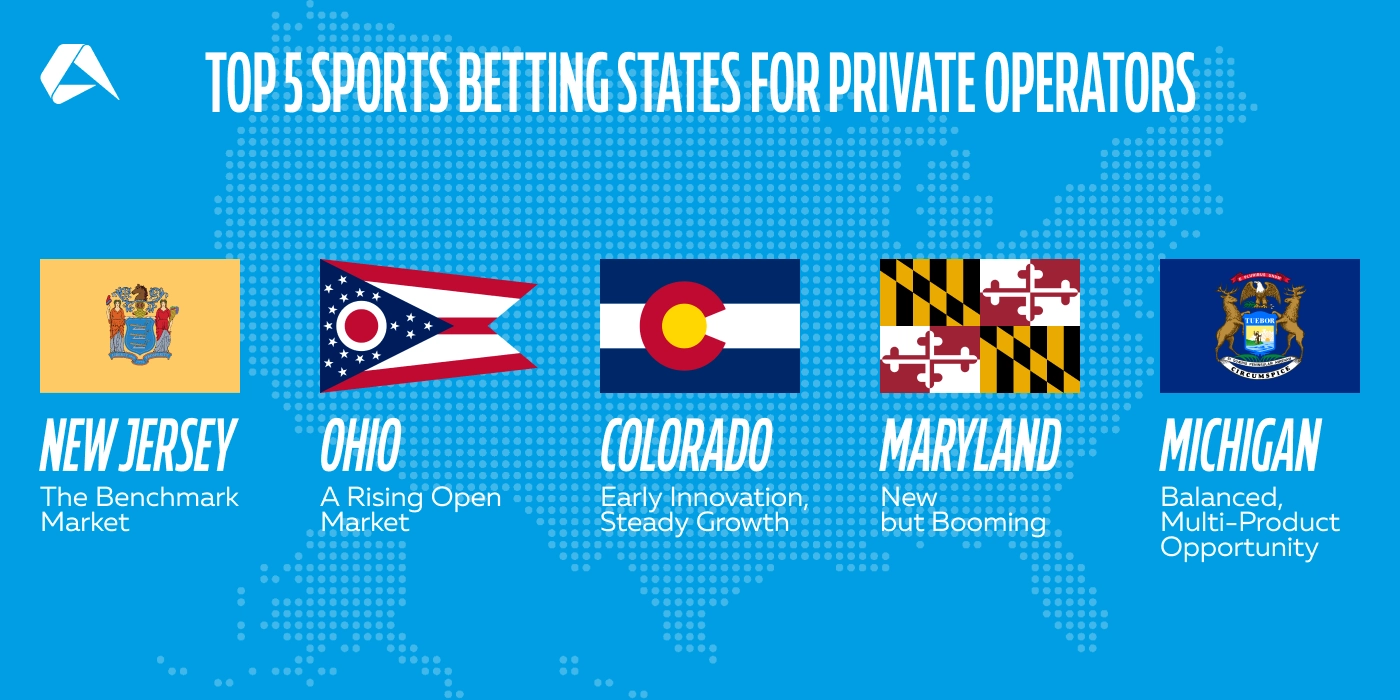

The top five markets stand out, including New Jersey, the benchmark market with $12.77 billion in handle and a moderate 14.25% tax. Ohio is rapidly rising, posting $8.9 billion in handle and 33% growth with a sustainable 20% tax rate. Colorado offers low 10% taxes and flexible tethering. Maryland and Michigan also appear as strong opportunities, offering high growth and balanced regulation respectively. Navigating high competition, regulatory complexity, and diverse tax burdens is essential for sustainable success in US sports betting.

Discover which states lead the race and where new opportunities lie — read the full blog below for expert insights.

The US sports betting industry has reached a point where the word ‘boom’ is less of a headline grabber and closer to a measurable reality. In 2024 alone, legal online sportsbooks across the country processed tens of billions of dollars in wagers, with several states posting year-on-year growth above 20%. For operators, that translates into one of the fastest-expanding digital entertainment markets in North America.

Yet the picture is uneven across the nation. Some states have established open, competitive frameworks that foster innovation and scalability, while others are hindered by restrictive models or tax rates that erode operator margins. The result is a fragmented market where opportunity depends as much on the regulatory framework as on player demand.

However, what’s clear is that the momentum is not slowing. Sports betting has evolved into a substantial mainstream economic driver, with every NFL season and March Madness cycle pushing new records. But the real question operators are asking is not whether this growth is real, but which states are truly setting the pace.

The table below highlights every US state that currently allows online sports betting, the ones driving the market forward and those that remain harder for operators to penetrate. The overall rating balances core metrics (Handle, Growth, Market Access and Environment), to rank where opportunities are strongest in 2025.

Table of US Commercial Sports Betting Opportunities

Column headings

State: U.S. jurisdiction with legal online/mobile sports betting.

Handle (2024): Total amount wagered during calendar year 2024 (unless noted as fiscal year) wagered by bettors, before payouts or revenue share.

Growth Rate: Year-on-year percentage change in handle, showing how fast the market is expanding or stabilising.

Market Access: How private operators can enter the market (e.g. open licensing, tethered to land-based casinos, limited/lottery controlled).

Environment: A concise description of operator conditions, combining gross gaming revenue (GGR) tax rate, competition level, regulatory complexity, and barriers to entry.

Rating: Comparative score reflecting operator friendliness, balancing scale, growth, tax burden, competition, and regulatory access.

Terminology

YoY: Year-on-year comparison; measures growth against the same period in the previous year.

FY: Fiscal year - some regulators report on a fiscal rather than calendar year basis.

GGR (Gross Gaming Revenue): Operator revenue after winnings are paid out; used here only in the context of tax rates.

Skin: An individual online sportsbook brand operating under a land-based casino or partner licence.

Tethered: Licensing model that requires online sportsbooks to be partnered with a local casino, racetrack, or tribe.

| Rank | State | Handle (2024) | Growth Rate | Market Access | Environment | Rating |

|---|---|---|---|---|---|---|

| 1 | New Jersey | $12.77bn | +30.7% YoY | Open, multi-skin tethered | 14.25% tax, intense competition, moderate licensing complexity, partner-based entry | 8.0 |

| 2 | New Jersey | 8.90bn | +33% YoY | Open (Type A mobile) | 20% tax, high competition, moderate licensing complexity, open entry | 7.5 |

| 3 | Colorado | $6.19bn | +11.3% YoY | Open, tethered | 10% tax, many skins, moderate licensing complexity, open entry | 7.3 |

| 4 | Maryland | $5.37bn (FY) | +85.9% YoY (FY) | Open mobile | 15% tax, growing competition, moderate licensing complexity, open entry | 7.2 |

| 5 | Michigan | $5.30bn | +15.2% YoY | Open, tethered (1 skin) | 8.4% tax, mid-high competition, moderate licensing complexity, partner-led entry | 7.0 |

| 6 | North Carolina | $5.36bn (Mar–Dec) | Not Available | Open through a designation agreement | 18% tax, growing competition, moderate licensing complexity, open via designation | 7.0 |

| 7 | Massach.. | $7.40bn | Not Available | Open but limited | 20% tax, concentrated competition, strict compliance, and limited openings | 6.8 |

| 8 | Arizona | $8.00bn | Not Available | Limited (tribe/team tethered) | 10% tax, mid-high competition, moderate licensing complexity; limited windows | 6.7 |

| 9 | Pennsyl.. | $8.42bn | Not Available | Tethered (1 skin/casino) | 36% tax, heavy competition, high licensing complexity, partner-based entry | 6.5 |

| 10 | New York | $23.94bn (FY) | +21.9% YoY (FY) | Closed, platform-model | 51% tax, very high competition, high complexity, limited new entry opportunity | 6.0 |

| 11 | Illinois | $14.01bn | +20.6% YoY | Open, tethered | 15% tax, heavy competition, moderate licensing complexity, partner entry | 6.9 |

| 12 | Indiana | $5.72bn | +14% YoY | Open, tethered | 9.5% tax, mid competition, moderate licensing complexity, partner entry | 6.8 |

| 13 | Iowa | $2.26bn | +11% YoY | Open, tethered | 6.75% + 0.75%, light competition, low licensing complexity, partner entry | 6.8 |

| 14 | Virginia | $4.21bn | +10% YoY | Open, tethered | 15% tax, mid competition, moderate licensing complexity, open entry | 6.6 |

| 15 | Tennessee | $3.68bn | Not Available | Open, online-only | $0.035 per wager (~1.85%), mid competition, moderate licensing complexity, open entry | 6.8 |

| 16 | Kentucky | $1.20bn (partial 2024) | Not Available | Open, tethered | 14.25% tax, low competition, moderate licensing complexity, conditional entry | 6.7 |

| 17 | Louisiana | $1.00bn (est.) | Not Available | Open, tethered | 15% tax, low competition, moderate licensing complexity, partner entry | 6.5 |

| 18 | Wyoming | $1.15bn | +5% YoY (est.) | Open, online-only | 10% tax, low competition, low licensing complexity, open entry | 6.7 |

| 19 | Vermont | $75m (est.) | Not Available | Contracted multi- operator | 20% tax, limited competition, moderate licensing complexity, state contract | 5.0 |

| 20 | West Virginia | $1.20bn | +3% YoY (est.) | Open, tethered | 10% tax, mid competition, moderate licensing complexity, partner entry | 6.6 |

Sources:

The figures in this table were compiled from official state regulator reports and year-end summaries. Industry-standard publications, such as iGaming Business, EGR North America, and the American Gaming Association’s State of the States 2025 report, were also referenced for consolidated market figures and year-over-year comparisons. The following Altenar publications were used for context and cross-checking: ‘States Where Online Gambling is Legal in the USA 2025,’ 'Gaming Taxes in the USA: Which State Should You Choose for Launch in 2024,’ and ‘Top 10 U.S. Sportsbook Operators and Their Owners in 2025.

Top 5 Sports Betting States for Private Operators

Not every legal state is created equal. Some markets offer enormous scale but shut the door to new entrants. Others are smaller in size but far easier to operate in. For private sportsbook operators, the real opportunities lie where growth, access, and profitability line up.

The five states below stand out in 2025. Each combines meaningful betting volume with frameworks that let operators genuinely compete. From the maturity of New Jersey to the fast-climbing trajectory of Ohio, these are the markets setting the pace, and the ones most worth watching for those serious about U.S. expansion.

1. New Jersey: The Benchmark Market

New Jersey continues to define what ‘open’ looks like in US sports betting. With $12.77 billion in handle in 2024, it remains one of the largest markets in absolute terms and continues to grow year-on-year, despite its maturity. Operators benefit from a multi-skin system tied to casinos, as well as a moderate sports tax of 14.25% compared to some other US states.

So what’s the catch? Well, for starters, competition is intense. DraftKings, FanDuel, BetMGM, and Caesars all compete aggressively, but smaller brands still carve out niches, thanks to the sheer size of the pie. As our tax comparison piece on iGaming taxes in the USA highlights, New Jersey’s costs are middle of the road and less punitive than those in New York or Pennsylvania. For private operators, this state offers the most balanced blend of scale, access, and viability.

2. Ohio: A Rising Open Market

Ohio didn’t open until 2023, yet by the end of 2024, it was already posting $8.9 billion in handle, which equates to an average 33% increase on previous years. The framework is genuinely open, with multiple Type A mobile licences available and a 20% tax rate that remains sustainable.

Competition has intensified quickly, with FanDuel and DraftKings firmly established, but there’s room for newer entrants that offer an altogether different user experience (UX) or strong local partnerships. Regulatory oversight is firm but not overly burdensome, making compliance achievable without the headaches seen in states like Pennsylvania. For many, Ohio is the next New Jersey, meaning it’s big enough to matter, and open enough to compete.

3. Colorado: Early Innovation, Steady Growth

In industry circles, Colorado is often referred to as the ‘sandbox state’ for a reason. It offers one of the broadest operator rosters, thanks to its tethered but flexible licensing model. It is known for testing product innovations, such as in-play micro-markets. Handle reached $6.19 billion in 2024, representing a 11.3% increase over the previous year.

Taxes are 10%, among the lowest in the country, and compliance demands are relatively straightforward. The downside is saturation. Dozens of skins compete for attention, and marketing costs can outpace revenues unless operators lean into niche strategies. Still, for private operators, Colorado remains a low-barrier, high-competition proving ground that rewards creativity more than scale.

4. Maryland: New but Booming

Similar to Ohio, Maryland only launched mobile betting very recently, in late 2022, to be precise. But the speed of growth has been remarkable. In FY 2024, sportsbooks generated $5.37 billion in handle, representing an 86% year-over-year increase. With a 15% tax rate, mobile access, and an open licensing framework, Maryland checks most of the operator-friendly boxes.

The challenge is marketing in a mid-sized state with strong local allegiances. The Ravens (NFL), Orioles (MLB), and college teams drive the calendar, and national brands are already heavily leveraging those partnerships. Even so, Maryland remains a high-trajectory, medium-scale market where strong product localisation can deliver outsized results.

5. Michigan: Balanced, Multi-Product Opportunity

Michigan is one of the few US jurisdictions offering a trio of sports betting, casino, and poker opportunities, which makes it highly attractive for cross-selling. Sports handle in 2024 hit $5.3 billion, up 15.2% year-on-year. The 8.4% sports tax is competitive, and the Michigan Gaming Control Board is seen as one of the most professional regulators in the US.

Entry requires tethering with either a Detroit commercial casino or a tribal casino, each of which allows one skin. That keeps the operator field contained, but also ensures new market entrants aren’t overwhelming in number. For private operators who can secure a partner, Michigan offers a sustainable blend of scale, cross-product LTV, and regulatory predictability.

Why not New York or Pennsylvania?

Both rank in the top five by volume, but their economics are brutal. New York’s 51% tax and fixed roster of nine licensees slam the door shut on newcomers, while Pennsylvania’s 36% tax and one-skin tether structure limits margin flexibility and access. For private operators, these are markets to consider carefully rather than markets to chase.

The Real Challenges to Entering the US Sports Betting Market

For all the headlines about soaring betting volume and turnover, entering the US sports betting market is anything but straightforward. Even in states considered operator-friendly, the road to sustainable success is significantly influenced by competition, complex licensing rules, and regulatory obligations that evolve as quickly as player behaviour. The following challenges highlight why scale alone isn’t enough and why operators need a clear view of the realities behind the growth.

High Competition and Cost Pressures

In New Jersey and Ohio, size and openness create opportunities, but while that’s true, these states are also highly competitive. Major US sportsbook brands like FanDuel, DraftKings, and BetMGM dominate with brand awareness, deep marketing budgets, and highly integrated media partnerships. For new entrants, this translates into higher acquisition costs and the constant risk of being drowned out by aggressive promotions.

New Jersey’s handle shows that the market is still growing, but margins are thinner than they appear once bonuses, taxes, and retention spend are factored in. Even in Ohio, where growth is rapid, early adoption by national leaders has left little low-hanging fruit. Smaller operators must find niches, UX, localisation, or even specialised odds, to avoid competing purely on spend.

Regulatory Complexity and Tethering

Michigan and Colorado both show promise with balanced tax structures, but access is not as simple as applying for a licence. Michigan requires tethering to either a Detroit commercial casino or a tribal partner, and only one online skin is allowed per licence. That means negotiating partnerships is necessary, and those slots are often already taken.

Colorado, though more flexible, still requires operators to link with local casinos, and the sheer number of skins available creates a different challenge in the form of oversaturation. For international brands, the rules may be familiar, but for smaller or newer operators, the legal and operational requirements demand time, money, and specialist compliance knowledge just to get through the door.

Tax Burdens That Cut Margins

Tax rates alone don’t always give an accurate view of the real burden. Maryland’s 15% rate, for instance, looks manageable until you add marketing and partnership costs that erode margins. At the higher end of the scale, Pennsylvania’s 36% rate shows the pressure at its most extreme. And even in lower-tax states like Michigan (8.4%), operators still face significant expenses on technology, compliance, and revenue sharing.

This suggests that US markets may be large, but profitability can be uncertain. Operators must price bets carefully, control promotions tightly, and find efficiency in CRM and cross-sell if they want to sustain a viable business.

Marketing, Localisation, and Player Loyalty

Handle growth (money wagered by bettors) doesn’t guarantee player loyalty. Bettors adopt quickly, but retaining them is another matter altogether. US customers are typically bombarded with bonuses, cross-sell offers, and integrated media campaigns, making brand switching easier and more common.

Maryland is a good example. Bettor allegiances to local teams and college programs mean that generic national marketing doesn’t always land as well as targeted local campaigns. In Colorado, sportsbooks often lean into micro-markets and niche offerings to stand out in a crowded field. Still, there may be good news for smaller operators around the corner if the SAFE Bet Act advances, which aims to bring consistency to advertising rules and micro-betting standards, giving operators a more level playing field.

Compliance and Responsible Gambling Expectations

In the United States, regulatory oversight and compliance are evolving toward greater uniformity, with a trend toward harmonisation by independent state regulators across jurisdictions. Regulators in New Jersey and Michigan are regarded as among the most professional in the country, but demand detailed reporting, solid KYC and geolocation checks, along with proactive responsible gambling controls.

Ohio and Maryland have already followed suit with strict advertising rules, particularly around bonus language and promotions targeting young audiences. Even Colorado, known as a more experimental state, enforces close oversight of in-play betting markets and integrity monitoring. For operators, this means sustained investment in compliance systems, staff training, and third-party integrations.

As a result of these challenges, it is clear that size alone doesn’t always equal success, but greater adaptability does, especially for smaller operators.

Where the Next Opportunities May Come From

As discussed in our article ‘States where Online Gambling is Legal in the USA’, the American sportsbook market is still evolving. In some capitals, it is no longer a question of if sports betting, particularly online, will eventually be legalised, but what legalised sports betting will look like in the years to come.

Some jurisdictions are already over the threshold in terms of public support. Missouri, for example, cleared the hurdle of voter approval in 2024, leaving the state focused on rulemaking and implementation rather than persuasion. Others, like Georgia and Minnesota, remain in political and legislative discussions, but their repeated appearances on state agendas, backed by influential sports franchises and civic interest groups, show that pressure is building rather than fading.

A different challenge is unfolding in Oklahoma, where tribal compacts introduce additional layers of complexity. Progress there has been slower, but the combination of leadership backing and fiscal incentives means the conversation is no longer whether the market should exist, only how it should be structured.

Collectively, these states highlight where operators can expect the next real opportunities to appear and legitimate chances to gain a head start if they prepare early, forge partnerships, and anticipate how the resulting regulatory frameworks will ultimately shape up.

With taxes, reporting, and advertising restrictions tightening, the US compliance framework is a maze. Altenar can help you find your way through. Request your personal demonstration now and discover how our software keeps sportsbooks legal and aligned in every state.