It would be fair to say that Hong Kong’s gambling market is one of the most tightly regulated in Asia, yet its influence stretches far beyond its borders. With a deep-rooted betting culture, a high-spending audience, and a regulatory model that sets it apart, the real opportunity lies in understanding how it all connects to the broader Asian market.

This guide explores the possibilities, from strategic brand positioning to regional opportunities that could redefine the future for ambitious operators looking to gain a foothold on the continent’s thriving iGaming scene.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

The Evolution of Gambling in Hong Kong

As you might expect, the story of gambling in Hong Kong began long before the towering skyscrapers and lively cultural fusion it's currently renowned for. Evidence of gambling can be traced back to the late Qing Dynasty when traditional games like Pai Gow and Fan-Tan emerged as popular cultural pastimes. Back then, betting was a binding ritual, uniting people across communities and celebrated at festivals and special occasions. Over the decades, though, gambling evolved into a tradition that was loved and enjoyed, yet controversial at the same time.

Horse racing arrived in the early 20th century and quickly captured Hong Kong society. The founding of the Hong Kong Jockey Club in 1884 was a landmark moment, transforming horse racing from a leisurely pursuit into a major social event and, eventually, a significant wealth generator. Still, like many gambling nations, horse racing's popularity brought societal anxieties about addiction and illicit betting.

Responding to these concerns, the Hong Kong government established the Gambling Ordinance (Cap. 148) in 1977, a giant step that defined lawful gambling and curbed illegal operations. Later amendments, including the Betting Duty Ordinance (Cap. 108), introduced clearer taxation rules and strengthened oversight, laying the groundwork for the modern regulatory environment.

As digital technologies reshaped entertainment, online gambling in the early 2000s tested the boundaries of existing laws. In response, Hong Kong updated its regulatory framework, notably enhancing AML measures through the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615) to protect its financial integrity.

Timeline of Historical Events

From outlawed gaming houses to government-sanctioned betting, Hong Kong’s gambling laws have undergone dramatic shifts over the years. This timeline charts the key events that shaped its regulatory framework:

1847: The first legalization, ‘the Gambling Ordinance’, regulated gambling activities under British colonial rule.

1871: A new Gambling Ordinance enacted, imposing stricter restrictions on unregulated betting.

1886: The Hong Kong Jockey Club (HKJC) founded to oversee horse racing.

1931: Government regulation of horse racing betting officially begins.

1975: Betting Duty Ordinance (Cap. 108) formalizes tax on wagers.

1977: Mark Six lottery launched by HKJC to curb illegal betting.

1985: Gambling Ordinance (Cap. 148) enacted, prohibiting most forms of betting.

1993: Offshore gambling made illegal with stricter enforcement measures.

2002: Internet betting and telephone wagering legalized under HKJC.

2003: The government Lotteries Ordinance (Cap. 334) was passed to regulate lottery operations.

2018: Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615) extended to gaming.

2022: HKJC granted exclusive rights to operate football betting.

2024: Government updates regulations to tackle illegal online betting.

The Current Situation for iGaming

Decades of legislative refinements have shaped Hong Kong’s gambling sector into one of the most tightly regulated in Asia. While betting remains an integral part of local culture, the legal framework governing it is firmly defined.

At present, only a handful of gambling activities are permitted. The Hong Kong Jockey Club (HKJC) retains an exclusive legal monopoly on horse racing, football betting, and the Mark Six lottery. These operations are strictly regulated under the Gambling Ordinance (Cap. 148) and the Betting Duty Ordinance (Cap. 108), ensuring that all revenues are taxed and a portion is allocated to public welfare initiatives.

Meanwhile, all forms of unauthorized gambling, whether physical or digital, remain illegal. Even social gambling in private settings exists in a gray area, permitted only under strict conditions. Betting outside authorized channels through underground bookmakers or offshore websites carries legal consequences, with authorities actively enforcing penalties on both operators and participants. The rise of digital payment methods has added complexity to enforcement, prompting regulators to monitor transactions more closely and collaborate with financial institutions to curb unauthorized gambling-related payments.

Despite the rise of online wagering platforms worldwide, Hong Kong authorities have consistently reinforced their stance against offshore gambling operators targeting local residents. Enforcement efforts remain firm. Websites offering unauthorized online betting face blocking measures, and individuals caught participating in illicit gambling as organizers or players risk hefty fines and imprisonment under existing laws. For now, Hong Kong maintains a conservative approach to iGaming, favoring state-controlled betting while keeping external operators at bay.

Key Gambling Institutions and Enforcement Bodies

Hong Kong’s tightly restricted gambling sector is shaped by a combination of regulators, enforcement agencies, and a single authorized operator. While public oversight remains in the hands of government bodies, betting services are run exclusively by the Hong Kong Jockey Club. The sections below outline the key institutions that uphold legal, operational, and compliance responsibilities across the gambling framework in HK:

Hong Kong Jockey Club

To be clear, the Hong Kong Jockey Club (HKJC) is not itself a regulator but rather the sole licensed operator of Hong Kong permitted to offer horse racing, football betting, and the Mark Six lottery. Established in 1884, it operates as a not-for-profit entity, channeling surplus funds into public and charitable initiatives. Gambling operators have no direct market access beyond HKJC’s monopoly, making it a dominant force in Hong Kong’s betting industry.

HKJC operates under a strict regulatory framework, working closely with the Betting and Lotteries Commission and the Hong Kong Police Force to combat illegal betting and uphold integrity. Compliance measures, including anti-money laundering protocols and responsible gambling policies, are integral to its operations.

HKJC’s influence extends beyond betting. It actively collaborates with international racing bodies and technology providers to refine betting platforms, reinforcing its status as one of the most regulated betting institutions globally.

Betting and Lotteries Commission

The Betting and Lotteries Commission (BLC) is a key regulator of Hong Kong’s highly regulated gambling sector. Operating under the Home and Youth Affairs Bureau, the BLC advises the government on betting and lottery policies and ensures that legal gambling remains tightly controlled and free from criminal influence.

One of its primary responsibilities is monitoring the operations of the HKJC, the city's sole legal betting and lottery services provider. The BLC ensures HKJC complies with the Betting Duty Ordinance (Cap. 108) and other regulatory requirements.

The Commission also evaluates public concerns about the social impact of gambling and provides recommendations on responsible gambling measures and anti-money laundering compliance. While it does not license new operators, its oversight is instrumental in shaping Hong Kong’s gambling sector.

Office of the Licensing Authority

The Office of the Licensing Authority (OLA), operating under Hong Kong’s Home Affairs Department, plays a key role in overseeing charitable and non-profit lottery licensing. While large-scale betting remains the exclusive domain of the HKJC, the OLA is responsible for issuing permits for smaller-scale activities such as raffles, trade promotion competitions, and social gaming events, provided these are organized for approved charitable purposes.

Its primary function is to evaluate and issue lottery licenses, ensuring compliance with the Gambling Ordinance (Cap. 148). The OLA also provides regulatory oversight to prevent unauthorized gambling and works closely with enforcement agencies to uphold the law.

Operators seeking approval for legally permitted lotteries must submit applications through the OLA, which imposes strict conditions on fund allocation, transparency, and responsible gambling measures.

Hong Kong Police Force and Gambling Enforcement

The Hong Kong Police Force (HKPF) is central to enforcing the Gambling Ordinance (Cap. 148) by cracking down on illegal betting activities, unlicensed gaming operations, and underground gambling syndicates. The HKPF is tasked with preventing, detecting, and prosecuting gambling-related offenses. To uphold Hong Kong's strict gambling laws, the HKPF collaborates with other regulatory bodies, including the BLC and the OLA.

Their Organised Crime and Triad Bureau (OCTB) regularly conducts operations targeting unlawful bookmaking, online betting platforms, and illicit gaming venues. Severe penalties, including hefty fines and imprisonment, serve as deterrents against unauthorized gambling. The HKPF also works to curb money laundering linked to illegal betting.

Opportunities for Private Gambling Operators

As of 2025, private gambling operators have no legal opportunities to enter the Hong Kong market. The city's gambling framework remains tightly controlled, with the HKJC monopolizing all legal betting activities. Any expansion of betting options, such as additional sports, as reported by sources such as SBC Eurasia, would not create new entry points for private companies but rather increase revenues within HKJC’s exclusive licensing structure.

This situation applies to private land-based and online gambling operators in Hong Kong. Private operators have no legal access to the market, whether through physical betting shops, casinos, or digital platforms.

Private Online Gambling Operators

Hong Kong’s stance on online gambling is unyielding. No licensing framework exists for private operators, meaning there is no legal avenue to offer online betting services to Hong Kong residents. Authorities actively block offshore sites, and individuals risk prosecution under the Gambling Ordinance (Cap. 148). So far, there’s no indication that this will change anytime soon.

Land-Based Private Operators

Unlike Macau, Hong Kong has never opened its doors to private land-based casinos or betting shops. The HKJC holds a monopoly over legal betting, leaving no room for independent operators. Even lotteries are tightly controlled, with only charity-based raffles and approved promotional lotteries permitted under conditions laid out by the Office of the Licensing Authority. At present, no legislative efforts suggest this will change.

Current Market Limitations

-

No iGaming Licensing Framework: Unlike other jurisdictions that issue online gambling licenses to private operators, Hong Kong does not have a licensing regime for online casinos or sportsbooks.

-

Monopoly System: HKJC is the only authorized entity permitted to operate horse racing, football betting, and the Mark Six lottery. No private companies have been granted a license to offer similar services.

-

Strict Prohibition on Unlicensed Operators: The Gambling Ordinance (Cap. 148) explicitly prohibits any person or entity from operating gambling services in Hong Kong unless expressly authorized. Offshore iGaming companies targeting Hong Kong residents do so at significant legal risk.

-

No Public Discussions on Market Liberalization: Unlike in other jurisdictions where regulatory shifts are debated, Hong Kong has not officially indicated that it intends to open its market to private operators in the foreseeable future.

Legal Avenues for Market Exposure Through Sponsorships, Partnerships, and Content

Hong Kong’s tightly controlled gambling market leaves little room for direct operator promotions, but some businesses have found creative ways to build brand recognition while staying compliant. Sponsorships, content marketing, and strategic partnerships offer potential avenues, though all must be carefully executed within the legal framework.

One area with some flexibility is sponsorships. While gambling-related advertisements are heavily restricted under the Broadcasting Ordinance (Cap. 562), companies have supported sports teams, cultural events, and charitable initiatives without explicitly promoting betting services. This approach allows brands to remain visible while steering clear of direct gambling promotion, though care must be taken to avoid any implied endorsement of gambling in Hong Kong.

Content marketing is another option. Publishing market insights, research reports, or educational materials on responsible gambling can help maintain industry relevance without crossing legal lines. Some businesses have also applied international media partnerships to reach a broader audience while sidestepping local advertising restrictions.

Affiliate marketing, however, is a different story. Under the Gambling Ordinance (Cap. 148), facilitating or promoting unauthorized gambling, including offshore platforms targeting Hong Kong players, is a criminal offense. Authorities actively monitor and prosecute breaches, meaning any attempt to direct traffic to unlicensed operators carries serious risks.

While creative ways exist to establish a presence, Hong Kong’s regulatory stance remains strict. Any business exploring these avenues must conduct thorough compliance checks to avoid significant legal consequences.

Cross-Border Influences and Alternative Markets

Hong Kong remains a restricted market, but other neighboring jurisdictions can present real opportunities for gambling operators seeking expansion in Asia. Hong Kong’s proximity to well-regulated gambling jurisdictions like Macau, the Philippines, and Thailand may open the door to alternative strategies for entering the region.

A stone's throw from The Dragon’s Pearl, Macau presents an intriguing alternative. As the only legal casino gaming hub in China, Macau attracts a substantial number of high-net-worth gamblers from Hong Kong. While direct market access for external operators is highly restricted, opportunities exist through partnerships, VIP junket collaborations, and technology service agreements. Licensed operators in Macau often seek software providers and betting platform solutions, making strategic B2B ventures a viable avenue.

Beyond Macau, several Asian jurisdictions offer regulated frameworks for foreign sportsbook and casino operators. Notably, the Philippines, through the Philippine Amusement and Gaming Corporation (PAGCOR), issues offshore gaming licenses (POGOs), allowing international operators to target foreign markets. Historically, this has made it a key hub for online gambling in Asia. However, recent government proposals and enforcement actions suggest the country is reassessing its approach, with calls to tighten controls or even phase out certain offshore operations. For operators eyeing this market, staying abreast of pending regulatory reforms is essential.

Meanwhile, Thailand is gaining attention as a market with future potential. In early 2025, its Cabinet approved a draft bill to legalize casinos as part of integrated entertainment complexes. While the legislation is still under review, the proposal marks a meaningful shift in policy and could pave the way for international operators to enter a high-growth tourism and entertainment economy. Should these plans move forward, Thailand may become one of Asia’s next legal gambling hubs.

Finally, India’s state-level regulations provide another potential entry point. While online gambling laws remain fragmented, Goa and Sikkim offer casino and sports betting licenses under controlled conditions. These regions have established regulatory bodies, providing a legal framework for international brands to operate within defined parameters.

Understanding HK’s Betting Environment and Audience

If market regulations should ever change, private operators will be stepping into one of Asia’s most enthusiastic betting environments. Legal gambling remains tightly controlled, but Hong Kong’s passion for wagering is undeniable. Horse racing, football betting, and the government-backed lottery attract billions in turnover, proving just how deep the betting culture runs.

High-net-worth individuals are a significant force, frequently heading to Macau for high-stakes casino action. If private operators were allowed into the market, demand for online sportsbooks would likely surge, particularly for global football leagues, basketball, and esports – an area gaining popularity with bettors.

Mobile-first platforms, live betting, and digital payments would be key to tapping into this market. However, operators would also need to meet Hong Kong’s high compliance expectations, as financial integrity is essential to its regulatory environment.

Should policy shifts ever create an opening, success would depend on a tech-driven, locally tailored approach that speaks to the habits and expectations of this sophisticated betting audience.

Future Legal Outlook: Is There Any Path for Private Operators?

While Hong Kong’s gambling laws remain rigid, history has shown that regulatory frameworks are not set in stone. Economic factors, political shifts, and regional trends could pave the way for potential change, though any transformation would likely be slow and carefully controlled.

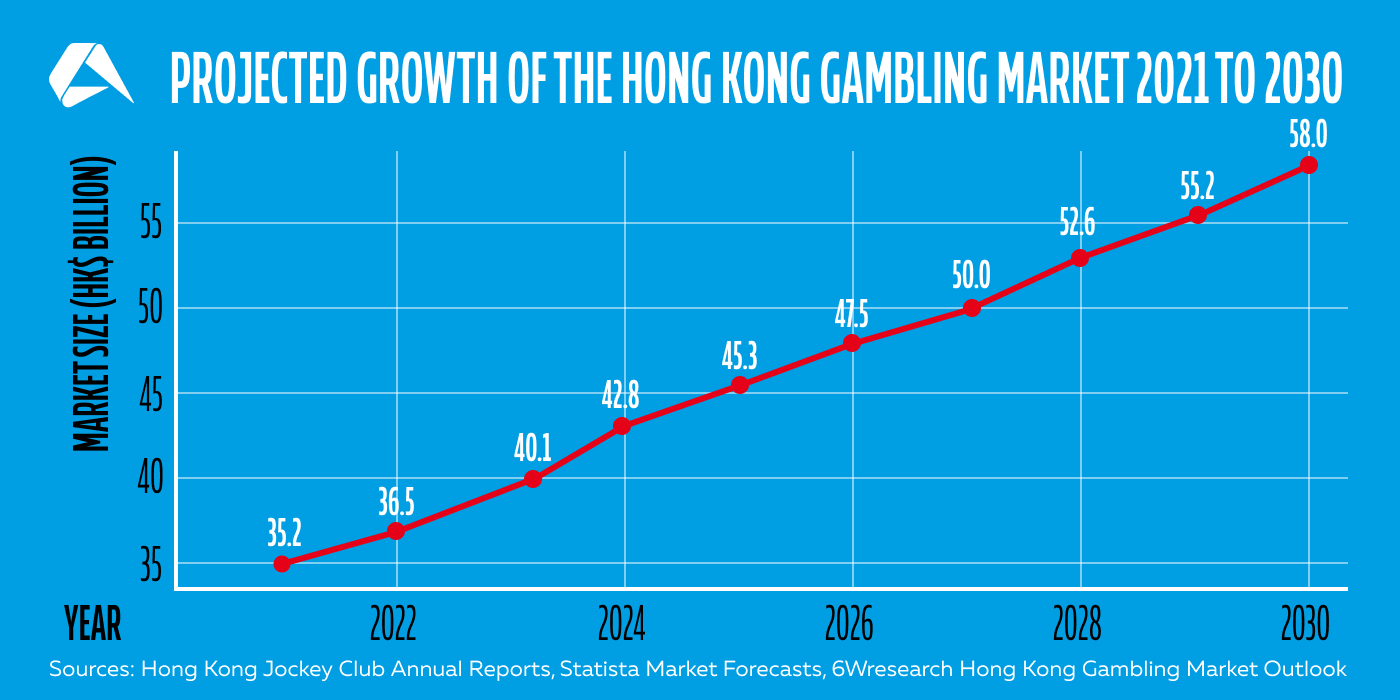

One of the most significant influences on future policy is the city’s reliance on tax revenue. The HKJC contributes billions annually to public funds, but with growing competition from Macau and offshore platforms, lawmakers may eventually reconsider a broader regulatory framework. According to recent financial reports, the HKJC contributed HK$40.1 billion in 2023 through betting duties, taxes, and charitable donations. However, questions remain about the long-term sustainability of this model.

Political factors are equally influential. While Beijing maintains a firm stance against unregulated gambling across Greater China, the success of Macau’s licensing model could serve as a template for a restricted expansion in Hong Kong. Some analysts speculate that allowing limited online betting under state supervision could generate substantial revenue while maintaining regulatory oversight.

Meanwhile, regional trends suggest a gradual shift towards legalization in parts of Asia. If neighboring jurisdictions continue liberalizing their markets, Hong Kong may face pressure to adapt.

For now, any change would require a strong political will and clear economic justification. However, operators who monitor policy discussions closely may find opportunities in the future.

Power your expansion with the right technology. From high-volume sportsbooks to extensive casino integrations, Altenar provides customizable solutions built for Asian iGaming environments. Schedule a software demo of our advanced platform today, and let’s explore the possibilities together.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.