Overview Gambling Laws and Regulations in the US State of Louisiana

Louisiana stands out as a unique and complex US gambling jurisdiction, characterized by its parish-by-parish approvals and a tethered licensing model. With a long history dating back to 19th-century New Orleans, the state has developed into a mature, diversified market. Today, regulated gambling encompasses 15 riverboat casinos, a single land-based casino, licensed video poker terminals, and mobile sports betting. The state entered the digital era when online sports betting launched in early 2022 in the 55 parishes that approved it in 2020, quickly climbing into the national top 10 by handle.

Market entry is highly structured, requiring deep understanding of the rules and strict compliance. Crucially, all online operators must secure a partnership with an existing licensed land-based facility, as standalone licences are not permitted. This partnership model limits the total number of online sportsbook "skins" to 41, though opportunities remain. Licensing requires submitting detailed documentation to the State Police Gaming Enforcement Division for vetting, followed by final approval from the Louisiana Gaming Control Board (LGCB). While Louisiana offers competitive tax rates and a strong local appetite for sports betting, operators looking for full online casino gaming will have to wait for future legislation.

Discover all the insights and step-by-step guidance—read the full blog below!

Those exploring Louisiana’s gambling market may already sense that it is not just another US jurisdiction. With its parish-by-parish approvals, tethered licensing model, and strong appetite for sports betting, this state stands out for its complexity and potential. If you’re here, you’re likely weighing that opportunity and wondering what it takes to enter.

And you’re right to want to dig deeper. With 55 parishes open for business and major operators already live, this is a structured market with real commercial upside. But it’s not a free-for-all. Market entry means understanding the rules, aligning with the right partners, and meeting strict compliance standards.

In this detailed guide, we discuss the specifics of market entry and the developments that could reshape the market. If Louisiana is on your radar, this is where to start.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

Historical overview of Louisiana

Long before Nevada carved out its gaming empire, Louisiana was already dealing cards, collecting wagers, and writing laws to contain them. In 19th-century New Orleans, gambling was tolerated and ingrained into the city's identity. Riverboats ferried players along the Mississippi, racetracks drew crowds, and informal betting was part of daily life. From the outset, gambling in Louisiana was guided by tension between public appetite and religious conservatism, economic ambition and moral restraint.

That tension would eventually crystallise into policy. By the late 20th century, state legislators were no longer trying to eliminate gambling, but rather trying to regulate it. In 1991, the Louisiana Economic Development and Gaming Corporation Act authorised the state’s first land-based casino in New Orleans. In the same year, riverboat casinos were introduced through the Riverboat Economic Development and Gaming Control Act, enabling licensed operations under clearly defined rules. Oversight was consolidated in 1996 with the creation of the Louisiana Gaming Control Board, which today remains the state’s chief regulatory authority.

The 1990s also saw the rise of video draw poker, a peculiarity of Louisiana’s legal model. Authorised through parish-level referenda, these machines became fixtures in truck stops, bars, and OTB (off-track betting) venues. This decentralised form of regulated gambling blurred the line between convenience and control. Alongside this, the launch of the Louisiana Lottery Corporation added a state-run layer to the mix, generating substantial public funds without direct stakeholder lobbying.

More recently, the regulatory spotlight shifted online. In 2020, voters in 55 of 64 parishes approved sports betting, paving the way for Acts 440 and 443 (2021), which formally legalised retail and mobile sportsbooks. Louisiana’s online sports betting market launched in early 2022. Fantasy sports received their own framework under Act 322 (2018) and were subject to taxation.

Timeline of Gambling Milestones

Below is a timeline of key regulatory events that have shaped the state’s approach to gaming over the past three decades:

1990: Constitutional amendment on gambling legislation approved.

1991: Riverboat Gambling Act permits 15 licensed casinos.

1991: Land-based casino approved via Economic Development Act.

1991: The Louisiana Lottery Corporation launches statewide.

1993: Video poker legalised in bars, truck stops, and OTB venues.

1996: The Louisiana Gaming Control Board formally established.

2001: Historical horse racing authorised at eligible OTB facilities.

2018: Act 322 legalises fantasy sports (pending parish approval).

2020: 55 parishes vote to allow sports betting operations.

2021: Acts 440 & 443 legalise retail and mobile sportsbooks.

2022: Online sports betting launches in approved parishes statewide.

2023: Historical horse racing machines formally codified into law.

2024: Proposition bets on college athletes suspended by regulator.

The Current Situation for iGaming in Louisiana

Building on a long history of balancing regulation with public demand, Louisiana now operates one of the more mature and diversified gambling markets in the United States. While much of its infrastructure dates back to riverboats and video poker machines, the last five years have ushered in a digital era of oversight and participation.

Today, regulated gambling in Louisiana spans multiple verticals. These include 15 riverboat casinos, a single land-based casino in New Orleans, racinos (slot machines at racetracks), licensed video poker terminals, a state-run lottery, pari-mutuel wagering, fantasy sports, and mobile sports betting. Oversight is handled primarily by the Louisiana Gaming Control Board, with support from the State Police Gaming Enforcement Division and the Louisiana Racing Commission.

Mobile sports betting is currently the only form of regulated online gambling, with operators permitted to offer services in 55 of the state’s 64 parishes. Licensing requires separate approvals for platform providers, service vendors, and retail establishments, with detailed internal control, verification, and geolocation procedures outlined in Title 42 of the Louisiana Administrative Code.

Fantasy sports were legalised in 2018, and while online casino legislation has been proposed, it has yet to progress beyond preliminary discussion. Social casino gaming remains unregulated, and electronic sweepstakes machines are explicitly prohibited.

Regulatory Gambling Authorities and Their Role

Louisiana doesn’t run on a single gambling regulator like most other gambling jurisdictions. Instead, a group of agencies shares the work, regulating, investigating, taxing, and interpreting the rules that keep the market in motion:

Louisiana Gaming Control Board

The Louisiana Gaming Control Board (LGCB) sits at the centre of the state’s regulated gambling industry. It oversees everything from casinos and sports betting to fantasy contests and video poker, granting licences and approving internal controls along the way. For operators, it’s the first and final stop, whether that’s applying for market access, renewing permits, or getting platform technology signed off. The Board doesn’t work in isolation. It coordinates with the State Police and the Attorney General’s Office to keep the sector in check and running smoothly. If you’re active in any of Louisiana’s 55 legal parishes, you’ll be working with the LGCB.

Louisiana State Police – Gaming Enforcement Division

While the LGCB sets the rules, it’s the Louisiana State Police Gaming Enforcement Division that digs into the details. This unit conducts background checks, investigates licence applicants, monitors operations, and builds the regulatory case files that keep the system running with integrity. For iGaming operators, they’re often the first point of contact during suitability reviews and compliance audits. Their scope extends across sportsbook platforms, gaming suppliers, and key personnel. Working behind the scenes but always present, the division helps turn policy into practice, ensuring every operator that enters the market is properly vetted, compliant, and fit to run a legal business.

Louisiana Racing Commission

The Louisiana Racing Commission may be rooted in the traditions of the track, but its relevance to modern operators is far from limited. Alongside regulating live and simulcast horse racing, it oversees off-track betting (OTB) facilities and historical horse racing (HHR) machines, two sectors that increasingly intersect with digital betting environments. For sportsbook operators with race wagering integrations or partnerships tied to OTBs, the Commission’s role matters. It issues licences, enforces pari-mutuel wagering rules, and works closely with both the LGCB and local authorities to maintain compliance.

Office of the Attorney General – Gaming Division

The Gaming Division of Louisiana’s Attorney General steps in when legal questions arise or enforcement action is needed. This office handles everything from interpreting gambling laws to prosecuting illegal operations, particularly those that fall outside the state’s tightly licensed system. It also works closely with the LGCB and State Police on rulemaking and settlement enforcement. For iGaming operators, their involvement is most visible in cases involving unlicensed activity, consumer protection issues, or disputes over advertising and promotions. While not part of the day-to-day licensing pipeline, the AG’s Gaming Division helps define the legal boundaries every operator must respect.

Louisiana Department of Revenue

Tax compliance in Louisiana’s gambling sector runs through the Department of Revenue. This agency handles collecting, auditing, and enforcing gaming-related taxes, from sportsbook takings to slot machine proceeds. Operators are required to file returns, report earnings, and remit payments according to licence type, whether that’s land-based, online, or fantasy-based. While not a licensing body, the Department plays a significant role in financial oversight. Failure to comply with regulations can affect a licence's standing and trigger audits. For any operator entering Louisiana, understanding tax expectations is just as important as meeting regulatory ones.

Gambling Ecosystem and Parishes

The State of Louisiana runs on a patchwork model, and that matters for anyone considering market entry. While most states regulate gambling through top-down state laws, Louisiana divides its permissions across 64 parishes. Only 55 permit sports betting, forcing operators to deploy geolocation tech that blocks users in opt-out areas.

But location isn’t the only operational variable. In Louisiana, all online sports betting licences are tethered to land-based venues. There’s no standalone route. Every digital operator must partner with a casino, racino, or track to enter. That partnership model limits the number of skins and keeps the field tight, currently capped at 41.

The state also maintains a vast network of regulated video poker terminals in bars, truck stops, and restaurants, creating one of the broadest retail gaming footprints in the US. Meanwhile, Class III tribal gaming operates independently under federal compacts, and racetracks control both live betting and historical racing machines.

Parishes Where Sports Betting is Legal

Acadia, Allen, Ascension, Assumption, Avoyelles, Beauregard, Bienville, Bossier, Caddo, Calcasieu, Cameron, Claiborn, Concordia, DeSoto, East Baton Rouge, East Carroll, East Feliciana, Evangeline, Grant, Iberia, Iberville, Jefferson, Jefferson Davis, Lafayette, Lafourche, Lincoln, Livingston, Madison, Morehouse, Natchitoches, Orleans, Ouachita, Plaquemines, Pointe Coupee, Rapides, Red River, Richland, St. Bernard, St. Charles, St. Helena, St. James, St. John the Baptist, St. Landry, St. Martin, St. Mary, St. Tammany, Tangipahoa, Tensas, Terrebonne, Vermilion, Vernon, Washington, Webster, West Baton Rouge, West Feliciana

Total: 55 Parishes

Parishes Where Sports Betting is NOT Legal

Caldwell, Catahoula, Jackson, Franklin, LaSalle, Sabine, Union, West Carroll, Winn

Total: 9 Parishes

How to Secure a Gambling Licence in Louisiana

Obtaining a licence in Louisiana is more than a matter of filling out forms. It starts with finding the right partner, navigating a state-led vetting process, and proving you’re equipped to operate under one of the strictest tethered models in the US. Here are the fundamental steps sportsbook operators need to take to unlock access to the state’s legal betting market.

Step 1: Partner with a Licensed Land-Based Gambling Establishment

Louisiana’s regulatory model requires every online sportsbook operator to partner with a land-based gambling facility. These include riverboat casinos, racetracks (with slot-machine licences), or the state’s single land-based casino in New Orleans. This partnership is non-negotiable, and standalone licences are not permitted. Each facility can offer up to two online sportsbook “skins”, meaning operators must negotiate and contract with a host licensee before applying for a platform licence. This agreement becomes the legal foundation of the operator’s application to enter the Louisiana market.

Agreements are private and commercial in nature but must be disclosed in full to the LGCB for review. Terms typically involve revenue sharing, platform integration, and compliance responsibilities. Once the partnership is formalised, both parties must submit documentation for suitability approval, including technical systems, branding, and financial terms.

Licensed Land-Based Gaming Facilities in Louisiana Eligible for Online Partnerships

According to the Louisiana Gaming Control Board, eligible facilities for online betting partnerships include:

Riverboat Casinos (15 total):

-

Amelia Belle Casino

-

Belle of Baton Rouge Casino

-

Boomtown Casino – New Orleans

-

Boomtown Casino – Bossier City

-

Eldorado Resort Casino – Shreveport

-

Golden Nugget – Lake Charles

-

Hollywood Casino – Baton Rouge

-

Horseshoe Bossier City

-

L’Auberge Casino – Baton Rouge

-

L’Auberge Casino – Lake Charles

-

Margaritaville Resort Casino – Bossier City

-

Sam’s Town Hotel and Casino – Shreveport

-

Treasure Chest Casino – Kenner

-

Isle of Capri – Lake Charles (relocated as land-based)

-

Queen of Baton Rouge (formerly Hollywood Baton Rouge)

Racetracks with Slots: (4 total)

-

Delta Downs Racetrack & Casino

-

Evangeline Downs

-

Fair Grounds Race Course (New Orleans)

-

Louisiana Downs Racetrack

Land-Based Casino: (1 total)

-

Harrah’s New Orleans (now Caesars New Orleans)

This framework permits a maximum of (20 licensees × 2 skins) + 1 lottery-operated platform = 41 online sportsbooks.

While the law allows for up to 41 online sportsbooks, the actual number operating (in 2025) is lower. The number depends on how many licensees choose to utilise both of their allotted skins and the status of the Louisiana Lottery's platform.

Step 2: Submit Documentation to the Louisiana State Police Gaming Enforcement Division

Once a partnership is secured, the operator must submit its licensing application to the Louisiana State Police Gaming Enforcement Division. This stage involves the submission of detailed corporate documents, platform specifications, internal controls, responsible gaming protocols, and key personnel disclosures. The State Police conduct thorough background checks on the company and its executives, with a strong focus on criminal history, financial probity, and operational integrity. Applicants should be prepared to undergo a rigorous vetting process with possible follow-up queries or supplementary requests for documentation.

Step 3: Undergo Financial and Technical Evaluation

The Gaming Enforcement Division performs a financial suitability assessment parallel to background checks. This includes analysis of funding sources, monetary reserves, tax compliance history, and the ability to meet operational liabilities. Simultaneously, the operator’s technical platform undergoes evaluation for security, geofencing capability (restricted to the 55 legal parishes), player identity verification, and responsible gambling features. In addition, a system demo or technical inspection may be requested to verify functionality.

Step 4: Approval by the Louisiana Gaming Control Board

Once all investigations are complete, the LGCB reviews the findings and issues final approval. This step includes a public meeting and a formal vote by the Board. If approved, the operator receives a Sports Wagering Platform Provider Licence, legally authorising it to begin operations under the land-based partner’s umbrella.

Step 5: Implement Geolocation Controls

The operator may launch its sportsbook upon approval, but only in the 55 parishes that voted to legalise sports betting in the 2020 referendum. Strict geolocation controls must be implemented to block access from the nine parishes that opted out. State enforcement authorities continuously monitor operations to verify compliance.

Step 6: Maintain Ongoing Compliance and Reporting

Licensed operators must submit regular reports to the LGCB and Louisiana State Police, including GGR data, player activity reports, AML compliance, and taxation. System audits may be conducted, and changes to key personnel or ownership structures require regulatory approval. Failure to meet these obligations can result in fines or licence revocation.

Operator Costs for Market Access

Entering Louisiana’s online betting market requires a partnership, and that partnership comes at a price. These commercial agreements are privately negotiated and vary by land-based operator, but they typically involve upfront payments, revenue sharing, or both. Costs can be significant, especially for first-choice venues with established brand recognition and market access.

Once a partnership is secured, operators face additional state-level licensing fees, which are fixed by law and paid directly to the Louisiana Gaming Control Board.

State Licensing Costs for Online Sportsbook Operators

All sportsbook operators entering Louisiana must obtain a sports wagering license. These are the state-mandated fees:

| Fee Type | Amount | Paid To | Notes |

|---|---|---|---|

| Application Fee | $250,000 | LGCB | One-time fee due at the time of application and is nonrefundable. |

| Initial Licence Fee | $500,000 | LGCB | Payment submitted at the time of application. |

| Renewal Fee | $500,000 | LGCB | Recurs every five years to maintain authorised operator status. |

| Commercial Partnership | Varies | Land-Based Licensee (private agreement) | May include upfront fees and a share of net revenue or GGR. |

Additional one-off and ongoing costs

These costs are in addition to operational expenses such as geolocation technology, compliance systems, platform maintenance, and marketing.

NOTE

The fees listed above reflect the most recently published state-level costs for online sportsbook operators in Louisiana. However, all expenses are subject to change based on regulatory updates or legislative amendments. Operators are strongly advised to consult the Louisiana Gaming Control Board for the most current information.

Opportunities and Future Outlook

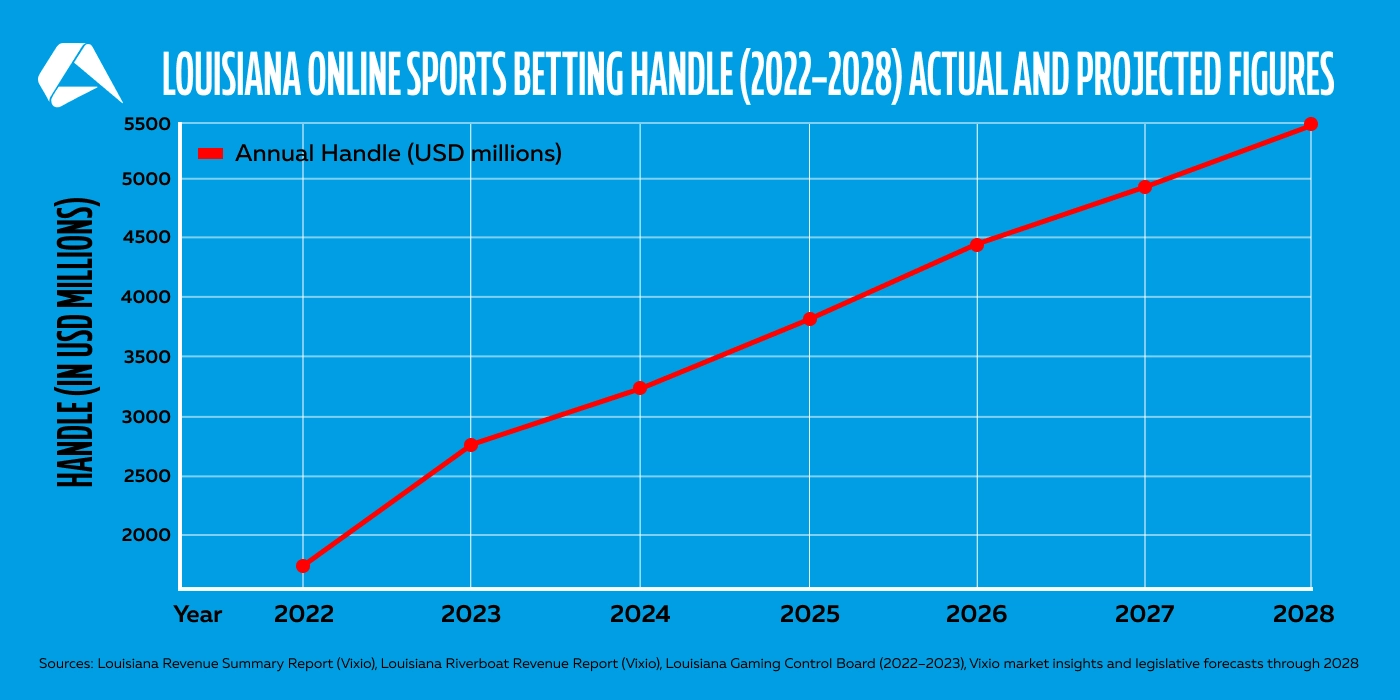

When Louisiana opened the gates to online sports betting in 2022, it didn’t just join the pack. It stood out, launching with multiple major operators on day one, and quickly climbing into the national top 10 by handle. With 55 out of 64 parishes voting to legalise online wagering, the public’s message was clear: there’s a strong appetite for digital betting across the state.

And the numbers back it up. According to the Louisiana Gaming Control Board, the state collected over $36 million in online sports betting taxes in FY2023, up from $10.7 million the year before.

Still, Louisiana isn’t New Jersey. At least, not yet. Online casino gaming remains off the table for now, with only early legislative conversations taking place in Baton Rouge.

Louisiana’s gaming market is shaped predominantly by commercial regulation, with tribal gaming present but limited to three federally recognised operators, unlike in other neighbouring states, where tribal sovereignty typically defines the market. From a regulatory standpoint, the structure is business-friendly. Licensing is centralised through the Louisiana Gaming Control Board, tax rates are clearly defined (15% for online and 10% for retail), and compliance obligations are split between the LGCB, the Department of Revenue, and the State Police Gaming Enforcement Division.

That said, entry isn’t wide open. Operators must partner with a licensed land-based venue, and the state caps the number of skins at 41, although only a fraction of those skins are currently in use.

Market Advantages and Disadvantages

Louisiana’s gambling market has plenty of room to grow, but not without limits. Below, we break down the upsides and operational constraints operators need to weigh up when making market entry or expansion decisions.

Market Advantages

Strong local appetite for betting

Sports betting is culturally ingrained, particularly around college and NFL games.

Legal online sports betting is legal and live

Operators can enter a functioning online market in 55 of 64 parishes.

Defined market size and structure

Clear licence caps (41 skins) and a partner-based entry model reduce ambiguity.

Competitive but not oversaturated

Top national brands are present, but several skins remain underused, and opportunities remain.

Competitive tax rates

The retail tax rate is 10%, and the online tax rate is 15%, which aligns with the national average.

Scope for legislative expansion

Online casino discussions could lead to longer-term potential beyond sports betting.

Market Disadvantages

Entry tethered to land-based partnerships

No direct path to market without aligning with existing casino licence holders.

No online casino opportunities

Operators looking for full iGaming will have to wait for further legislation.

Award-Winning Sportsbook Technology for Regulated US States

Altenar supports sportsbook operators with a platform trusted in over 30 countries and licensed across leading regulated markets. Our solution features US-facing layouts, built-in compliance and rapid integration tailored to local requirements. Recognised as Best Sportsbook Provider at the SiGMA Americas Awards 2025, Altenar combines regulatory readiness with proven scalability to help operators succeed in regulated markets.

Join the operators who trust Altenar worldwide. Book a software demonstration today to see how our award-winning, compliance-ready sportsbook solution helps you launch faster, operate smarter, and scale confidently in Louisiana and throughout regulated US betting markets.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.