Few countries have balanced freedom and control in the gambling space quite like Sweden. Once a state monopoly, it is now a model for responsible liberalisation, with a market that continues to attract serious operators. This report examines the laws, regulations, and realities that define what doing business looks like in Sweden’s regulated gaming sector in 2025 and beyond.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

A Brief History of Gambling

Gambling in Sweden dates back to a time when betting was seen as entertainment, with temptation kept in check. As early as the late 19th century, the state introduced its first national lottery in 1897, marking a significant step towards regulated gambling. This move was followed by the emergence of horse betting, legalised in 1923, and sports pools in 1934. Over time, the Swedish state gradually assumed dominant control of gambling through AB Svenska Spel and ATG. One controlled casinos and lotteries, while the other managed horse racing. Both were created to channel gambling revenues toward public benefit and to keep activities under government control.

As foreign online casinos began targeting Swedish players during the 2000s, the state monopoly model started to show its age. Swedish regulators found themselves unable to block offshore sites under EU single-market rules, and consumer protection began to decline. After years of political debate, the Gambling Act (2018:1138) marked a turning point for regulated gambling within the country. Coming into force on January 1 2019, the new legislation ended the monopoly on commercial gambling and introduced a competitive licensing system under the supervision of the Swedish Gambling Authority (Spelinspektionen).

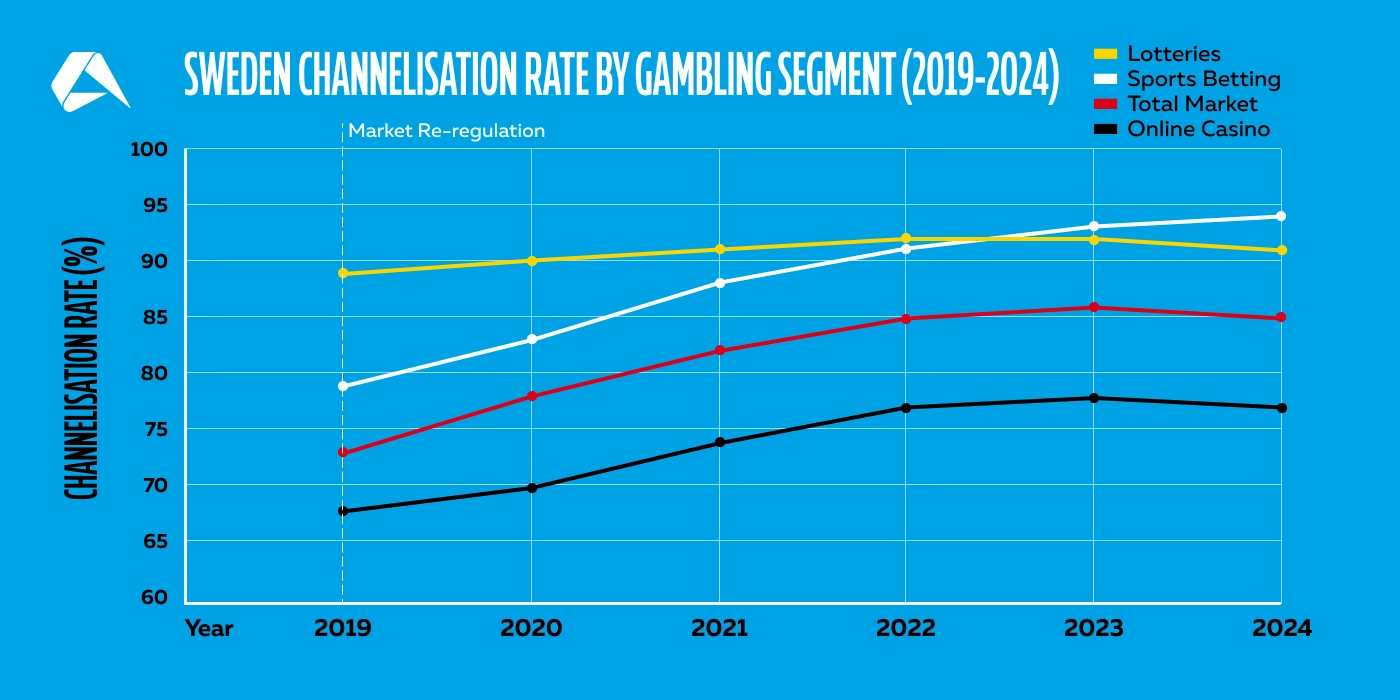

The reform sought to channel at least 90 per cent of all Swedish gambling activity into the regulated market under licensed control, a target that initially seemed within reach. Yet even as new entrants emerged, the government retained control of state-owned operators and maintained strict limits on advertising, bonuses, and responsible-gaming obligations, preserving the social-welfare policy of the old system within a modern legal framework.

Since this liberalisation, Sweden’s focus has gradually moved from expansion to enforcement. Amendments in 2023 introduced mandatory licences for gaming software suppliers, while 2024 and 2025 have brought tighter tax, payment, and marketing controls. The country’s trajectory remains distinct in Europe, maintaining a market open to private enterprise while still being guided by the principle that gambling is a privilege to be managed, not a freedom to be exploited.

Timeline of Significant Events

The evolution of Sweden’s gambling industry reflects a history of state influence and cautious modernisation. Here are the most influential events that have occurred in the modern era:

1897: Sweden holds its first national lottery, introducing gambling under formal state supervision.

1923: Horse racing is legalised.

1934: Tipstjänst is established to manage football pools, forming Sweden’s first structured sports betting company.

1958: AB Trav och Galopp (ATG) is formed to oversee horse-race betting, securing its place as a core institution in Swedish wagering.

1994: The Lottery Act (1994:1000) codifies Sweden’s fragmented gambling rules, reaffirming the state’s control and limiting private competition.

1997: AB Svenska Spel is created through the merger of Tipstjänst and Penninglotteriet, consolidating state control over lotteries, casinos, and sports betting.

2001: The first Casino Cosmopol opens in Sundsvall, followed by Malmö, Gothenburg, and Stockholm, marking Sweden’s brief foray into state-run land-based casinos.

2012–2017: EU pressure mounts against Sweden’s monopoly model, with several infringement proceedings challenging its compliance with single-market principles.

2018: Parliament passes the Gambling Act (2018:1138) and Gambling Ordinance (2018:1475), dismantling the outright monopoly and introducing a licensing system.

2019: The new regime takes effect, allowing private operators to apply for Swedish licences under the supervision of Spelinspektionen.

2023: Sweden introduces mandatory B2B gaming software licences to strengthen supplier accountability and market integrity.

2024: The gambling tax increases from 18% to 22% of GGR, while enforcement intensifies against unlicensed operators.

2026 (scheduled): Sweden’s land-based casino operations to end, completing a move from physical monopolies to a digital market.

The Gambling Market in Sweden Today

Sweden’s gambling industry in 2025 presents a fully liberalised yet carefully governed environment that combines the efficiency of a digital market with the legacy of traditional forms of betting. Since the Gambling Act (2018:1138) came into force, the Swedish Gambling Authority (Spelinspektionen) has maintained strict control over licensing and compliance, allowing both domestic and foreign operators to participate under equal conditions.

Most licensed betting activity now takes place online, reflecting Sweden’s strong digital adoption. Sports betting and online casino products continue to dominate, supported by one of Europe’s most active player bases. Operators must meet demanding technical and social responsibility standards, including integration with the national self-exclusion tool Spelpaus, ongoing monitoring of risk behaviour, and transparent communication in marketing. These requirements are rigorous, but they also define the Swedish market’s credibility, offering compliant operators a stable and respected base to build brand trust.

Offline gambling, though smaller in scale, still plays a visible role. Retail betting remains popular in convenience outlets and sports shops across the country, particularly through agents affiliated with Svenska Spel Sport & Casino and ATG, the long-standing horse-racing operator. ATG’s tote and fixed-odds racing products maintain a loyal following, boosted by Sweden’s strong equestrian culture and televised events such as the V75. Bingo halls, though fewer in number, persist mainly as community activities licensed for charitable purposes.

Lotteries continue to hold a distinct place in Swedish gambling culture, operated primarily by Svenska Spel and several charitable organisations. They remain one of the most trusted and socially accepted forms of gambling in Sweden, promoted through long-running national draws that support public and community causes.

All major forms of gambling, both online and offline, are available to residents and visitors in Sweden through licensed operators. Players can legally take part in online casino games, sports betting, horse racing, lotteries, and charitable bingo, provided these are offered under a Swedish licence. The only exception is land-based casinos, which are being phased out following a government decision that cited declining customer numbers, increased online participation, and the high costs of maintaining physical operations. The closures also mark the end of Sweden’s state casino licence category, which by law could only be held by a state-owned company, meaning private operators cannot reopen or replace these venues under the current law.

Gambling Regulators and State-Owned Gaming Institutions

A network of regulatory bodies and state-operated institutions shapes how gambling is supervised and delivered in Sweden, each carrying a distinct role in licensing, oversight, consumer protection and operational standards. Together, they define how the system functions in practice.

Swedish Gambling Authority (Spelinspektionen)

The Swedish Gambling Authority, known as Spelinspektionen, is the principal regulator for all forms of gambling in Sweden under the Gambling Act (2018:1138) and the Gambling Ordinance (2018:1475). It issues and monitors licences for online casinos, sports betting, land-based commercial operations, lotteries, and gaming machines, ensuring that operators comply with strict conditions on responsible gambling, anti-money laundering, player protection, and technical integrity. Spelinspektionen also manages enforcement actions, including suspensions, fines and licence revocations against operators who breach Swedish law.

Further to this, it also oversees the national self-exclusion register Spelpaus and publishes data on regulated market share, which helps shape policy and industry strategy.

Swedish Consumer Agency (Konsumentverket)

The Swedish Consumer Agency is the national authority tasked with protecting consumer interests, including those in the gambling sector. Operating under the Marketing Act (2008:486), also known as SFS 2008:486, the act ensures that marketing and advertising by gambling operators are fair, transparent, and not targeted at minors.

In daily practice within Sweden’s licensed market, the Agency works with operators by reviewing their advertising campaigns, issuing guidance on good marketing practice, and investigating firms whose promotions may breach consumer-law rules. Before launching a new platform in the market, operators need to verify the compliance of their marketing material and frequently engage proactively with Konsumentverket’s guidelines.

AB Svenska Spel

While AB Svenska Spel is not in itself a regulatory authority, it remains central to Sweden’s gambling framework as the state-owned operator responsible for lotteries, retail betting, and, until recently, casino gaming. Operating under the supervision of the Swedish Gambling Authority (Spelinspektionen), Svenska Spel was restructured following the 2019 Gambling Act to separate its competitive commercial division (Svenska Spel Sport & Casino AB) from its monopoly operations in lotteries and number games.

For industry operators, Svenska Spel can be considered both a benchmark and competitor, representing Sweden’s model of balancing market liberalisation with state oversight. It often collaborates with regulators on responsible gambling initiatives and supports the national Spelpaus programme. Although its physical casinos are set to close by 2026, Svenska Spel continues to set high compliance standards for online and retail gambling.

ATG (AB Trav och Galopp)

ATG, which stands for AB Trav och Galopp, is Sweden’s long-standing horse racing and betting operator, jointly owned by the Swedish Trotting Association (Svensk Travsport) and the Swedish Jockey Club (Svenska Galopp). Similar to the status of AB Svenska Spel, it has no official regulatory powers and operates under licence and supervision of Spelinspektionen, making it a significant presence in Sweden’s regulated betting environment. Historically, ATG held a monopoly on horse-race wagering. Since the 2019 market liberalisation, however, it now competes alongside private bookmakers while continuing to fund Sweden’s racing industry through betting revenue.

In practice, operators often view ATG as a model for regulatory compliance and player protection. Its systems are closely monitored to ensure transparency, responsible gambling measures, and AML alignment, thereby fostering player trust and contributing to the social sustainability of Sweden’s horse-racing sector.

Other Key Regulatory Institutions

Beyond the primary regulators and state-owned operators, three additional institutions play integral roles in upholding Sweden’s legal and ethical gambling environment.

The Swedish Financial Supervisory Authority (Finansinspektionen) oversees financial stability and compliance in the gambling sector, particularly regarding payment service providers and the proposed national credit card gambling ban. It works closely with operators to verify that all deposits and withdrawals occur through approved financial channels under the Payment Services Act (2010:751).

The Swedish Police Authority, through its Financial Intelligence Unit (FIU), monitors and investigates money-laundering and terrorist-financing risks linked to gambling transactions. Operators are required to file Suspicious Activity Reports (SARs) directly to the FIU under Sweden’s AML Act (2017:630).

Finally, the Swedish Authority for Privacy Protection (Integritetsskyddsmyndigheten, IMY) ensures compliance with the General Data Protection Regulation (GDPR) and the Data Protection Act (2018:218), which is a significant consideration for online gambling operators processing sensitive player data in Sweden.

Compliance Requirements for Market Entry

Every operator wishing to offer games to Swedish players, whether based locally or abroad, must meet several essential obligations outlined in various acts. These laws establish the foundation for successful market entry.

Unlike in some EU markets, operators do not need to maintain a physical office in Sweden as long as they are established within the European Economic Area (EEA). However, they must maintain complete technical and operational visibility to the Swedish Gambling Authority (Spelinspektionen). Non-EEA companies are required to appoint a local representative based in Sweden, authorised to act on their behalf before national authorities.

Below are the key compliance requirements that all operators must satisfy before receiving a licence and to remain compliant thereafter.

Organisational and Professional Competence

Applicants must demonstrate adequate technical knowledge, managerial experience, and an organisational framework capable of meeting all compliance and reporting obligations. This requirement ensures operators can uphold Swedish legal and consumer protection standards. See Gambling Act (2018:1138), Chapter 4, Section 1 for more details.

Lawful Conduct and Business Integrity

A licence is issued only if the applicant can be reasonably expected to operate in accordance with Swedish law, EU regulations, and responsible gambling principles. This includes financial transparency and ethical marketing. See Gambling Act (2018:1138), Chapter 4, Section 1 for more details.

EEA Establishment or Local Representation

Operators established outside the EEA must appoint a physical representative resident in Sweden, empowered to liaise with Spelinspektionen and receive legal notifications. This ensures effective local oversight. More info: Gambling Act (2018:1138), Chapter 11 Section 6c

System Location and Remote Supervision

The operator’s central gaming system must be located in Sweden, unless an exemption allows remote access for Swedish regulators. This gives Spelinspektionen real-time supervisory capability over licensed activities. More info: Gambling Act (2018:1138), Chapter 16, Section 2

Technical Certification and ISO Compliance

All gaming platforms must undergo inspection, testing, and certification by a SWEDAC-accredited body under SIFS 2022:3. Systems must comply with ISO/IEC 27001:2013, the information security standard. This ensures software fairness, integrity, and data protection.

Player Verification and Account Security

Operators must verify every player’s identity through secure digital identification, such as BankID, before play or payout. Personal and gaming data must be retained for five years for inspection, according to Section 5, Chapter 17 of the Gambling Act.

Responsible Gambling Obligations

Licensees must integrate the national self-exclusion register with Spelpaus.se and offer tools to set deposit, loss, and time limits. These measures are mandatory to minimise gambling-related harm. More info: Gambling Act Ch. 14 §§ 6–12

Anti-Money Laundering (AML) and Customer Due Diligence

Under the AML Act (2017:630), operators must perform ongoing customer due diligence, maintain risk-assessment policies, and report suspicious transactions to the Swedish Police Financial Intelligence Unit via the goAML system.

Marketing and Advertising Moderation

All gambling marketing must be moderate, truthful, and not aimed at minors or self-excluded players. Violations can result in warnings, fines, or licence suspension. More info: Gambling Act Ch. 15 §§ 1–3

Payment and Credit Restrictions

Deposits must be processed only through authorised providers under the Payment Services Act (2010:751). A proposed credit card gambling ban, scheduled for 2026, will further strengthen player protection. More info: Swedish Ministry of Finance Memorandum, February 2024

Record-Keeping and Regulatory Reporting

All gaming, financial, and player data must be securely logged and preserved for five years. Operators must provide full access to Spelinspektionen upon request. More info: Gambling Act Ch. 16 § 5

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

Licensing Costs and Taxation in Sweden

Entering the Swedish gambling market is a significant commitment, not only in terms of compliance but also in terms of cost. Compared with other EU jurisdictions, Sweden’s licensing structure is transparent, rule-based, and set directly by law under the Gambling Ordinance (2018:1475), Chapter 15.

Initial Licensing Costs

The Swedish Gambling Authority Spelinspektionen applies fixed application fees based on licence type. The main fees currently in force are:

-

Commercial online gambling or betting licence:

SEK 230,000 (≈ €20,900).

-

Gaming software (B2B) permit:

SEK 120,000 (≈ €10,500).

-

Lottery licences for charitable or public-benefit purposes:

From SEK 6,000 to SEK 175,000, depending on total prize value.

Application fees must be paid upfront and are non-refundable regardless of outcome.

Renewal and Supervision Fees

Swedish licences are valid for up to five years. When renewed, applicants must pay a new examination fee equal to the original licence category. In addition, all licensees are subject to an annual supervision fee payable to Spelinspektionen, calculated to achieve full cost recovery for regulatory oversight.

The supervision fee, as defined in the Gambling Ordinance (2018:1475) and confirmed by regulation (2022:1679), varies depending on the operator’s size, volume of play, and compliance intensity, but typically ranges from SEK 50,000 to SEK 250,000 per year.

For gaming software licence holders, the annual supervision fee ensures continued audit, inspection, and certification coverage.

Ongoing Operational Costs

In addition to statutory fees, operators face recurring expenses tied to regulatory obligations. These include:

-

Technical compliance: Initial and annual system certification under SIFS 2022:3 and ISO/IEC 27001 audits.

-

Responsible gambling integration: Connection to Spelpaus.se and player-protection mechanisms.

-

AML/CTF systems: Ongoing due diligence, transaction monitoring, and reporting obligations under Money Laundering and Terrorist Financing prevention.

-

Marketing and data-handling reviews: Routine supervision by Konsumentverket and the Swedish Authority for Privacy Protection.

Combined, these make operational compliance in Sweden an active, continuing cost rather than a one-time expenditure.

Taxation Rates for Industry Operators

Under the Gambling Tax Act (2018:1139), licensed operators must pay 22% tax on gross gaming revenue (GGR), defined as stakes received minus winnings paid out. The rate applies uniformly across all licensed sectors, including online betting, casinos, and lotteries, ensuring consistent fiscal treatment of commercial gambling activities.

DISCLAIMER

All fees and rates in this section are accurate as of the time of writing. Licensing and taxation levels are subject to amendment by the Swedish Government. Operators should verify the latest figures directly on the Swedish Gambling Authority's official website.

Opportunities and Future Outlook

Sweden’s gambling market has entered a new phase of calm maturity. It is regulated, disciplined, yet profitable for operators who meet its standards. After several years of adjustment following re-regulation in 2019, the market has found its feet. In 2024, total GGR reached SEK 27.85 billion, up 2.6% year-on-year, according to data from Spelinspektionen, with online casino and sports betting still commanding the lion’s share of revenue.

Analysts, however, maintain that the real success story is not growth but stability. Channelisation, which is the proportion of betting activity within the licensed system, sits around 85–86%, a level that most European regulators would envy.

Further to this, the proportion of gambling taking place outside the licensed market remains considerably low, estimated at around 9% for lotteries and closer to 28% for online casino play, as noted in a recent Vixio.com publication. This suggests that Swedish consumers now instinctively choose licensed brands, while enforcement pressure keeps unlicensed operators on tight margins.

For new entrants, that maturity brings predictability. Licensing fees are fixed by statute, and compliance expectations are transparent. Operators who invest in long-term localisation, data-driven responsible-gaming tools, Swedish-language support, and cultural fluency can find sustainable profit margins.

There are, however, two policy shifts that could nudge the field. The first is the ban on credit-based gambling, effective April 2026, aimed at limiting high-risk play and reducing debt exposure. The second is the closure of all Casino Cosmopol venues by January 2026, which will end state-run land-based casino gambling altogether. The move is expected to channel more adult entertainment spend online, potentially creating a windfall for licensed iGaming and sportsbook operators with a stake in Sweden’s digital gaming space.

With that said, challenges remain. Sweden’s strict advertising code and marketing-moderation rules limit aggressive acquisition, and supervision costs are rising as Spelinspektionen invests in data-driven oversight. Yet most market observers describe Sweden as one of Europe’s safest and most reputable jurisdictions for serious operators, likening it to a steady performer rather than a speculative bet.

Market Pros and Cons for Operators

For iGaming operators, Sweden represents one of Europe’s most structured but accessible jurisdictions, offering room for sustainable growth without the volatility seen elsewhere.

Here are the primary advantages and disadvantages for iGaming operators eyeing up the potential for market entry in 2026 and beyond:

Advantages

Open, liberalised framework

Sweden’s fully open licensing model allows private operators to enter the market independently, without local partnerships or quotas, across online casino and sports betting segments.

Predictable taxation

The flat 22% GGR tax rate provides rare predictability for financial modelling and long-term business planning.

Digital-first maturity

More than 80% of total GGR comes from online activity, creating an ideal environment for tech-driven sportsbooks and casinos optimised for mobile and data analytics.

Efficient licensing

Applications are processed directly by Spelinspektionen and can be completed online considerably faster than in comparable EU markets.

High player trust

Swedish players actively prefer licensed brands.

Disadvantages

Bonus restrictions

Operators may offer a bonus only on a player’s first deposit, which is a limitation that constrains acquisition campaigns and ongoing engagement.

High supervision costs

Annual oversight fees charged by Spelinspektionen increase with turnover, which can weigh heavily on mid-size operators.

Cross-border competition

Neighbouring Denmark and Finland (pending its 2026 market opening) are expected to create strong Nordic competition for player attention. This could squeeze acquisition costs and retention.

How to Apply for a Swedish Gambling Licence

Applying for a Swedish gambling licence is considerably more straightforward than in many other European jurisdictions. The process is fully digital and can be completed online via the Spelinspektionen application portal. Clear instructions, predictable fees, and standardised document requirements make Sweden one of the more administratively transparent EU markets for regulated gambling operators.

Obtaining a gaming licence in Sweden can be achieved by taking the following steps:

Step 1: Choose the correct licence category

Review Spelinspektionen’s ‘Apply Licence or Permit’ area to identify the appropriate category (e.g., commercial online gambling or betting, software permit, lottery/bingo).

Step 2: Read the “About application” instructions

Spelinspektionen explains what a licence covers, the market structure, and key formalities before you apply.

Step 3: Prepare application documents in Swedish

Applications must be in writing and in Swedish under the Gambling Ordinance - FAQs clarify language/identity-verification formalities (e.g., certified ID).

Step 4: Use the web service to submit your application

File your application via Spelinspektionen’s online service. Follow the form-specific instructions provided on the application page.

Step 5: Pay the application fee (processing starts after payment)

Your case is registered and handled only after the fee is paid. You’ll receive a diary/registration number (diarienummer) on payment. See ‘Application fees’.

Step 6: Designate a contact person for the application

The Ordinance requires applicants to appoint a contact person for communication with Spelinspektionen during processing.

Step 7: Provide technical documentation & testing plan

Consult SGA’s technical guidelines (SIFS 2022:3 guidance) covering testing, certification (SWEDAC-accredited bodies), information security and system change control expected at application/onboarding.

Step 8: Demonstrate a responsible gambling set-up

Show how you will meet the duty of care and integrate the Spelpaus self-exclusion system, including player monitoring, limits and interventions, as outlined in SGA guidance.

Step 9: Demonstrate an AML/CTF framework

Follow SGA’s AML guidance (risk assessment, customer due diligence, monitoring, and SAR procedures) in alignment with Swedish AML rules. Spelinspektionen provides operator-facing guidance.

Step 10: Expect due diligence & requests for supplements

Spelinspektionen may ask for clarifications or additional documents. Use the ‘Change, Supplement & Renew’ channel when instructed.

Step 11: After approval: onboarding & listing

Once granted, your licence/permit appears in the Licence and Permit directory. Ensure your systems and procedures match the approved scope before go-live.

Step 12: Plan early for renewals

Apply at least four months before expiry. Timely renewal applications keep the existing licence valid while SGA processes the new one.

Curious to know how Altenar’s B2B-licensed technology adapts to Sweden’s market? Schedule a software demonstration today and experience the compliance, flexibility, and data control trusted by licensed operators across Europe.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.