Michigan has become one of America’s richest digital gambling hubs, with iGaming giants such as BetMGM, FanDuel, and Caesars anchoring a market worth more than $2 billion annually. But this is no open frontier. Every licence is tethered, every partnership hard won, and regulators have shown little patience for those testing the boundaries.

What makes this state interesting is not just the money, but the model. It’s a market built through tribal compacts, casino interests, and state oversight. This article explains how that framework was built and what it demands of operators.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

The Evolution of Gambling in Michigan

Michigan’s entry into gambling has been taken by steady, often hard-fought steps rather than sudden leaps. For much of the 20th century, the state’s political climate leaned conservative, with gambling viewed through a lens of social caution. That began to change in 1972, when voters approved the establishment of the Michigan Lottery. It was pitched as a way to fund education, and its success helped soften public scepticism by linking gambling to social well-being.

Horse racing, long a part of the state’s sporting traditions, offered the next outlet. The Horse Racing Law of 1995 provided a legal foundation for pari-mutuel wagering. However, the decline of live racing would eventually lead to the closure of Northville Downs in 2024, bringing an end to horse racing in Michigan for the first time in generations.

The breakthrough moment for commercial gambling came in 1996, when voters backed a constitutional amendment to allow three commercial casinos in Detroit. MGM Grand, MotorCity, and Greektown would come to symbolise both the economic promise and regulatory discipline of the Michigan Gaming Control and Revenue Act. In parallel, tribal gaming compacts flourished, resulting in the development of more than 20 Class III casinos across the state. This balance of commercial and tribal interests became a defining feature of Michigan’s gambling environment.

By the late 2010s, attention had shifted from brick-and-mortar venues to the online space, where the next phase of Michigan’s gambling story would unfold. After years of debate and failed bills, the Lawful Internet Gaming Act and Lawful Sports Betting Act were passed in 2019, legalising both online casinos and sports wagering. When the first mobile platforms launched in 2021, Michigan positioned itself as a national leader. Joining the interstate poker compact in 2022 reinforced that reputation, linking its players with New Jersey, Nevada, Delaware, and West Virginia.

By 2025, Michigan had built one of the most expansive regulated markets in the United States., which was rooted in pragmatism but unafraid to embrace innovation when the time was right.

Timeline of Key Moments and Events

From the first state lottery ticket to the arrival of interstate poker, these are the milestones that shaped Michigan’s regulated gambling market.

1972: Michigan voters approve the creation of the state lottery.

1980s–1990s: Tribal-state compacts signed under IGRA.

1996: Voters approve three commercial casinos in Detroit.

1995: Horse Racing Law provides a framework for pari-mutuel betting.

2019: Lawful Internet Gaming Act and Lawful Sports Betting Act signed into law, authorising online casinos and sports wagering.

2021: First online casino and sportsbook platforms go live.

2022: State joins the Multi-State Internet Gaming Agreement (MSIGA)

2023: Start of fantasy sports rules banning ‘pick’em’ style contests.

2024: Northville Downs closes after nearly 80 years of operation.

2025: MGCB issues cease-and-desist orders to offshore operators.

Current Landscape for Gambling

From those early experiments with the lottery and Detroit’s casino ventures, Michigan has grown into one of the most comprehensive gambling markets in the country.

At the centre of today’s market are Detroit’s three commercial properties joined by more than 20 tribal casinos across the state under Class III agreements. Together, they form a dual structure that has proven to work, with both tribal and commercial properties adapting to the arrival of online play rather than resisting it. Both sets of operators (commercial and tribal) are not only allowed to operate land-based gaming floors but also hold licences for online casinos and sportsbooks, creating one of the widest fields of operators of any US state.

This online sector is now one of the country’s largest. Mobile casino games, digital slots, and sports betting platforms have rapidly gained mainstream adoption since their launch in 2021. In support of this, monthly figures consistently show hundreds of millions in revenue. The Michigan Lottery has also built out its own digital offering, while remaining constitutionally protected as the sole operator of draw games and keno.

Other verticals remain more contained. Charitable gaming is permitted under the Bingo Act, while fantasy sports are regulated but limited in scope after rules banning “pick’em” style contests emerged. And horse racing, once part of Michigan’s sporting heritage, has all but vanished.

Who Regulates Gambling in Michigan?

The state’s legal market depends not only on laws but on the regulators tasked with enforcing them. Michigan has several, each with its own sphere of authority and influence. Here are the key institutions that shape Michigan’s gambling environment today.

Michigan Gaming Control Board (MGCB)

The Michigan Gaming Control Board is the state’s lead regulator and the key authority for any operator entering the online gambling market. Its remit covers commercial casinos, tribal compliance, sports betting, internet casino gaming, daily fantasy sports, and horse racing. The board issues licences to operators, suppliers, and vendors, and enforces laws such as the Lawful Internet Gaming Act and the Lawful Sports Betting Act.

Beyond licensing, it supervises technical testing, mandates player verification standards, and approves all gaming systems used in the state. The MGCB is known for having a firm enforcement record, regularly issuing cease-and-desist orders to unlicensed offshore operators, while also funding responsible gambling initiatives like the ‘Don’t Regret the Bet’ campaign. For operators, it represents both the gatekeeper and guarantor of Michigan’s gambling market.

Michigan Lottery / Bureau of State Lottery

The Michigan Lottery operates as a state monopoly, running draw games, instant tickets, keno, and a growing iLottery platform. By constitutional design, its expansion into other forms of gambling is restricted, maintaining a tight focus on traditional lottery products. The Lottery also regulates charitable gaming through the Bingo Act, which covers bingo nights, raffles, and charity tickets for non-profit organisations. With IGT contracted as its technology partner through 2031, it remains one of Michigan’s most stable revenue generators.

Tribal Gaming Commissions

Michigan’s 12 federally-recognised tribes operate their own Class III casinos under tribal–state compacts, with each tribal commission responsible for licensing and oversight of facilities on their lands. These compacts outline permitted games, revenue-sharing obligations, and exclusivity provisions that protect the interests of the tribes. While sovereignty grants tribes broad autonomy, the National Indian Gaming Commission provides federal oversight, and the MGCB retains inspection rights under the governor’s authority. Together, this framework strikes a balance between tribal independence and state-level compliance.

Department of Insurance and Financial Services (DIFS)

The Department of Insurance and Financial Services regulates Michigan’s financial and payment systems, thereby giving it an indirect but essential role in the state's gambling industry. For licensed operators, the primary role of DIFS is to oversee anti-money laundering compliance and the integrity of payment channels used in gaming transactions. Working in conjunction with federal regulations under the Bank Secrecy Act, the department ensures that the financial practices of operators meet both state and national standards to reinforce Michigan’s reputation as a secure and tightly regulated market.

Gateway to Market: Michigan’s Partnership Route

For independent operators eyeing Michigan’s iGaming market, the reality is that entry isn’t possible without a local partner. Every online sportsbook and iCasino licence is tethered to either one of Detroit’s three commercial casinos or one of the 12 federally-recognised tribes operating Class III casinos under compacts. That tethering requirement defines how the market functions, meaning that access depends on partnerships rather than an open application process.

How It Works

The MGCB only issues operator licences to casino licence holders. These licensees, in turn, may contract with external brands to run digital platforms under their umbrella. In practice, this means an operator like FanDuel or DraftKings doesn’t hold a standalone licence. Instead, they partner with an existing casino and operate as a ‘skin’ (sub-licences) under its approval. For online casinos, two brands are permitted per licence. For sports betting, each licence supports a single digital brand.

What the Partnership Entails

Partnership agreements typically involve revenue-sharing, brand usage rights, and operational integration. The casino licence holder remains legally responsible to the MGCB for compliance, and the partnered operator manages the platform, technology, customer-facing product, and marketing.

These agreements can vary significantly in terms of economics, as some partners operate as the dominant brand, while others share branding with the underlying casino. For tribal agreements, negotiations may also encompass broader commercial terms aligned with tribal economic priorities.

Finding a Suitable Partner

For would-be entrants into Michigan, the first step is recognising that the pool of potential partners is fixed, consisting of three commercial casinos and 12 federally-recognised tribes as listed on the MGCB website:

Detroit’s three commercial casinos:

-

MGM Grand Detroit

-

MotorCity Casino Hotel

-

Hollywood Casino at Greektown

Twelve federally-recognised tribes with Class III gaming compacts:

-

Bay Mills Indian Community

-

Grand Traverse Band of Ottawa and Chippewa Indians

-

Hannahville Indian Community

-

Keweenaw Bay Indian Community

-

Lac Vieux Desert Band of Lake Superior Chippewa Indians

-

Saginaw Chippewa Indian Tribe

-

Sault Ste. Marie Tribe of Chippewa Indians

-

Little River Band of Ottawa Indians

-

Little Traverse Bay Bands of Odawa Indians

-

Nottawaseppi Huron Band of Potawatomi Indians

-

Pokagon Band of Potawatomi Indians

-

Gun Lake Band of Match‑E‑Be‑Nash‑She‑Wish Band of Potawatomi Indians

Operators seeking to establish partnerships should start by identifying which tribe aligns best with their strategy, taking into consideration factors such as geography, brand voice, or prior supplier relationships, before initiating outreach.

In practice, partnerships typically form through two primary routes. The first is brand strength. National leaders, such as FanDuel, DraftKings, and BetMGM, were able to secure early slots by leveraging their reputations and resources. The second is relationship-building. Smaller entrants have been known to begin as licensed suppliers, providing technology, content, or payment solutions, before expanding those relationships into full operating agreements when opportunities arise.

Operators should prepare for complex negotiations with tribal casinos, since agreements may be shaped by revenue share, technology provision, and alignment with tribal economic or sovereignty priorities. To this extent, unlike commercial casinos, tribes may weigh broader community benefits as part of their decision-making process, making political and cultural sensitivity just as important as financial terms.

Yet, the real challenge is scarcity. All licences are currently spoken for, and most existing operators are locked into long-term deals. In this state, patience and positioning matter as much as product innovation.

Current Skin Arrangements in Michigan

Michigan’s 15 available licences are currently taken, split between Detroit’s three commercial casinos and the state’s 12 tribal operators. Each licence supports at least one online sportsbook, and most also back an iCasino platform. Below is an overview of notable partnerships as of 2025:

| Licence Holder | Partner Brands | Vertical(s) |

|---|---|---|

| MGM Grand Detroit | BetMGM | Casino + Sportsbook |

| MotorCity Casino Hotel | FanDuel | Casino + Sportsbook |

| Hollywood Casino at Greektown | Barstool (transitioning to ESPN BET) | Casino + Sportsbook |

| Bay Mills Indian Community | DraftKings | Casino + Sportsbook |

| Little River Band of Ottawa Indians | BetRivers | Casino + Sportsbook |

| Pokagon Band of Potawatomi Indians | Four Winds Online Casino | Casino + Sportsbook |

| Sault Ste. Marie Tribe of Chippewa Indians | Caesars | Casino + Sportsbook |

| Nottawaseppi Huron Band of Potawatomi | FireKeepers Online | Casino + Sportsbook |

| Gun Lake Band (Match-E-Be-Nash-She-Wish) | Gun Lake/Parx | Casino + Sportsbook |

| Grand Traverse Band of Ottawa & Chippewa | WynnBET (recently scaling back) | Casino + Sportsbook |

| Lac Vieux Desert Band | PointsBet (Fanatics acquisition in progress) | Casino + Sportsbook |

| Hannahville Indian Community | SI Sportsbook (transition under way) | Sportsbook |

| Saginaw Chippewa Indian Tribe | Soaring Eagle Online | Casino + Sportsbook |

| Keweenaw Bay Indian Community | Golden Nugget | Casino + Sportsbook |

| Little Traverse Bay Bands of Odawa Indians | Odawa Online | Casino + Sportsbook |

Source: MGCB & Vixio Michigan State Report

Note: The partnerships listed reflect current operator–licence arrangements as of 2025. Several brands are undergoing rebranding or ownership transitions (e.g., Barstool to ESPN BET, PointsBet to Fanatics, and WynnBET scaling back nationally), which may alter the branding associated with some licences. The Michigan Gaming Control Board maintains the definitive register of approved operators.

Licensing and Compliance Requirements

The following requirements are fundamentally essential under the Lawful Sports Betting Act and Internet Sports Betting Rules for operators wanting to obtain and maintain approval in the state of Michigan:

For Sportsbook Operators

Operate Under a Casino or Tribal Partnership

Only a Detroit casino licensee or a federally-recognised tribe operating a Class III casino may apply for a sports-betting operator’s licence. A maximum of one mobile sports-betting brand (skin) is permitted per licence.

Application and Licensing Fees

Applicants must pay a $50,000 application fee and a $100,000 initial licence fee. Once licensed, operators are subject to a $50,000 annual renewal fee. Licences are valid for five years.

Technical and Security Standards

Operators must comply with GLI-33 technical standards for event wagering systems. Annual security assessments against ISO 27001 (or an equivalent standard) are required, along with data retention for a minimum of five years and mechanisms for MGCB audit access.

Server Location Requirements

All sports-betting servers must be located within Michigan’s borders to ensure MGCB oversight.

Anti-Money Laundering Obligations

Operators must comply with federal AML standards under the Bank Secrecy Act, including know your customer (KYC) checks, suspicious activity reporting, and maintain AML compliance records for at least five years.

Taxation and Financial Requirements

Sports-betting operators are taxed at 8.4% of adjusted gross sports-betting receipts. Detroit casinos must also pay an additional 1.25% municipal services fee. A federal excise tax of 0.25% on handle applies nationwide.

Responsible Gambling Requirements

Operators must implement deposit, wagering, and time-limit tools, support permanent or temporary self-exclusion, and display the state’s official helpline (1-800-GAMBLER). Auto-play features are prohibited, and reality checks must be delivered at least every 30 minutes.

Advertising and Marketing Standards

Marketing must not target minors, self-excluded persons, or vulnerable groups. All advertising must include the compulsive gambling helpline. Operators may share exclusion lists with licensed third parties solely for the purpose of removing names from promotional campaigns.

For iCasino Operators

The broad structure is nearly identical between online sportsbooks and iCasinos in Michigan, since the MGCB governs both under tethering rules. But when you dig into the details, a few things stand out. Here are the key differences:

Number of skins: Online casino operators may run up to two brands (one poker, one ‘other’ casino games), whereas sportsbooks get only one.

Tax rates: Online casino receipts are taxed on a graduated scale (20–28%), which is higher than the flat 8.4% tax rate for sports betting. Detroit casinos also pay an extra 1.25% city services fee.

Permitted games: Internet casino licences cover poker, blackjack, slots, and other typical casino games, but not lottery-style games, which remain the exclusive domain of the Michigan Lottery.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

Opportunities and Future Outlook

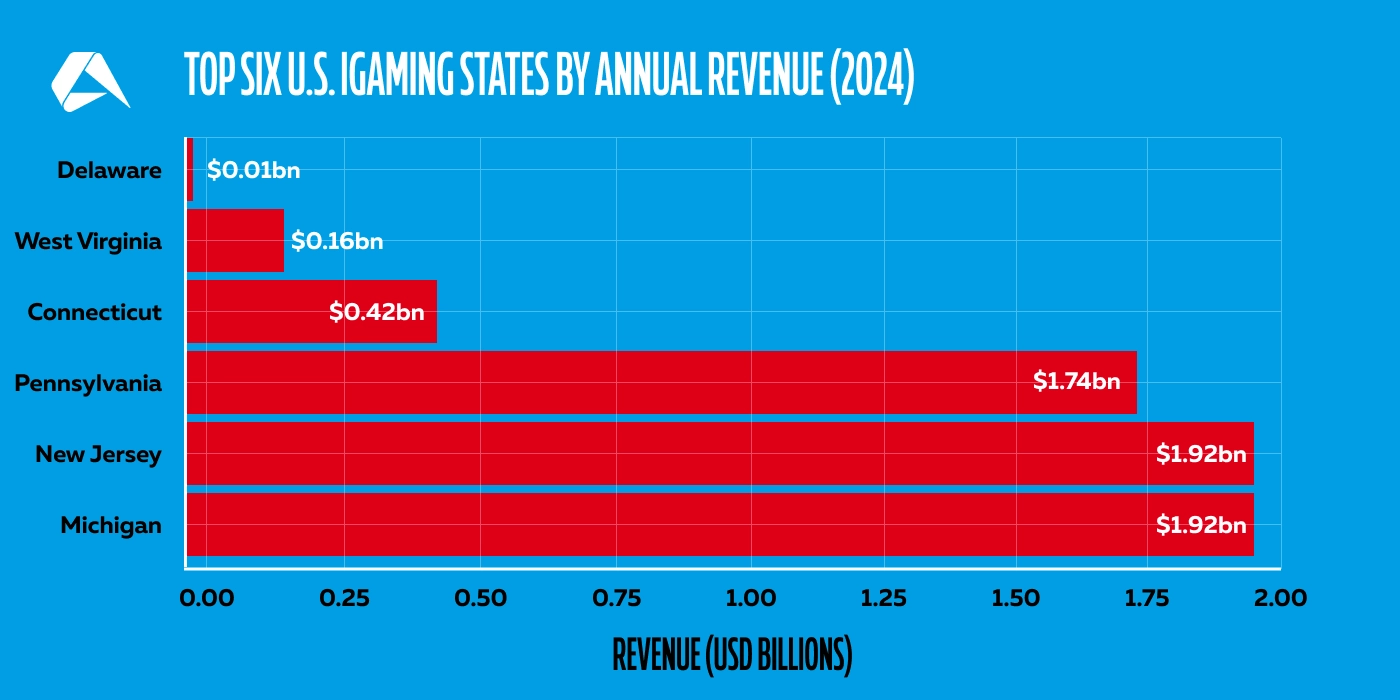

Five years after Michigan took the leap into full digital regulation, the state has carved out a reputation as one of the most stable iGaming jurisdictions in the US. In 2024, internet gaming operators generated $2.2 billion in adjusted gross receipts (AGR), while sports betting contributed an additional $194.3 million. By January 2025, the monthly iGaming AGR alone was already topping $233 million, demonstrating a strong market that has not only matured but is still edging upwards.

Data Sources: American Gaming Association (Commercial Gaming Revenue Tracker, 2024); Michigan Gaming Control Board; New Jersey Division of Gaming Enforcement; Pennsylvania Gaming Control Board; CDC Gaming Reports; Sportsbook Review; MarketWatch.

That level of digital consistency places Michigan alongside New Jersey and Pennsylvania as one of the top three US iGaming markets. Unlike New York, which relies on betting handle, Michigan’s story is casino-led, with operators enjoying one of the most comprehensive frameworks in the country, encompassing online slots, poker, blackjack, and sports wagering all under a single regulatory umbrella.

But the market is not wide open. All 15 available licences are spoken for, tethered either to the three Detroit commercial casinos or to Michigan’s tribal properties. For new entrants, this means partnerships, acquisitions, or supplying licensed operators are the only realistic paths into the market.

Regulators, meanwhile, are doubling down on enforcement against unlicensed operators and tightening oversight of licensed platforms. In 2025, the MGCB issued a wave of cease-and-desist orders against offshore operators and welcomed the exit of Bovada, which had long been considered the highest-profile unlicensed brand in the US market. As Executive Director Henry Williams noted in a July comment this year in an MGCB article: “Illegal gambling operators threaten the safety of our citizens and the integrity of our gaming industry… we take this seriously.” It’s a statement that should be read as both reassurance to licensees and a warning to outsiders.

For operators, the next chapter will not be about raw consumer demand, which is already proven, but about positioning. Differentiation, stronger responsible gambling tools, and readiness for regulatory evolution will decide who thrives. Michigan is not expanding its licence count anytime soon, but with iGaming revenues growing month by month, the market remains one of the most attractive and fiercely protected in the US.

Advantages and Disadvantages of the Michigan Gaming Market for Independent Operators.

Michigan is both a lucrative and restrictive market. Strong regulation and a broad product mix have created real opportunity, but access is tightly controlled, and competition is intense. The points below highlight the main advantages and drawbacks:

Market Advantages

-

Mature and diversified market: One of only a handful of US states that permits both online casinos and sports betting.

-

High digital engagement: Michigan consistently ranks among the top three iGaming states by annual revenue.

-

Stable regulatory framework: The MGCB has a strong track record of enforcement and transparency.

-

Interstate poker access: Michigan offers pooled liquidity in online poker, an opportunity not available in most states.

-

Large population base: With ~10 million residents, Michigan is the most populous state to combine sports betting and iCasino.

Market Disadvantages

-

Closed licensing environment: All available online casino and sportsbook licences are already tethered in 2025.

-

Heavy competition: Market share is concentrated among dominant brands like FanDuel, DraftKings, and BetMGM.

-

Tax and fee structure: Graduated iCasino tax rates of up to 28% and additional Detroit city fees reduce margins.

-

No new racetrack or ADW opportunities: With Northville Downs closed in 2024, the racing vertical is effectively gone.

Applying for a Gaming Licence in Michigan

In 2025, independent entry to the Michigan iGaming market isn’t possible. All online sportsbook and iCasino licences are already tethered to commercial or tribal casinos, meaning operators can only realistically enter by acquiring an established partnership or by positioning themselves as a supplier until opportunities emerge.

Furthermore, these partnerships are not short term in nature. Most are structured as multi-year agreements, often running five to 10 years, with renewals negotiated well in advance. As a result, turnover is rare, and spaces open only when an incumbent operator exits or a casino chooses to re-align its strategy. This creates a highly competitive environment where timing and market awareness matter as much as capital.

Once an agreement is in place, the prospective operator must file directly with the MGCB, which requires disclosure of ownership, financial records, and operational plans to establish suitability, as well as payment of application fees.

Application forms for operators seeking an iGaming or sportsbook licence are publicly available on the MGCB’s website.

Markets like Michigan are closed to all but the best-prepared, and entry demands technology partners who meet regulatory and commercial expectations. Altenar delivers that foundation. Book your private demo today and learn how to position for entry into mature US markets.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.