Overview Understanding Moldova’s Gambling Laws, Opportunities and Limitations

Moldova’s gambling market is characterized by a state-first monopoly, making it one of Europe’s most tightly controlled jurisdictions. The core framework was restructured by Law No. 291/2016, which formalized the state's expanded control.

Today, the state-owned National Lottery of Moldova holds exclusive operational rights over nearly all gambling verticals, including all forms of online wagering, retail sports betting, and slot halls. This means that commercial operators are entirely excluded from the digital sector, as no licensing routes exist.

The sole opportunity for private operators is in the land-based casino sector, regulated by the Public Services Agency. Although foreign ownership is capped at 49%, this segment offers stability, low operational costs, and limited domestic competition. Looking ahead, Moldova’s ongoing EU accession process is the most likely catalyst for regulatory evolution, which could lead to gradual liberalisation or reinforcement of the state model. This position makes Moldova a jurisdiction to monitor for long-term potential.

Read the blog below to understand Moldova’s regulatory landscape and explore potential opportunities in this unique market.

In reality, you’re unlikely to hear Moldova mentioned in the same breath as Europe’s significant gambling markets. And yet, that’s precisely why it deserves a closer look. Beneath its monopoly-driven framework lies a market characterized by cautious control, steady demand, and the potential for change in the years to come.

While most operators see closed doors, others see quiet potential. In this guide, we provide a detailed overview of Moldova’s regulated gambling scene and why patient operators may find long-term value in closely monitoring the developments that follow, even if not yet worth pursuing.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

A Brief History of Gambling in Moldova

Gambling has long been a presence in Moldovan society, with early records dating back to 1918, when card games and informal betting were standard in Chişinău's social clubs. Yet for a good part of the 20th century, gambling remained largely unregulated, influenced more by Soviet-era restrictions than by formal national policy.

That changed in the late 1990s, as Moldova transitioned from Soviet governance to an independent regulatory structure. The first significant step came in 1999 with the introduction of Law No. 285-XIV, which formally legalized gambling for the first time. This early framework created a state monopoly over lotteries but left other forms, such as casinos and slot halls, open to licensed private operators.

Public attitudes towards gambling during this period were largely pragmatic. Gambling was seen as a potential revenue source rather than a moral concern, though rising reports of problem gambling and underage access gradually shifted perceptions. Action to counteract this trend emerged in 2016, when a significant regulatory reform was introduced. The passage of Law No. 291/2016 effectively restructured Moldova’s betting sector, expanding the state’s monopoly to cover not just lotteries but also sports betting, slot halls, and all forms of online gambling.

Only land-based casinos remained open to private licensing.

This new direction was said to be driven by political concerns over money laundering, organized crime, and the perceived social harms linked to unregulated gambling, particularly within slot halls and unlicensed betting shops.

Timeline of Events

Here’s a timeline of some of the most significant moments in the history of gambling in Moldova:

1918: First recorded gambling in Chişinău’s private clubs

1999: Law No. 285 legalizes gambling and state lottery monopoly

2001: Licensing regime introduced for casinos and slot halls

2008: Regulation tightened amid concerns over illegal operators

2013: Criminal Code amended to penalize match-fixing and fraud

2016: Law No. 291 establishes extended state gambling monopoly

2017: National Lottery takes control of monopoly operations

2019: Launch of state-controlled online and retail sportsbook platform

2023: Advertising law amended to permit limited promotion

2025: Stricter ID verification rules enforced at land-based venues

The Current Situation for Gambling

Today, in 2025, Moldova’s gambling sector is defined by this state-first philosophy. The result is one of Europe’s most tightly controlled gambling markets, where the state monopoly governs nearly all forms of wagering, both online and offline, while private operators find opportunities restricted solely to licensed casino operations. This centralized structure continues to reflect the government’s cautious, protectionist stance towards gambling as a public policy issue.

In practice, this means that all forms of online gambling, from lotteries and slot halls to casino platforms and sportsbooks, are operated exclusively by the National Lottery of Moldova, a wholly state-owned enterprise. Private operators are entirely excluded from the online sector. While international providers may supply technology and content behind the scenes, the platform itself remains in the hands of the state. Significantly, for commercial operators, there are no licensing routes to enter the digital market.

The same restrictions apply offline. Retail sports betting, including kiosks and physical betting shops, falls under the same state-run system. Unlike other restricted markets where retail betting may remain open to private firms, Moldova’s approach extends public control to both digital and land-based betting environments.

The exception lies in Moldova’s land-based casino sector. Here, private operators can still participate under a license, although foreign ownership is capped at 49%. Approximately 350 casinos operate nationwide, providing the only point of access for commercial gambling businesses today.

The Legal Framework in Moldova

Moldova’s gambling sector operates under the provisions of Law No. 291/2016, which serves as the primary legal framework governing the industry. This law formalized the state’s expanded control over nearly all forms of gambling, including lotteries, slot halls, sports betting, and digital casino products. The result is a strict monopoly model where the National Lottery of Moldova, a state-owned entity, holds exclusive operational rights across all these verticals.

In addition to this, Law No. 291/2016 mandates strict compliance with responsible gambling standards, AML controls, and financial reporting, with oversight split among the National Lottery, State Tax Service, and other regulatory bodies. While the legal framework is considered stable, there are currently no legislative proposals aimed at expanding private sector access, thereby reinforcing Moldova’s state-first regulatory stance.

Key Regulatory Authorities and Licensing Control

Moldova’s gambling industry is overseen by a small network of regulatory bodies, each playing an exclusive role in licensing, compliance, and enforcement. Together, they control access and operational oversight across the sector:

National Lottery of Moldova (Loteria Națională a Moldovei)

The National Lottery of Moldova acts as both an operator and gatekeeper of the country’s gambling industry. Entirely state-owned, it holds exclusive rights to all forms of online gambling, including sports betting, digital slots, and lotteries, as well as controlling physical betting shops and slot halls. Its monopoly status was formalized under Law No. 291/2016, positioning it as the central authority responsible for most of Moldova’s gambling sector.

Beyond daily operations, the Lottery enforces responsible gambling measures, manages revenue reporting to the Ministry of Finance, and implements AML controls across its platforms. Effectively, it acts as the face of Moldova’s gambling framework, shaping the market around its state-first operational model.

Licensing & Public Services Agency (Agenția Servicii Publice)

While Moldova’s online gambling sector remains closed, the Public Services Agency plays an instrumental role in regulating the country’s land-based casino market. This government body holds exclusive authority to issue, suspend, and revoke casino licenses. Its remit extends to maintaining the national register of licensees and overseeing compliance checks to ensure operators meet Moldova’s strict regulatory standards.

Notably, foreign investment is permitted, although ownership stakes are capped at 49%. For any private company seeking entry into Moldova’s highly-controlled gambling sector, this agency represents the first and only gateway. In a market dominated by state control, its role is significant for those targeting the country’s limited casino opportunities.

State Inspectorate for Supervision of Non-Food Products and Consumer Protection

Although the State Inspectorate for Supervision of Non-Food Products and Consumer Protection oversees a wide range of sectors in Moldova, including retail goods and service standards, its responsibilities also extend to the gambling industry. In the context of gambling, the Inspectorate plays a fundamental role in safeguarding consumers and enforcing responsible gambling regulations. This includes ensuring that licensed land-based casinos comply with age restrictions, venue location rules, and player protection standards.

Inspectors are authorized to conduct compliance checks at gambling establishments, verifying that operators uphold regulatory requirements regarding signage, staff training, and the prevention of underage or intoxicated play. While the Inspectorate does not issue licenses or regulate gambling revenues, it acts as an important enforcement body protecting players at the consumer level.

State Tax Service (Serviciul Fiscal de Stat)

Gambling revenues in Moldova don’t go untracked, as every wager is subject to real-time government oversight. The State Tax Service acts as the financial watchdog behind both the state monopoly and privately licensed casinos, monitoring every wager placed in the country. Through a mandatory real-time reporting system, the agency receives continuous data from licensed gambling venues, allowing it to track betting volumes, payouts, and taxes owed in real time.

For operators, this means there is no room for error. Financial transparency is enforced not just annually or quarterly, but on a daily basis. Beyond tax collection, the Service supports Moldova’s broader anti-money laundering efforts by identifying irregular transactions and ensuring that all gambling revenues are correctly accounted for. In a system built on state control, the Tax Service plays the role of auditor, enforcer, and gatekeeper of gambling revenues.

Casino Licensing: The Sole Opportunity for Private Operators

In a market where nearly every gambling vertical is state-controlled, the existence of privately operated casinos in Moldova is undoubtedly not an oversight but a strategic exception. Casinos, often perceived as more controllable environments, were deliberately left open to private investment, viewed as manageable revenue sources under strict supervision.

For operators, this presents an unusual proposition, providing a market where private casinos are tolerated but heavily regulated. Ultimately, the real opportunity lies not in rapid growth but in operational predictability. Moldova’s casino sector, centered mainly in Chișinău, faces little domestic competition, benefits from a captive player base, and is aided by the absence of licensed online alternatives.

While many European markets are saturated or state-controlled, Moldova’s casino industry remains accessible, offering steady returns within a controlled environment. Partnerships with local stakeholders can provide access to a stable, mid-sized market with consistent demand. Labor and infrastructure costs remain comparatively low, and regulatory policy has shown consistency since 2016. However, operators must weigh this stability against future uncertainty, particularly in view of Moldova’s EU accession process. This has the potential to push lawmakers in either direction, towards tighter market control or gradual liberalization, depending on how regulatory alignment unfolds.

How to Enter Moldova’s Land-Based Casino Market

For operators interested in Moldova’s physical casino sector, options are limited but well established. Entry requires setting up a Moldovan-registered company and securing a casino license through the Public Services Agency, which oversees the sector. Foreign investors may hold up to 49% ownership, necessitating partnerships with local entities. New casino ventures must comply with strict venue location rules and operational regulations. Alternatively, acquiring or partnering with an existing licensed operator can offer a faster route into Moldova’s controlled casino market.

Opportunities and Future Outlook

Moldova’s gambling market remains tightly restricted yet commercially active. The state monopoly currently dictates digital and retail betting, limiting consumer choice and leaving much of the sector’s potential unmet. With approximately 2.5 million adults and a population heavily reliant on land-based entertainment, the nation’s current gambling infrastructure meets basic demand but leaves room for broader market engagement.

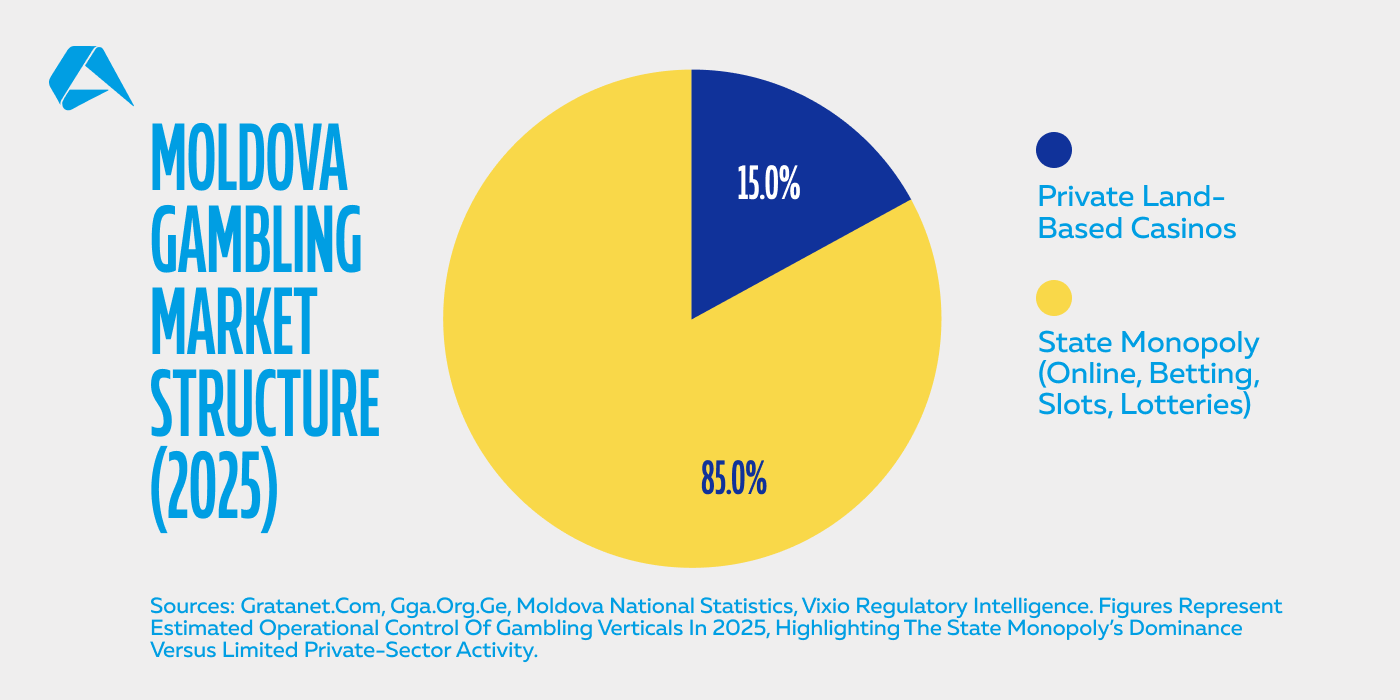

Sources: gratanet.com, gga.org.ge, Moldova National Statistics, Vixio Regulatory Intelligence. Figures represent estimated operational control of gambling verticals in 2025, highlighting the state monopoly’s dominance versus limited private-sector activity.

Furthermore, as seen in many similarly structured markets, the absence of local private operators may encourage Moldovan players to explore offshore platforms, especially in the absence of strict enforcement mechanisms, such as IP blocking or blacklisting, which remain limited in Moldova compared to more tightly regulated jurisdictions.

This gap, combined with minimal domestic competition, suggests Moldova’s digital gambling segment remains both underdeveloped and commercially limited, though not without potential if liberalization occurs.

Looking forward, Moldova’s ongoing EU accession process remains the most likely driver of change in the foreseeable future. EU accession could create regulatory pressure in both directions, depending on how Moldova aligns with broader EU gambling policy trends. While some member states have moved towards market liberalization, others, such as Finland and Austria, maintain state monopolies under EU law. Ultimately, this means that Moldova’s current state-first approach may be challenged. But equally, it could be reinforced if positioned as a model of responsible gambling governance within its accession negotiations.

Should market liberalization emerge, Moldova’s untapped digital sector could evolve into a controlled but commercially favorable opportunity. And while unlikely to rival larger EU markets, its lack of saturation, steady consumer demand, and proximity to eastern Europe could position Moldova as a valuable entry point for mid-tier or regionally-focused operators.

For now, Moldova is a jurisdiction to watch, being a market with no immediate openings but meaningful long-term potential.

Market Pros and Cons

Here’s a snapshot of Moldova’s key market advantages and disadvantages for international gambling operators considering future entry.

Market Advantages

Accessible Land-Based Casino Licensing

Private operators can still enter the market through licensed physical casinos.

Low Operational Costs

Labor and premises costs remain comparatively low compared to western Europe.

Stable Regulatory Framework

Moldova’s gambling laws have remained consistent and stable since 2016, offering predictable oversight.

Limited Domestic Competition

The restricted market structure minimizes the risk of saturation for land-based operators.

Market Disadvantages

State Monopoly on Digital and Betting Sectors

Online casino, sports betting, and retail betting are entirely state-controlled.

No Private Access to Online Gambling

There is currently no licensing route for private iGaming or sportsbook operators.

Foreign Ownership Restrictions

Casino investors face a 49% foreign ownership limit, requiring local partnerships.

Limited Market Scale

With a small population and modest spending power, Moldova offers limited revenue potential even if liberalization occurs.

Absence of Reliable Market Data

A lack of transparent industry reporting makes accurate demand assessment difficult.

Is Moldova Moving Toward Market Liberalization?

All things considered, the signals emerging from Moldova’s gambling market are mixed. While the state’s monopoly structure remains firmly in place, recent legislative activity, including amendments to advertising restrictions and increased ID verification requirements, suggests a government willing to adapt, albeit cautiously. These moves reflect a policy framework focused on social protection rather than market expansion.

At the same time, Moldova’s public–private partnership model within its monopoly operations, outsourcing technology and service provision to external suppliers, for instance, indicates a state that is comfortable working alongside private sector expertise, even if it resists fully opening its markets.

What’s absent, however, is any formal discussion of online licensing or digital market access for private operators. While regulatory reforms are occurring, they remain notably focused on refining control rather than broadening participation.

Over the coming years, Moldova’s strategic priorities, particularly in relation to fiscal stability and EU integration, may ultimately shape its direction. Whether liberalization is seen as a tool for revenue generation or a risk to public welfare will likely determine the next chapter of Moldova’s gambling policy. For now, operators should read the signals, but expect the state-first model to remain in effect for the foreseeable future.

Some markets move slowly. But your technology shouldn’t. Schedule a private demonstration today to explore Altenar’s sportsbook platform, designed for long-game operators in controlled markets.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.