With a fiercely loyal betting audience, a regulatory system that balances structure with opportunity, and the murmurs of long-awaited reforms growing louder, France isn’t just another European market. It’s a high-stakes table where the right players stand to win big, but breaking in demands more than ambition.

This guide explores the rules, rewards, and roadblocks of France’s iGaming sector, arming you with the knowledge to make informed decisions. From regulatory requirements to emerging opportunities, every key aspect is covered. Keep reading to discover what it takes to thrive in one of Europe’s most lucrative betting markets.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

The Evolution of Gambling Laws in France

If there’s one nation that has turned gambling into both an art and a science, it’s France. The birthplace of roulette, the origin of pari-mutuel betting, and a country where Napoleon dictated casino law, France’s approach to gambling has always been as much about state control as it has been about public appetite.

A Story of Control, Innovation, and Cultural Identity

From the royal courts of the 16th century, where playing cards became a noble pastime, to the high-stakes battles over online regulation in the 21st, the history of gambling in France is a story of power, prohibition, and profit. Unlike the free-market approach of jurisdictions like the UK or the heavily restricted models seen in parts of the US, France has crafted its own blueprint, constantly adapting its rules to suit the times while keeping a firm grip on the industry.

From Kings to Casinos

The first recorded evidence of gambling in France dates back to the Renaissance when card games flourished among the aristocracy. By the 17th century, Blaise Pascal’s mathematical explorations accidentally gave rise to the roulette wheel, unknowingly laying the foundation for what would become one of the world’s most famous casino games.

Ever the strategist, Napoleon Bonaparte saw gambling not as a moral dilemma but as a means of economic regulation and social order. His 1806 decree legalized casinos but restricted them to spa towns, ensuring that gambling remained both a controlled activity and a tool for tourism. This principle of regulated monopoly has echoed throughout France’s gambling laws ever since.

The 20th Century Shift in Public Perception

By the early 1900s, France’s government had recognized that gambling, whether permitted or not, was deeply ingrained in the public psyche. To prevent illicit betting, the Pari Mutuel Urbain (PMU) was formed in 1930, cementing the state’s control over horse racing wagers. The 1933 introduction of the National Lottery further underlined the government’s preference for state-sanctioned gambling as a revenue generator rather than an unregulated vice.

A defining moment arrived in 1988 when slot machines were legalized in casinos after decades of prohibition. This single legislative move redefined the French gambling industry, driving up revenue and transforming the country’s casino scene overnight.

France’s Digital Dilemma

The rise of online gambling in the 2000s put pressure on France to modernize its regulations. For years, operators and lawmakers clashed over whether the internet should be seen as an opportunity or a threat. The debate culminated in the French Online Gambling Act (Law No. 2010-476), which legalized online sports betting, poker, and horse race betting but notably excluded online casino games, fearing social risks and market instability.

This decision created one of the most restricted online gambling markets in Europe, with high taxation and limited competition. The government’s reluctance to extend legalization to online casinos has sparked ongoing discussions, with industry stakeholders questioning whether France’s rigid approach is sustainable in an era of globalized iGaming.

Timeline of Key Events

France's gambling history is rich and complex, marked by significant milestones shaping its current regulatory framework. Below is a concise timeline of key events:

1539: King Francis I establishes the first state lottery.

1806: Napoleon Bonaparte legalizes casinos in designated spa towns.

1891: Official regulation of horse racing and associated betting.

1930: Creation of Pari Mutuel Urbain (PMU) to manage horse betting.

1933: Introduction of the National Lottery to generate state revenue.

1987: The legal gambling age was lowered from 21 to 18 years.

1988: The legalization of slot machines in casinos.

2010: Enactment of Law No. 2010-476, opening online gambling.

2019: Establishment of Autorité Nationale des Jeux (ANJ) as the unified gambling regulator.

2024: Proposal to legalize online casinos withdrawn after industry opposition.

2024: Launch of consultation to assess online gambling reforms.

2025: Ongoing discussions on the potential legalization of online casino games.

2025 and Beyond. A Changing Landscape?

Today, the French gambling market remains a tightly regulated ecosystem, with distinct boundaries between permitted and prohibited activities. The Autorité Nationale des Jeux (ANJ) oversees all legal gambling operations, ensuring compliance with strict player protection measures. Française des Jeux (FDJ) retains its state-backed monopoly over lottery games and offline sports betting, while Pari Mutuel Urbain (PMU) dominates the horse racing sector. Licensed private operators are limited to online sports betting, poker, and horse race wagering, leaving online casino games outside the legal framework.

This fragmented structure has long defined France’s approach, which involves a delicate balance between consumer demand, state control, and economic interests. In 2024, France considered legalizing online casinos but scrapped the proposal on October 28 after industry backlash. Instead, authorities launched a nationwide consultation to assess risks and market impact. While legalization isn’t imminent, discussions continue, keeping the possibility of reform open. For now, France is weighing its next steps in shaping a sustainable online gambling environment.

Regulatory Gambling Authorities and Their Role

Gambling in France is a carefully administered system of oversight and governance. From licensing to enforcement, these key regulatory bodies shape the market, ensuring integrity, security, and compliance in one of Europe’s most structured gambling environments.

Autorité Nationale des Jeux

The ANJ holds unprecedented control over France’s gambling sector, overseeing 80% of the market since its creation in 2019. Unlike passive regulators, the ANJ actively shapes industry policies, requiring operators to submit annual risk prevention strategies and imposing strict marketing controls. It monitors transactions, blocks unlicensed sites, and enforces state-driven oversight to keep gambling within France’s jurisdiction. While some argue its approach is restrictive, the Autorité Nationale des Jeux prioritizes consumer protection and market integrity, making it one of Europe’s most interventionist gambling regulators. In France, gambling operates on the state’s terms and not the industry’s.

Ministry of the Interior's Sous-Direction des Courses et des Jeux

The SDCJ, a division within France’s Ministry of the Interior, oversees the security, licensing, and compliance of the country’s land-based casinos. It regulates approximately 160 state-licensed gaming establishments, ensuring strict adherence to anti-money laundering measures, operational integrity, and public safety laws. Unlike the ANJ, which focuses on market regulation, the SDCJ works closely with law enforcement, investigating fraud, organized crime links, and irregular betting activities. Its enforcement role makes it a powerful entity in maintaining strict oversight over France’s physical gambling sector, ensuring casinos operate within tightly controlled legal boundaries.

Française des Jeux

Established in 1976, FDJ is France's national lottery operator, inheriting the legacy of the 1933 National Lottery designed to support war veterans. FDJ holds exclusive rights to operate lottery games and offline sports betting nationwide. In 2019, as part of France's gambling sector re-regulation, FDJ was privatized, securing a 25-year monopoly over these services. Operating under the supervision of the ANJ, FDJ is committed to responsible gaming and contributes significantly to public finances and the funding of various social initiatives.

Pari Mutuel Urbain

Established in 1930, Pari Mutuel Urbain (PMU) is France's premier horse racing betting operator. It holds a state-sanctioned monopoly over offline pari-mutuel wagering. Operating under the supervision of the ANJ, PMU organizes and manages betting on horse races nationwide. Its duties encompass registering and processing bets, ensuring compliance with national regulations, and promoting responsible gambling practices. PMU collaborates closely with racing societies to support and develop the French horse racing industry, reinvesting profits to maintain its global competitiveness.

Requirements and Regulations for Online Sportsbooks

To operate legally in France, private sportsbook operators must adhere to the following criteria:

Licensing: Operators must obtain a license from the ANJ, the independent authority overseeing online gambling in France. This process involves a comprehensive evaluation of the operator's financial stability, integrity, and commitment to responsible gambling practices.

Local Representation: Under Article 16 of the Online Gambling Law, operators must designate a compliance officer based in France who is responsible for ensuring adherence to all legal and regulatory requirements set by the ANJ. This role ensures that the operator meets its obligations regarding responsible gaming, anti-money laundering, and operational compliance within the jurisdiction.

Local Presence: Online gambling operators in France are not required to establish a physical office in France (under Article 18 of the Online Gambling Law). However, if necessary, they must appoint a local representative for tax purposes in accordance with Article 302a bis ZN of the General Tax Code.

Establishment of a French Legal Entity: Operators must be registered in an EU/EEA member state that has a fraud or tax evasion convention with France (Article 21(II), Online Gambling Law). Companies based in blacklisted jurisdictions (Article 238-0A, General Tax Code) or controlled by entities in such territories are ineligible for a license.

Server Localization within French Territory: Operators are mandated to host their servers within French territory to maintain data integrity and regulatory compliance. This enables the ANJ to monitor activities effectively and ensure adherence to national standards.

Implementation of AML Measures: Operators must implement stringent AML protocols, including thorough customer verification processes and continuous transaction monitoring, to detect and prevent illicit activities.

Adherence to Advertising and Promotion Regulations: Marketing efforts must comply with French advertising standards, which prohibit targeting minors and mandate the inclusion of responsible gambling messages in all promotional materials.

Contribution to Problem Gambling Prevention: Gambling operators must actively contribute to preventing excessive or pathological gambling. Under Article L. 320-11 of the French Internal Security Code, operators cannot send commercial communications to self-excluded players or those with a voluntary gambling ban. Promotional offers must not encourage excessive gambling or relapse.

Compliance with Betting Limits and Payout Caps: French regulations require operators to enforce betting limits and payout caps to promote responsible gambling. Under Article L. 320-11 of the Homeland Security Code, players must set weekly deposit and betting limits, which can be adjusted anytime. Increases take effect after 48 hours, while reductions apply immediately (Article 16, Decree No. 2010-518).

Licenses, Costs and Taxes

In France, operators can apply for licenses in three categories: online sports betting, horse race betting, and poker. As of December 28, 2018 (French Finance Law No. 2018-1317), the application fee for these licenses has been abolished, making the application process free of charge. This legislative change aimed to encourage more operators to enter the French market by reducing initial financial barriers.

However, while the application itself is free, licensed operators are still subject to various taxes and ongoing compliance costs once they begin operations. These costs include mandatory technical certifications, which are conducted annually by ANJ-approved independent organizations to ensure adherence to technical and security standards.

In addition to compliance costs, France applies strict taxation on online gambling operators, with different rates depending on the type of gambling offered. Operators must factor these high taxation levels into financial planning, as they directly impact profitability and market competitiveness.

Online Sports Betting

-

33.7% of GGR – State levy

-

10.6% of GGR – National Center for the Development of Sport

-

10.6% of GGR – Social Security contributions

Online Horse Race Betting

-

20.2% of GGR – State levy

-

25.2% of wagers – Racing companies

-

6.9% of GGR – Social Security contributions

Online Poker

-

1.8% of wagers – General tax

-

0.2% of wagers – SS & problem gambling contributions

-

Tournament tax – Based on total collected fees

Taxation on Player Winnings

Player winnings may also be taxed if the game involves skill rather than chance, such as professional poker. Current rates vary between 11% and 45%, depending on income level. Furthermore, sports betting operators must contribute to event organizers, as negotiated under Article L. 333-1 of the Sports Code.

NOTE

The income tax rates mentioned above apply to earnings received or realized from January 1, 2024, and are typically updated annually. For the most current information on tax rates for gambling operators, refer to the ANJ's official publications.

How to Apply for a Gambling License in France

To legally offer online gambling services in France, operators must obtain a license from the ANJ. The application process involves several key steps, which are detailed on the ANJ’s official website. Operators should review the latest licensing requirements directly with the regulator.

-

Determine Eligibility: Ensure your organization is established within a European Union member state and seeks to offer online poker, sports betting, or horse race betting.

-

Prepare Application Dossier: Compile required documents, including the application form, financial statements, and information system security policies.

-

Submit Application: Send the completed dossier electronically ([email protected]) or by registered mail to the ANJ at their registered address: 99-101 Rue Leblanc, 75015 Paris, France.

-

Undergo Review Process: The ANJ evaluates the application, which involves background checks and financial assessments, within a maximum of four months.

-

Comply with Technical Standards: Ensure gaming software and systems meet ANJ's technical requirements, including information system security and data reporting standards.

-

Obtain Software Approval: Submit gaming software for approval prior to deployment, ensuring compliance with ANJ regulations.

-

Maintain Ongoing Compliance: Adhere to all regulatory obligations, including responsible gambling measures, anti-money laundering protocols, and reporting to the ANJ.

NOTE

This information is provided for informational purposes only and should not be considered legal advice. For detailed guidance and access to necessary forms, visit the ANJ's official documentation page.

What’s Next for iGaming in France?

Trends, Expansion, and Market Potential

France is not just one of Europe's largest gambling markets. It’s a mature, evolving, and tightly regulated sector that continues to expand. With over 67 million residents, a well-developed legal framework, and a strong appetite for online betting, the market offers significant opportunities for operators willing to play by the rules.

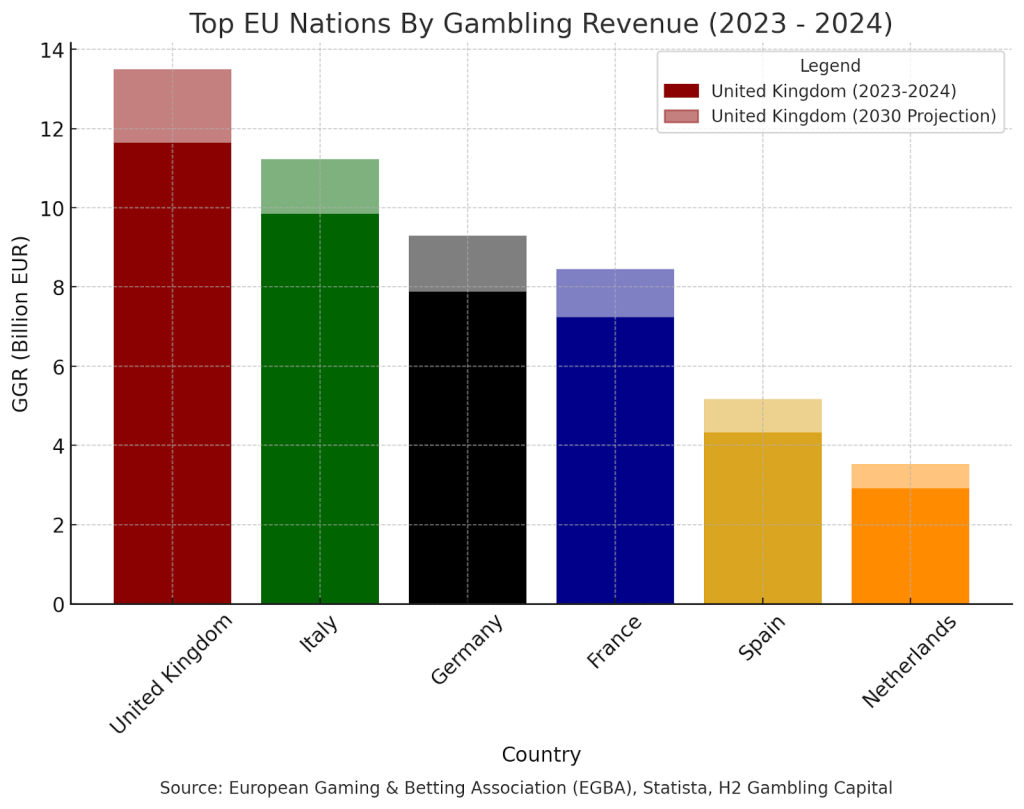

The online gambling sector, in particular, has seen consistent year-on-year growth. In 2024, industry reports valued the market at $7.3 billion (≈ €7 billion (GGR)), and projections suggest that if reforms materialize, it will reach $12.3 billion (≈ €11.8 billion) by 2033. That growth rate outpaces that of many of its European neighbors.

This demand is evident in sports betting, which accounts for the lion’s share of online gambling activity. French bettors placed over €8 billion in online sports wagers in 2023 (Handle), with football, tennis, and basketball leading the way. Horse racing betting remains a pillar of the French market, generating billions annually, while online poker has also rebounded, fueled by regulatory adjustments that improved liquidity and competition.

France’s player base is among the most sophisticated in Europe, with strong demand for premium betting experiences, tailored promotions, and high-quality sportsbook offerings.

Gaming Intelligence, France Market Analysis

Unlike some European jurisdictions where market uncertainty prevails, France offers a clear and structured licensing regime under the ANJ. The abolition of application fees in 2018 has made entry more accessible, reducing upfront costs compared to high-barrier markets like Germany or the Netherlands.

Taxation, on the other hand, remains a significant consideration. Recent reports indicate that effective from July 1, 2025, public levies on online sports betting will increase from 54.9% to 59.3% of GGR. This adjustment includes an increase in the social security levy (CSG) from 10.6% to 15% of GGR. Fortunately, there is a potent counterbalance with strong player engagement and a consumer preference for regulated operators over offshore sites.

The legalization of online casino gaming in France is no longer a question of ‘if’ but ‘when,’ as regulators acknowledge the financial and protection advantages of a controlled market.

French National Assembly, iGaming Policy Discussion

One of the most exciting developments is the ongoing debate around online casino legalization. While France has historically resisted regulating online casino games, policymakers are revisiting the issue, recognizing the potential tax revenue and player protection benefits of a fully regulated framework. Should the green light be given, it will unlock an entirely new vertical for operators looking to diversify their offerings.

Ultimately, the rewards could be substantial for operators who understand compliance, consumer demand, and the importance of strategic differentiation. With possible changes in the years ahead, the country could soon assert itself as one of Europe’s most lucrative iGaming destinations for those willing to stake their claim in a thriving market.

Pros and Cons of Market Entry

France’s gambling market holds undeniable appeal, but success requires a keen understanding of its opportunities and obstacles. Weighing the benefits against the challenges is key to making market entry decisions with confidence and clarity.

Market Advantages

High Revenue Potential: France’s regulated market generates billions in GGR annually, offering substantial revenue opportunities.

Established Player Base: A mature gambling culture with high demand for sports betting and horse racing.

Mobile-First Market: Over half of online bets are placed via mobile, favoring technically advanced operators.

Large Sports Betting Market: Football, tennis, and horse racing dominate, ensuring steady engagement.

Clear Regulatory Framework: A structured licensing system provides legal certainty and consumer protection.

Strong Digital Infrastructure: High-speed internet penetration supports high-quality online gambling experiences.

Market Disadvantages

Heavy Tax Burden: High GGR taxation impacts operator profitability, especially in sports betting.

Limited Online Casino Market: Current laws prohibit online casino games, restricting diversification.

State-Owned Competition: Major operators like FDJ and PMU dominate, making market penetration challenging.

France’s iGaming Market is Growing - Will You Be Part of It?

France’s gambling market thrives on sports betting and horse racing, with mobile-first solutions driving the next wave of growth. The potential is vast, but seizing it requires the right technology and expertise. Are you ready to take the lead? Contact our experts now, and let’s discuss your entry strategy.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.