Overview Online Gambling Market Size 2015-2025

The online gambling industry has undergone a "Billion-Dollar Boom," evolving from a developing sector in 2015 to a global giant. Its market value soared from $37.5 billion in 2015 to over $81 billion by 2023, achieving an impressive Compound Annual Growth Rate (CAGR) of 9.6%. This significant growth is largely attributed to the robust performance of online casinos, driven by live dealer games and mobile integration, and the surging popularity of online sports betting, which now accounts for over 40% of the total market.

Geographically, Europe remains dominant, while North America and the Asia-Pacific region have experienced substantial growth, with legalisation efforts in the US (post-PASPA repeal in 2018) sparking unprecedented expansion. Emerging markets like India (1200% growth), Brazil (500%), and Finland (1000%) are rapidly becoming key players, propelled by widespread smartphone adoption and evolving regulatory frameworks. Consumer behaviours have also shifted, with user penetration projected to reach 30% by 2025, attracting a more diverse demographic, including younger players and women, drawn by mobile convenience, gamified experiences, and immersive storylines. The COVID-19 pandemic in 2020 further accelerated this digital transition, prompting a permanent shift towards online platforms and fostering innovation in areas like live dealer games, virtual sports, and esports. With ongoing technological advancements and strategic investments in high-growth regions, the online gambling market is poised for continued expansion.

Billion-Dollar Boom - The Meteoric Rise of Online Gambling

Over the past decade, the online gambling industry has transformed from a developing sector to a global giant. Back in 2015, the market was valued at approximately $37.5 billion, a figure that - at the time - hinted at untapped potential. Fast forward to 2023, and the industry had risen to over $81 billion, representing an impressive Compound Annual Growth Rate (CAGR) of 9.6%, according to data from H2 Gambling Capital.

CAGR might sound like a dull financial term, but its significance here is anything but. It tells the story of an industry that has not just grown but thrived, year after year, shrugging off economic uncertainty and regulatory hurdles. This is a market that didn’t just keep pace - it sprinted ahead.

Driving this growth are two of the most significant segments: online casinos and sports betting. Online casinos have solidified their dominance with the attraction of live dealer games and increased mobile integration and usage. Meanwhile, sports betting has surged forward, now commanding over 40% of the total market, according to VIXIO GamblingCompliance. The numbers tell a compelling story, but they only scratch the surface of an industry teeming with innovation and opportunity.

On the whole, the ascent of online gambling is more than just a narrative of numbers. It’s a snapshot of changing consumer habits, advancing technology, and a relentless pursuit of creative online entertainment. The industry’s trajectory offers one clear takeaway: the game is far from over.

Data Source: H2 Gambling Capital and VIXIO GamblingCompliance

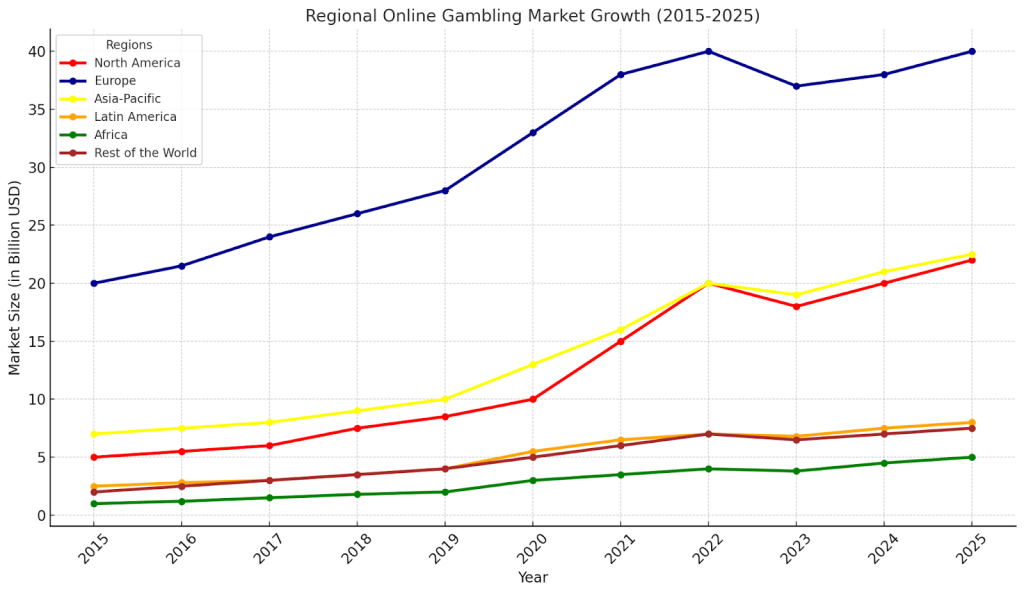

Regional Shifts in Online Gambling Revenue

The growth of online gambling has varied across global regions over the last decade. Europe, being the most enthusiastic region for online gambling, has long dominated, climbing from $20 billion to $42 billion, underpinned by its well-established regulations and consumer trust in digital platforms. Across the pond, North America has also seen a significant rise, from $5 billion to $20 billion over the same period. The post-2018 legalisation of online sports betting (PASPA) sparked an unprecedented wave of operator expansion and consumer enthusiasm.

The Asia-Pacific region, meanwhile, surged from $7 billion to $21 billion, riding on a wave of smartphone penetration to embrace virtual experiences. Latin America and Africa, though smaller, are also carving out their own presence, with steady growth revealing untapped opportunities leading to localised platforms serving emerging player bases keen for new and innovative online gambling experiences.

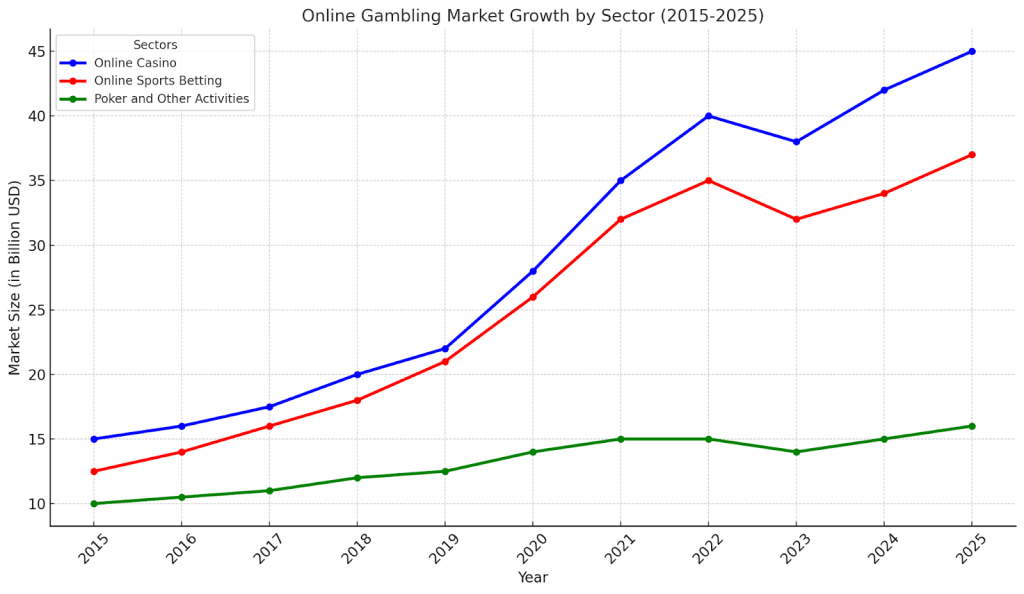

Sectoral Growth in Online Gambling

While regional trends highlight where growth is happening, the performance of the leading market sectors reveals how the online gambling market has unfolded. With revenues climbing from $15 billion to $40 billion between 2015 and 2024, online casinos have not only maintained their lead but extended it, driven by a surge in mobile-first experiences and live dealer innovations. Its trajectory reflects the sector’s ability to balance tradition with innovation, offering everything from classic slots to immersive live-action streaming experiences that bring the casino floor directly to a player’s screen.

Online sports betting, once a more niche offering, has also roared in popularity, growing from $12.5 billion to $35 billion. Its impressive rise has been fuelled by the sheer thrill of real-time wagering, amplified by global sporting events that grab the attention of audiences worldwide. For many, the integration of sports data into betting platforms has transformed the way fans engage with their favourite teams and players, making it an indispensable part of the digital gambling ecosystem.

On the other hand, poker and other activities, such as bingo and lotteries, have a more steady and gradual progression, growing from $10 billion to $15 billion. While more modest in scale, these segments remain a fundamental part of the online gambling scene, forging tight-knit communities with specialised offerings that appeal to dedicated players seeking unique entertainment.

Segment Analysis

Growth in online gambling is driven by innovative sports betting, online casinos, and enduring poker games, each shaping the industry’s evolution in unique ways.

Sports Betting

In just a few years, online sports betting has reimagined fan experiences, turning every play into a chance for engagement. It’s no longer just about placing a bet but rather more focused on real-time involvement and interaction, allowing players to wager as the action unfolds. Ultimately, rapid technical innovation available on today’s betting platforms adds a layer of excitement that mirrors the unpredictability of the sport itself. Real-time data, AI-driven odds, and mobile tech are the real game-changers behind live betting. When you break it down, these tech innovations have helped to create personalised experiences and keep the excitement flowing in this fast-paced betting revolution.

Partnerships with major leagues and teams have further raised the industry’s profile, turning trusted operators into household names. Moreover, events like the FIFA World Cup and Super Bowl trigger heightened engagement as millions flock to platforms to participate.

Online Casinos

The online casino market has undergone significant advancements, redefining how players interact with their favourite games. It is no understatement to acknowledge that today’s players demand variety, innovation, and convenience. As a result, game developers are stepping up with diverse game offerings and live dealer experiences that bring the thrill of the casino floor directly to the player’s screen.

A notable trend is the push toward gamification. Features like leaderboards, missions, and reward systems create more engaging experiences. What’s more, players increasingly prefer titles with immersive storylines, high-quality graphics, and customisable gameplay.

Consumer preferences are also driving inclusivity. Titles that appeal to a broader audience, including women and casual gamers, are shaping the industry’s trajectory. With technology advancing at a rapid pace, online casinos are evolving faster than ever, incorporating convenient technologies for online operators, such as casino game aggregation, that make the selection and integration of culturally preferred games faster and more efficient.

As consumer preferences evolve, so does the way players choose to access online casino games. Mobile compatibility has shifted from a luxury to an expectation, driven by an expanding demand for convenience and flexibility. Today’s players seek gaming experiences that fit naturally into their lives, whether it’s a quick spin on a slot machine during a commute or a live dealer game from the comfort of their sofa.

Poker and Other Games

The poker boom of the early 2000s saw the online game become a cultural phenomenon by the end of the decade, with millions of players participating in cash games, sit-and-go tournaments, and multi-table events. Televised tournaments further amplified its growth along with the rise of online poker influencers. By 2015, this enthusiasm had stabilised. Major markets like the United States experienced regulatory challenges (e.g., the Unlawful Internet Gambling Enforcement Act of 2006), which limited the expansion of online poker platforms. While poker remains popular among dedicated players in 2025, casual gamers have leaned towards emerging formats like live casino games and social casino platforms, leaving poker growth comparatively flat.

Modern platforms are now focusing on dynamic formats like fast-fold poker and short-deck games with their faster pace. Meanwhile, other games, like online bingo and lottery, have seen consistent popularity, especially among more casual players. Once associated with local halls, bingo has found an online presence appealing to a diverse demographic, including a growing number of younger players. Customisable game themes and social features have helped maintain its relevance in a competitive market. Similarly, online lottery games continue to thrive by offering simplicity and the attraction of massive jackpots.

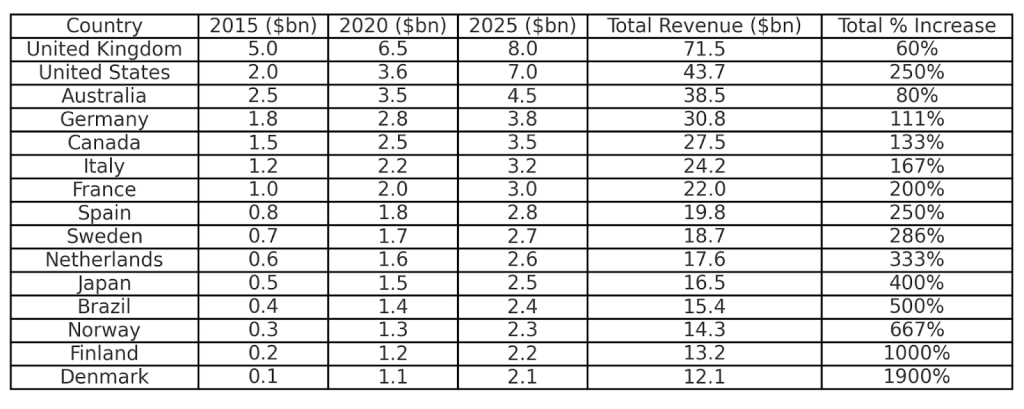

Global Leaders and Emerging Stars 2015 to 2025

Highest Revenue Earning Countries

The top 15 countries for online gambling revenue from 2015 to 2025 tell a story of national strength and emerging opportunities. The United Kingdom stands firm at the forefront of earnings with $71.5 billion in total revenue. Its leadership is rooted in a mature regulatory framework, high consumer adoption rates, and a history of innovation in the sector.

Across the Atlantic, the United States emerges as the fastest-growing market, boasting a 250% increase in revenue over the decade. This explosive growth can be largely attributed to the gradual liberalisation of US gambling markets, which opened the floodgates for operator expansion and consumer participation. Similarly, Australia and Germany demonstrate consistent growth, reflecting the benefits of regulated markets that balance operator freedom with consumer protection.

Further down the table, we see interesting shifts in traditionally less dominant markets. With a staggering 500% revenue growth, Brazil highlights the potential of untapped markets that have embraced digital gambling. Japan’s 400% increase tells a similar tale of opportunity as mobile technology reshapes consumer behaviour in the region.

The Nordic countries, such as Sweden, Norway, and Finland, punch well above their weight, with Finland's extraordinary 1000% growth illustrating its transformation into a digital gambling hub. These figures emphasise how smaller, tech-innovative nations can rival larger markets in per capita engagement.

Key Players in the Online Gambling Surge

The following three nations - the US, Brazil, and Finland - show how tailored strategies and unique market conditions have forged paths of extraordinary growth in online gambling.

Case Study A: United States

From Legal Hurdles to Exponential Growth

Online gambling revenues surged in the US by 250% between 2015 and 2025, driven by a regulatory transformation. The 2018 repeal of PASPA (Professional and Amateur Sports Protection Act) marked a watershed moment, legalising sports betting in several states. This unleashed a wave of investment in online platforms, bolstered by partnerships with major sports leagues. States like New Jersey and Pennsylvania became pioneers, setting a pace for others to follow. The result? A booming market poised for continued growth.

In 2025 and beyond, sports betting platforms are expected to dominate, driven by technological advancements and increasing consumer trust. Strategic partnerships with sports leagues and an expanding array of betting options are expected to fortify the market further, potentially surpassing $7 billion annually as adoption widens.

Case Study B: Brazil

A Sleeping Giant Awakens

Brazil’s 500% growth in online gambling revenue between 2015 and 2025 tells of a market awakening to its immense potential. Although largely unregulated during the early years, the shift toward legalisation and digital adoption has transformed the market. The country’s large, mobile-savvy population has embraced online betting platforms, particularly during major football events. With regulatory frameworks consolidating in recent years, Brazil is set to become a key player in the global online gambling industry.

The nation’s growth trajectory is now expected to accelerate further as regulations evolve. With a large, tech-proficient population and increasing smartphone penetration, online gambling could grow beyond its current projections. As the government refines licensing processes and taxation frameworks, international operators are likely to invest heavily, making Brazil a frontrunner among emerging global markets in the years to come.

Case Study C: Finland

A Digital Trailblazer

Finland’s impressive 1000% growth in online gambling revenue highlights its transformation into a digital gambling hub. A digitally competent population and high internet penetration have powered this growth, along with a strong preference for locally tailored platforms. State-owned monopoly Veikkaus has leveraged gamification and advanced digital solutions to encourage player interest. Finland’s success is one of innovation and adaptation, where a forward-thinking approach to online gambling offsets its smaller market size.

Future success for Finland lies in its ability to balance regulation with innovation. With Veikkaus exploring advanced digital tools and international operators eyeing this lucrative market, future growth prospects remain strong. The increasing adoption of advanced technologies and personalised gaming experiences will likely drive revenue growth, keeping Finland at the frontline of a global online gambling industry with its small market.

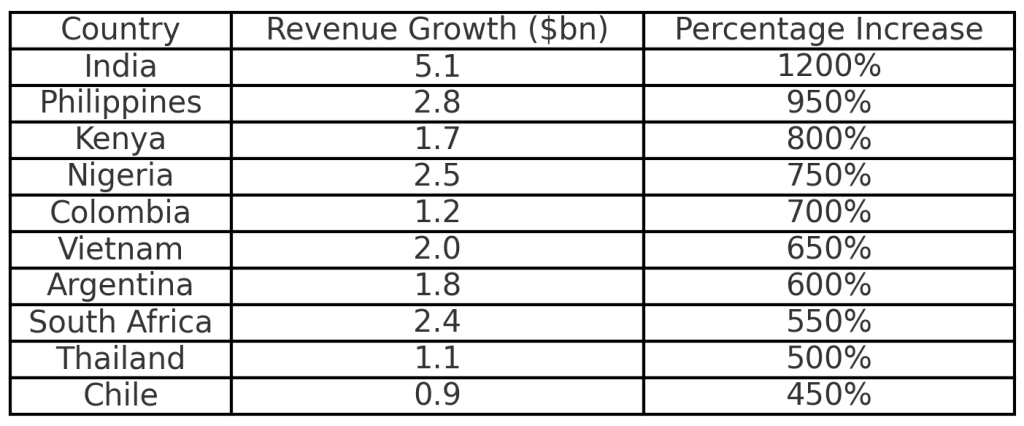

Fastest Emerging Markets

The following emerging markets have also shown extraordinary growth rates in online gambling over the last decade, typically driven by mobile technology, innovative platforms, and advancing regulations.

The percentage growth figures presented for emerging online gambling markets are approximations, reflecting general trends rather than precise measurements.

Data source: based on insights and data trends from H2 Gambling Capital and VIXIO GamblingCompliance.

India

Beyond Brazil, India ranks highly among emerging online gambling markets with a substantial 1200% growth. This rapid expansion is driven by its enormous population, widespread smartphone penetration, and increasing internet access. The rise of mobile-first platforms and fantasy sports leagues has further accelerated growth. Over the next five years, projections estimate continued annual growth of over 25%, driven by deeper market penetration and evolving regulatory frameworks, making India a digital gambling powerhouse.

Philippines

With a 950% growth rate, the Philippines is an emerging leader in Southeast Asia’s gambling market. Regulatory reforms, particularly the rise of offshore gaming operators (PAGCOR), and a growing interest in sports betting are key factors. Mobile integration and the popularity of esports betting also contribute to its momentum. Over the coming years, focusing on localised platforms and improved regulation is expected to drive further growth, positioning the Philippines as a regional hub.

Kenya

Kenya’s 800% growth highlights the power of mobile-based betting in Africa. A strong cultural enthusiasm for sports, especially football, paired with the widespread use of mobile payment systems like M-Pesa, has fuelled this surge. Going forward, the foreseeable future projects consistent growth as operators expand offerings and mobile connectivity improves. With ongoing advancements in payment technology and sports partnerships, Kenya will likely remain one of the standout nations in Africa’s online gambling movement.

Nigeria

Nigeria’s 750% growth is supported by its massive population and increasing smartphone adoption. Football betting dominates, with online platforms offering localised options. Despite regulatory hurdles, the growing middle class and improved mobile access are driving market expansion. Projections suggest a steady increase, with annual growth rates of over 20%. Nigeria’s potential as Africa’s largest economy ensures its continued prominence as an emerging online gambling market.

Colombia

Colombia’s early adoption of gambling regulation has resulted in a 700% growth since 2015. As the first Latin American country to legalise online gambling, it has attracted significant international investment. Sports betting and mobile-friendly platforms are key contributors. Over the next five years, Colombia’s market should grow further, benefiting from regional influence and a consumer base increasingly adopting digital technologies.

Vietnam

Like other emerging markets, Vietnam’s 650% growth is perpetuated by increasing smartphone use and the popularity of digital wallets. The rise of esports and online sports betting plays a significant role in market expansion. Over the next few years, growth is expected to accelerate as operators explore localised games and the government evaluates regulatory changes. At this time, Vietnam is projected to be one of Asia’s fastest-growing markets by 2030.

Argentina

Argentina’s 600% growth stems from its passion for football and a move toward regulatory frameworks at the provincial level. The adoption of mobile betting and international operators entering the market are driving growth further. With continued regulatory improvements, projections indicate that a steady increase of 18–20% annually is possible, reinforcing Argentina’s status as another emerging gambling market in Latin America.

South Africa

South Africa’s 550% growth over the previous decade reflects the region’s highest internet penetration and diverse gambling offerings. Sports betting and online casinos dominate the market, supported by a stable banking infrastructure. Future projections highlight continued growth as operators focus on localisation and mobile-first solutions, ensuring South Africa remains a key player in Africa.

Thailand

Thailand’s 500% growth is impressive, given its strict regulatory environment. The rise of mobile platforms and social casino games has driven market expansion. Within the next decade, projections estimate consistent growth as online platforms adapt to local preferences and consumer demand for digital entertainment rises despite ongoing regulatory challenges.

Chile

Chile’s 450% growth marks it as a rising star in South America. Increasing internet penetration and growing interest in online casinos and sports betting contribute significantly. With the potential for regulatory reforms in the not-too-distant future, projections suggest strong annual growth of 15–18%, positioning Chile as a key market in the region.

Changing Consumer Behaviours and Demographics

Over the past decade, the online gambling industry has matured into a substantial global enterprise, shaping the domain of online entertainment, with user penetration skyrocketing from 10% in 2015 to a projected 30% by 2025. Remarkable growth like this signals a change in who gambles and how they engage. Younger players aged 18–34 lead the way, drawn by mobile convenience and gamified experiences that blend entertainment with wagering. Women are also stepping into the spotlight more than in previous years, influenced by social gaming and casual-friendly formats. Even older demographics are embracing digital platforms nowadays, with games like online bingo and lotteries proving particularly popular. These shifting behaviours underscore an industry reinventing itself, welcoming a broader, more diverse audience than ever before.

The Year That Transformed Online Gambling

2020 saw a noticeable surge in market revenue. This change is directly linked to the COVID-19 lockdowns, which forced consumers to realign from land-based to online gambling. Moreover, the industry experienced an accelerated adoption of digital platforms as players sought engaging and accessible entertainment. This trend, driven by necessity, not only expanded revenues throughout the year but also initiated a permanent shift toward online gambling as a preferred mode of play.

With physical venues silenced and sports calendars wiped clean, operators faced an unexpected opportunity to redefine their offerings. And redefine they did. Live dealer games didn’t just replicate the casino experience but reimagined it, bringing the thrill of the tables to homes. Virtual sports and esports, once niche markets, stepped into the spotlight, capturing audiences with their fast-paced excitement. Even bingo found new life online, creating digital spaces where players connected like never before.

Where Visionary Technology Meets Ethical Governance

Rapid advancements in technology matched these ongoing shifts in consumer behaviour, ensuring operators could meet the evolving demands of a digital-first audience. Smartphones have been pivotal in transitioning occasional players into active participants, while high-speed internet provides access to secure, stable and reliable connections in more regions.

Regulation has played an equally transformative role. The US repeal of PASPA in 2018 didn’t just legalise sports betting, it created a wealth of opportunities, inspiring new market entrants and innovative platforms. Meanwhile, Europe’s regulatory frameworks, led by the UK Gambling Commission, provided a template for responsible growth, combining consumer trust with operational freedom. In Asia, emerging markets like the Philippines have become hotspots by blending local regulation with international appeal.

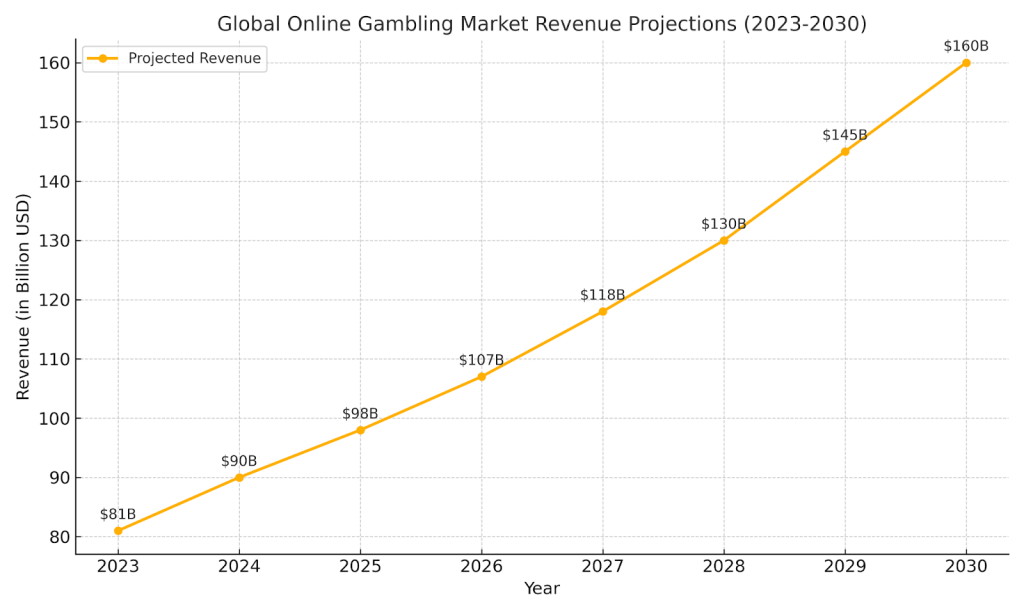

Investment Opportunities in 2025

Source: The projections on the chart are based on a combination of historical growth data and industry insights from reliable sources.

As we head into 2025, the online gambling industry stands on the brink of even greater growth, offering substantial rewards for operators and investors alike. Emerging markets, driven by favourable regulatory reforms and increasing internet penetration, promise massive untapped potential. Regions in Africa, Latin America, and parts of Asia are currently witnessing a surge in demand, creating prime conditions for market entry. While challenges such as compliance and cultural adaptation remain, the rewards for those who act strategically could be substantial.

Technology continues to lead this evolution. Artificial intelligence and machine learning are redefining player experiences through personalised recommendations, more intelligent risk management, and enhanced game mechanics. For operators willing to invest in top-tier technology, these innovations represent not just an upgrade but a turning point.

Success for new entrants in this industry will depend on strategic foresight. Operators can gain an edge by focusing on customer acquisition through advanced targeting and retention strategies prioritising loyalty and trust. By expanding into high-growth regions while embracing tech-driven solutions, iGaming professionals have the potential to yield sustainable returns. With the online gambling market projected to exceed expectations in the coming years, there has never been a better time to get involved.

The game is changing. Contact Altenar now for a software demonstration and discover how tech-driven platforms with tailored strategies can help you lead in emerging markets.

Disclaimer

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice and Altenar does not accept any liability in relation to its use.