Peru has rapidly emerged as one of Latin America’s most exciting gambling markets, blending a strong land-based sector with a booming online industry. With a clear regulatory framework now in place, both domestic players and international giants are locked in a battle for market share in an industry that’s expanding at pace.

This article takes a strategic look at Peru’s gambling sector, examining the key players, existing opportunities, competitive pressures, and future trends shaping the market.

Market Size and Growth Potential

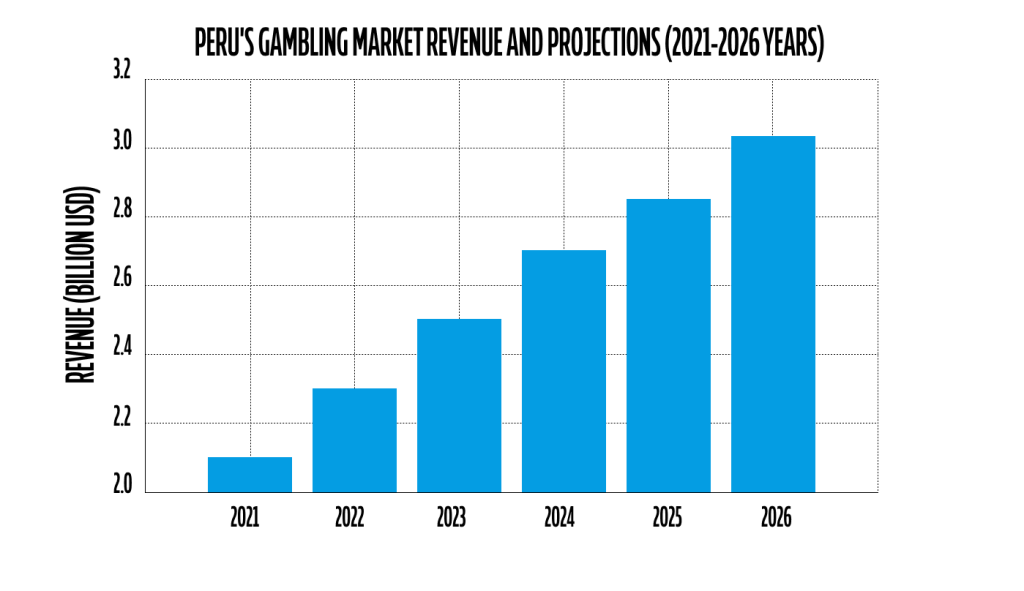

In 2025, Peru’s gambling industry is no longer just an emerging market; it’s a regional heavyweight in the making. With a total market turnover estimated at $2.5 billion, Peru is proving to be a lucrative LatAm jurisdiction for operators seeking to capitalize on a fast-growing player base. And it’s not slowing down anytime soon. Industry forecasts suggest that by 2026, total market revenue could hit the $3 billion mark.

Internet penetration and smartphone adoption are at the heart of its growth. As of early 2024, around 75% of Peruvians were online, and with mobile connections exceeding the total population, the country is primed for digital-first gambling. Mobile payments have also surged, with 59% of all e-commerce transactions made via smartphones, meaning players expect fluid, app-driven experiences when betting online.

The nation is making significant strides in digital adoption compared to its Latin American neighbors. While other countries wrestle with regulatory gray areas, Peru has already established a framework that gives operators the confidence to invest. This combination of consumer enthusiasm and regulatory certainty is why major players are doubling down on their Peruvian operations.

Major Gambling Operators in Peru

Peru’s online gambling market has expanded following Law 31557, which established a formal licensing framework. MINCETUR’s regulatory structure, finalized in 2024, has enabled local brands and global operators to compete in a legally structured, high-growth environment, strengthening market confidence and industry consolidation.

Due to these developments, the new licensing framework has granted 120 licenses to 60 online gambling operators, encompassing both sports betting and online casino games.

These regulatory advancements have leveled the playing field, encouraging market consolidation while simultaneously boosting consumer trust in licensed operators. The result is a more structured industry in which leading local brands such as Apuesta Total, Inkabet, and Te Apuesto compete alongside international heavyweights like Betsson, Bet365, and 1xBet in an increasingly sophisticated and high-growth environment.

Online Betting & Casino Operators

With Peru’s online gambling market now fully regulated, local and international operators are vying for dominance. Apuesta Total, Inkabet, and Te Apuesto have secured strong footholds, capitalizing on brand familiarity and extensive retail networks to retain loyal players. Apuesta Total, in particular, stands out with aggressive expansion strategies and high-profile football sponsorships, reinforcing its visibility among bettors.

Meanwhile, global players such as Betsson, Bet365, and 1xBet are solidifying their presence. Betsson’s acquisition of Inkabet in 2021 extended its influence, allowing it to challenge well-established local brands.

In the battle for market dominance, industry insiders predict that market consolidation will shape the future, with only a handful of dominant operators emerging. Gonzalo Pérez, CEO of Apuesta Total, expects that “three or four bigger operators” will take the lead, making brand differentiation and strategic partnerships key to long-term success.

Top 5 Local Online Brands in Peru:

-

Apuesta Total

A leading Peruvian sportsbook known for its extensive retail network and strategic football sponsorships.

-

Te Apuesto

Operated by La Tinka S.A., Te Apuesto offers sports betting services alongside traditional lottery products.

-

Inkabet (acquired by Betsson 2021)

A popular platform among local bettors, offering a wide range of sports betting options.

-

Doradobet

Known for its diverse betting markets and user-friendly interface.

-

Betano

Recognized for its competitive odds and comprehensive sports coverage.

Top International Online Brands in Peru:

-

Bet365

A global leader in online sports betting, offering a vast array of markets and live streaming services.

-

Betsson

A Swedish-based operator with a strong presence in Peru, offering both sports betting and casino games.

-

1xBet

Known for its extensive sportsbook and diverse betting options, including esports.

-

Unibet

Offers a comprehensive range of sports betting markets and casino games.

-

Betway

Renowned for its live betting platform and competitive odds.

-

Rabona

Provides a unique gamified betting experience with a wide selection of sports and casino offerings.

Land-Based Sector:

Peru’s land-based betting industry is driven by established operators expanding their foothold through strategic acquisitions and retail growth. Grupo CIRSA, which entered the market in 1996, has built a commanding presence and now operates 19 casinos, 74 betting outlets, and over 3,200 slot machines nationwide.

In a bold move to strengthen its position, CIRSA acquired a 70% stake in Apuesta Total, Peru’s largest sportsbook operator, which manages approximately 500 betting locations nationwide. This acquisition emphasizes the sector’s growth potential and ongoing market consolidation.

Major urban centers like Lima and Arequipa serve as key hubs for casino and retail betting activity. In Lima, gaming venues draw a steady mix of local and international customers, while Arequipa’s betting shops contribute significantly to the regional economy. With operators focusing on expansion and market dominance, Peru’s land-based sector remains a lucrative environment for domestic and international stakeholders.

Top Domestic Land-based Operators:

-

Apuesta Total

A leading Peruvian sportsbook with an extensive network of betting shops nationwide.

-

Intralot de Peru

A subsidiary of the global gaming company Intralot, offering lottery and sports betting services across the country.

-

Te Apuesto

Operated by La Tinka S.A., Te Apuesto provides sports betting services alongside traditional lottery products.

-

Casino Golden Palace

A prominent casino offering a variety of gaming options in Lima.

Top International Land-based Operators:

-

CIRSA

A Spanish gaming company operating multiple casinos in Peru, including the Casino Majestic in Lima.

-

Aristocrat Gaming

An Australian company supplying gaming machines and solutions to Peruvian casinos.

-

EGT (Euro Games Technology)

A Bulgarian gaming equipment manufacturer with a significant presence in Peru's casino industry.

The Rising Star of Peruvian Gambling

In Peru, football is more than a passion. It’s a driving force behind one of the country’s fastest-growing industries: sports betting.

This enthusiasm is reflected in strategic partnerships between betting operators and local football entities. For instance, in 2023, Betsson extended its title sponsorship of Peru's top football division, Liga 1 Betsson, for an additional four years. Similarly, FCB Melgar, one of Peru's oldest football clubs, secured Stake as its official sponsor for the 2025 season, further strengthening the bond between sports and betting.

The surge in mobile-first platforms and in-play betting options has reinvigorated the betting experience, offering real-time engagement that resonates with modern consumers. This digital evolution has broadened access and enhanced the overall appeal of sports betting in Peru.

Current Market Opportunities for Operators

Peru’s online gambling market is expanding rapidly, creating interesting opportunities for operators ready to tap into its potential. Recent regulatory developments, including licensing requirements set by MINCETUR, have introduced stricter compliance measures, yet they have also reinforced market confidence, attracting local and international investors. Rather than slowing growth, these regulations have established a safer, more transparent industry that is increasingly appealing to players.

One of the biggest factors driving this surge is the widespread adoption of mobile-friendly platforms and instant payment solutions. With high smartphone penetration and increasing internet access, Peruvians are embracing digital betting more than ever. Operators delivering fast, intuitive mobile experiences and transactions have access to the most significant market share.

At the same time, many operators are using casino and sportsbook cross-selling strategies to drive engagement. By integrating multiple gaming verticals into a single platform, these operations are expanding player lifecycles and increasing customer retention.

Regional expansion offers another avenue for growth beyond Lima, but operators must tailor their strategies to local consumer habits. Those who successfully negotiate the regulatory framework and embrace digital innovation will find Peru a highly rewarding market.

The Regulatory Landscape

Peru recently transformed its gambling industry by enacting Law No. 31557, which regulates online gaming and sports betting. Effective since February 2024, this legislation mandates that all operators, domestic and international, obtain licenses from the Ministry of Foreign Trade and Tourism (MINCETUR). Compliance requirements include implementing security protocols, Know Your Customer (KYC) processes, and responsible gaming policies.

Key Elements of the Regulatory Framework:

-

Mandatory Licensing: Must obtain approval from MINCETUR.

-

Taxation: 12% tax on net profits plus a 1% excise tax on transactions.

-

Player Protection Measures: Age verification, self-exclusion, and responsible gaming policies.

-

Local Representation Requirement: Foreign operators must appoint a legal representative in Peru.

-

Technical Compliance: Must meet security and fair play standards.

-

Anti-Fraud and KYC Protocols: Strict identity verification and financial security measures.

-

Advertising and Marketing Restrictions: Guidelines to prevent misleading promotions and underage targeting.

-

Regulatory Oversight: Ongoing compliance monitoring and enforcement by MINCETUR.

-

Enforcement Against Illegal Gambling: Measures to crack down on unlicensed operators.

-

Approval Process for New Platforms: Licensing resolutions are expected within 30 business days.

The nation's regulatory framework makes it one of the few South American countries to regulate sports betting, following Colombia, Brazil, and certain provinces in Argentina. Colombia established a comprehensive online gambling framework in 2016, while Argentina's regulations vary by province, with regions like Buenos Aires implementing their own systems. Brazil has legalized sports betting but is still in a transitional period. Unlike its neighbors, where regulations vary by province or remain in development, Peru has embraced a single, nationwide framework, giving operators clarity, consistency, and a direct path to market entry.

Challenges Facing Gambling Operators in Peru

Operators looking to establish a foothold in this fast-moving market must contend with fierce competition, shifting economic conditions, and an evolving regulatory landscape that continues to shape the industry's direction.

With both local giants and international brands vying for dominance, the market is reaching a point of saturation. While we can expect the emergence of dominant players, others will be left competing for smaller market segments. For newcomers, standing out requires more than just competitive odds and attractive promotions. It demands strategic differentiation, strong brand positioning, and a deep understanding of Peruvian betting habits.

Beyond the crowded playing field, Peru’s economic landscape presents additional hurdles. A newly implemented Selective Consumption Tax (ISC) on online gaming and sports betting will gradually increase from 0.3% to 1% by mid-2025, adding another layer of taxation to the existing 12% gross gaming revenue tax. While the government argues that these measures will boost tax revenues, operators are concerned about profit erosion and potential pricing pressures.

Meanwhile, Peru’s fiscal deficit reached 3.6% of its GDP in 2024, the highest in decades outside of pandemic years. In an effort to stabilize public finances, the government is considering selling bonds to finance the shortfall. These are moves that could impact consumer confidence and discretionary spending, including gambling.

For operators, the challenge is twofold: navigating regulatory and tax pressures while ensuring long-term sustainability in a highly competitive space. Those who can adapt, offer tailored experiences, and build trust with Peruvian players will be the ones best positioned to overcome the hurdles and thrive.

The Next Phase of Peru’s iGaming Boom

Latin America’s online gambling scene is shifting fast, and Peru is emerging as one of the region’s most strategic marketplaces. With forecasts predicting an accelerated growth path, what’s more telling is the level of interest from major players moving in and what this signals for the next phase of competition.

In the past year, international operators have doubled down on Peru, snapping up local brands, securing sponsorships with top-tier football clubs, and building tech infrastructure that rivals more established markets. Peru’s regulatory framework provides a level of stability that Brazil and Argentina are still struggling to match. Operators aren’t just entering the market; they’re scaling fast.

Technology is driving this expansion. Mobile-first platforms, advanced risk management, and instant online payments are reshaping how Peruvians bet, and players now expect a global-level user experience. With the competition heating up, local brands are pushing back, reinforcing customer loyalty through hyper-local strategies and aggressive marketing. The race is on.

For operators eyeing Peru, the window to establish market share is shrinking. Success here won’t come from simply launching. It will come from understanding the competitive dynamics, integrating smart tech, and moving quickly before the next wave of consolidation begins. The time to act isn’t soon - it’s now.

Where Local Knowledge Meets Global Innovation

Succeeding in Peru’s competitive online gambling market takes more than just securing a license; it requires the right technology. Altenar’s sportsbook and casino solutions are built to match Peru’s unique market demands, giving operators the edge they need.

Stay ahead of the competition and schedule a personalized software demonstration today to discover how our advanced technology can unlock new revenue opportunities in a fast-moving market.