Finding the right social media platforms for customer acquisition can be a decisive factor for iGaming operators, but establishing the best fit isn’t as simple as picking the biggest names. What works in Europe might flop in Asia, and a strategy that thrives in the USA could hit roadblocks in Latin America.

That’s why we at Altenar have taken a data-driven approach to break it all down. This article reveals the top platforms for gambling promotion in each region, highlighting where operators can run paid ads, build communities, and drive real player engagement. No guesswork involved, just real insights to help you get the most out of your social media marketing efforts.

Biggest challenges of promoting gambling on social media

The rules of the game are changing fast for iGaming operators who wish to deploy high-impact campaigns on social media platforms. Tighter restrictions, tweaking algorithms, and deploying AI-driven moderation make it harder than ever for operators to run ads without getting flagged.

Moreover, Meta’s approval process is increasingly unpredictable, with ads vanishing overnight even when they meet regulatory standards. This is forcing operators to rethink their campaign strategies to bypass restrictions without violating platform policies.

Meanwhile, TikTok, YouTube, and Twitter/X remain go-to hotspots for betting and game discussions, yet operators still face shadow bans, content suppression, and sudden policy changes. Furthermore, the old approach of relying on paid ads is no longer a sure bet. Instead, operators are turning to influencer marketing, interactive content, and private communities to stay visible while avoiding restrictions.

Regional challenges add another twist. Latin America and parts of Asia still offer room for organic betting discussions, but European regulators are demanding more transparency, and the US remains a region with ever-changing rules. Given these considerations, it is essential to understand that success in 2025 isn’t about avoiding the rules. It’s about understanding them, adapting faster, and building smarter yet more resilient campaigns. In essence, the opportunities remain, but they just require more intelligent execution.

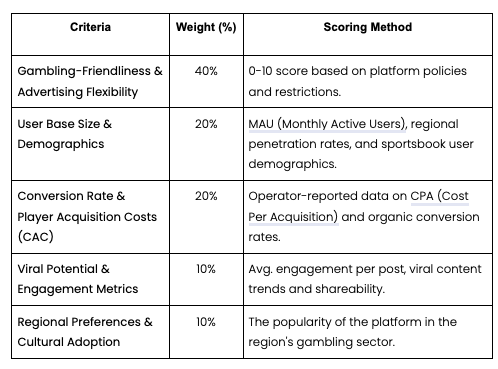

Explanation of Key Criteria

Rather than relying on general popularity, we've assessed each platform methodically, using key performance indicators that directly impact player acquisition, engagement, and compliance. Together, the following KPIs reflect real-world marketing success rather than speculation.

User Base Size & Demographics:

The bigger the audience, the greater the potential reach. Market penetration rates and demographic alignment determine a platform’s viability for gambling promotions.

Gambling-Friendliness & Advertising Flexibility:

Not all platforms allow gambling ads. We assess ad policies, case studies, and grey-area marketing opportunities.

Conversion Rate & Player Acquisition Costs (CAC):

High traffic means nothing if it doesn’t convert into real money players. We measure CPA, referral conversions, and other operator-reported data.

Viral Potential & Engagement Metrics:

Some platforms reward organic reach, while others rely on paid ads. We analyse engagement rates and shareability.

Regional Preferences & Cultural Adoption:

A platform’s dominance in one region doesn’t guarantee success elsewhere. We factor in local usage trends and regulatory constraints.

Weighting System for Platform Rankings

Some factors hold far more influence than others, so in addition to selecting the key criteria, we’ve introduced a weighting system to reflect real-world marketing impact.

Each platform will be rated out of 10 in five key categories, with different weightings applied to each, as follows:

Sources: Statista, Datareportal, Statcounter Global Stats, Pew Research

Regional Breakdown of Where to Promote Gambling on Social Media

Not all social media platforms offer gambling operators the same opportunities. Regional differences in user behaviour, advertising regulations, and content policies shape which platforms are the most effective. Below, we dissect the best social media sites for gambling promotion in Europe, the USA, Latin America, and Asia, supported by data-driven rankings and analysis.

Europe Ratings

| Platform | Gambling Friendliness (40%) | User Base (20%) | Conversion Rate (20%) | Engagement (10%) | Cultural Adoption (10%) | Overall Score |

|---|---|---|---|---|---|---|

| Telegram | 9 | 7 | 8 | 8 | 8 | 8.2 |

| Twitter/X | 7 | 8 | 7 | 7 | 7 | 7.4 |

| 6 | 9 | 7 | 6 | 8 | 7.2 | |

| 5 | 10 | 6 | 7 | 7 | 7.0 | |

| YouTube | 6 | 9 | 7 | 7 | 8 | 6.9 |

| 4 | 9 | 6 | 7 | 8 | 6.6 |

Summary Analysis

Telegram

Telegram’s open-content policy makes it an ideal space for gambling-related communities, betting tips, and direct player engagement. Private channels and group chats sidestep advertising restrictions, creating a direct-to-player marketing advantage. However, limited mainstream adoption and an overreliance on organic reach mean operators must work harder to attract users outside existing betting circles.

Twitter/X

Twitter/X is a solid option for real-time sports discussions and betting insights. It allows operators to engage with an audience actively seeking gambling content. Hashtag-driven conversations and influencer partnerships enhance visibility, though gambling ad restrictions limit direct promotions. However, a mixed reputation for content moderation means compliance risks must be carefully managed.

WhatsApp thrives on direct and personalised marketing, allowing gambling operators to engage players in private, high-conversion environments. Its broad user base in Europe makes it a powerful retention tool. However, the lack of official advertising options and increasing scrutiny over bulk messaging could restrict large-scale promotions.

Facebook’s vast audience and precise ad targeting tools make it a top choice for regulated gambling ads, but the approval process is strict and time-consuming. Organic reach has declined, pushing operators to rely heavily on paid promotions. Still, its user depth ensures consistent player acquisition if campaigns comply with platform rules.

YouTube

YouTube’s long-form content, tutorials, and live streams offer a powerful way to educate and attract players. Gambling-related videos, when structured within policy guidelines, can drive high-intent traffic. However, stringent content moderation and limited paid ad opportunities require a strong focus on organic, influencer-led promotion.

Highly visual and popular among younger audiences, Instagram enables gambling brands to showcase content creatively. Reels and influencer collaborations offer solid alternatives to direct ads, which require approval. Even so, algorithm-driven content suppression can reduce visibility for gambling-related posts, demanding a well-planned content strategy.

Key Takeaways for Operators in Europe

✔ Target Platforms with Advertising Approval Processes: Facebook and Instagram permit gambling ads but require pre-approval and strict compliance with national laws, making them the most structured options for paid promotions.

✔ Use Direct Messaging for Player Retention: WhatsApp and Telegram allow private, one-on-one communication, ideal for personalised promotions, VIP player engagement, and loyalty-driven retention strategies.

✔ Tap into Niche Communities for Organic Growth: Reddit and Telegram offer highly engaged betting discussions, but each platform has strict community guidelines, requiring a transparent, value-driven approach to avoid removal.

✔ Adapt Campaigns to Market-Specific Restrictions: Gambling laws in Europe vary by jurisdiction, and social media platforms enforce different levels of restriction depending on location. Operators must tailor regional ad strategies accordingly.

✔ Monitor Regulatory and Platform Policy Updates: European gambling regulations frequently evolve, and social media platforms tighten restrictions unpredictably. A proactive approach is necessary to avoid compliance risks and maintain effective promotions.

USA Rating

| Platform | Gambling Friendliness (40%) | User Base (20%) | Conversion Rate (20%) | Engagement (10%) | Cultural Adoption (10%) | Overall Score |

|---|---|---|---|---|---|---|

| 6 | 9 | 7 | 7 | 8 | 7.4 | |

| 5 | 8 | 6 | 7 | 7 | 6.6 | |

| Twitter/X | 4 | 7 | 6 | 6 | 7 | 6.0 |

| TikTok | 3 | 7 | 5 | 8 | 6 | 5.8 |

| Snapchat | 3 | 6 | 5 | 7 | 6 | 5.6 |

| 4 | 5 | 5 | 6 | 5 | 5.4 |

Summary Analysis

With the US gambling market highly fragmented by state laws, Facebook’s geo-targeting tools are invaluable for operators needing state-compliant ads. However, approval for gambling promotions is mandatory, and recent algorithm changes reduce organic visibility, forcing brands to invest heavily in paid media.

Instagram’s younger US audience leans toward sports betting, making it a prime space for sportsbook branding and influencer collaborations. All the same, gambling promotions require strict adherence to state laws, and Meta’s ad review process often results in delays or outright rejections. Organic visibility also remains volatile due to algorithm-driven content suppression.

Twitter/X

The US sports betting boom makes Twitter/X a prime channel for sportsbook operators. From live betting odds discussions to real-time sports commentary, the platform thrives on fast-paced engagement. With that said, gambling ads remain heavily restricted, and policy enforcement is inconsistent, making long-term paid strategies unpredictable.

TikTok

TikTok’s US audience is one of the most engaged worldwide, but the platform outright prohibits gambling ads. Still, sports betting brands have found loopholes through viral challenges, influencer-led content, and storytelling-driven engagement. Platform moderation remains aggressive, meaning content takedowns are frequent.

Snapchat

Snapchat’s US demographic is younger than most other platforms, making it unsuitable for direct gambling promotions. Nonetheless, operators targeting the 21–30 age group may succeed through gamification strategies, sportsbook partnerships, and fantasy sports engagement. Paid advertising is tightly restricted, but creative storytelling can help brands build awareness.

Reddit’s niche sports and gambling communities are among the most engaged in the US market, with discussions covering betting strategies, sportsbook reviews, and high-stakes wagers. Despite this, advertising options are highly restricted, and Reddit’s audience is known for scrutinising promotional content. Authentic engagement is essential for success.

Key Takeaways for Operators

✔ Maximise Geo-Targeting for State-Regulated Betting: Facebook and Instagram allow state-specific gambling ads, making them essential for legal sportsbook promotions in regulated markets like New Jersey, Pennsylvania, and Nevada.

✔ Use Twitter/X for Real-Time Betting Conversations: Sportsbook operators can engage bettors in live discussions, share odds updates, and capitalise on in-game betting trends, though ad restrictions still apply.

✔ Explore Influencer Strategies on Restricted Platforms: TikTok and Snapchat ban gambling ads, but operators use sports influencers, streamers, and viral content strategies to increase brand visibility without violating policies.

✔ Understand Platform-Specific Content Suppression: Gambling-related content is frequently removed from mainstream platforms, requiring operators to experiment with different messaging styles and avoid outright promotional language.

✔ Stay ahead of Shifting Regulations. The patchwork of US gambling laws means that compliance varies from state to state. Operators must stay updated on platform policies and federal advertising guidelines to avoid costly missteps.

Latin America Ratings

| Platform | Gambling Friendliness (40%) | User Base (20%) | Conversion Rate (20%) | Engagement (10%) | Cultural Adoption (10%) | Overall Score |

|---|---|---|---|---|---|---|

| 6 | 9 | 7 | 7 | 9 | 7.4 | |

| 5 | 9 | 7 | 6 | 9 | 7.2 | |

| 5 | 8 | 6 | 7 | 8 | 6.8 | |

| Kwai | 6 | 7 | 5 | 8 | 7 | 6.4 |

| TikTok | 4 | 7 | 5 | 8 | 7 | 6.0 |

| Taringa! | 5 | 6 | 5 | 6 | 6 | 5.6 |

Summary Analysis

Facebook is where gambling brands find the region’s most engaged audiences, enabling operators to reach high-intent players through precise targeting. While paid ads require approval, smart campaigns using influencer marketing and video drive strong player acquisition. Organic reach is limited, but the investment typically pays off.

WhatsApp is the dominant communication platform in Latin America, and it plays a huge role in player acquisition and retention. Operators can engage with players through private groups and direct messaging, but WhatsApp's lack of formal advertising options makes scaling campaigns difficult. Regulatory scrutiny over bulk messaging is increasing, particularly in Brazil and Argentina.

Instagram thrives in Latin America’s mobile-first digital market, where visually driven content performs well. Sportsbooks and casinos use influencer marketing to bypass ad restrictions, though the platform’s algorithms often suppress organic gambling-related content. Paid ads require approval and must adhere to local gambling regulations.

Kwai

This TikTok rival is gaining momentum in Brazil and Spanish-speaking Latin America, providing a less restrictive alternative for gambling promotions. Its short-form video format encourages viral content, though its smaller audience limits campaign reach. Gambling-related content faces moderation risks, but it’s not as aggressively policed as TikTok.

TikTok

Latin America’s youth-driven TikTok audience makes it an exciting but risky platform for gambling brands. Direct advertising is banned, but creative operators use influencer partnerships and viral trends to stay visible. Even so, content removal policies remain unpredictable, creating an uncertain long-term strategy.

Taringa!

A niche Spanish-language social platform, Taringa! is particularly popular in Argentina and Mexico, making it valuable for localised gambling discussions. Organic engagement is strong, but limited paid advertising options restrict its scalability. Best suited for content marketing and community-driven campaigns rather than direct promotions.

Key Takeaways for Operators

✔ Explore Emerging Video Platforms: Kwai and Taringa! provide regional alternatives for engagement with fewer content restrictions than mainstream platforms.

✔ Leverage Platforms with Advertising Opportunities: Facebook and Instagram allow gambling ads with prior approval, making them the best options for paid promotions.

✔ Utilise Direct Communication Channels: WhatsApp is widely used for personal messaging and is, therefore, an excellent tool for private promotions and community engagement.

✔ Adapt to Local Gambling Laws: Regulations vary across Latin American countries, so operators must ensure compliance with national advertising laws.

Asia Ratings

| Platform | Gambling Friendliness (40%) | User Base (20%) | Conversion Rate (20%) | Engagement (10%) | Cultural Adoption (10%) | Overall Score |

|---|---|---|---|---|---|---|

| 6 | 9 | 7 | 7 | 8 | 7.4 | |

| 5 | 9 | 7 | 8 | 9 | 7.2 | |

| LINE | 5 | 8 | 6 | 7 | 8 | 6.8 |

| TikTok | 4 | 8 | 6 | 8 | 7 | 6.4 |

| Douyin | 4 | 7 | 6 | 8 | 7 | 6.2 |

| Xiaohongshu | 3 | 6 | 5 | 7 | 6 | 5.4 |

Summary Analysis

Despite its dominance in Southeast Asia and India, Facebook’s impact varies across the region. It is blocked in China, while it competes with local alternatives in Japan and Korea. Gambling ads require prior approval, and enforcement is strict, yet for operators targeting India, the Philippines, and Thailand, its detailed audience segmentation makes it an indispensable marketing tool.

As China’s all-in-one super app, WeChat blends messaging, payments, and social media, making it integral to daily life. However, gambling content is heavily censored and monitored by state regulators. Private groups and peer-to-peer networks are sometimes used for indirect promotions, but visibility is always at risk of takedown. WeChat Pay integration makes it useful for operators in China’s grey market.

LINE

LINE is deeply embedded in Japan, Taiwan, and Thailand. The platform’s messaging-first model allows for loyalty-building and direct engagement, making it an effective retention tool. Gambling ads are heavily regulated, and ad approval processes are less transparent than on Western platforms, requiring a more localised approach.

TikTok

TikTok’s explosive growth in Asia makes it attractive for audience-building, but gambling ads are strictly banned. Operators attempting organic reach face frequent content removals, while influencer-led promotions require careful execution to avoid platform penalties. Some markets, such as India, have banned TikTok entirely, reducing its regional footprint.

Douyin

The Chinese counterpart to TikTok, Douyin has a massive user base but operates under heavy state censorship. Gambling-related content is immediately removed, leaving very little room for direct promotion. Some brands experiment with stealth marketing tactics, such as entertainment-driven brand awareness, but the risk remains high.

Xiaohongshu

A social media and e-commerce hybrid, Xiaohongshu attracts younger, affluent Chinese users seeking lifestyle content. Gambling discussions are heavily restricted, but gamification strategies tied to sports, entertainment, and travel could allow operators to gain indirect brand exposure. It is a challenging platform with niche potential for those willing to experiment.

Key Takeaways for Operators

✔ Understand Regional Regulations: Asia's diverse regulatory environment requires operators to research and comply with country-specific laws regarding gambling promotions thoroughly.

✔ Engage Platforms with Advertising Opportunities: Platforms like Facebook offer avenues for gambling advertisements with prior approval, making them viable options for reaching broader audiences.

✔ Utilise Local Platforms for Targeted Engagement: WeChat and LINE are integral to daily communication in their respective regions. Crafting compliant, engaging content on these platforms can foster community building and brand loyalty.

✔ Explore Creative Content Strategies: On platforms with advertising restrictions like TikTok and Douyin, consider influencer collaborations and organic content to enhance brand presence without violating policies.

Best Social Media for Gambling Across All Geo’s

To create this global ranking, we use the same weighted criteria applied to each region, averaging the scores from Europe, the USA, Latin America, and Asia to identify the top-performing platforms worldwide.

| Platform | Gambling Friendliness (40%) | User Base (20%) | Conversion Rate (20%) | Engagement (10%) | Cultural Adoption (10%) | Overall Score |

|---|---|---|---|---|---|---|

| 6 | 9 | 7 | 7 | 9 | 7.4 | |

| 6 | 9 | 7 | 7 | 9 | 7.2 | |

| 5 | 8 | 6 | 7 | 8 | 6.8 | |

| TikTok | 4 | 8 | 6 | 8 | 7 | 6.6 |

| Twitter/X | 5 | 7 | 6 | 6 | 7 | 6.2 |

| Telegram | 5 | 6 | 6 | 7 | 7 | 6.2 |

While Facebook leads the global rankings, its dominance isn’t universal. In Latin America and Europe, it remains a key platform for targeted advertising and sportsbook promotions, offering operators a structured approach to paid campaigns. WhatsApp, meanwhile, has carved out a role as a powerful retention tool, allowing operators to engage VIP players, manage customer relationships, and drive repeat play through direct messaging.

However, Asia presents an entirely different proposition. WeChat and LINE, the dominant platforms in China, Japan, and Thailand, are deeply integrated into users' daily lives, yet strict advertising regulations make them challenging to monetise through paid promotions. Instead, operators must focus on organic engagement and influencer-led content to gain traction.

For iGaming operators in 2025, success depends on platform selection and strategy:

-

For paid advertising, Facebook and Instagram are the most reliable options. Geo-targeting ensures ads reach regulated markets without compliance risks.

-

For direct engagement & player retention, WhatsApp and Telegram excel in community-building and loyalty-driven marketing. This is particularly true in Latin America and eastern Europe, where private groups and personal connections hold influence.

-

For brand awareness & viral growth, TikTok and Twitter/X provide high engagement, but gambling ad restrictions require an organic, content-driven approach, often relying on sports influencers and betting-related discussions.

The key takeaway to keep in mind is that a one-size-fits-all approach generally won’t work. Operators must align regional trends, platform policies, and advertising strategies to effectively reach and convert players in accordance with individual business aims.

List of Social Media Policy Pages for Gambling

Social media platforms frequently update their policies. Before initiating advertising campaigns, consulting the latest guidelines directly from the platforms is essential.

Online gambling and gaming Policy.

-

TWITTER/X: Gambling Content Policy Page

-

YOUTUBE: Advertising Policy Page for Gambling and Games

-

TIKTOK: General gambling policy page

-

REDDIT: Ads Policy Page for Lead Generation

-

TELEGRAM: Ad Policies and Guidelines Page

-

SNAPCHAT: Policy section for Gaming, Gambling, and Lotteries

There are no specific policy pages on gambling for the following platforms:

-

Kwai

-

Taringa!

-

WeChat

-

LINE

-

Douyin

-

Xiaohongshu

While explicit policy pages may not be publicly accessible, operators should consult the platforms directly or seek legal counsel to understand the specific guidelines and ensure compliance when considering gambling-related promotions on these platforms.

Casino vs. sportsbook promotion

The best platform for gambling promotion invariably depends on the product since sports betting and casino gaming attract different audiences, demand distinct engagement strategies, and face varying platform restrictions across regions.

For sportsbooks, platforms with real-time interaction and trending discussions tend to work best. Twitter/X leads the way in this area, as live betting odds, match updates, and community engagement fuel high-intent traffic. Facebook and Instagram provide targeted advertising for sportsbooks in regions where gambling ads are permitted, particularly in Latin America and parts of Europe. WhatsApp and Telegram are also highly influential in direct customer engagement and VIP betting groups in Eastern Europe and Asia.

The focus shifts to entertainment-driven content in casino gaming. YouTube and TikTok stand out for slot reviews, influencer-led gameplay, and immersive video content, though TikTok’s strict policies generally require creative workarounds. Instagram’s Reels and Facebook Groups also make a significant contribution to community-building. In Asia, platforms like WeChat and Douyin offer an option, though content regulations remain strict on these platforms.

Give your brand a competitive edge in a market where differentiation is everything. Altenar’s customisable marketing tools help operators reach the right players at the right time. But don’t take our word for it - book a demonstration now and see it in action for yourself.