For a small state, Connecticut has a surprisingly rich history, with tribal casinos that once ranked among the largest in the world, a lottery that helped shape public opinion on gaming, and now, a digital presence that’s modern yet tightly controlled. What makes Connecticut stand out is not betting volume, but the way it balances revenue, regulation, and public opinion.

In the pages ahead, we’ll examine the milestones that have shaped this gambling market, the regulators who oversee it, and the licensing rules that permit only a select few brands to operate skins. More importantly, we’ll explore what this model says about the future of online gambling in the US and whether the balance Connecticut has struck between exclusivity and oversight can be sustained.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

History of Gambling in Connecticut

More than in many other states, Connecticut’s gambling history is a balance of legal codes and public perception. In the post-war decades, small-stakes wagers in bingo and church raffles were seen as harmless community fundraisers, which were mostly embraced. The launch of the state lottery in 1971 brought both excitement and debate, with supporters praising a new revenue stream and critics warning of state-sanctioned vice. That push and pull between economic promise and social unease would echo through every major expansion that followed.

When the modern casino era began in the early 1990s, it signified a period when the state was grappling with fiscal pressure at a time when native American tribes were asserting their rights under the federal Indian Gaming Regulatory Act. When the Mashantucket Pequot Tribal Nation opened Foxwoods Resort Casino in 1992, it instantly became one of the largest casinos in the world. For many residents, Foxwoods was a marvel, an engine for jobs and tourism, but it also stirred unease about addiction and the pace of social change.

Four years later, the Mohegan Tribe’s Mohegan Sun brought another wave of both pride and apprehension. The slot revenue-sharing agreements, which guaranteed the state a steady 25 per cent cut, softened opposition, but concerns about the social costs of gambling never entirely disappeared.

Through the 2000s, the debate widened. Calls for expanded gambling, especially online, were met with caution, as lawmakers weighed revenue needs against public risks. It was not until 2021 that Connecticut took the plunge. Governor Ned Lamont’s signature on Public Act 21-23 authorised online casino gaming, sports betting, and fantasy contests. The move reflected changing attitudes, as by this time, the public had grown more accustomed to regulated online services in daily life. Legislators paired the expansion with strong responsible-gambling requirements to reassure sceptics.

More recently, the state has refined its framework in ways that reflect both pragmatism and principle. Online lottery sales launched in 2024, extending online gambling activities under familiar oversight. In the same year, lawmakers banned live greyhound racing, a move widely supported as aligning with modern views on animal welfare. By 2025, regulators were also cracking down on sweepstakes-style casinos and scrutinising marketing tactics, reinforcing the message that while gambling is accepted as part of Connecticut’s economy, it must be tightly controlled.

Today’s system is thus the product of half a century of gradual, contested change, with each step balancing public appetite for revenue and entertainment against enduring concerns about its risks.

Timeline of Significant Events

The path to today’s tightly-controlled market has been steered by defining moments:

1971: Connecticut Lottery launches, creating a new revenue stream.

1992: Foxwoods opens, becoming one of the world’s largest casinos.

1996: Mohegan Sun debuts, consolidating Connecticut’s reputation as a casino hub.

1993–1994: Slot revenue-sharing compacts established, guaranteeing the state 25% of the revenue.

2000s: Debates on online expansion grow amid fiscal pressures.

2021: Public Act 21-23 authorises online casino gaming and sports betting.

2021: Federal approval of amended tribal compacts confirms new digital rights.

2023: Live online casino dealers required to hold individual state licences.

2024: iLottery launches, extending online draw games and keno.

2024: Greyhound racing formally banned.

2025: Sweepstakes-style casinos prohibited by law.

The Current Market Conditions

Connecticut’s gambling market today is both modern and tightly regulated. The foundation remains with its tribal compacts, which grant tribes exclusive rights to operate casino gaming, both in physical venues and online. This exclusivity means that independent commercial operators cannot obtain their own direct iGaming licence.

In recent years, the range of legal gambling options available to the general public has expanded. Online casino is available through the Foxwoods-branded DraftKings platform and the Mohegan Sun partnership with FanDuel, with sports betting available through those same two tribal skins and a third offered by the Connecticut Lottery Corporation. Retail sports betting locations tied to the Lottery further extend access across the state.

Beyond casino and sports, the Connecticut Lottery continues to play a central role through both its draw games and its new iLottery platform. Residents can purchase draw games and Keno tickets online through the iLottery channel launched in 2024. Charitable gaming, including raffles, bazaars, and bingo, remains authorised under long-standing state statutes, though tightly regulated by the Department of Consumer Protection (DCP).

At the same time, the state has drawn clear boundaries. Sweepstakes-style casinos, which mimic real-money play, were banned in 2025, closing off a previously grey area. Greyhound racing is also prohibited, and wagering on in-state college sports teams is restricted to tournament play only. In addition to this, election betting has been declared unlawful, and regulators have issued public warnings against offshore sites offering such markets.

For operators, the situation is clear. Connecticut is not an open market. All consumer-facing licences are already allocated, and new entry is only possible through partnership as a B2B supplier. For residents, the system offers a wide range of legal options, all of which are regulated and overseen by a built-in framework. The result is a market that channels demand into a few authorised operators while maintaining strict consumer protections and clear legal lines.

Connecticut Gaming Regulators

Connecticut’s gambling oversight is not centralised under a single authority. Instead, it is divided between state agencies and tribal commissions, reflecting both federal law under the Indian Gaming Regulatory Act (IGRA) and the terms of Connecticut’s two tribal-state compacts. On one side, the Department of Consumer Protection (DCP) and the Connecticut Lottery Corporation regulate state-authorised gaming, including the lottery, fantasy contests, iLottery, and commercial sports betting. On the other hand, the Mashantucket Pequot and Mohegan tribal commissions oversee their respective casinos and digital platforms, operating within their sovereign authority while partnering with state regulators.

The following sections break down the roles of the four principal regulators presiding over Connecticut’s legal gambling market.

Connecticut Department of Consumer Protection – Gaming Division

The Connecticut Department of Consumer Protection’s Gaming Division is the state’s central gaming regulator, responsible for overseeing all non-tribal gaming activities and ensuring that operations are conducted transparently and responsibly. Created to manage consumer-facing industries, the Gaming Division’s role in gambling oversight expanded significantly with the passage of Public Act 21-23 in 2021, which authorised online casino gaming, sports betting, fantasy contests, and iLottery sales.

Today, the division licenses online operators, gaming service providers, and key employees, while enforcing technical standards for platforms and live dealer studios. It also monitors advertising practices and implements consumer protections, including self-exclusion programs and responsible gambling messaging. By coordinating closely with tribal gaming authorities, the Gaming Division ensures that state and tribal obligations remain aligned under compact agreements.

Connecticut Lottery Corporation (CLC)

Established in 1971, the Connecticut Lottery Corporation operates as a state-run monopoly and is one of the most significant revenue contributors to the state budget. Initially created to manage draw-based lottery games, the CLC’s remit has expanded to include instant ‘scratch’ games, keno, iLottery offerings, and, more recently, both online and retail sports betting. Under its statutory framework, the CLC partners with third-party operators to power its sportsbook and is authorised to maintain up to 15 retail betting locations across the state.

It also licenses lottery sales agents and oversees procurement processes for retailers. The CLC’s contribution to the state’s gambling market is twofold. First, as a direct operator generating hundreds of millions of dollars annually for public programs, and second, as a central hub for introducing new verticals, such as mobile wagering, within a state-controlled model.

Mashantucket Pequot Tribal Nation Gaming Commission

The Mashantucket Pequot Tribal Nation Gaming Commission serves as the primary regulator of Foxwoods Resort Casino, which opened in 1992 and remains one of the largest tribal casinos in the world. Formed under the tribe’s sovereign authority and consistent with federal requirements of the IGRA, the commission licenses employees, vendors, and gaming equipment providers. It enforces operational integrity, monitors compliance with internal controls, and conducts audits to ensure Foxwoods meets state and federal compact obligations.

Following the 2021 amendments to the tribal-state compact, the commission also assumed oversight of the tribe’s online casino and mobile sportsbook operations, extending its reach beyond reservation land. Its contribution to Connecticut’s gambling market is significant, as Foxwoods remains central to employment, tourism, and revenue-sharing, while also acting as a regulatory partner with the state to uphold responsible gambling standards.

Mohegan Tribal Gaming Commission

The Mohegan Tribal Gaming Commission oversees all gaming activity at Mohegan Sun, the state’s second tribal casino, which opened in 1996 following the tribe’s federal recognition in 1994. Established to ensure the integrity of gaming on sovereign land, the commission regulates licensing, auditing, game approvals, and vendor oversight. Like its Mashantucket counterpart, it enforces compliance with the IGRA and the tribe’s state-approved compact.

Since 2021, the commission’s authority has also extended to off-reservation operations, including Mohegan Sun’s online casino and mobile sportsbook. Its work ensures that employees, technology providers, and financial partners meet stringent standards of integrity. Beyond regulation, the commission supports economic development by enabling Mohegan Sun to thrive as a major employer and entertainment hub. Through compact-based revenue sharing and cooperative enforcement with the state, it has been a central component of Connecticut’s gambling framework.

Licensing, Market Structure, and Taxation

Connecticut’s gaming market is organised around three master wagering licensees, each holding exclusive authority under state law and amended tribal compacts.

The Mashantucket Pequot Tribal Nation and the Mohegan Tribe operate Foxwoods Resort Casino and Mohegan Sun respectively, with rights extending from their Class III casino floors into online casino gaming and one mobile sportsbook skin each. Alongside them, the Connecticut Lottery Corporation functions as the state’s public operator, managing draw-based lottery games, keno, iLottery, and a separate mobile sportsbook with up to 15 retail outlets.

Connecticut Master Wagering Licensees

| Master Licensee | Master Licensee | Retail Sportsbooks | Online Skin Partnerships |

|---|---|---|---|

| Mashantucket Pequot Tribal Nation | Foxwoods Resort Casino | At Foxwoods | DraftKings (sportsbook + online casino platform) |

| Mohegan Tribe | Mohegan Sun Casino | At Mohegan Sun | FanDuel (sportsbook + online casino platform) |

| Connecticut Lottery Corporation (CLC) | State lottery monopoly | Up to 15 retail outlets | PlaySugarHouse (Rush Street Interactive) powers sportsbook |

Independent operators cannot obtain a master licence directly, meaning there is no open licensing route for commercial sportsbook brands. Instead, access to the market runs through partnership agreements.

Licensing costs and taxation

Online operators contracting with a master licensee must pay an initial application fee of $250,000 and an annual renewal fee of $100,000. Suppliers, including payment processors, geolocation services, and live dealer studios, fall under the online gaming service provider licence, which requires an annual fee of $2,000.

Taxation is similarly defined. Online casino gaming is taxed at 18 per cent of gross gaming revenue (GGR) for the first five years, rising to 20 per cent thereafter. Sports betting and fantasy contests are taxed at 13.75 per cent GGR. Slot revenue from tribal casinos is shared with the state at 25 per cent, a longstanding arrangement dating back to the 1990s. Each master licensee also contributes $500,000 annually to fund responsible gambling programmes.

On top of these state obligations, all wagers face the federal excise tax of 0.25 per cent on handle.

This closed but clearly structured model creates stability for the state and its licensees, while leaving little room for independent operators outside of carefully-negotiated partnerships.

Market Access Options in Connecticut

While Connecticut’s market is closed to new sportsbook or casino operators, there are still a few windows for independents to participate as service providers and technology partners. The state’s licensing regime specifically recognises online gaming service providers, covering suppliers such as geolocation firms, payment processors, KYC vendors, and live dealer studios. For companies with specialist products, particularly those in compliance or responsible gambling technology, the barrier to entry is relatively modest.

Marketing affiliates and data providers may also find routes, although these are subject to strict licensing and advertising standards. With regulators taking a close interest in consumer protections, suppliers offering advanced player analytics, fraud detection, or harm-prevention tools stand out as potential partners to the master licensees. Looking ahead, opportunities will likely remain B2B rather than B2C. Independent operators seeking visibility in Connecticut should focus their strategies on enhancing the value of existing licensees.

Policy Refinement Over Liberalisation

Connecticut’s gambling policy has shown itself to be pragmatic but cautious, with change coming in measured steps rather than sweeping reforms. The state’s most significant leap forward in authorising online casino gaming and sports betting in 2021 was a result of long negotiations with the tribes and carefully-drafted legislation that ensured exclusivity while broadening consumer choice. Since then, reforms have tended to focus less on expansion and more on refining the existing framework.

For operators outside the existing partnerships, near-term prospects for direct entry remain unlikely. Legislative debate in recent sessions has centred more on responsible gambling measures, advertising restrictions and limits on inducements, rather than on opening additional licences. Enforcement activity, including settlements over marketing practices, underlines this focus.

That said, the market’s direction is worth watching. Pressure could mount if neighbouring states adjust their tax structures or expand licensing, forcing Connecticut to consider its regional competitiveness.

The Future of Online Gaming in Connecticut

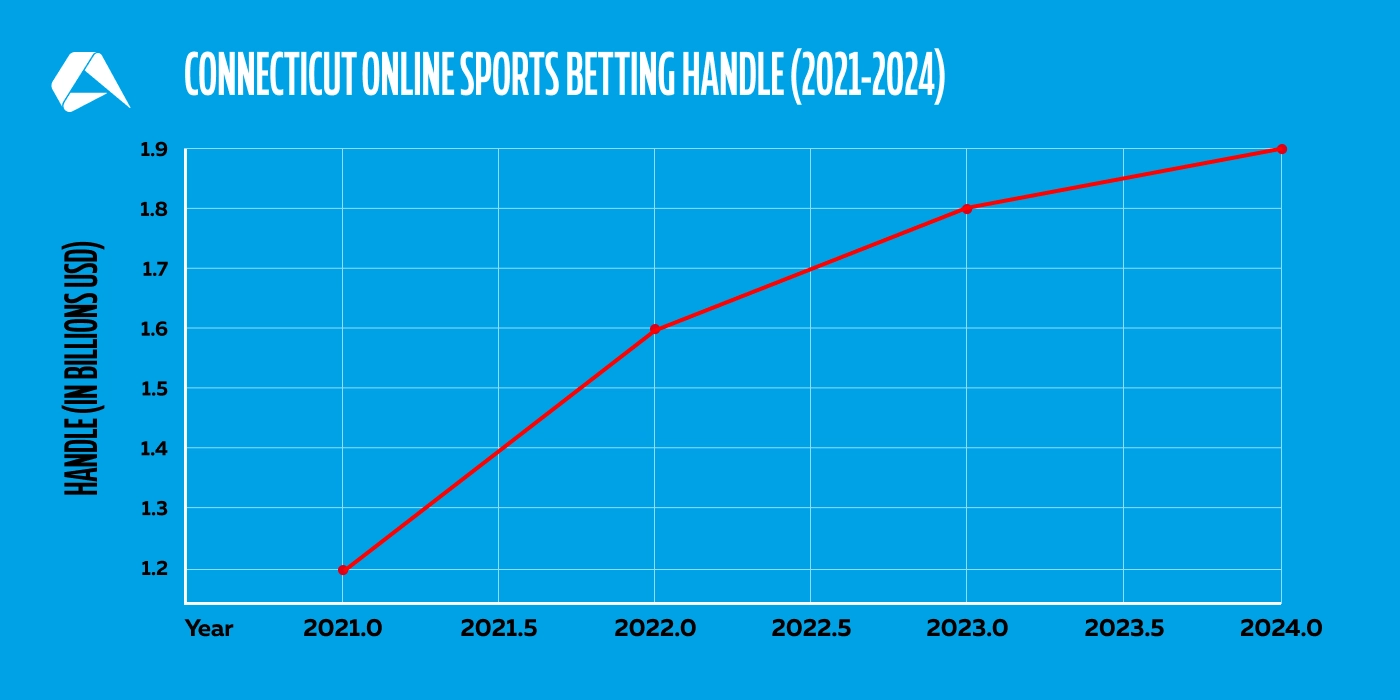

Connecticut’s gambling market may be narrow, but it is proving lucrative. Since legalising online casinos and sports betting in 2021, digital revenues have become a dependable source of income for the state budget. According to the CT Mirror, for every dollar wagered online, roughly 91.7 per cent is returned to players, 1.35 per cent is claimed in taxes, and just under seven per cent is retained by operators as net revenue. For a small state, those margins illustrate how much weight national brands like DraftKings, FanDuel, and Rush Street Interactive can pull even in a restricted environment.

Sources: Figures reflect 2021–2024 regulator disclosures and industry reporting. Connecticut Department of Consumer Protection, Connecticut Lottery Corporation, Mashantucket Pequot Tribal Nation and Mohegan Tribal Gaming Compact filings, Legal Sports Report, Vixio GamblingCompliance.

Connecticut’s business model is unusual by regional standards. Neighbouring New York has embraced a large-volume, high-tax sportsbook market, while New Jersey and Pennsylvania thrive on open competition in online casinos. By contrast, Connecticut has opted for exclusivity, grounding online action in just three skins. In many ways, this has created stability but capped innovation. The question operators are now asking is whether this model can hold in the long term, especially as regional comparisons become increasingly hard to ignore.

Policymakers are showing a cautious hand. “Before the season kicks off, create a game plan. Know your odds, understand the house rules … take advantage of setting time and money limits,” said Bryan Cafferelli, Commissioner of the Department of Consumer Protection, ahead of the 2025 football season. That language captures the state’s regulatory mood. Expansion is not the priority, consumer protection is.

Still, there are potential openings in the status quo. Lawmakers have debated lifting restrictions on betting for in-state college teams and floated the idea of joining interstate poker compacts. Neither represents a radical overhaul, yet both hint at a willingness to make incremental adjustments. The more telling pressure may come from outside Connecticut, as neighbouring states experiment with licensing, tax reform, and new products.

For now, the exclusivity model may look closed, but Connecticut’s market is a test for how limited licensing can coexist with digital modernisation. If it falls flat, the door could open to wider access.

Market Pros and Cons for Operators

Connecticut offers a small but steady online gambling market. When evaluating Connecticut’s gambling market, it is helpful to identify the advantages and limitations that apply for independent operators. The following points highlight the key strengths and challenges.

Pros

-

Stable regulatory framework: Exclusivity agreements provide predictability and reduce volatility.

-

High consumer adoption: Strong online sports betting handle per capita.

-

Established iCasino base: Online casino revenues are firmly established, supporting long-term operator margins.

-

Incremental growth avenues: Potential reforms in interstate poker compacts and iLottery.

Cons

-

Closed licensing model: No independent access to B2C licences.

-

Dominance of established operators: DraftKings and FanDuel control market visibility. No room for new brands.

-

High compliance burden: Strict oversight on advertising, licensing, and supplier conduct increases operational costs.

-

Limited expansion prospects: Political debate centres on consumer protections rather than new market liberalisation.

Building Success in US Markets

The US isn’t one market. In many ways, it’s a fragmented battlefield. Each state writes its own rules, and the differences are typically more than cosmetic. High-tax states squeeze margins hard, closed states keep outsiders at arm’s length, and fresh markets tempt with volume but lack maturity. Operators who treat America like Europe quickly learn that localised oversight makes uniform strategies almost impossible. So the real test here isn’t about chasing every licence. It comes from proving you can withstand pressure, adapt to changing rules, and still deliver a product that regulators trust and players return to.

When market access is on the line, aligning with the right partner matters. Altenar’s sportsbook platform is designed to address the challenges faced by US operators. Book a software demonstration today to see disciplined performance in action.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.