When it comes to gambling laws and regulations in the United States, few markets attract more attention - and frustration - than California. Home to nearly 40 million people and a fiercely protective tribal gaming structure, the Golden State offers enormous potential, but little in the way of immediate access for online gambling operators. Digital betting is largely off-limits, ballot efforts have failed, and entrenched interests remain firmly in control of the legal conversation.

And yet, this is a market that refuses to be ignored. From licensed racetrack betting to ADW platforms and signs of tribal preparation for a regulated digital future, the pieces are shifting, even if slowly. For operators with long-term ambition and a realistic view of the hurdles, there are meaningful advantages to be gained now, ahead of any major legal breakthrough.

This article examines what is actually legal, what is possible, and where opportunities may emerge, offering operators a grounded, forward-looking view of the California gambling market as it stands in 2025.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

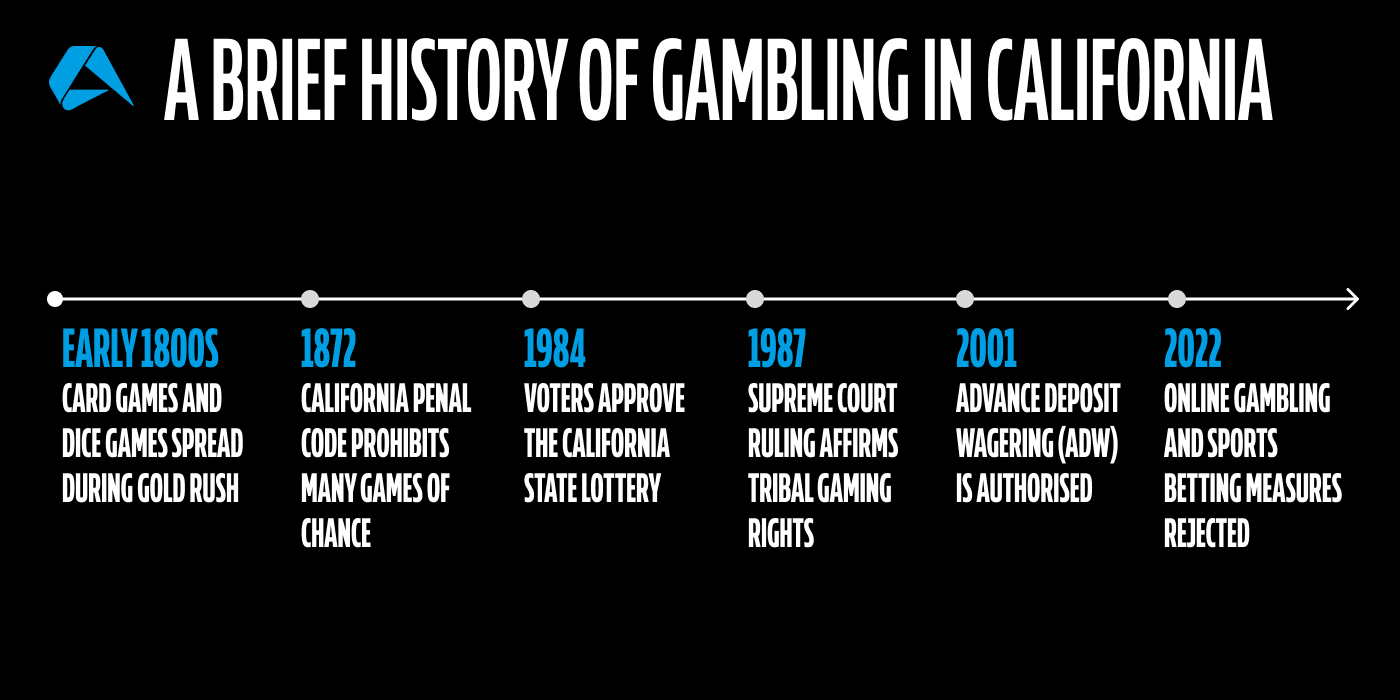

A Brief History of Gambling in California

Before California built its reputation on gold, technology, and Hollywood dreams, gambling had already taken root. Indigenous tribes played hand games and bet goods in ceremonies long before the first European settlers arrived. By the early 1800s, gambling had become a common part of daily life, with card tables and dice games spreading from mining camps to bustling towns as prospectors chased their fortunes during the Gold Rush. Wagering was part of the risk-taking spirit that defined the early frontier.

By the mid-1800s, gambling halls had become fixtures of towns like San Francisco and Sacramento, though legality often lagged behind popularity. In 1872, the California Penal Code formally outlawed many games of chance, including faro, monte, and roulette (Section 330), framing gambling as a threat to public morals. Still, underground gaming flourished, setting up decades of legal tug-of-war between enforcement and demand.

A turning point came in 1984, when voters approved the California State Lottery through Proposition 37, signaling a public shift in attitude. That momentum expanded in 1987 with the US Supreme Court’s decision in California v. Cabazon Band of Mission Indians, which affirmed the sovereignty of tribal governments to offer gaming on their land. This laid the groundwork for the Indian Gaming Regulatory Act (IGRA) in 1988 and, later, a wave of tribal-state compacts beginning in 1999.

Cardrooms offering non-banked games, such as poker, remained legal as long as they were licensed. In 2001, horse racing introduced Advance Deposit Wagering (ADW), bringing a legal form of online betting to the state. However, repeated ballot measures aimed at legalizing broader online gambling and sports betting, most notably Propositions 26 and 27 in 2022, have failed, often amid clashes between commercial and tribal interests.

A Timeline of Key Gambling Events

Here’s a concise timeline of the key moments that have shaped California’s gambling framework as we know it today:

1872: California enacts Penal Code Section 330, banning faro, monte, roulette, fan-tan, and other banking or percentage games.

1933: Pari-mutuel wagering on horse racing becomes legal across the state.

1976: New law permits charitable bingo for nonprofit organizations.

1984: Voters approve the California State Lottery (Proposition 37).

1987: Cabazon Band Supreme Court ruling strengthens tribal gaming rights.

1988: Indian Gaming Regulatory Act (IGRA) lays federal foundation for tribal gaming.

1999: First tribal-state gaming compacts signed, formalizing Class III casino operations.

2000: Proposition 1a passes, expanding and securing tribal gaming rights.

2001: Advance Deposit Wagering (ADW) authorized for horse race betting.

2022: Propositions 26 and 27 fail, keeping online sports betting illegal.

2023: Cardroom expansion moratorium extended to Jan 1, 2043.

2024: New surveillance and advertising rules adopted for cardrooms.

The Current Situation for Gambling

In practice, tribal casinos remain the backbone of California’s gambling sector, dominating offline gaming with slot machines and table games under federal-state compacts. Online sports betting and iGaming remain prohibited, except for tightly regulated advance-deposit wagering on horse racing. While racetrack betting and cardrooms offer limited openings, the road to broader digital expansion continues to face significant political and legal hurdles.

Tribal Casinos

More than 60 tribal casinos operate under federally approved compacts, offering a variety of games including slot machines, table games, and bingo. These facilities form the backbone of California’s legal gambling industry.

Cardrooms

As of July 2025, 80 licensed cardrooms remain active across the state. Only non-banked card games are permitted, and a moratorium prohibits the issuance of new cardroom licenses until 2043.

Horse Racing and ADW

Pari-mutuel betting on horse racing is legal, both at racetracks and online via ADW platforms.

State Lottery

Launched in 1985, the California Lottery operates as a state-run monopoly. Retailers must be licensed, and all profits are directed toward public education funding.

Online Gambling

Online casino gaming is not permitted in California. No licensing framework exists, and previous ballot measures to legalize online sports betting have been decisively rejected.

Social Casinos and Sweepstakes

Social casinos continue to operate in a legal gray area. Although widely used, platforms like Stake.us have recently drawn legal challenges questioning their compliance with state law.

Currently, the most accessible route into the California market for iGaming operators and suppliers remains through partnerships with tribes or obtaining an ADW license for racing. Moreover, efforts to liberalize digital betting continue to face resistance from both voters and tribal governments. For everyday players, tribal casinos, horse race betting (online and offline), and the lottery are the only fully legal forms of gambling. Sports betting remains prohibited, and there are no licensed online casinos available to California residents.

ADW Licensing: California’s Hidden Gateway to Online Betting

In a state that keeps a tight lid on digital betting, Advance Deposit Wagering is the one legal workaround. It allows Californians to bet on horse racing online, but only after they have funded an account with a licensed ADW provider, such as TVG, Xpressbet, or TwinSpires, in advance. That prepayment structure is what keeps it compliant under California law.

ADW was legalized back in 2002 under the Business and Professions Code 19604, and it’s still tightly regulated by the California Horse Racing Board (CHRB), which licenses and monitors all authorized ADW providers.

Currently, this is the only legal form of online betting in the Golden State, making it a valuable, if narrow, entry point for operators looking to test the market without waiting for full iGaming reform.

Who Can Apply for an ADW License?

So, who gets to run one of these legal online horse betting platforms in California? It’s a small club. ADW licenses are typically granted to established racing associations or experienced wagering operators with a solid track record in pari-mutuel betting. This isn’t a fast track for sportsbook brands, since California wants applicants with real racing ties and local credibility.

Applications are reviewed by the CHRB, which thoroughly examines financials, compliance history, technical capabilities, and ownership details. Operators also need a California business address and must follow CHRB’s rules strictly. In short, if you're not already in the racing game or partnered with someone who is, it’s a steep climb.

Operational Requirements and Compliance Expectations

Those approved to operate must meet the state’s detailed expectations for technical, financial, and player-facing standards.

Under California Business and Professions Code § 19604(f), Operators must fully integrate their systems with live racetrack pools, meaning all wagers placed via ADW must feed into the same pari-mutuel structure as on-site betting. This is a statutory requirement rather than negotiable flexibility. Player identity checks are also mandatory under § 19604(b). The CHRB requires operators to verify age, location, and account funding before a single bet is placed.

Daily reporting is also part of the deal, as covered in (§ 19604(f)(7)), covering everything from handle summaries to settlement data. Records must be available for regulatory inspection in accordance with standard CHRB enforcement procedures. Just as important are the rules around responsible gambling. While self-exclusion programs and clear disclosures around odds and risks are explicitly expected, deposit limits are generally part of operator best practices but should be confirmed within individual license conditions.

Note

For a full breakdown of the technical standards, operational requirements, and compliance obligations tied to ADW licenses, the California Horse Racing Board (CHRB) publishes detailed regulatory guidance. This includes rules on pool integration, reporting protocols, player verification systems, and other related matters. Operators can review the official documentation directly via the CHRB’s published rules and regulations at: CHRB Website.

Commercial Potential and Limitations of ADW Platforms

While ADW licensing offers a rare point of entry into California’s digital betting space, it comes with a tight legal framework under Business and Professions Code § 19604. Operators can get involved, but only on the state’s terms, meaning the scope is narrow, and the ceiling is low.

Under § 19604(a), ADW licenses only permit pari-mutuel horse race wagering. That means no fixed odds, no sports betting, and no online casino content. The customer base is loyal but niche, and growth primarily depends on retaining customers rather than acquiring new ones. Still, for those willing to think strategically, it has value.

Some operators use ADW as a brand-building tool, staking a presence in California now, with a view to broader legalization later. Others structure affiliate deals or explore white-label arrangements with existing ADW providers, staying within the law while testing the market.

There are also regulatory barriers to consider. Marketing and advertising activities are governed by § 19604(f)(5), requiring CHRB approval to ensure compliance with consumer protection standards.

So, while ADW won’t be a game-changer on its own, for those looking to establish early market presence or test audience engagement within legal bounds, ADW remains a credible pathway.

Strategic Presence in a Restricted Market

While ADW licensing remains the only formal gateway to online betting in California, some companies continue to explore legally permissible ways to maintain brand visibility and market familiarity without offering wagers. This does not create market entry rights, but rather highlights how gambling brands sustain their relevance in restricted environments.

-

Sponsorship and Media Partnerships

Certain operators build brand recognition through sponsorship deals with local sports teams, media networks, or high-profile events. These initiatives increase public familiarity, even where betting remains prohibited.

-

Affiliate-Style Content With Free-to-Play Tools

Other brands engage audiences with informational content, odds previews, and free-to-play platforms embedded within sports news outlets or apps. While these offerings cannot facilitate wagering, they provide education and entertainment for local sports fans.

-

Minority Stakes and Acquisitions

A few companies take a structural position by investing in businesses that hold ADW licenses or operate in the media and racing verticals. While such investments do not grant gaming privileges or online market access, they are often pursued to expand local knowledge and prepare for any future legal shifts.

Regulatory Gambling Authorities and Their Role

While California’s gambling laws set the rules, its regulators bring them to life. These commissions and boards handle everything from licensing and compliance to enforcement actions that define the operational boundaries for all legal gambling.

Here are the leading authorities governing gambling activities in the US state of California:

California Gambling Control Commission

The California Gambling Control Commission (CGCC) stands at the center of the state's regulatory framework for gambling. Its primary role is to license cardrooms, third-party proposition player services, and key employees, while also overseeing aspects of tribal gaming under state compacts. Working closely with the Bureau of Gambling Control, the CGCC sets rules, resolves disputes, and conducts suitability reviews for license applicants. For operators, the Commission acts as both gatekeeper and referee, maintaining integrity across the state's legal gambling market.

The Bureau of Gambling Control

Operating under the California Department of Justice, the Bureau of Gambling Control (BGC) is the state's chief law enforcement authority for gambling activities. Its responsibilities range from conducting background checks and compliance inspections to investigating regulatory breaches and criminal activity linked to gaming. Working closely with the CGCC, the Bureau handles licensing investigations and monitors cardrooms, third-party providers, and tribal casinos. For operators, interaction with the Bureau is a necessary part of maintaining suitability and meeting California’s high regulatory standards.

California Horse Racing Board

The California Horse Racing Board (CHRB) regulates all aspects of horse racing and pari-mutuel wagering in the state of California. It licenses racetracks, approves wagering systems, and oversees compliance with betting regulations, including Advance Deposit Wagering. The Board also monitors the integrity of racing operations, from drug testing to financial reporting. For iGaming professionals looking at ADW opportunities, the CHRB is the central authority shaping how online and offline racing bets are authorized and administered.

California Lottery Commission

California’s approach to gambling regulation is cautious, and nowhere is that more evident than in the tightly managed work of its Lottery Commission. The California Lottery Commission oversees the operation of the state’s lottery, managing licensing for retailers, approving new games, and setting operational policies.

Its mandate is clear - maximize funding for public education while maintaining the integrity of lottery activities. For operators and suppliers, direct market participation is limited. This is a strictly state-run monopoly. However, the Commission’s rules on advertising, responsible play, and retailer conduct provide an essential reference point for understanding broader regulatory expectations.

Opportunities and Future Outlook

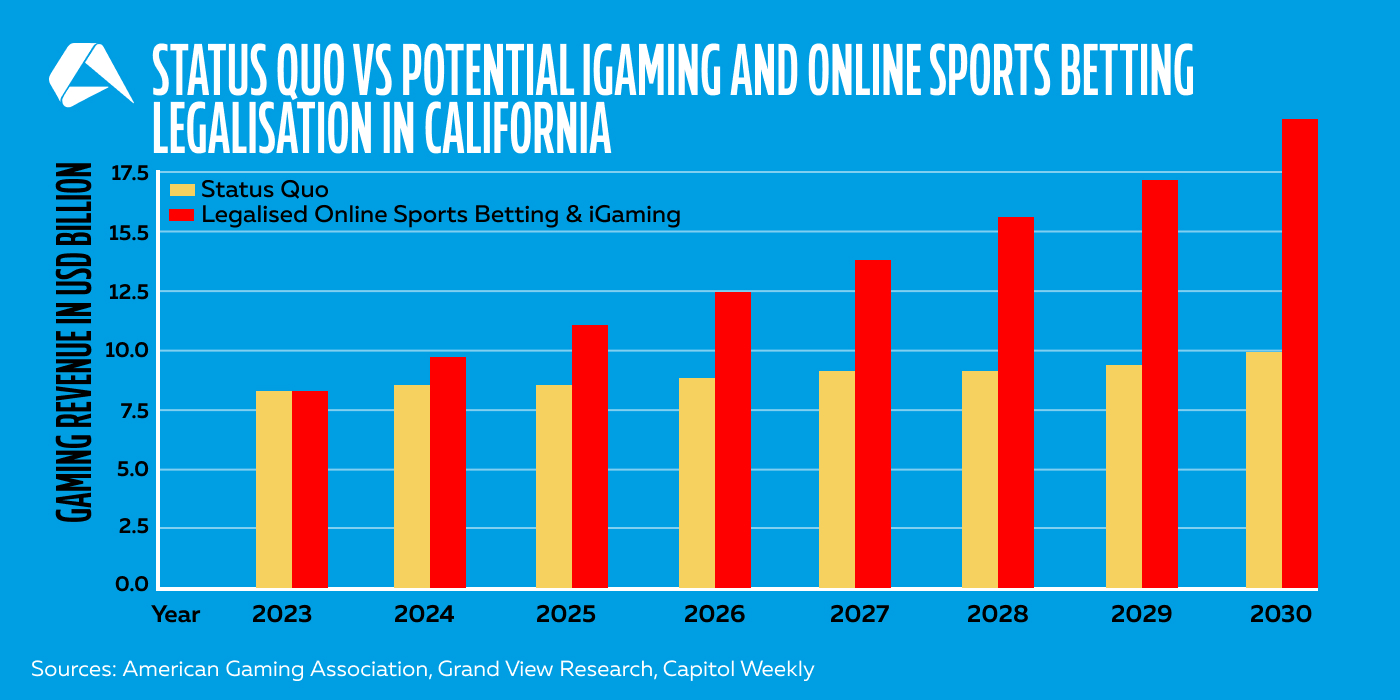

If market scale is the ultimate goal, California is still the biggest trophy left on the US map. With nearly 40 million residents and a $3.9 trillion economy, now officially the fifth-largest in the world according to the US Bureau of Economic Analysis, the Golden State remains one of the most coveted, albeit complicated, frontiers for gambling for ambitious gambling operators in 2025.

Public enthusiasm for online betting hasn’t exactly cooled either. According to the Berkeley IGS Poll, only 33% of California voters say they would oppose legalizing sports betting outright, suggesting a public that’s more hesitant than hostile. Yet, while support may be lukewarm for now, there’s still political space to work with.

Today, legal gambling is mostly confined to tribal casinos, licensed cardrooms, the state lottery, and horse racing venues. The road to broader online expansion is at an impasse with political infighting, particularly between powerful tribal coalitions and commercial operators. Yet for those willing to play the long game, opportunities already exist. Advance Deposit Wagering (ADW) platforms such as TVG and TwinSpires continue to operate successfully, and strategic partnerships with tribal operators offer a legitimate, if complex, entry point into California’s regulated market.

Further to this, tax conditions, while not low, are considered manageable compared to some emerging US markets. As Jason Robins, CEO of DraftKings, told Politico: “There's no other state out there that has the ability to impact our long-term growth than California.” For ambitious operators, the message is clear. California’s sheer size, economic clout, and deep-rooted sports culture make it a once-in-a-generation prize, if the political barriers can eventually be cleared.

Looking ahead, future innovation is quietly gathering pace. Several California tribes are reportedly investing in digital platforms, preparing for a future where mobile wagering and iGaming could be back on the ballot. Technology-driven disruption (think blockchain betting to AI-enhanced compliance systems) is also gaining attention.

Market Pros and Cons for Gambling Operators

California may be a tightly controlled gambling jurisdiction, but the fundamentals are hard to ignore. Below is a snapshot of what makes the Golden State attractive and where the roadblocks still stand.

Market Advantages

Massive Untapped Market

Home to nearly 40 million people, California surpasses most regulated markets in terms of potential player volume.

Strong Gambling Culture

Long-standing familiarity with tribal casinos, cardrooms, horse racing, and the lottery fuels strong baseline demand.

Favorable Demographics for Online Gambling

A highly tech-literate, mobile-first population with significant smartphone penetration and broad digital payment adoption.

ADW (Advance Deposit Wagering) Opportunities

Horse racing platforms offer a rare legal online betting gateway while broader digital reforms are debated.

Predictable Regulatory Infrastructure

Agencies like the CGCC and Bureau of Gambling Control bring structured oversight. Operators know the rules they must play by.

Market Disadvantages

Digital Entry Remains Off the Table

Currently, online casino games and online sports betting are prohibited, leaving few legal pathways for digital operators to enter the California market.

Entrenched Tribal Gaming Interests

Tribal operators hold substantial political power, creating a major hurdle for wider iGaming legalization.

Prohibitive Ballot Measure Costs

Running a statewide ballot campaign costs hundreds of millions, making entry politically and financially daunting.

What to Watch in California’s Regulatory Debate

For gambling operators eyeing California, the conversation doesn’t end at the ADW license. If anything, that’s just the prelude to wider debate about where the market could go, and what it will take to get there.

At the heart of the regulatory stand-off are two powerful forces: the state’s politically influential tribal gaming coalitions and the deep-pocketed commercial sportsbook operators pushing for online access. The clash between these two camps was laid bare in 2022, when Propositions 26 and 27 went head-to-head on the same ballot. Neither passed. Voters rejected both by wide margins, sending a clear message that a billion-dollar ad spend isn’t enough without a broader consensus and a smarter policy pitch.

But the door isn't shut. If anything, it’s been nudged open just enough to keep conversations alive. Recent legislative sessions haven’t produced breakthrough bills, but they have surfaced more detailed policy discussions around responsible gambling, revenue sharing, and potential frameworks that could satisfy both tribal and commercial interests. Several tribes are also investing quietly in their own digital platforms, suggesting a shift in strategy from blanket opposition to future participation.

What matters most now is momentum, and the potential for legislative change is eventually possible, even if not immediate. California’s policy environment is evolving, shaped by growing public dialogue around consumer protections, unregulated offshore markets, and the economic benefits of taxed digital betting. Recent efforts by state lawmakers to revisit gambling bills, alongside tribal discussions about digital readiness, suggest the door is not fully closed. While past ballot failures have exposed divisions, they have also surfaced valuable lessons that could inform more viable and inclusive proposals in the years ahead.

California may be limited for now, but the wider US market is starting to open up. The same tools that can open doors in the Golden State are shaping success elsewhere in the US market.

Book a personalized demonstration now to see Altenar’s advanced iGaming platform in action, tailored to your US expansion strategy.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.