Overview Winning Without Bonuses: How To Retain Players Through Non-Financial Incentives

The limitations of traditional bonus-based retention in online gambling are becoming evident, driven by regulatory tightening, bonus abuse, and players growing indifferent to generic offers. Operators seeking genuine, long-term loyalty are shifting towards non-financial incentives, which aim to build behavioural loyalty by making the platform experience itself the reward.

Key non-financial retention models are gaining traction. Gamification Tools are vital when implemented correctly, focusing on clear progression and rewarding participation to build habit, often resulting in 10–20% retention uplift among engaged segments. Personalisation Engines must move beyond basic content filtering to adapt to changing player behaviours, making the entire journey feel naturally tailored and increasing session length by 8–15%.

Furthermore, Non-Monetary Loyalty Systems utilize status, exclusivity, and access perks—such as priority support or early product access—to create value without eroding margins. This is supported by Social and Community Features that build enduring player-to-player connections, and AI-Driven Emotional Engagement, which uses machine learning to acknowledge behavioural shifts in real-time with subtle, non-promotional triggers. Ultimately, non-financial retention delivers a superior commercial outcome: loyalty is built, not bought, reducing ongoing financial outlay, lowering regulatory risk, and strengthening customer lifetime value.

Find out how to keep players coming back without spending a dime—explore the full blog for practical strategies.

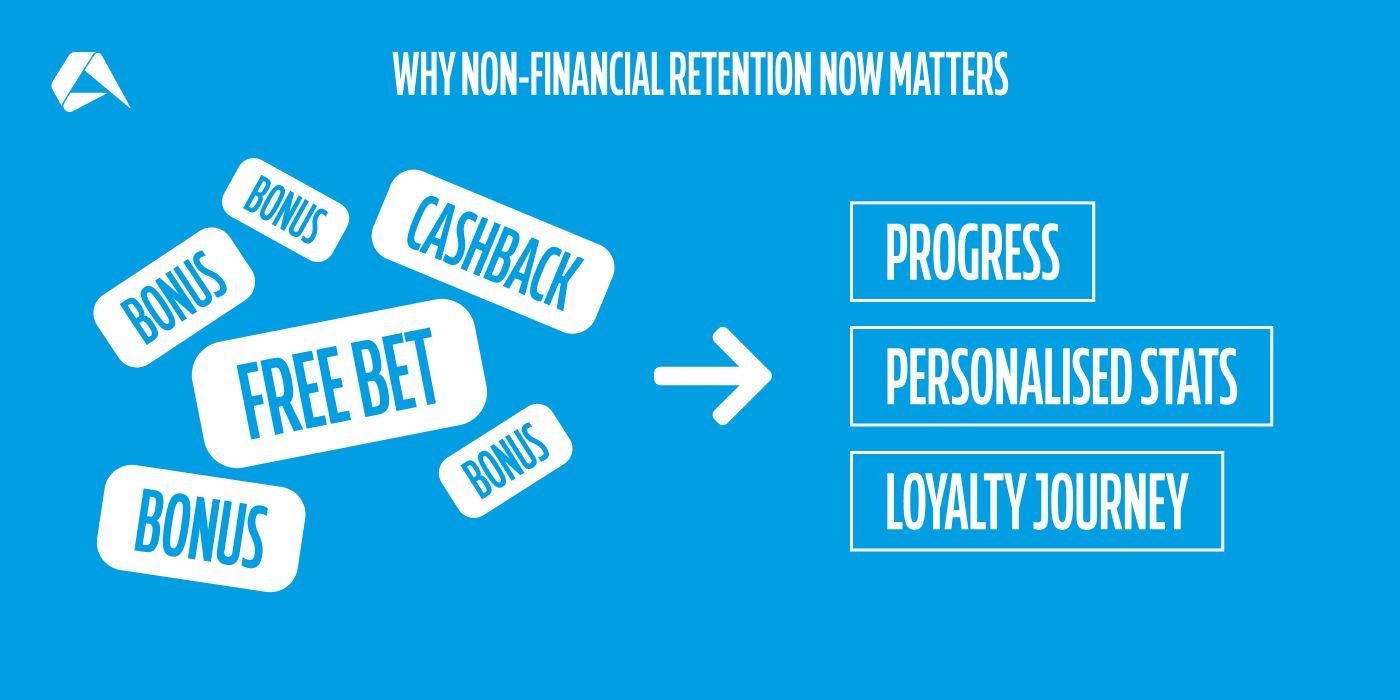

In modern online gambling, bonuses have been traditionally used as the answer to everything. Customer interest? Let’s give a bonus. At-risk customer? Another bonus. Dormant account? You guessed it, yet another bonus. For years, free bets and cashback kept players spinning reels and placing bets, but the limitations of the bonus model are becoming increasingly harder to overlook. Bonus abuse is eroding margins. Regulatory pressure is tightening. And players themselves are starting to ignore offers they’ve seen a hundred times over.

So, what’s the alternative? Operators who want genuine long-term loyalty - that is to say, real retention and not simply transactional stickiness - are turning to non-financial incentives. From social-driven loyalty models to AI-powered personalization, today’s leading platforms are learning how to keep players engaged without giving away cash.

In this article, we’ll explore the non-monetary retention methods sportsbook and casino operators can adopt right now, explaining how each should work at its full potential and the estimated impact they’ll have on your bottom line when done well.

Why Non-Financial Retention Now Matters

For most sportsbook and casino operators, retention has always followed the same logic, i.e., the policy of spending more to keep players. Bonuses, cashback, and free spins are typically viewed not just as incentives, but also as retention tools, and therefore, as ways to buy loyalty and encourage extended play. But there’s a flaw with this approach. Purchased loyalty rarely lasts.

Today’s market realities are exposing this weakness more clearly than ever. Bonuses are being squeezed from every direction. Regulators are tightening restrictions, while fraudsters are exploiting loopholes, and players who have learned to view offers as disposable are becoming increasingly indifferent. Yet many operators remain stuck in reactive cycles, giving away more money to solve problems that bonuses can no longer fix. And perhaps more telling is the question: if bonuses are industry standard, what makes yours a loyalty driver?

This is why non-financial retention matters. It’s not about replacing bonuses entirely. To be clear, we recommend that you don’t do this overnight. However, there is a significant advantage in building systems that create genuine behavioral loyalty, which is loyalty that lasts because players enjoy your platform for reasons beyond the incentives attached to it.

Core Non-Financial Retention Models

Winning without bonuses isn’t just possible. In today's market, it is becoming a smarter way to retain players. Below, we break down the core non-financial retention models that are being employed by many forward-thinking operators today and their commercial impact on KPIs.

Note:

Uplift figures are based on industry-reported case studies, vendor data from CRM providers such as Optimove, and observed trends across engaged player segments. Actual outcomes depend on platform maturity, segmentation, and the quality of gamification design. Figures represent typical outcomes where methods are well-targeted and adequately implemented.

Gamification Tools

In theory, gamification should serve as a retention engine. Yet in practice, many operators still get it wrong by layering points, badges, and levels onto platforms without linking them to meaningful player progression. For example, a sportsbook may implement a points system where players earn badges for every five bets they place. However, beyond the badge itself, there’s no next step. The result is that players often see the achievement as superficial and thus disengage from it entirely.

The key to effective gamification isn’t the achievement, but the psychology behind it. Therefore, operators should aim to reward participation, not just spending, and players will return to advance their progress.

So, knowing this, what defines effective gamification? Start with clear progression systems, which are non-monetary milestones that feel significant, and activities that build habit through recognition (not complexity). When players can track their growth visually and tangibly (without needing a tutorial), engagement becomes self-sustaining.

Equally important is understanding when not to gamify, as not every player segment craves challenges or missions, and misapplied options can clutter the user experience or create disengagement. Done successfully, gamification encourages players to return because they’re progressing, not because they’re paid to.

Commercial Impact:

-

Session frequency uplift: Typically 5–10% among engaged player segments.

-

Churn reduction: 3–8% (dependent on gamification relevance and UX execution).

-

Retention uplift: 10–20% reported in vendor and cross-industry studies.

-

Reduced reliance on cash-based loyalty incentives over time.

Figures are indicative, based on vendor data and cross-sector gamification trends, and do not guarantee specific outcomes.

Personalization Engines

Personalization is one of the most misused terms in online gambling. Most operators believe they’re personalizing the player experience, but in practice, they’re just filtering content. Recommending similar games based on recent plays isn’t true personalization. It’s basic sorting.

To drive actual retention, personalization must move beyond content suggestions to shaping the entire journey. This means recognizing when players are changing behaviors, not just repeating patterns, and adapting accordingly. Does a player who bets on football want casino recommendations? Probably not, but relevant stats overlays or bet-builder prompts might keep them engaged. Ideally, the goal isn’t to sell, but instead, to make the experience feel naturally tailored.

The operators who succeed in this area don’t just use personalization to upsell. They use it to make players feel understood. And it is this emotional alignment that turns personalization from a UX tool into a retention strategy.

Commercial Impact:

-

Session length uplift: 8–15% among targeted segments.

-

Cross-product engagement increase: 5–10%.

-

Reactivation rate improvement via relevant content prompts: 5–8%.

-

Gradual reduction in bonus-driven retention through experience-led loyalty.

Figures are indicative, based on vendor data and cross-sector gamification trends, and do not guarantee specific outcomes.

Non-Monetary Loyalty Systems (VIP Tiers & Access Perks)

While personalization shapes how players experience your platform, loyalty systems define how they feel valued within it. The concept of loyalty systems isn’t new. But too often, loyalty is viewed as synonymous with financial reward, such as VIP tiers built entirely around cashback percentages or bonus thresholds. What’s frequently overlooked is that status itself can be a reward.

Non-monetary loyalty systems can encompass exclusivity, recognition, and access, rather than payouts. Whether it’s priority support, early access to new products, entry to private tournaments, or even platform perks, the goal is to create value through a differentiated experience, not just financial cost.

Furthermore, operators need to rethink how they segment loyalty. Offering non-monetary perks to high-value players makes sense, but mid-tier, high-activity customers often represent untapped retention potential. Access-based perks give these players a reason to stay without eroding margins and shouldn’t feel like a promotion, but a sense of belonging.

Commercial Impact:

-

Potential retention uplift in high-activity segments: 6–12%

-

Churn reduction among mid-tier players

-

Reduced bonus expenditure through status-driven retention

-

Improved customer sentiment and platform loyalty

Figures are indicative, based on vendor data and cross-sector gamification trends, and do not guarantee specific outcomes.

Social and Community Features

Loyalty systems create a sense of belonging between player and platform. Community features, however, take that connection a step further by building relationships between players themselves. For operators focused solely on transactional retention, this is commonly an overlooked opportunity.

Let’s be clear. Social elements don’t need to be complex. Friend lists, private betting groups, collaborative challenges, and shared leaderboards can be enough to create what financial incentives rarely can. When players return to interact with each other, retention shifts from platform-driven to community-driven, which is a far more enduring form of engagement.

Assuming all players want to socialize, community features work best when they’re optional, unobtrusive, and designed around shared goals rather than forced interaction. Operators who implement social components successfully are creating spaces where participation itself becomes the reward, keeping players connected long after the offers stop.

Commercial Impact:

-

Retention improvement in socially engaged segments: 8–15%.

-

Session frequency uplift via collaborative efforts.

-

Increased platform stickiness through community-driven engagement.

-

Long-term churn reduction via player-to-player connections.

Figures are indicative, based on vendor data and cross-sector gamification trends, and do not guarantee specific outcomes.

Interface (UX) Personalization

Personalization engines typically shape content. However, when it comes to interface personalization, the focus shifts to control. And ultimately, control is a powerful form of retention. Giving players the ability to customize dashboards, adjust menus, or select visual themes is more than an attractive visual. It’s much more psychological, since a personalized interface creates a sense of ownership over the platform itself.

The mistake many operators make is viewing interface personalization as a nice-to-have or as a purely cosmetic feature. In real terms, subtle UX personalization directly reduces cognitive load, making the platform feel simpler, faster, and more familiar with every session to the individual user. This matters in retention. Players are more likely to return to an environment that feels like their own, especially in cluttered verticals like slots or on complex, multi-product platforms.

Commercial Impact:

-

Session frequency uplift: 5–10% via reduced friction.

-

Bounce rate reduction on key product pages.

-

Increased stickiness through environmental familiarity.

-

Subtle reinforcement of long-term loyalty via player ownership cues.

Figures are indicative, based on vendor data and cross-sector gamification trends, and do not guarantee specific outcomes.

AI-Driven Emotional Engagement

True personalization connects emotionally with the player, and AI-driven emotional engagement strives to operate at a deeper level by recognizing and responding to player mood, behavioral shifts, and emotional triggers in real time. While still an emerging strategy, this form of adaptive engagement is already shaping how forward-thinking operators retain players without relying on offers.

Significantly, AI shouldn’t just be about upselling. Platforms that deploy machine learning to track engagement patterns can trigger subtle, human-like interactions by recognizing when a player’s routine changes, when frustration builds, or when a return visit deserves acknowledgment. Whether it’s a simple "Welcome back, we missed you" message or an unexpected game suggestion that matches recent frustrations, emotional engagement personalization aims to make players feel noticed, and not targeted.

Commercial Impact:

-

Reactivation uplift via non-promotional triggers: 3–7%.

-

Passive churn reduction through emotionally timed interventions.

-

Increased player satisfaction via perceived recognition.

-

Foundations for future conversational engagement models (e.g. AI companions).

Figures are indicative, based on vendor data and cross-sector gamification trends, and do not guarantee specific outcomes.

Notifications and Non-Financial Offers

Notifications are among the simplest retention tools operators have, and often among the most poorly used. Typically, they’re used as a direct sales channel for bonus reminders, event alerts, and generic push messages, among other purposes. The problem is, players learn to ignore what feels like noise.

To function as a tool for retention, notifications should shift from transactional prompts to behavioral reinforcements. A well-timed reminder that acknowledges a player’s preferences, without pushing a bonus, can sometimes be enough to trigger return play.

Furthermore, non-financial offers, such as exclusive access or personalized content alerts, carry more weight when framed as relevant information rather than sales tactics. The key, therefore, is to use notifications and present offers subtly. Overused, notifications become spam. Used well, they act as quiet nudges, reminding players they’re part of an experience, not just a customer list.

Commercial Impact:

-

Reactivation uplift via relevant, non-sales notifications: 5–10%.

-

Reduction in passive churn through preference-based content nudges.

-

Lower promotional costs via non-financial re-engagement loops.

-

Improved brand perception through value-driven communication.

Figures are indicative, based on vendor data and cross-sector gamification trends, and do not guarantee specific outcomes.

What Operators Often Get Wrong

Non-financial retention strategies promise long-term loyalty without relying on bonuses, yet many operators fail to explore their full potential.

Here are the common pitfalls where even experienced teams often fall short:

1. Thinking in Features, Not Frameworks

One common mistake is viewing retention tools as standalone fixes. Operators invariably deploy gamification, loyalty tiers, or personalization in isolation, expecting each to deliver results independently. But retention success isn’t driven by features. It’s driven by how those features interact. Without a cohesive strategy linking each layer of the experience, even well-designed tools can underperform.

2. Ignoring Player Behavior Over Time

Retention models have the potential to fail because they’re designed around player type, not player behavior. Operators invariably segment users by product preference or spend, although retention largely depends on behavioral shifts, such as slowing session frequency or early signs of churn. Platforms that can’t adapt their retention strategy in response to player activity will lose players mid-cycle, long before any loyalty perk or notification is triggered.

3. Overusing Notifications as Sales Triggers

As mentioned earlier, it’s easy to misuse notifications as simple sales prompts, but this ultimately damages long-term engagement. Players trained to expect offers ignore messages that don’t contain them. Effective notification strategies, therefore, require subtlety in their delivery of content that feels relevant and non-promotional, using timing and frequency to reinforce connection rather than disrupt it.

4. Overcomplicating Experience Personalization

Operators sometimes assume more personalization equals better retention. It doesn’t. Offering endless interface controls or poorly targeted suggestions adds complexity without adding value. The goal of UX personalization should be to reduce clutter, making the platform feel more straightforward and more intuitive over time.

5. Underestimating Operational Complexity

Ultimately, many operators underestimate the resources required to sustain non-financial retention strategies. AI-driven engagement, community tools, and adaptive personalization aren’t plug-and-play features. They need continuous data analysis, strategic oversight, and UX refinement. Treating these systems as set-and-forget tools will almost always guarantee underperformance.

Loyalty Built Beats Loyalty Bought

The Commercial Case for Non-Financial Retention

Central to standard bonus models today, retention still means spending. This relies on more free spins, cashback, and bonus offers designed to keep players engaged for another day. However, as margins tighten and regulatory pressure intensifies, the commercial flaws of this approach are becoming increasingly difficult to ignore. Fundamentally, bonuses don’t tend to build loyalty. They rent it.

Non-financial retention strategies offer operators a very different commercial model. Instead of incentivizing players to stay, they give players reasons to want to. Gamification, personalization, loyalty access, and community features all drive repeat play by making the platform itself the reward. When employed effectively, these strategies create retention that is less costly to maintain and delivers more sustainable player value over time.

A Commercial Comparison of Bonus-Based vs. Non-Financial Retention Models

| Factor | Bonus-Based Retention | Non-Financial Retention |

|---|---|---|

| Cost Model | Ongoing financial outlay (bonuses, cashback) | Lower operational cost over time (one-time feature investment) |

| Retention Driver | External financial incentives | Platform experience and behavioural engagement |

| Scalability | Limited by bonus budget and margins | Sustainable. Scales without increasing spend |

| Regulatory Risk | High (bonuses often restricted or capped) | Low (mechanisms are non-promotional) |

| Customer Loyalty | Transactional, offer-driven | Behavioural, experience-led, long term |

| Commercial Outcome | Margins erode as retention spend rises | Growth through loyalty, not spending |

In commercial terms, non-financial retention not only reduces bonus spend but also strengthens customer lifetime value (LTV), protects acquisition investments, and improves operational stability in regulated markets.

In the end, loyalty built beats loyalty bought, every time.

Stop paying players to stay. Book a personalized demonstration with Altenar today and explore how our non-financial retention tools deliver sustainable loyalty, reduced bonus costs, and higher player lifetime value across your sportsbook and casino verticals.