For years, the Philippines has served as a launchpad for operators looking to expand in Asia, offering a proving ground where early success often unlocks broader regional opportunities. But the rules of the game have changed. The offshore chapter has ended, enforcement has increased, and a new regulatory framework is now firmly in place. What remains can be just as appealing for the right platforms, but it’s now a market that rewards compliance, local expertise, and long-term strategy.

As SiGMA Asia brings the industry to Manila, this article breaks down the rules and practical requirements behind one of Asia’s largest regulated markets.

Disclaimer

This information is not intended to be legal advice and is solely sourced from public information. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

Key Developments Over the Decades

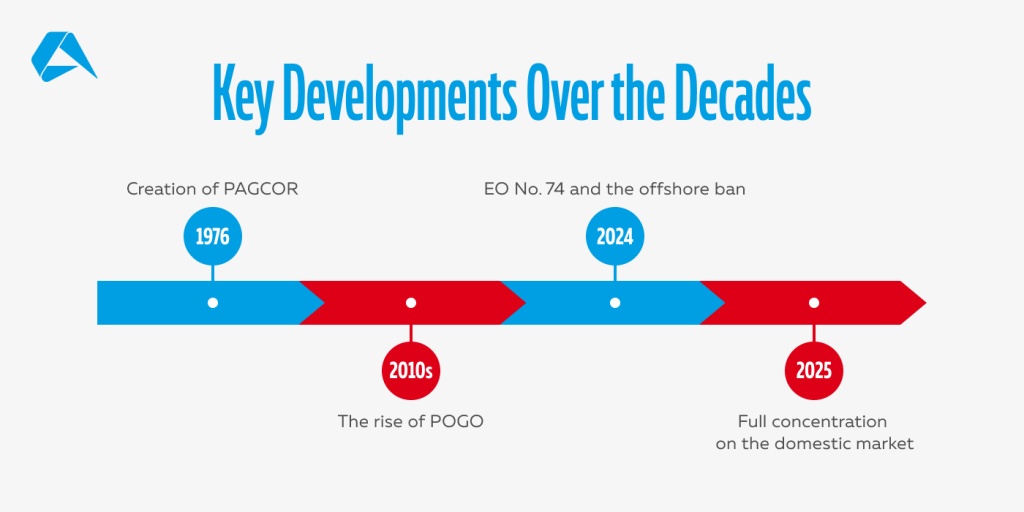

Betting was never a foreign concept to the Philippines, but regulation certainly was—until the mid-1970s. From cockfighting rings to community card games, informal betting was common, albeit largely unregulated and vulnerable to abuse. That changed in 1977 when President Ferdinand Marcos established the Philippine Amusement and Gaming Corporation (PAGCOR) under a Presidential Decree. For the first time, gambling had a legal framework, and the government had a direct role in both regulation and operations.

In the decades that followed, PAGCOR's dual role shaped a local environment of land-based casinos, bingo parlors, and gaming venues. Then came the POGO era. By the mid-2010s, Philippine Offshore Gaming Operators became the industry’s fastest-growing sector, drawing billions from Chinese and other foreign players. At its peak, the POGO segment contributed over 11 percent of PAGCOR’s total revenue.

This early enthusiasm, however, soon gave way to growing concerns. Rising crime, opaque corporate structures, and increasing pressure from foreign governments quickly eroded confidence in the model. By late 2024, it was over. Executive Order No. 74 came into effect, shutting down all offshore operations and support services as of January 2025.

While the offshore market collapsed, the domestic side quietly flourished. Recognizing the shift, PAGCOR expanded its Electronic Gaming Licensing Department (EGLD) to support locally focused online operations. Licenses were granted for e-bingo, RNG games, sports betting, and poker, as long as they were tied to physical sites and complied with strict IP-blocking rules. This transition has sparked a new phase of growth, particularly in mobile-first verticals.

For iGaming operators, the Philippine market has evolved from a promising frontier to a rules-based arena. Success here means understanding not just what’s allowed but how PAGCOR expects it to be implemented.

Who Regulates What in 2025

Making sense of the regulatory environment of the Philippine gambling industry requires a clear understanding of the various agencies and their evolving roles. Below is an overview of the key regulatory bodies as of 2025.

PAGCOR’s Responsibilities and Dual Role

The Philippine Amusement and Gaming Corporation has historically held a dual mandate, functioning as the country's primary regulator and operator of gambling activities. Initially established by Presidential Decree No. 1067-A in 1977, PAGCOR was tasked with regulating gaming establishments and directly operating casinos under the Casino Filipino brand.

In recent developments, PAGCOR has initiated steps to transition into a purely regulatory body. This move aims to privatize its casino operations, focus solely on oversight, and ensure a level playing field for all industry participants. During the IAG Academy Summit on September 13, 2023, PAGCOR Chairman and CEO Alejandro Tengco emphasized that this shift is designed to “level the playing field and ensure future growth and viability for all gaming industry players.”

This divestment plan is expected to take effect by 2026 and, as PAGCOR leadership publicly confirmed, reflects the regulator’s current policy direction.

Special Economic Zones

Beyond PAGCOR, several special economic zones have played roles in the licensing and regulation of gambling operations:

-

Cagayan Economic Zone Authority (CEZA): Established under Republic Act No. 7922, CEZA was authorized to grant licenses for online gaming operations targeting offshore markets. It is responsible for managing and supervising the development of the Cagayan Special Economic Zone and Freeport (CSEZFP).

In practice, CEZA exercises its authority through strategic partnerships with designated Master Licensors, who are responsible for overseeing both online and land-based gambling activities on its behalf. This model enhances CEZA’s operational reach and provides a delegated framework for licensing and compliance.

-

Aurora Pacific Economic Zone and Freeport Authority (APECO): APECO was fundamentally authorized to license online gaming entities within its jurisdiction (Province of Aurora, Luzon).

-

Authority of the Freeport Area of Bataan (AFAB): AFAB also moved into gaming licensing to attract operators to its zone.

However, the relevance of these zones has diminished over time. Executive directives, such as Executive Order No. 13 (2017), sought to clarify overlapping jurisdictions and reinforce PAGCOR’s regulatory mandate while still recognizing the authority of special economic zones such as CEZA and APECO to issue licenses within their borders.

In practice, though, national policy has steadily moved toward centralization. That direction was reinforced in 2024 with the government’s ban on Philippine Offshore Gaming Operators (POGOs), which significantly curtailed operations linked to these zones.

Roles of GAB, AMLC, and NPC

Several other agencies contribute to the regulatory framework:

-

Games and Amusements Board (GAB): GAB oversees professional sports and related betting activities, ensuring integrity and compliance within the sports betting sector.

-

Anti-Money Laundering Council (AMLC): Tasked with preventing money laundering activities, the AMLC works with PAGCOR and other agencies to monitor and enforce compliance with anti-money laundering laws across the national gaming industry.

-

National Privacy Commission (NPC): With the growth of online gaming, the NPC ensures that operators comply with data privacy regulations, protecting the personal information of players.

Regulatory Fragmentation and Centralization under PAGCOR

The Philippine gambling industry has experienced significant regulatory fragmentation over the years, with multiple agencies and economic zones issuing licenses and overseeing operations. This led to inconsistencies and challenges in enforcement. Recognizing these issues, the government has been steadily working toward centralizing regulatory authority under PAGCOR. The transition of PAGCOR to a purely regulatory body and the phasing out of POGOs are steps in this direction, aiming to create a more efficient and transparent regulatory environment.

Offshore Ban and Its Impact (Executive Order 74)

In a decisive move to address growing concerns over illegal activities linked to offshore gaming, President Ferdinand R. Marcos Jr. issued Executive Order No. 74 on November 5, 2024, mandating the immediate cessation of all Philippine Offshore Gaming Operators (POGOs) and Internet Gaming Licensees (IGLs) by December 31, 2024.

What Does It Mean in Practice?

The executive order explicitly prohibits issuing new licenses and renewing existing permits for offshore gaming operations. This directive aims to eliminate unregulated online gambling activities associated with crimes such as financial scams, money laundering, and human trafficking. Operators previously engaged in offshore gaming are now required to either cease operations or explore opportunities within the domestic regulatory framework established by PAGCOR.

The Crackdown

In alignment with Executive Order 74, Philippine authorities have intensified enforcement actions against illegal POGO operations. This crackdown has led to numerous raids, resulting in the arrest of operators and the rescue of individuals subjected to exploitative conditions. In addition, the Office of the Solicitor General has initiated proceedings to seize assets acquired through illegal activities, including real estate and other properties linked to unauthorized gaming operations.

Licensing & Compliance: What Operators Must Know

Now that the offshore era is over, domestic licensing is the only path available for operators serious about entering the Philippine market. And that route runs through PAGCOR. Executive Order No. 74 has fundamentally reset the rules, and licensing here is more than just paperwork; it’s a process layered with legal, technical, and procedural demands.

This section explores license types, platform obligations, and compliance infrastructure. If you plan to launch or localize operations in the Philippines, the following matters more than ever.

EGLD Licenses

PAGCOR’s Electronic Gaming Licensing Department (EGLD) issues the following types of domestic licenses:

-

Traditional bingo games

-

E-bingo games

-

E-casino games

-

Sports betting

-

Specialty games

-

Online poker games

-

Numeric games

-

Other games that may be allowed by PAGCOR in the future

These licenses are specifically for operations targeting players located in the Philippines, distinguishing them from the discontinued offshore POGO framework.

Core licensing conditions for all categories:

-

Local Incorporation

Applicants must be registered as a duly organized entity in the Philippines, complying with corporate law. While majority Filipino ownership is not explicitly mandated, incorporators must include Philippine residents (as per SEC regulations).

-

Server & Infrastructure Location

All gaming servers, backup systems, and databases must be physically hosted within the Philippines. PAGCOR-approved monitoring systems must be in place for auditing and regulatory access.

Disclaimer

While PAGCOR has historically required gaming servers, backup systems, and databases to be physically hosted within the Philippines, the most recent circulars and application kits detailing this requirement are not publicly accessible as of May 2025. Operators should consult directly with PAGCOR or a qualified legal advisor to confirm the current infrastructure requirements applicable to their licensing application.

-

Compliance & KYC Systems

Licensed operators are required to carry out Know Your Customer (KYC) procedures for both new and existing players. This includes verifying player identity, age, and source of funds, and implementing measures to support anti-money laundering and responsible gaming obligations.

-

IP & Geo-Blocking

Operators must restrict access exclusively to users located within Philippine territory. IP filtering and geolocation verification are mandatory technical safeguards.

-

Lab Certification

All games and betting platforms must be tested and certified by a PAGCOR-recognized independent testing laboratory.

Cultural Heritage Foundation Requirement (Land-Based Casino Operators)

In addition to standard licensing obligations, PAGCOR imposes a unique social responsibility requirement on certain land-based casino licensees. Operators in designated areas such as Clark are mandated to establish dedicated foundations, funded by a fixed percentage of gross gaming revenue from non-junket table games. These foundations support cultural preservation and socio-civic projects in alignment with PAGCOR’s broader public mandate. While this does not apply to online licensees under the EGLD, it reflects PAGCOR’s commitment to integrating public benefit into the gaming sector.

Fees and Terms

Operators seeking licensure from PAGCOR's Entertainment Licensing Department (EGLD) must adhere to the following financial obligations and validity periods:

Application and Processing Fees: A non-refundable application fee is required upon submission. The exact amount varies depending on the particular gaming activity and is detailed in PAGCOR's fee schedules. The Regulatory Framework for the Fees and Rates on Gaming Venue Operations (Revision No. 3) outlines these fees comprehensively.

License Fees: Upon approval, operators must remit the corresponding license fee before commencing operations. This fee is determined based on the gaming category and is specified in the regulatory framework mentioned above.

Validity Period: Licenses for new gambling sites are typically granted for a period of one year and are subject to renewal. Renewal license validity is two years, contingent upon continued compliance with PAGCOR's regulations and the timely submission of required documentation.

Regulatory Fees: In addition to the initial fees, licensees must pay ongoing regulatory costs, which may include a percentage of Gross Gaming Revenue (GGR) or fixed monthly charges, as stipulated by PAGCOR.

Note

For the most accurate and up-to-date information, operators are advised to consult the relevant laws, regulations, and regulatory manuals governing electronic gaming in the Philippines. Direct engagement with PAGCOR’s Electronic Gaming Licensing Department (EGLD) is also recommended to clarify financial, technical, and operational requirements.

Platform Infrastructure Requirements

Infrastructure compliance is non-negotiable. Under Section III(A)(5) of PAGCOR’s Regulatory Framework for the Remote Gaming Platform, remote gaming service providers must submit certification from an independent gaming laboratory confirming that IP blocking is implemented to restrict access solely to Philippine-based IP addresses. Additional platform requirements typically include geo-fencing, IP restrictions, and anti-VPN measures, along with standards for KYC, responsible gaming, and system integrity.

This is one of the most rigid areas of PAGCOR’s framework, and foreign operators accustomed to regional hosting arrangements, such as in Taiwan or Singapore, will need to recalibrate. Operators must integrate e-KYC and customer due diligence processes that meet Anti-Money Laundering Council (AMLC) standards. This includes multi-level ID verification, player risk assessment, and active monitoring of the source of funds, when applicable. PAGCOR’s compliance guide also outlines data logging and encryption standards that are aligned with the National Privacy Commission (NPC).

The Regulatory Framework for the Accreditation of Service Providers and Processing of System-Related Requests (Rev. No. 3) outlines PAGCOR's technical and platform expectations, including accreditation procedures and system-related processing requests. A full list of PAGCOR-accredited service providers and online gaming platforms as of March 2025 is also available for operators evaluating technical partners or platform vendors.

Furthermore, recent developments highlight PAGCOR's commitment to stricter oversight, as detailed in AffPapa's article on the new accreditation framework for iGaming, which introduces updated compliance requirements for affiliates and B2B providers.

Backend platforms must maintain 24/7 remote access for regulators, who may conduct unannounced audits or initiate event-based investigations. This has prompted some operators to move toward API-first platforms with automated compliance alerts, which are especially useful where micromarket or esports volumes make manual tracking impractical.

Responsible Gambling, AML and Data Compliance

Since being removed from the FATF gray list in early 2025, the Philippines has made notable progress in tightening oversight and gaining trust among global stakeholders. This milestone was formally acknowledged in the FATF Public Statement (February 2025), which recognized improvements in the country’s AML/CFT framework and regulatory enforcement. This means a more transparent environment that demands clear, verifiable accountability for operators.

At the heart of this shift is a stronger focus on transaction oversight. Operators are expected to monitor player activity and report transactions that raise red flags, whether due to size, frequency, or unusual behavior. These expectations form part of a broader push to detect and prevent money laundering, with financial watchdogs taking a more active role in cross-checking platform activity.

This heightened scrutiny feeds directly into the country’s KYC obligations. All licensees must conduct ID verification, assess player risk levels, and record essential data in a way that satisfies both gaming regulators and privacy authorities. Personal and financial data must be stored securely (Data Privacy Act of 2012), with clear access, retention, and breach reporting rules, overseen by the National Privacy Commission.

Tied into this is the country’s Responsible Gambling Code of Practice, which lays out precise requirements for timeout options, self-exclusion registers, and limitations on promotional targeting. Operators must offer tools for customers to manage their play while avoiding marketing practices that could exploit at-risk groups.

How to Apply for a Gaming License in the Philippines

Before any bets are placed or platforms go live, there’s a licensing process to go through. In the Philippines, that means dealing directly with PAGCOR, the governing body regulating market entry. Here’s how to approach it.

Step 1: Incorporate a Philippine Entity

Applicants must be registered as a business enterprise in the Philippines. This includes registering with the Securities and Exchange Commission (SEC), securing a local business permit, and complying with corporate ownership and residency rules.

Begin the application process by drafting a letter addressed to PAGCOR's Chairman and CEO, expressing your intent to apply for a gaming license.

Step 3: Prepare Required Documents

Documentation typically includes:

-

SEC registration and Articles of Incorporation

-

Notarized board resolution applying for a license

-

Location map and lease agreement (if applicable)

-

Technical infrastructure plans and systems architecture

-

Description of game types, player acquisition models, and responsible gambling controls

Step 4: Complete the Application Kit

PAGCOR provides downloadable forms via its Application Kit portal, including EG Form No. 1 for operator license applications.

Step 5: Submit to PAGCOR

Applications must be submitted physically to PAGCOR’s corporate office in Pasay City. There is no option for online submission.

Step 6: Await Evaluation and Inspection

PAGCOR reviews the documents, may request clarifications, and conducts a site inspection or technical assessment. The approval timeframe varies depending on complexity.

Once approved, operators are invoiced for the license and regulatory fees. Upon payment, a Certificate of Accreditation or License to Operate is issued.

Note

For those unfamiliar with PAGCOR’s compliance environment, engaging local legal counsel or using tailored intelligence templates can reduce risk and streamline approvals.

Local Player Preferences and Operational Realities

Player preferences in the Philippines are distinct, and a successful operation begins by understanding what locals want to play, watch, and spend on.

Slots are the undisputed king of digital entertainment globally. Still, unlike Western markets, they share the spotlight with electronic bingo and live-stream games, options with the feel of social play. On the sports side, the NBA commands almost mythical status. Basketball isn’t just popular; it’s part of the national identity. Esports, too, is gaining traction fast, with mobile-first games leading the charge. And while e-sabong (online cockfighting) once drew massive numbers before its suspension, interest in niche sports like baseball is quietly on the rise.

The audience here is highly engaged, but the infrastructure isn’t always forgiving. Lightweight platforms that don’t collapse under patchy mobile connections are a necessity. Localization is another key factor, supported by products that Filipino players already know and love.

But understanding what players want is only part of the equation. The other lies in how products are built and delivered. Local success is often decided not by innovation alone but by its execution under real-world constraints. Platforms running flawlessly on intermittent 3G, compressing data-heavy content without killing the experience, and streamlining logins through local authentication providers all gain a competitive edge.

It’s no coincidence that the fastest-growing operators are those who tailor their product flows and UI for Filipino behavior patterns, typically short bursts of play, low-latency streaming, and instant results. Micro betting tools, local sports overlays, and simplified account recovery also have a role to play. Filipino players notice the difference and gravitate toward brands that get it right.

Where’s the market heading?

After a period of unchecked expansion and offshore ambiguity, the Philippine gambling market has entered a new phase, one that is now driven by consolidation, domestic focus, and renewed trust, while there is increasing scrutiny on marketing activities.

Centralization under PAGCOR, clearer oversight, and the country’s removal from the FATF graylist have collectively created a stronger foundation for sustainable growth. Domestic-facing platforms are now driving the market, with operators reporting steady demand across e-games, bingo, and sportsbook verticals. Rather than chasing mass appeal, the model now focuses on regional authenticity and rewards those who invest in the right way.

Looking ahead, further gains could come from the regulated return of e-sabong and the continued growth of esports, live casino, and peer-to-peer formats like poker. This is a sign that growth is still on the table and a signal to serious players that the Philippines isn’t just open for business. It’s open to operators who respect regulations and can deliver locally. Evidently, with the right licensing, localization, and intelligence tools, there’s still plenty of ground to win.

Missed us at SiGMA Asia?

Couldn’t make it to Manila? No problem — our team is ready to walk you through a tailored solution, one-on-one. Book a personalized demo today, and let’s explore how your brand can thrive in the Philippines.

Disclaimer

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.