Every sportsbook talks about growth, and for obvious reasons, few like to talk about loss. Players come in, place a few bets, maybe win, maybe not, and then stop visiting the platform. That is what we call churn. Everyone in the iGaming industry measures it, but not everyone understands what it’s really saying.

For many industry professionals, churn is a percentage figure that must be reduced before the next board meeting. But the simple truth is that it’s not so much about how many players are leaving and more about why they stopped caring in the first place.

In many ways, it is the most honest feedback a sportsbook will ever get. Many KPIs can be spun. Churn simply can’t. It’s the one number that tells you whether the product experience is genuinely worth returning to, revealing how players feel about your product in practice beyond marketing.

The irony is that operators spend millions to find new customers, while the real insight into the value of your sports betting offer lies in understanding why the old ones walked away.

Churn as Product Feedback

Knowing your churn rate in sports betting is one thing, but comprehending how to read it intelligently is the difference between reacting to losses and learning from them. The real value, therefore, lies in uncovering the why, and that requires treating churn not as an outcome but as feedback from the product itself.

When examined in detail, churn data reveals when the experience stops meeting the expectations of bettors and pinpoints the moments they commonly exit. When operators start categorizing churn by behavior and timing rather than by volume, the data stops being abstract and becomes something that is truly actionable.

By categorizing patterns of attrition, you can start to build a picture that reports or surveys don’t always capture and expose areas of your sportsbook that aren’t working as well as they should be.

The table below illustrates the power of this kind of analysis. When used correctly, churn becomes a diagnostic tool that highlights operational inefficiency, user friction points, and missed moments of connection all in one dataset.

| Churn Signal | What It Reveals | Operational Insight |

|---|---|---|

| High drop-off within the first 7 days | Poor onboarding or weak first-time UX | Simplify registration, highlight top markets earlier |

| Post-withdrawal churn | Delays or mistrust in the payout process | Improve withdrawal speed and transparency |

| Decline after promo use | Bonus-driven rather than product-driven loyalty | Rethink incentive structures and promote value beyond offers |

| Seasonal or event-based churn | Engagement tied to specific sports or leagues | Diversify content and cross-sell verticals |

| Mid-session abandonment | Issues during bet placement or odds comparison | Optimise speed and usability on mobile |

| Localised churn spikes | Weak localisation or payment barriers | Strengthen local payment options and translations |

Top 10 Common (and Costly) Causes of Churn

While it’s impossible to capture every reason a bettor might abandon a sportsbook, understanding these patterns is essential for improving sportsbook customer retention and lifetime player value. Most forms of churn trace back to a familiar set of patterns. These are the most common reasons why players leave after they become active users:

1. Weak first-time experience

The first session sets the tone. If navigation feels awkward, markets are hard to find, or bet confirmation takes too long, many players will simply choose never to log in again.

2. Lack of trust in payouts

Even minor withdrawal delays can erode confidence in a platform. Once a player doubts whether they’ll be paid fairly or promptly, they may never come back.

3. Overcomplicated promotions

Bonuses that require a calculator to understand create frustration. Bettors want offers that feel fair, not ones designed to confuse them.

4. Uncompetitive odds or margins

For experienced sports bettors in particular, price sensitivity can lead to exits. If players consistently find better value elsewhere, loyalty disappears, no matter how well the platform works.

5. Poor mobile performance

Lag, broken layouts, or failed logins are churn accelerators in mobile-first markets. On these platforms, bettors don’t complain. They just stop opening the app.

6. Regulatory overload

Re-verification, betting limits, and pop-up reminders may be compliance necessities, but too many at once make betting feel more bureaucratic than enjoyable.

7. Content irrelevance

Players tune out when they’re offered odds or promos that don’t match their interests. Local sports, seasonal relevance, and personalization matter more than quantity.

8. Poor customer support

When players reach out, it’s because they have an issue that needs a quick resolution. Slow or generic responses will accelerate an exit.

9. Excessive communications

Push notifications and constant emails can make even loyal users tune out. Over-engagement is still disengagement by another name.

10. Negative word of mouth

Reputation moves fast in the betting industry. A few stories about delayed payouts or unfair limits can spread through forums and social channels, prompting players to lose faith.

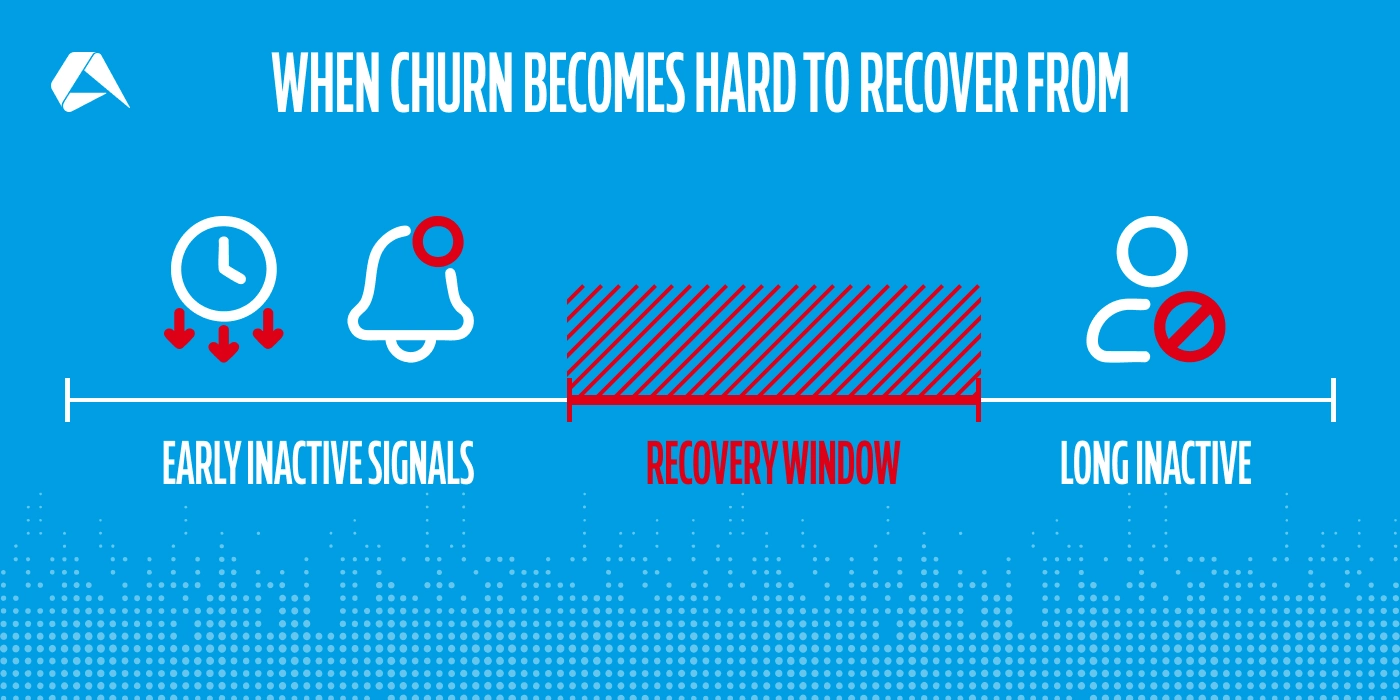

When Churn Becomes Hard to Recover From

Every operator understands that once a player goes silent, the odds of bringing them back get smaller with each passing day. Yet few will make the effort to quantify when that tipping point actually happens, or what warning signs usually appear beforehand. This section explores how the churn rate in sports betting builds in stages and how recognizing early signs can help prevent long-term revenue loss.

Operators who track engagement reduction in real time gain two advantages. First, they identify the moment when a player is starting to lose interest, and secondly, how long they have to act before reactivation attempts become a poor investment.

The Window for Recovery

Once a user’s betting activity stops, the chance of re-engagement begins to fall immediately, often within the first week. Research from retention platforms such as Optimove shows that players who are inactive for seven days remain responsive to targeted offers or reminders, but after 30 days, their recovery potential drops off substantially.

This pattern forms what many CRM teams call the ‘recovery curve’. The curve reflects behavioral memory. The longer the gap between sessions, the weaker the emotional link to the platform becomes. Communication feels colder, incentives cost more, and even strong campaigns convert at lower rates.

For operators, this window defines the most efficient point of intervention. Data suggests that quick reactivation, ideally between days 3-10 of inactivity, delivers the best ROI. Beyond that, recovery efforts often cost more than the player’s future lifetime value. Understanding this curve turns reactivation from guesswork into a strategy.

Segment-Based Reactivation Tactics

When it comes to player reactivation, it is important to recognize that not every lost player is worth chasing, and not everyone can be won back the same way. For this reason, the most effective reactivation strategies begin with segmentation. This will provide insight into who left, when they left, and what kind of player they were while active.

For high-value or VIP bettors, churn is rarely about interest. Typically, it is much more than that and often about trust. These players respond best to personal outreach, where trust can be established with a direct message from an account manager, a goodwill gesture, or access to tailored markets.

Casual and event-driven bettors, the weekend football fan or seasonal punter, for instance, need a different approach. They’re motivated by relevance and timing. A reminder ahead of the next big match, or a small, low-effort bonus that brings them back into the action, often works better than generic promotions.

Dormant early-stage players, on the other hand, are usually a product of poor early engagement. Their reactivation should focus on simplifying re-entry through login efficiency, reminders of easy wins, and clear ‘what’s new’ messaging that inspires curiosity.

The common thread is sportsbook personalization. Reactivation campaigns that ignore player history and push irrelevant offers are simply wasted spend. Segmentation allows operators to meet each player where they dropped off, rather than trying to pull everyone back in the same way.

Know When to Stop Chasing

Reactivation in real terms has a point of diminishing returns. That’s to say that beyond a certain point, every offer, reminder, or personalized campaign delivers less impact. For sports betting platforms, the longer a player stays inactive, the colder the relationship becomes, and the higher the risk that reactivation spend simply burns through marketing budget without delivering meaningful retention.

Operators that track response deterioration know this curve well. Inactive players past the 60–90 day mark rarely return with any genuine lifetime value, even if they respond to an offer. Their activity often spikes briefly before disappearing again, creating what CRM teams call ‘flash reactivation’, which are short bursts of engagement that look good in metrics but add little to revenue.

The more intelligent approach is to draw a clear line between re-engagement and reinvestment. After a set inactivity threshold, players move from ‘recoverable’ to ‘write-off’. That line isn’t fixed. It varies by market, product mix, and player value, but the underlying principle remains - chasing everyone drains resources that could otherwise be used to protect the ones who still matter.

Some operators assess this through reactivation scoring, assigning probability bands to returning user segments and allocating spend accordingly. Those with high potential receive tailored outreach, while those with a low probability of reactivation are archived.

The key takeaway worth remembering is that retention only works when it’s selective, disciplined, and based on evidence, not emotion.

Predicting Churn Before It Happens

The most profitable sportsbooks aim to anticipate churn rather than analyze it after the fact. Predictive churn analysis gives operators an advanced view of who’s at risk and why, refocusing retention efforts from a reactive to a preventive approach.

Accurate churn prediction begins with behavioral indicators. Bettors do not always just disappear without warning. More often than not, activity slows first before momentum is lost. In practice, this can be seen when they log in less frequently, bet on fewer sports, place smaller wagers, or deposit without betting again. Each of those changes is an early warning sign.

Technology now makes this kind of analysis practical. Machine learning models, trained on historical player data, can assign a churn probability to each active user. These models do more than track frequency. They learn what normal looks like for each segment and flag deviations in real time. But prediction is only useful when it drives action, so the key is putting this insight into practice through initiatives like sending re-engagement prompts at the right moment or adjusting bonus timing for maximum impact.

From Reactivation to Retention Intelligence

Moving a step beyond prevention, the same data used to reactivate players can also show operators how to build a product that they will never want to leave.

Patterns in failed reactivation attempts often point straight to structural flaws that break natural flow. When those signals are fed back into product and UX design, the platform starts to learn what sportsbook bettors value most through their behavior.

In other words, think of structural flaws as the hairline cracks that only appear under real pressure. Reactivation failures expose those weak points. They’re not just signs of disengagement, but proof of where the experience stops holding the player’s attention. When those moments are recognized and fed back into design, the sportsbook starts to evolve around genuine behavior rather than internal assumptions.

Retention intelligence, at its best, is a loop. Data moves from marketing to design to communication and back again. It’s how top-tier sportsbooks find momentum, because the product speaks the player’s language, the CRM knows when to stay quiet, and the odds feed feels personal rather than generic.

And technology is what makes that feedback loop possible in real time. Altenar’s advanced retention tools for sportsbooks combine segmentation, analytics, and automation to transform churn data into design decisions. They don’t just trigger reactivation, they fine-tune how each user experiences the sportsbook as it evolves.

Instead of generic retention campaigns, operators can identify specific issues, such as drop-off after a payout delay or market inactivity and address them instantly. The same tools adjust communication frequency, personalize content, and even optimize promotions according to player lifetime patterns. Every user action becomes an opportunity to test and learn, building a sportsbook that improves with every interaction.

That’s the power of advanced sportsbook technology. It doesn’t just react to individual behavior. It evolves with it, and anticipation becomes the edge.

Book your personalized demonstration now to see how Altenar’s data-driven iGaming solutions help operators predict churn before it happens, and how intelligent automation keeps bettors engaged long after the first bet.