The mood was openly optimistic when Brazil officially switched on its regulated fixed-odds betting market on January 1, 2025. The long-anticipated rollout, supported by the Department of Finance and guided by the Secretariat of Prizes and Bets (SPA), was hailed as the beginning of a new era, with order replacing chaos and oversight replacing unaccountability. Within weeks, global operators planted flags in the sand and ‘bet.br’ domains jumped into public consciousness. On the ground, a new commercial framework began taking shape.

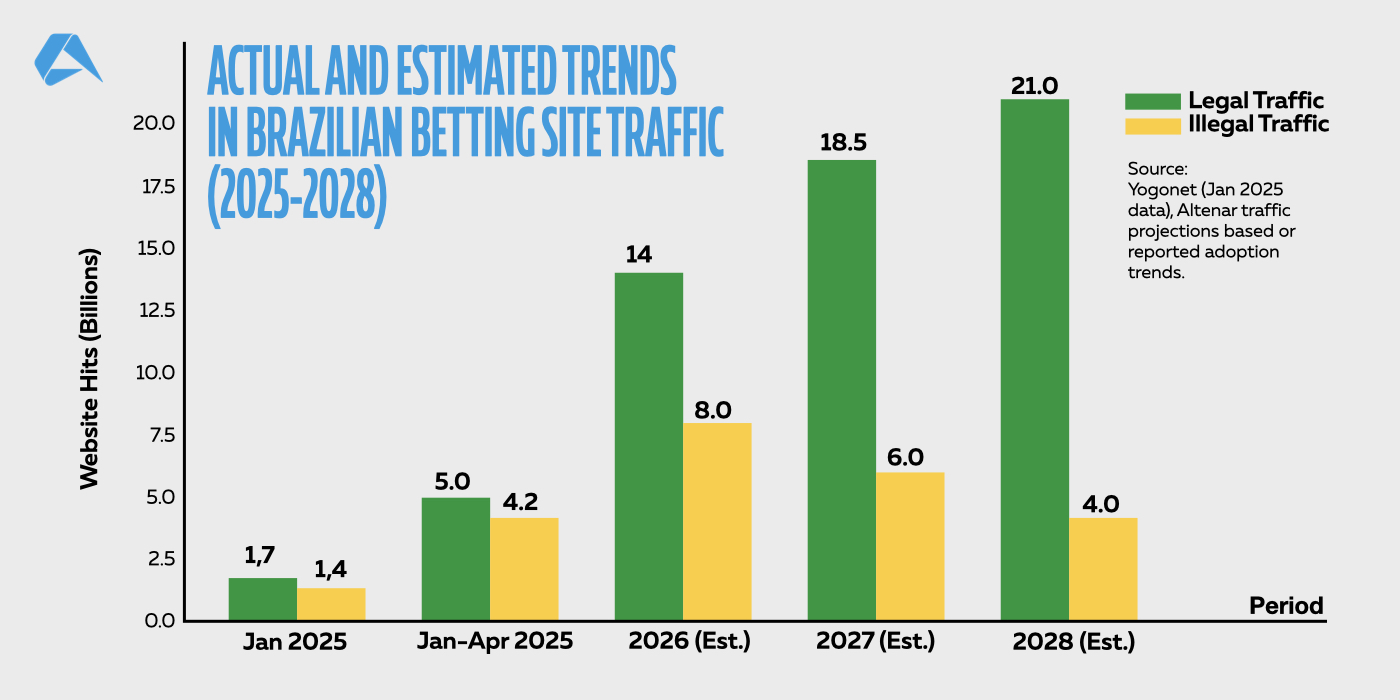

For sure, the early signs were promising. Superbet, Bet MGM, and SportyBet were among the 14 operators granted definitive licenses, while more than 50 others were fast-tracked with provisional authorizations. Legal betting platforms recorded more than 1.7 billion hits in January alone, even outpacing Brazilian traffic to Instagram and YouTube, according to Yogonet.

And yet, here’s the rub. Illegal betting hasn’t just survived the regulatory reboot. It’s still thriving. According to Brazil’s Anatel, over 12,000 unauthorized websites have been blocked, yet roughly 80% remain accessible. The illegal market, by most current estimations, is not in retreat.

So, four months in, we’re left asking a difficult but necessary question:

If regulation was meant to bring betting out of the shadows, why are so many players still placing their bets in the dark?

Legal Market Surge Meets Illegal Market Reality

Brazil’s newly licensed operators didn’t waste time claiming their share of the table. From day one, several platforms benefitted from aggressive marketing, local brand familiarity, and a regulatory badge of trust. Initially seen as bureaucratic, the ‘.bet.br’ domain system helped legitimize offerings in the eyes of more cautious bettors. The SPA’s swift rollout of regulatory infrastructure gave early entrants a head start in building traffic, trust, and transactional volume. That early advantage paid dividends, at least on the surface. The early traffic numbers were staggering, but this isn’t the whole story.

While the regulated market came out swinging, the illegal market never left the ring. Four months in, illegal betting sites remain not only active but alarmingly profitable. Industry estimates suggest that unlicensed operators turned over more than $70 million in recent months, which is a figure that makes it difficult to argue that the shadow market is retreating.

Much of that resilience comes down to one simple fact. Access, it appears, hasn’t been meaningfully disrupted. The SPA, collaborating with Anatel (Brazil’s federal telecommunications regulator), made a headline-grabbing move in early 2025, submitting over 12,500 websites for blocking. However, according to local reporting from UOL, around 80% of those sites remain accessible, often through mirror websites, redirection tricks, or alternative URLs. In Anatel’s own words, enforcement feels like “mopping ice.”

And players know exactly where to look. Popular platforms blocked one week reappear the next under slightly altered names or via Telegram groups and social media channels. Moreover, blocked sites routinely reappear under new websites, often within days, sometimes even hours, of being taken down.

In this context, the legal market’s early traffic boost doesn’t represent a clean migration. It seems to suggest the beginning of a parallel market. Regulated operators may be drawing in a new audience or reclaiming casual bettors, but long-time users of offshore platforms remain immersed in a set-up that, for now, still works just fine. In every practical sense, the illegal market hasn’t blinked. It’s adapted, and it’s still taking bets.

This dual-track outcome shouldn’t come as a surprise. Regulation creates legitimacy, not exclusivity. In other words, legal operators may now have the keys to Brazil’s front door, but the back entrance remains wide open. For a significant portion of bettors, especially those already comfortable with unregulated platforms, the shift to legal alternatives offers no compelling reason to move. Many online sports bettors and casino players weren’t waiting for legitimacy. They were already placing bets with minimal consequences, flexible payment options, and no demands for identification.

Brazil now faces an overlap. One sector thrives in the light, while the other persists in the shadows. Unless enforcement improves access, there’s little reason to believe one will eclipse the other anytime soon.

Inside the Problem: Why Illegal Sites Still Win

But blocking access is only half the fight and not the harder half. The technical agility of illegal operators continues to outpace enforcement at every turn. Beyond the basics of VPNs and mirror sites, some platforms now automate URL cycling, re-routing players in real time when a website goes dark. Others use geo-blocking, showing compliant content to authorities while serving up betting platforms to actual users. It’s a digital sleight of hand, and it’s working.

Even if enforcement could close every technical loophole, the illegal market would still have one powerful asset on its side: the players themselves. For many, the choice to stick with offshore sites isn’t just about convenience, it’s more about preference. Familiar brands, faster payment processing, and the absence of the usual bureaucratic hurdles when it comes to registration and verification all work in their favor. Competitive odds and perceived anonymity only strengthen the appeal.

There’s also the matter of awareness, or, in reality, the lack of it. Many bettors either don’t know or don’t care whether a site is licensed, especially when the experience feels polished and the rewards flow quickly. In some cases, illegal platforms still offer a slicker UX than newly regulated alternatives. For seasoned players, it becomes not a question of legality but a matter of habit, speed, and getting more for less.

Can Enforcement Catch Up?

Brazil’s licensed operators are proving the market’s potential, but fair play requires more than just policy. It needs enforcement that works. To this end, the federal government hasn’t been idle. In March 2025, the SPA issued an ordinance mandating that financial institutions block transactions linked to unlicensed gambling operators, which is an attempt to disrupt the economic engine behind illegal betting.

Moreover, earlier in the year, operators were also instructed to submit formal anti-money laundering policies by March 17 and comply with new GGR tax calculation rules. A framework for inspections has been introduced, and the SPA has opened several public consultations, including one aimed at defining a national exclusion system for at-risk players.

The intent is self-evident. Brazil is trying to build a complete regulatory framework, from financial monitoring to player protection. But regulation, no matter how well it is drafted, takes time to settle into real-world impact.

The Gaps in Patchwork Enforcement

Turning regulation into results is especially slower in a system where enforcement is split across multiple agencies. The SPA may write the rules, but execution depends on coordination with Anatel, COAF, state-run lotteries, and the judiciary, with each moving at its own pace. Such a patchwork system slows response times and leaves room for exploitation. Legal gray areas don’t help either. Some state-run lotteries still claim the right to issue licenses independently, blurring the boundaries of authority.

On the player side, stricter anti-money laundering (AML) and know your customer (KYC) measures, while being necessary, risk nudging certain users back to platforms with fewer demands. The rules are in place. But until the system is fully aligned, illegal operators will keep slipping through the cracks.

What Comes Next, and What Should?

With the foundations now in place, Brazil’s regulatory focus will likely shift from policy design to active enforcement. The March ordinance requiring financial institutions to block unauthorized betting transactions signals the start of a wider push to disrupt illegal cash flows in real time. More rigorous oversight from COAF and the Central Bank is expected, alongside sterner monitoring of Pix transfers and payment intermediaries. Meanwhile, the national self-exclusion system, which is currently in development following public consultation, is likely to usher in new onboarding and monitoring obligations for operators.

Yet the road ahead also demands clarity. Ongoing disputes over whether state-run lotteries can issue their own licenses, most recently brought into sharp focus by Bodó City Hall’s controversial move, risk weakening federal authority unless resolved through legislative or judicial intervention.

Beyond these expected actions, Brazil has the opportunity to take the lead with a more innovative, player-focused approach. A government-backed verification portal listing authorized operators could help players check brand legitimacy at a glance. A recognizable legal seal, for instance, backed by media campaigns, might raise consumer awareness where regulation alone hasn’t. Incentivizing the betting public toward legitimate operators through streamlined KYC, competitive bonuses, or better UX could accelerate legal adoption more effectively than punitive messaging ever could.

As a final thought, perhaps the SPA could benefit from investing in a dedicated, technology-driven enforcement team, much like Ukraine’s PlayCity approach. This team could be equipped with AI-powered tools to track affiliate networks, cloned websites, and crypto-based payment flows.

The tools exist, and the intent is visible. What’s needed next is execution that’s just as agile as the market it’s trying to reform.

Outperform the Illegal Market with Tech That’s Built for the Real World

Brazil isn’t the only Latam market wrestling with regulation versus reality. Across the region, similar tensions between enforcement and accessibility are playing out in real time. In markets where speed, flexibility, and local precision separate winners from everyone else, Altenar delivers more than compliance. It empowers legal operators to respond with the same agility as offshore rivals - minus the risk. From tailored sportsbook architecture to real-time localization, our advanced technology helps partners not just enter regulated Latam markets but also outperform them.

Want to see how Altenar helps licensed operators outmanoeuvre the illegal market?

Book your private Latam-ready software demonstration today.