Overview Gambling Laws and Regulations in Malta - A Complete Guide

Malta has firmly established itself as a premier global hub for the iGaming industry, having pioneered online gambling regulation in the European Union in 2001. This detailed guide unpacks the country's robust legal framework, appealing to operators considering its market.

The Malta Gaming Authority (MGA) serves as the primary regulatory body, overseeing all gaming operations with a proactive approach to maintaining a safe and transparent environment. Operators can apply for Business-to-Consumer (B2C) licences for direct gaming services or Business-to-Business (B2B) licences for software and platform solutions, encompassing various gaming types such as casino games, fixed-odds betting, and peer-to-peer games.

Financial obligations include a non-refundable application fee of €5,000 and annual licence fees that vary based on revenue and licence type, ranging from €3,000 to €35,000. Additionally, operators are subject to a 5% gaming tax on revenue generated from players in Malta and other gaming levies. Maintaining compliance requires adherence to Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) regulations monitored by the Financial Intelligence Analysis Unit (FIAU), system audits, and player protection measures.

Licensing requirements are stringent, involving comprehensive business plan submissions, minimum share capital, and 'fit and proper' assessments for key personnel. Despite market competition, Malta offers EU market access, a competitive tax regime, a skilled multilingual workforce, and the credibility of a globally respected MGA licence, positioning it as an attractive choice for iGaming operators seeking sustainable growth and market expansion.

Are you considering Malta’s iGaming market? In this detailed guide, Altenar unpacks the legal framework for iGaming operators, covering everything from regulations and licensing procedures to associated costs and operational expenses. Plus, we’re also sharing insights that go beyond the basics.

History of Gambling in Malta

The history of gambling in Malta dates back centuries, with early evidence of gaming activity recorded during the rule of the Knights of St. John. Early games were often social and became a fixture of Maltese society. They gradually evolved into a more structured activity under British colonial rule, which introduced formal betting laws.

By the mid-20th century, attitudes towards gambling began to shift. What was once informal entertainment now held potential as an economic driver. The 1960s saw the introduction of the Public Lotto Ordinance, which regulated lotteries and marked the first step towards a controlled gambling environment. Public sentiment towards gambling began to soften, reflecting its acceptance as both leisure and a legitimate business sector.

In 2001, Malta transformed global gambling by becoming the first EU country to regulate online gambling with the Lotteries and Gaming Authority Act. This groundbreaking legislation positioned Malta as a pioneer in the iGaming industry, attracting operators worldwide. Over the years, significant updates, including the 2018 Gaming Act, streamlined and strengthened regulations, reinforcing the country’s reputation as a regulatory innovator.

Timeline of Events

Malta’s reputation as a global hub for the iGaming industry is built on decades of strategic legislation and forward-thinking regulatory frameworks. This timeline highlights its evolution and key moments that have defined its position as a leader in the sector.

- 1922 – Establishment of Malta’s first lottery

- 1948 – Betting regulations introduced for horse racing

- 1950 – Launch of the National Lottery

- 1998 – First Gaming Act regulating local gambling

- 2001 – The nation pioneers licensing for online gambling

- 2004 – Malta joins the European Union

- 2010 – Revision of laws for online poker

- 2015 – Introduction of the Responsible Gaming Fund

- 2018 – New Gaming Act simplifies regulations

- 2020 – AML compliance strengthened for iGaming operators

The Current Situation for iGaming

Building upon Malta's rich gambling history, the nation has emerged as a premier iGaming hub. It offers a comprehensive and regulated environment for various online and land-based gambling games and sports betting. The Malta Gaming Authority (MGA) oversees all gaming operations, which has created a flexible regulatory framework that stands out in Europe. Moreover, Malta offers a more accommodating environment for operators than many other EU countries with stricter regulations.

This approach has attracted numerous iGaming companies to establish operations in Malta. Furthermore, its progressive stance has positioned Malta as an influential jurisdiction in the global iGaming industry, balancing operator interests with player protection. As the first EU nation to regulate online gaming in 2004, Malta offers operators a well-defined legal structure, attractive tax incentives, and an internationally respected licence. Winnings from gambling are generally not subject to taxation for players in Malta, providing a favourable environment for sports betting enthusiasts. However, operators are subject to gaming taxes and must comply with MGA regulations.

Licence Costs and Tax Considerations

Malta's iGaming sector permits casino games, fixed-odds betting, pool betting, poker, bingo, and controlled skill games. Operators can apply for two primary licence types: Business-to-Consumer (B2C) and Business-to-Business (B2B). Each licence type encompasses different gaming services tailored to the operator's business model.

Gaming Services - Business-to-Consumer (B2C) Licence

A B2C Gaming Service Licence is mandatory for Maltese or EU/EEA entities intending to provide gaming services from Malta, either to Maltese residents or via a Maltese legal entity.

Gaming services encompass:

-

The offering, provision, or operation of gaming activities; and

-

Hosting gaming devices or systems in publicly accessible premises, whether owned, controlled, or managed by the operator.

Gaming Services - Business-to-Business (B2B) Licence

A corporate group may apply for a B2C corporate MGA licence, designating the parent entity (with over 90% control through shares or voting rights) as the Licensee. The nominal holder of the licence is responsible for regulatory dues, reporting, and compliance.

-

Providers of game software and platform solutions to B2C operators.

-

Licensing allows the provision of systems that facilitate gaming services but does not permit direct player interaction.

Under this licence, multiple gaming verticals can be offered upon approval and grouped by Gaming Types to determine compliance contributions and capital requirements.

Each gaming service licence type is tailored to the operator's specific business model.

Type 1

-

Casino games including blackjack, roulette, slots, and other random number generator (RNG) games.

-

Games of chance played against the house.

Type 2

-

Fixed-odds betting, including sports betting and other event-based wagering.

-

Bets placed against the house.

Type 3

-

Peer-to-peer games like poker, bingo, and betting exchanges.

-

Games where players compete against each other and those where the operator takes a commission.

Type 4

-

Controlled skill games, such as fantasy sports.

For further details, operators can refer to the MGA’s Remote Gaming Services Section.

Compliance Contribution

Compliance Contribution is a fee based on gaming revenue from qualifying activities, as outlined in Part A of the First Schedule of the Gaming Licence Fees Regulations (S.L. 583.03). It applies to Type 1, Type 2, Type 3, and Type 4 gaming services. A minimum fee must be paid monthly, depending on the approved gaming services and revenue generated during the licence period.

MGA Licence Application Costs

Applying for and maintaining a Malta Gaming Authority (MGA) licence involves several financial commitments. Upon submission, a non-refundable application fee of €5,000 is required. Once approved, B2C operators pay a fixed annual licence fee of €3,000 if their yearly revenue does not exceed €1,000,000 and €5,000 if it does.

For B2B operators, a one-time, non-refundable application fee of €5,000 initiates the licensing process. Once approved, annual licence fees depend on the operator’s revenue. For standard B2B licences, fees range from €25,000 for revenue below €5 million to €35,000 for revenue exceeding €10 million. All payments are non-refundable and must be made upfront.

In addition, operators must undergo a system audit by an MGA-approved auditor, incurring separate costs. These fees ensure that operators are financially prepared to maintain compliance and uphold the integrity of Malta's gaming industry.

Licence Renewals

MGA licences are valid for 10 years. Operators must pay the applicable annual licence fee each year in advance. Timely payment is needed to maintain good standing and ensure uninterrupted operations. Failure to comply may result in penalties or suspension of the licence.

Tax Obligations

Operators are subject to a 5% gaming tax on gaming revenue generated from services offered to players physically present in Malta. This tax is payable monthly and accompanied by regulatory returns detailing the relevant data.

Gaming Levy

In Malta, gaming levies are also imposed, which form an integral part of the taxation framework for licensed gaming operators. While traditional taxes focus on corporate income or VAT, the gaming levy specifically targets the revenue generated from licensed gaming activities. It acts as a regulatory tax, ensuring operators contribute directly to the funding of oversight, compliance, and enforcement mechanisms within the local gaming industry, as highlighted in the Malta Gaming tax regulations guide (S.L.583.10).

Maintaining Compliance

Maintaining compliance involves ongoing expenses, including regular system and compliance audits, adherence to anti-money laundering regulations, and implementation of responsible gaming measures. Operators must also invest in staff training and technological systems to monitor and report activities effectively. These efforts are essential to uphold the standards set by the MGA.

Operators should consult the MGA's Licence Fees and Taxation Guidance Note for detailed information on costs and fees.

Regulatory Gambling Authorities

Three principal authorities regulate gambling in Malta: the MGA, the FIAU, and the Commissioner for Revenue. Together, they form the backbone of a regulatory ecosystem designed to maintain fairness, financial integrity, and compliance, creating an attractive environment for operators looking to enter the Maltese market.

Malta Gaming Authority (MGA)

Established in 2001, the MGA is the backbone of Malta's gaming industry. Tasked with licensing operators and ensuring regulatory compliance, the Malta Gaming Authority is renowned for its proactive approach to creating a safe and transparent gaming environment. It enforces stringent measures to combat crime, protect vulnerable players, and uphold player rights. For operators, securing an MGA licence means gaining international credibility and access to one of the most respected regulatory frameworks in the iGaming world.

A key part of its influence is licensing operators, with its ability to set and adapt regulations to meet evolving industry needs. This includes guidelines on responsible gaming, reporting obligations, and data security. The MGA also conducts audits and investigations, ensuring operators consistently meet these standards.

Financial Intelligence Analysis Unit (FIAU)

The Financial Intelligence Analysis Unit plays a significant role in preserving Malta’s status as a leading iGaming jurisdiction by combating financial crime. It oversees anti-money laundering (AML) and counter-financing of terrorism (CFT) compliance for gambling operators, ensuring adherence to the Prevention of Money Laundering Act and related directives.

On a daily basis, the FIAU works closely with operators, providing detailed guidance on implementing effective AML measures, such as customer due diligence and transaction monitoring. Through periodic assessments and collaboration with the MGA, the FIAU ensures that operators maintain robust mechanisms to mitigate financial crime risks. Non-compliance can lead to penalties or licence revocation, highlighting the unit’s significant influence on how businesses operate. By ensuring financial transparency, the FIAU enhances Malta’s reputation as a trusted gaming jurisdiction.

Commissioner for Revenue

Like in other mature gambling jurisdictions, tax compliance is fundamental to operating successfully in Malta. The Commissioner for Revenue plays a central role in managing the tax obligations of licensed iGaming operators, including gaming taxes, corporate income tax, and VAT. The authority ensures that operators understand and fulfil their financial responsibilities through clear guidelines and streamlined reporting systems.

The Commissioner’s influence extends to policy enforcement, ensuring that tax revenues contribute to Malta’s economic growth while maintaining the country’s attractiveness to iGaming businesses. For operators, this means negotiating specific tax structures, such as Malta’s favourable corporate tax regime that allows compliant iGaming operators to significantly reduce their tax burden through strategic profit distribution and shareholder refunds for companies meeting regulatory requirements.

Licensing Requirements for iGaming Operators

The most significant challenge for new entrants is meeting the high compliance standards set by the MGA, which demand thorough preparation and adherence to detailed requirements. Below is an overview of the essential criteria operators must satisfy:

-

Corporate Establishment

Entities must be established within the EU or EEA, ensuring compliance with regional legal standards.

-

Minimum Share Capital Requirements

Operators are required to maintain a minimum share capital, varying by game type, to demonstrate financial stability.

-

Comprehensive Business Plan Submission

Applicants must present a detailed business plan outlining operational and financial strategies, ensuring sustainable and compliant operations.

-

Fit and Proper Assessment

Key individuals undergo rigorous evaluations to confirm their integrity, competence, and suitability.

-

System and Compliance Audits

Implementation of robust internal procedures is mandatory, with systems subject to MGA audits to verify adherence to regulatory standards.

-

Local Presence and Operational Infrastructure

While not explicitly mandated, establishing a physical office in Malta and employing local experts can facilitate compliance and greater operational efficiency.

-

Adherence to Anti-Money Laundering (AML) Policies

To prevent financial crimes, operators must implement comprehensive AML measures, including customer due diligence and reporting protocols.

-

Player Protection and Responsible Gaming Measures

It is essential to ensure mechanisms are in place to safeguard players, such as self-exclusion options and support for problem gambling.

Additional Requirements

The following additional requirements go beyond the standard application process and focus on maintaining long-term compliance and operational efficiency within Malta's regulatory framework:

-

Ongoing Compliance Reporting

Operators must submit regular reports to the MGA, including financial statements, proof of player fund segregation, and compliance audit results

-

Technical Infrastructure Standards

Operators must host their servers in an MGA-approved jurisdiction or within Malta. This facilitates regulatory oversight and ensures compliance with data protection laws like GDPR.

-

Gaming Taxation and Fees

Monthly gaming taxes must be paid based on revenue brackets. Operators are also responsible for covering licensing fees, which vary by the type of gaming services offered.

-

Prevention of Money Laundering and Terrorism Financing

Beyond AML policies, operators must establish mechanisms to monitor transactions, report suspicious activities, and keep records of all financial operations for at least five years.

-

Approval of Game Content

If the gambling software uses a random number generator (RNG), it must be tested and certified by approved independent labs to ensure fairness, randomness, and compliance with MGA standards. However, other types of gambling software may be subject to checks that the MGA carries out as part of its system and compliance audits.

-

Responsible Advertising

All marketing and promotional material must adhere to the MGA's advertising guidelines, as outlined in the Commercial Communications Committee Guidelines.

How to Apply for a Gambling Licence in Malta

By diligently following these steps and ensuring all criteria are met, iGaming operators can establish a compliant and successful gaming operation in Malta.

Step 1. Preliminary Assessment

Review the Malta Gaming Authority’s (MGA) System Documentation Checklist to understand the required documentation and ensure all prerequisites are met. This includes preparing policies, procedures, and technical specifications aligned with MGA standards.

Step 2. Local Presence and Expertise

While not mandatory, setting up a physical office in Malta can streamline communication with the MGA and demonstrate commitment. Local expertise can also offer guidance through complex requirements such as data protection under GDPR, anti-money laundering (AML) protocols, and player protection measures, as well as managing day-to-day operations in compliance with Maltese laws.

Step 3. Submission of Application

Applications are submitted through the MGA Licensee Portal. Select 'New Licence Application' and choose the appropriate licence type (e.g., B2C for Business-to-Consumer operations) and channel (remote, land-based, or both). The portal allows applicants to track the status of their applications in real time.

Note. The application fee is payable when submitting the licence application. This non-refundable fee covers the MGA’s evaluation process, including probity checks, documentation review, and other administrative assessments. The exact amount payable varies depending on the type of licence applied for.

Step 4. Documentation Requirements

Applicants must provide comprehensive documentation, including a detailed business plan outlining operational and financial strategies and documentation on the operating policies and procedures as specified in the ‘System Documentation Checklist’.

Step 5. Fit and Proper Assessment

The MGA conducts a thorough assessment of the applicant's shareholders and key persons to ensure they are fit and proper to conduct gaming business. This includes checks with national and international regulatory bodies to confirm the integrity and suitability of all individuals involved in the operation.

Step 6. Technical Setup and System Audit

Applicants must implement their gaming and control systems in a technical environment that is ready for operation. Arrange for an independent System Audit to be performed by a third-party service provider approved by the MGA. The audit evaluates the technical setup and verifies compliance with MGA standards.

Step 7. Compliance with Regulatory Framework

Operators must ensure adherence to the MGA's regulatory framework, including AML policies, player protection measures, and responsible gaming practices. Regular compliance audits may be conducted to verify ongoing adherence during the licence period.

Step 8. Licence Approval

The MGA grants a 10-year gaming licence upon successful completion of assessments and audits. Operators must maintain compliance with all regulatory requirements throughout the licence period.

Step 9. Develop a Compliance Framework

Create and implement solid compliance policies covering all operation aspects, from AML to responsible gambling practices. Establishing internal audit mechanisms to monitor ongoing compliance secures readiness for the MGA's periodic assessments and avoids penalties or licence revocation.

What the Future Holds for Malta’s iGaming Market

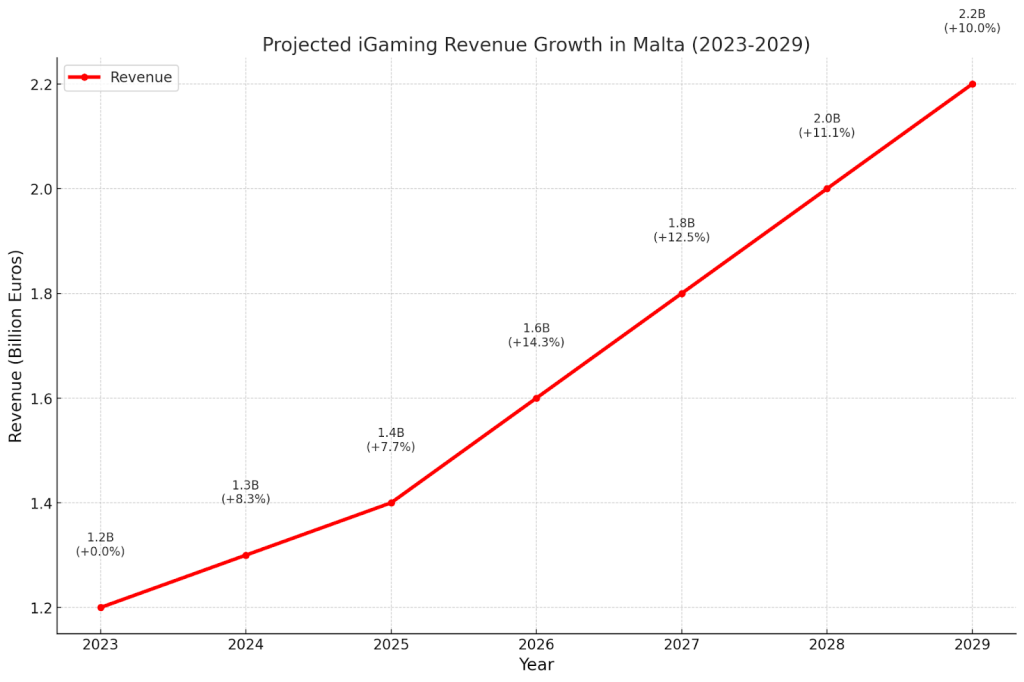

Data Sources: H2 Gambling Capital, VIXIO GamblingCompliance, or Statista for iGaming market trends and revenue statistics, MGA annual reports for official revenue figures.

Malta has firmly established itself as a premier destination for online sportsbook and casino operators, driven by remarkable growth in the iGaming sector. In 2023, the global online gambling market generated $81 billion in revenue, with a projected Annual Growth Rate (CAGR) of 9.6%; a trajectory Malta is well-positioned to benefit from. Its strategic location, EU membership, and advanced infrastructure give operators extraordinary access to European markets while encouraging local innovation and growth.

Malta's favourable tax environment is a key attraction for operators. With gaming tax rates designed to enhance profitability and an effective corporate tax system that is among the most competitive in the EU, Malta has become a financial haven for the industry. This is complemented by the MGA’s comprehensive licensing framework, which secures fair play, player protection, and high trust—qualities that resonate strongly with global audiences.

Malta’s population of approximately 514,000 demonstrates strong enthusiasm for online gambling, creating a supportive local market. On top of that, the nation’s multilingual, skilled workforce and advanced technological infrastructure give operators the resources needed to run efficiently. While the MGA’s licensing process is thorough, obtaining its highly regarded licence opens doors to other jurisdictions and enhances operational credibility.

Malta’s iGaming sector isn’t just growing - it’s redefining what a progressive, operator-friendly market can look like in Europe.

Looking forward, Malta continues to adapt and innovate. Emerging technologies like blockchain and AI are being integrated into operations, while regulatory updates maintain a dynamic and responsive environment. These advantages, paired with its flexibility compared to other European jurisdictions, make Malta a convincing choice for iGaming operators seeking sustainable growth and market expansion.

MARKET ADVANTAGES

-

Prestigious Licensing Authority: A globally respected MGA licence provides credibility.

-

EU Market Access: Operators gain legal entry to the entire EU market.

-

Favourable Tax Regime: Competitive gaming taxes attract operators.

-

Skilled Workforce: Access to a multilingual and highly trained iGaming talent pool.

-

Established iGaming Ecosystem: A solid network of gaming firms, tech providers, and financial services.

MARKET DISADVANTAGES

-

Intense Competition: A saturated market with numerous operators already established.

-

Strict Compliance Requirements: Extensive AML and responsible gaming measures demand ongoing investments.

The Compliant Solution Global Operators Trust

Don’t let compliance complexities hold you back. Altenar’s gaming software is your strategic partner for meeting Malta’s high standards for regulatory requirements while driving profitability. Contact us today to see how our technology can exceed your expectations.

Disclaimer

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice and Altenar does not accept any liability in relation to its use.