New York’s gambling market is a prime choice for operators ready to take on one of the most lucrative gaming jurisdictions in the US. With mobile sports betting breaking revenue records and discussions under way about potential online casino expansion, the stakes have never been higher. But thriving in this market is not just about ambition; it requires strategy.

This guide cuts through the complexity, giving you the key insights needed to understand regulations, maximise opportunities, and tackle the challenges head-on. Let’s uncover what it takes to succeed in New York’s gambling sector.

Disclaimer

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

History of Gambling in New York

The first recorded instances of gambling in New York emerged with colonial lotteries designed to fund civic projects such as universities and infrastructure. By the early 19th century, these games of chance had become deeply embedded in public life. However, concerns over corruption led to New York pioneering one of the first constitutional bans on lotteries in 1821, a decision that set a precedent nationwide.

Despite the restrictions, the appetite for gambling persisted. By the late 19th century, horse racing reigned supreme. The establishment of Saratoga Race Course in 1863 marked the birth of an iconic gambling venue. Yet, the 1908 Hart–Agnew Law, aimed at eradicating betting at racetracks, triggered a temporary decline. Ingenious bettors found loopholes, and by 1913, oral wagering revived the industry, reflecting the creativity of both operators and betting enthusiasts.

Gambling reemerged as a tool for economic development in the mid-20th century. In 1967 the state lottery was reintroduced, tapping into public demand while funding education. The 1970s brought Off-Track Betting, allowing race wagers to migrate beyond the tracks. Native American gaming compacts in the 1990s introduced casinos into the mix, further diversifying betting opportunities within the state.

The early 21st century marked significant developments with a wave of regulatory milestones mirroring shifting societal attitudes. The 2013 amendment permitting commercial casinos marked a turning point (though online casinos remain prohibited). By 2022, New York had embraced mobile sports betting, rapidly becoming one of the most lucrative markets in the United States. Each phase of New York’s gambling evolution demonstrates its influence as a benchmark for industry trends.

Key Milestones

Here's a timeline highlighting significant events and legislation that have shaped gambling in New York:

1821: New York enacts a constitutional ban on lotteries.

1853: Gambling houses were declared illegal statewide.

1863: Saratoga Race Course opens.

1908: Hart–Agnew Law imposes strict anti-gambling measures.

1913: Court ruling permits oral betting.

1939: The legalisation of pari-mutuel betting bolsters horse racing.

1967: State lottery reintroduced to fund education.

1970: Off-Track Betting (OTB) legalised, expanding wagering options.

1993: The first tribal-state gaming compact was signed, leading to tribal casinos.

2001: Video lottery terminals (VLTs) legalised at racetracks.

2011: New York approves seven new racinos.

2013: Constitutional amendment allows commercial casinos upstate.

2022: Mobile sports betting legalised, expanding the digital market.

The current situation in 2025

In 2025, New York has emerged as a central gambling hub, accommodating a broad spectrum of gaming activities that balance economic opportunities with firm oversight. Land-based gambling forms the backbone of New York's gaming industry, with commercial casinos like Rivers Casino and tribal establishments such as the Oneida Nation's Turning Stone Resort Casino offering diverse gaming options. Racinos at horse racing tracks complement these venues by providing video lottery terminals and electronic table games, significantly contributing to state revenues.

While online casino gambling remains off-limits, New York took a major leap forward in 2022 with the launch of mobile sports betting. This development has quickly positioned the state as a leader in the digital betting market. The state lottery, an enduring favourite, continues to support public education through a variety of draw games and scratch-off tickets. At the same time, live poker thrives in several casinos. Online poker, however, remains prohibited, reflecting the state’s cautious approach to further online gaming expansion.

Sports betting is another growing sector, available online and at retail locations within commercial and tribal casinos. However, bettors should note that winnings are subject to federal and state taxes, and operators are required to withhold taxes on significant payouts.

In summary, operators are required to withhold 24% federal income tax on winnings exceeding $5,000. Additionally, New York State imposes taxes on gambling winnings, with rates varying based on income levels.

Compared to states like New Jersey and Pennsylvania, where online casino gaming is entirely legal, New York takes a more measured stance. Its thriving land-based venues and successful foray into mobile sports betting, however, highlight a progressive regulatory approach moving forward.

Regulatory Authorities and Their Role

In New York State, gambling activities are primarily regulated by the New York State Gaming Commission and the National Indian Gaming Commission (NIGC). These two, along with other federal and non-governmental organisations, work collaboratively to maintain a well-regulated gaming environment within the state.

New York State Gaming Commission (NYSGC)

The NYSGC is the central regulator of New York’s gambling industry. Established in 2013, it ensures that every aspect of the sector operates with integrity, transparency, and accountability. The Commission oversees a diverse range of gambling activities, including horse racing, pari-mutuel wagering, commercial casinos, video lottery terminals, sports betting, interactive fantasy sports, and charitable gaming.

Operating under the Commission’s jurisdiction, the New York Lottery remains a significant source of state revenue, supporting educational programs while maintaining strict compliance with gaming regulations. The Commission also works closely with licensed casinos and racetracks, enforcing strict licensing, operational, and responsible gaming standards.

Beyond oversight, the NYSGC plays a key role in consumer protection, collaborating with stakeholders to implement responsible gambling initiatives and ensure fair gaming practices. Whether monitoring financial integrity, reviewing applications, or shaping future regulations, the Commission is at the heart of keeping New York’s gaming market competitive and well-regulated.

For official updates, licensing details, and regulatory guidance, visit the New York State Gaming Commission and Gaming Division pages.

National Indian Gaming Commission (NIGC)

Tasked with regulating gaming operations on tribal lands, the National Indian Gaming Commission plays a leading role in upholding the integrity of the US tribal gaming industry. Established under the Indian Gaming Regulatory Act (IGRA) of 1988, the NIGC ensures that tribal gaming remains fair, transparent, and beneficial to tribal communities while protecting operations from financial mismanagement and criminal activity.

Unlike the NYSGC, which regulates commercial gaming, the NIGC oversees all federally recognised tribal gaming operations nationwide. Its responsibilities include reviewing gaming ordinances, approving management contracts, conducting financial audits, and enforcing compliance with federal regulations. The Commission also provides technical assistance and training to tribal governments, helping them navigate evolving regulatory frameworks while promoting economic growth within their communities.

With over 500 gaming establishments operated by nearly 250 tribes across 29 states, the NIGC’s oversight is essential to maintaining the sustainability of tribal gaming. Its enforcement actions, combined with its commitment to regulatory education, safeguard tribal gaming enterprises and ensure that revenues continue to support essential services for Native American communities.

The FTC and FCC: Their Influence on Gambling Advertising

While they don’t regulate gambling operations directly, the Federal Trade Commission (FTC) and the Federal Communications Commission (FCC) wield considerable influence over how gaming companies market their services and communicate with consumers. Their enforcement shapes advertising strategies, ensuring gambling promotions remain truthful, transparent, and compliant with federal regulations.

The FTC is primarily responsible for consumer protection and antitrust enforcement. It works to prevent deceptive marketing practices and unfair competition in various industries, including gambling. In the context of iGaming, it mandates that advertisements must not mislead consumers, particularly regarding odds, bonus terms, and potential winnings. Operators who violate these guidelines risk fines, legal action, and reputational damage.

The FCC, meanwhile, oversees interstate and international communications via radio, television, wire, satellite, and cable. While it doesn’t regulate gambling directly, it influences how gambling-related content is broadcast and ensures compliance with federal communication laws. This oversight extends to advertising restrictions, sponsorship disclosures, and content standards, particularly for television and digital media campaigns.

Though neither agency plays a role in licensing or operational oversight, their strict enforcement of advertising and communication standards significantly impacts gambling operators. Violations can lead to financial penalties, content restrictions, and potential bans on ad placements, making compliance with FTC and FCC regulations an essential consideration for any iGaming business operating in the US.

Gambling Laws and Legal Framework

Traversing the regulatory environment for iGaming operations in New York requires a thorough understanding of the state's legal framework. The NYSGC serves as the primary regulatory authority, overseeing all facets of legal commercial gaming within the state, including sports wagering, commercial casinos, and interactive fantasy sports.

New York permits mobile sports wagering, allowing bets to be placed electronically from any location within the state. However, it's important to note that online casino gaming has not been legalised in New York.

Operators entering the New York market must comply with stringent licensing requirements. Individuals seeking to work for, or provide services to, a licensed gaming facility or operator must obtain a licence from the New York State Gaming Commission. In most cases, the gaming facility or operator coordinates occupational permits directly with the Commission.

For inquiries related to gaming facility licensing in New York, you can contact the New York State Gaming Commission at:

Mailing Address: New York State Gaming Commission

PO Box 7500

Schenectady, NY 12301-7500

Phone: (518) 388-3300

Email: [email protected]

Compliance with advertising regulations is also necessary. The NYSGC has established specific advertising restrictions to promote gambling activities responsibly. For instance, Interactive Fantasy Sports (IFS) operators are prohibited from marketing or advertising their platforms as gambling. Furthermore, they must implement measures to deter minors, self-excluded individuals, and problem gamblers from participating.

Responsible gaming measures. This includes providing options for players to self-exclude from gaming activities and offering resources.

Given the nature of gaming regulations, operators should stay informed about potential legislative changes that could impact their operations. Engaging with local legal experts and maintaining open communication with the NYSGC can help operators effectively overcome the complexities of the New York gaming market.

NOTE

This information is provided for informational purposes only and should not be considered legal advice. Regulations and licensing requirements for gambling operators in New York are subject to change. For the most up-to-date information, the New York State Gaming Commission (NYSGC) provides comprehensive information on the legal framework governing gambling operations in the state.

Operators can access relevant statutes and regulations through the NYSGC's official website. Furthermore, the Rules section offers insights into specific regulatory guidelines. These resources are essential for understanding the legal requirements and compliance standards for gambling operations in New York.

Types of Gaming Licences Available

Only the NYSGC can issue gaming licences in New York State. Depending on the gaming activity an operator wishes to offer, various licences are available, and each type has its own application procedures, fees, and compliance requirements.

The primary types of licences available for gambling operators include:

1. Commercial Casino Licence

This licence permits the operation of full-scale casinos featuring live dealers, table games, slot machines, and poker. Operators must undergo a comprehensive application process and demonstrate financial stability, integrity, and adherence to regulatory standards.

2. Video Lottery Gaming Licence

This licence allows entities to operate video lottery terminals (VLTs) and electronic table games. These games are connected to a centralised system that monitors gameplay. VLTs are typically found at racetracks, commonly called "racinos".

3. Sports Wagering Licence

With sports betting legalised in New York, licensed commercial casinos can offer both in-person and mobile sports wagering. Under Chapter 59 of the Laws of 2021, mobile wagers must be transmitted to and accepted by servers located at a licensed gaming facility. The New York State Gaming Commission conducts a competitive bidding process to award licences to at least two Mobile Sports Wagering Platform Providers, each hosting at least four Mobile Sports Wagering Operators. Licensed operators must meet strict regulatory requirements, including partnerships with approved platform providers and adherence to responsible gaming practices.

4. Interactive Fantasy Sports (IFS) Registration

Operators offering interactive fantasy sports (IFS) in New York must register with the New York State Gaming Commission (NYSGC) rather than obtain a traditional gaming licence. Registration ensures compliance with state regulations, maintaining fair play, transparency, and consumer protection. For application details, refer to the NYSGC IFS Registration page.

Prospective operators should consult the NYSGC's official website for detailed information and guidance on the application process.

NOTE

This information is provided for general informational purposes only and should not be considered legal advice. For the most up-to-date details on the different types of gambling licences available in New York, please visit the New York State Gaming Commission’s official website gaming page.

Costs of Acquiring and Maintaining a Licence

Operating a legal gambling business in New York requires a significant financial commitment. From the initial application process to ongoing compliance and taxation, operators must adhere to a costly and highly regulated environment. While the market potential is substantial, the financial burden of licensure and operational expenses is among the highest in the United States.

Below is a breakdown of the key financial aspects associated with obtaining and maintaining a legal gambling license in the state.

Licence Application

Gambling operators can apply for various licences, each with specific application fees, validity periods, and governing laws.

1. Mobile Sports Wagering Platform Licence

Mobile sports wagering platform licences are issued only through a formal Request for Applications (RFA) process conducted by the NYSGC. The application fee is $25 million, payable within 30 days of approval, and the licence becomes effective upon receipt of payment. This process is governed by the Racing, Pari-Mutuel Wagering and Breeding Law (PML) Section 1367-a(3). For the latest updates on licensing opportunities, refer directly to the NYSGC website.

2. Commercial Casino Gaming Facility Licence

For those aiming to operate a full-scale casino, the New York State Gaming Facility Location Board (GFLB) oversees the casino siting process. Prospective applicants must respond to the Request for Applications (RFA) issued by the GFLB, following the guidelines detailed in the official New York Casino RFA supplement

-

Application Fee: An initial fee of $1 million is required upon application submission.

-

Licensing Fee: The NYSGC determines the licensing fee, which must be paid within 30 days of the licence award. Recent developments indicate that new licences, especially in the New York City area, come with a $500 million fee.

-

Annual Fees: Under PML Section 1348, gaming facility licensees in New York must pay annual machine and table fees. Zone 1 licensees are charged $750 per slot machine and table game, while Zone 2 licensees pay $500 per unit. Fees are assessed annually on July 1 and applied pro rata for newly approved machines. The Commission may adjust fees for inflation.

The licensing process in New York varies based on gaming activity, with some licences subject to a Request for Proposals (RFP) rather than a standard application. Under PML Section 1321-a, licence terms range from 10 to 30 years based on investment size, with fees determined under PML Section 1321-e(3) and payable within 30 days of approval.

3. Interactive Fantasy Sports Licence

The application process requires detailed information about the applicant's business structure, ownership, and operational plans. Applicants must also submit personal history disclosure forms for key personnel and may be subject to fingerprinting as part of a comprehensive background check.

Applications can be submitted via email or mailed to the NYSGC's office. It's important to note that no operator may conduct interactive fantasy sports contests in New York State until the Commission has issued a registration unless offering such contests under a Commission-issued temporary permit.

Ongoing Costs

After securing a gambling licence in New York, operators should anticipate several ongoing expenses to maintain compliance and ensure smooth operations. The New York State Gaming Commission (NYSGC) mandates regular audits, requiring dedicated internal audit departments. Responsible gaming programs involving staff training and public awareness campaigns to promote safe gambling practices are also necessary.

Technological investments should also be factored in. These can involve secure servers, advanced cybersecurity measures, and data management systems to protect patron information. The need to comply with evolving regulations and continuously address legal challenges will undoubtedly result in legal and consulting fees.

In addition, operators must adhere to advertising standards set by the NYSGC, which may require further investment in marketing compliance. Collectively, these obligations represent significant ongoing financial commitments essential for lawful and ethical operation within the state.

Taxes for Operators

Gambling operators are subject to a 51% tax on gross gaming revenue (GGR) from online sports betting in New York, the highest rate in the United States. This substantial tax rate has enabled the state to collect approximately $1.9 billion over a span of three years.

Operators must carefully consider this significant tax obligation when planning their financial strategies. Furthermore, operators are responsible for withholding a 24% federal tax on players' winnings. At the same time, New York State imposes its own tax on gambling winnings, with rates varying from 4% to 10.9% based on the individual's annual income.

These combined tax responsibilities underline the importance of thorough financial planning for operators seeking to remain profitable in New York's competitive gambling market.

NOTE

This information is provided for general informational purposes only and should not be considered legal or financial advice. Tax rates and regulatory requirements are subject to change. For the most up-to-date details on gambling taxation in New York, refer to the NYSGC page on Tax and revenue.

Emerging Trends in New York - Outlook and Opportunities

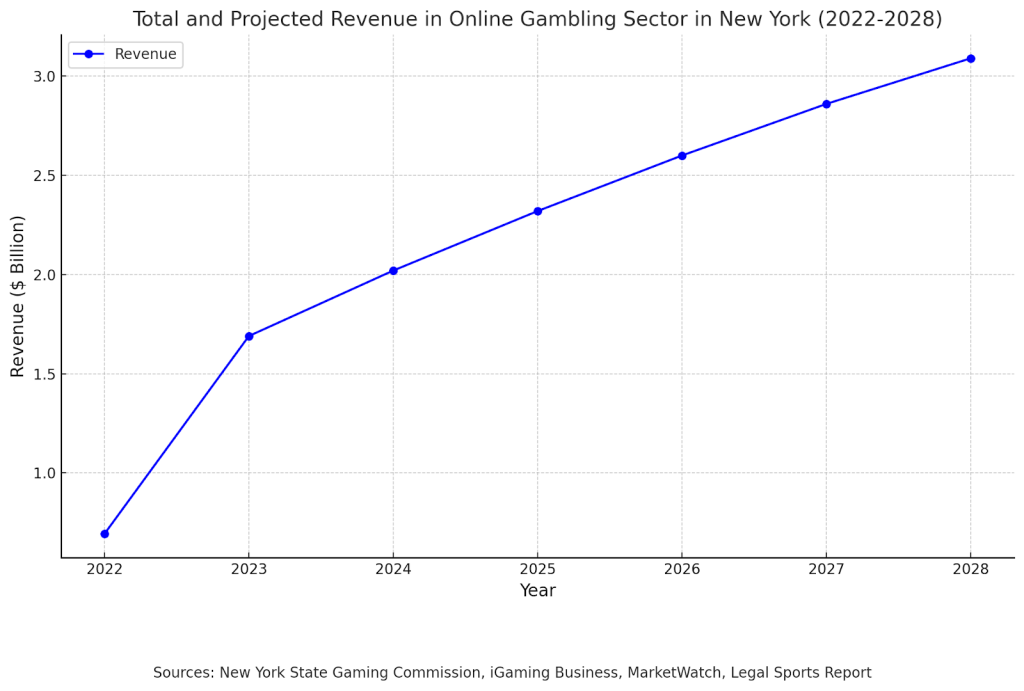

New York’s gambling market is fast becoming one of the most sought-after opportunities for online operators, offering a lucrative yet sophisticated market for iGaming operators. With a population exceeding 19 million and a proven appetite for online betting, the state has broken records since the launch of mobile sports wagering in January 2022. Notably, October 2024 saw $2.32 billion in online sports bets - the US's largest monthly handle ever recorded.

While New York offers enormous potential for iGaming operators, it also has some unique challenges. None more so than the 51% tax rate on betting revenue, which is one of the highest in the nation and generated over $2 billion in tax revenue in 2023 alone. While this may deter smaller operators, major players with sound strategies can find the rewards justify the cost.

The prospect of further liberalisation in the online market makes New York even more enticing. State Senator Joseph Addabbo introduced a proposed bill (S2614) in January 2025 to legalise online casino gaming, potentially opening the door to a much broader iGaming market. Speaking about the initiative, Addabbo stated:

Expanding online gaming is not just about economic benefits—it’s about meeting consumer demand and ensuring New York remains competitive in the modern gaming industry.

This sentiment reflects the growing recognition among lawmakers that innovation in the iGaming sector is key to keeping pace with neighbouring states, particularly as New York continues to attract significant interest from operators worldwide. If successful, the bill would broaden the scope of digital gaming options, creating opportunities for operators to establish a stronger presence in one of the most exciting gambling markets in the United States.

Operators considering entry to the New York market will undoubtedly face stiff competition from established giants like FanDuel and DraftKings, necessitating innovation and aggressive marketing to carve out their niche. Yet, with a rapidly evolving regulatory framework and significant legislative potential on the horizon, New York nonetheless presents an exciting opportunity for forward-thinking operators to capitalise on one of the most active gambling markets in the United States.

Advantages and Disadvantages of the New York Market

The New York gambling market offers significant opportunities for iGaming operators, but overcoming its challenges requires strategic planning and investment. Here is a list of the main advantages and drawbacks in 2025.

Market Advantages

-

Massive Revenue Potential: New York consistently reports record-breaking gambling revenues, demonstrating immense market opportunity.

-

Engaged Player Base: A population of over 19 million with an appetite for online wagering.

-

Strong Regulatory Framework: The New York State Gaming Commission governs all state commercial gaming activities.

-

Economic Centre: As a financial hub, the state attracts a diverse and affluent player demographic.

-

Future Growth Opportunities: Proposed legislation for online casinos could unlock even greater market potential.

-

Tech-Ready Environment: High internet penetration and digital infrastructure support engaging online gambling experiences.

Market Disadvantages

-

High Tax Rate: Operators face a steep 51% tax on online gambling revenue, impacting profitability.

-

Intense Competition: Dominance by established players like FanDuel and DraftKings makes market entry challenging.

-

Licence Costs: Significant expenses for obtaining and maintaining operational licences add to entry barriers.

How to Apply for a Gambling Licence in New York State

In New York, the application process for gambling licences depends on the specific type of gaming activity. Some licences, such as those for commercial casinos, may be subject to a Request for Proposals (RFP) process rather than a standard application.

For the most up-to-date licensing requirements, operators should refer directly to the New York State Gaming Commission (NYSGC) website, which provides detailed instructions and application materials for different licence types.

Similarly, entities aiming to offer mobile sports wagering must adhere to the Commission's Request for Applications page guidelines. Applicants must consult the NYSGC's official website to access the appropriate application forms and ensure compliance with all regulatory requirements.

Step-by-Step Guide to Applying for a Mobile Sports Licence

The process of applying for a mobile sports licence in New York ensures that only well-qualified operators enter the New York market.

Here’s a step-by-step guide for sportsbook operators seeking a mobile sports wagering licence in 2025:

Step 1: Submit a Request for Applications (RFA)

Operators must submit a formal application during the designated licensing periods outlined by the NYSGC. The Mobile Sports Wagering RFA Materials detail the requirements, financial obligations, and evaluation criteria. Applicants must provide a business plan, financial projections, and compliance measures.

Step 2: Meet Licensing Eligibility Requirements

Only qualified platform providers can apply. These include operators with a history of compliance, financial stability, and experience in regulated markets. Each applicant must undergo a background check, demonstrate ethical business practices, and meet state-mandated financial thresholds.

Step 3: Partner with a Licensed Commercial Casino

New York law requires that all mobile sports bets be processed through a licensed commercial casino’s servers. Operators must establish agreements with one of the four designated casino partners to legally accept wagers in the state.

Step 4: Comply with Tax and Revenue Requirements

New York imposes a 51% tax rate on mobile sports wagering revenue, the highest in the US. Operators must integrate NYSGC-mandated revenue reporting systems to maintain compliance and meet strict auditing requirements. The funds generated support education, youth sports, and problem gambling programs.

Step 5: Implement Responsible Gambling Measures

Operators must establish responsible gambling protocols, including self-exclusion tools, betting limits, and problem gambling awareness campaigns. Operators must also comply with the Office of Addiction Services and Supports (OASAS) to ensure consumer protection.

Step 6: Adhere to Advertising and Marketing Regulations

All marketing materials must comply with NYSGC advertising standards. Promotions cannot target minors or individuals enrolled in self-exclusion programs. Advertising must be truthful and transparent and include responsible gambling disclaimers.

Step 7: Undergo Technical Certification and Compliance Audits

Before launching, platform providers must complete technical compliance reviews, ensuring secure payment processing, geolocation tracking, and consumer protection mechanisms.

Disclaimer

The requirements for obtaining a mobile sports wagering licence in New York are subject to change. The licensing process is contingent on the New York State Gaming Commission (NYSGC) issuing a Request for Applications (RFA), which may have different criteria from previous licensing rounds. For the latest updates, including upcoming RFAs and regulatory changes, visit the NYSGC’s official website.

New York is just the beginning. Power up your operations with Altenar’s future-proof sportsbook solutions designed to expand with you. Schedule a software demonstration today, and let’s talk about growth.

NOTE

This information is provided for informational purposes only and should not be considered legal advice. For detailed guidance on applying for a mobile sports wagering licence in New York, please visit the New York State Gaming Commission’s official web page.