If Pennsylvania intimidates operators, it’s because it should. No other US state combines high costs with such reliable returns. Taxes bite hard, licenses cost millions, and tethering rules favor longstanding leaders. Yet behind these obstacles lies one of the most lucrative online markets in America, with revenues that rival New Jersey and adoption rates few can match.

For operators weighing a move, the real question is not whether Pennsylvania is tough, but rather how to make the market work for your operation. This guide covers it all, dissecting the state’s licensing structure, tax regime, and market dynamics to reveal where the risks lie and the real opportunities can be found.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

A Brief Historical Context of Gambling in Pennsylvania

Pennsylvania’s path to becoming one of the most diverse gambling jurisdictions in the US is best characterized by incremental reforms layered on top of a revenue-driven foundation. For decades, legal wagering in the state was mostly confined to horse racing and the state lottery, with thoroughbred and harness racing overseen by the Pennsylvania Horse Racing Commission and the lottery authorized in the early 1970s as a state-run monopoly. These products served as the primary legal outlets for gambling until the turn of the 21st century.

The modern era of gambling in the state took off in 2004. Facing budget pressures and watching neighboring states open casino doors, lawmakers passed the Race Horse Development and Gaming Act, better known as Act 71. When lawmakers approved casinos, they made sure the terms tilted heavily toward the public interest, and the Pennsylvania Gaming Control Board was created to keep a firm hand on regulation.

The first licenses went to racetracks to protect the horse racing industry, and tax rates were set at levels that few other states would dare attempt. The underlying message was that casinos could open, but only after proving they would serve broader state and public interests.

Table games arrived in 2010, transforming Pennsylvania’s casinos from slot-focused halls into more comprehensive entertainment venues that offered blackjack, roulette, and poker, thereby enhancing the promise of an entertaining night out.

A further step was taken in 2017 when the Expanded Gaming Act took Pennsylvania’s expansion onto digital platforms. This Act authorized interactive casino games and poker, while also green-lighting sports betting, video gaming terminals at qualified truck stops, fantasy contests, and a new class of mini-casinos.

This move made it clear that Pennsylvania wasn't experimenting. The goal was to build a comprehensive model that linked online operations to land-based licensees, set clear technical and security standards, and maintain a high tax rate, especially for online slots.

In retrospect, the rollout of legal online gambling in Pennsylvania arrived in waves. Sports betting launched after the federal PASPA decision fell in 2018. The first online casinos went live in 2019. By 2025, the state joined the Multi-State Internet Gaming Agreement, opening the door to shared poker liquidity and bringing local players into a wider network. Today, the addition of iGaming has transformed Pennsylvania into a national leader, consistently generating more online casino revenue than almost any state outside of New Jersey.

Timeline of Historical Events

Decades of change have moved Pennsylvania from modest lottery beginnings to a sophisticated gambling market where casinos, sportsbooks, and iGaming coexist under one roof.

These are the key milestones that shaped today’s market:

1971: Pennsylvania Lottery established.

2004: Passage of the Pennsylvania Race Horse Development and Gaming Act (Act 71) authorizes commercial casinos and creates the Pennsylvania Gaming Control Board (PGCB).

2006: First casino opens - Mohegan Sun at Pocono Downs.

2017: Expanded Gaming Act passed, introducing online casinos, online poker, sports betting, video gaming terminals (VGTs), fantasy contests, and Category 4 mini-casinos.

2018: US Supreme Court overturns PASPA.

2019: First online casinos launch under PGCB oversight.

2019: SugarHouse launches Pennsylvania’s first online sportsbook.

2021: Video gaming terminals roll out at licensed truck stops.

2022: Online casino revenues surpass $1 billion for the first time.

2025: Pennsylvania joins the Multi-State Internet Gaming Agreement.

The Current Landscape for State Gambling

From a single state lottery in the 1970s to a vast mix of casinos, sportsbooks, and iGaming platforms today, Pennsylvania has built one of the most comprehensive regulated gambling markets in the US.

Front and center of this framework are the state’s 17 licensed casinos, ranging from the original racetrack casinos - commonly referred to as racinos - to standalone resorts and newer Category 4 mini-casinos. Unlike Michigan, tribal gaming does not factor into the picture, so there are no federally-recognized tribes in the state, with every license running through the Pennsylvania Gaming Control Board. This centralized system has created consistency in how land-based and online activities are managed, but it also means access is tied to tethered relationships with existing casino certificate holders.

That tethering, however, has not held back growth. Online gambling is now a central feature of state revenue. Since the first platforms launched in 2019, iGaming has expanded to cover online slots, table games, and poker under a model that permits unlimited skins but requires branding transparency for the land-based partner.

This approach has helped Pennsylvania climb quickly into the top tier of US online markets. Monthly iGaming revenue regularly clears the $200 million mark, placing Pennsylvania at or near the top of the national rankings. In April 2025, the state also joined the Multi-State Internet Gaming Agreement, finally allowing operators to share online poker liquidity with neighboring jurisdictions; a move that is expected to significantly boost participation in a vertical that had previously struggled with liquidity.

Sports betting adds another strong component. Retail sportsbooks operate inside casinos, while mobile apps now dominate the market. The sector has grown steadily despite a tax rate of 36 percent on gross revenue, one of the highest in the country.

Other verticals remain active but more contained. The Pennsylvania Lottery continues to expand its iLottery catalogue, though it remains barred from offering casino-style games. Video gaming terminals at licensed truck stops, daily fantasy sports contests, and regulated charitable gaming through the Bingo Law and Small Games of Chance Act each provide additional, if smaller, regulated options. Together, these pieces make Pennsylvania’s market both well-rounded and revenue-rich, but also compliance-heavy. This is a reality that every operator must negotiate on market entry.

Influential State Gambling Regulators

A network of specialized bodies supports Pennsylvania’s gambling framework, each tasked with regulating a distinct aspect of the market. Together, they create a system of oversight that defines licensing, operations, consumer protections, and financial protections for operators.

Pennsylvania Gaming Control Board (PGCB)

The Pennsylvania Gaming Control Board is the central authority for all gambling activity in the state, and the institution operators must understand above all others. Created under Act 71 of 2004, the PGCB oversees licensing, compliance, enforcement, and technical standards for land-based casinos, iGaming, sports betting, video gaming terminals, and fantasy contests. Every operator wishing to enter the market must secure an interactive gaming certificate through a tethered arrangement with a licensed casino, making the PGCB the primary regulator for market access.

Its scope is wide. The Board sets responsible gambling requirements, approves suppliers and affiliates, mandates internal controls, and enforces advertising and data security standards. Regular fines for underage play, system failures, and advertising breaches highlight how active the PGCB is in supervision. For iGaming operators, no other institution exerts as much influence or demands as much ongoing compliance.

Pennsylvania State Horse Racing Commission

The Pennsylvania State Horse Racing Commission, operating under the Department of Agriculture, regulates all thoroughbred and harness racing within the state. Its authority covers licensing racetracks, approving pari-mutuel wagering, monitoring simulcasting, and setting standards for advance deposit wagering (ADW) platforms. For iGaming operators, the Commission plays a narrower role than the PGCB, but it remains essential for any operator wishing to integrate horse racing products into its portfolio.

The Commission’s oversight includes ensuring the integrity of races, enforcing medication and safety rules, and monitoring wagering pools for compliance. While racing’s revenue contribution has shrunk compared to casinos and iGaming in recent years, it retains political significance due to the state’s historic ties to the sport and its ongoing contribution to agricultural programs.

Pennsylvania Lottery Division

The Pennsylvania Lottery, established in 1971, is a state-run monopoly that operates independently from the casino and iGaming framework overseen by the PGCB. Administered through the Department of Revenue, the Lottery remains the exclusive provider of draw games, scratch tickets, Keno, and its expanding digital platform known as iLottery. For iGaming operators, the Lottery’s relevance lies less in direct licensing and more in defining the boundaries of what online games can be offered.

The iLottery may sell digital games resembling slots or instant wins, but casino-style titles such as blackjack or roulette remain off-limits, ensuring a clear separation between lottery products and PGCB-regulated iGaming. Revenues are earmarked for senior programs across the state, and the Lottery’s strong political backing means its protections are unlikely to change.

Like other multi-vertical gambling states such as Michigan and New Jersey, Pennsylvania relies on supporting institutions to safeguard payments, advertising, and consumer rights. This complements the direct oversight of the state's primary regulator with targeted financial and legal enforcement.

Office of Attorney General (OAG), Commonwealth of Pennsylvania

The Attorney General’s office plays a supporting but important role in gambling oversight. It enforces consumer protection laws, monitors advertising for misleading practices, and ensures compliance with the state’s Breach of Personal Information Notification Act. The OAG also has the authority to prosecute unlicensed or illegal gambling activity. For iGaming operators, this means marketing materials, promotions, and data protection procedures must align with state and federal standards, as violations can trigger direct intervention from the Attorney General.

Pennsylvania Department of Banking and Securities

This department regulates financial services across Pennsylvania, including money transmission and payment processing relevant to gambling transactions. It is responsible for licensing and supervising payment service providers that work with iGaming operators, ensuring deposits, withdrawals, and account verification meet state and federal requirements. Operators must also be mindful of its interaction with federal laws such as the Unlawful Internet Gambling Enforcement Act (UIGEA). While less visible than the PGCB, its oversight is necessary to maintain secure and compliant payment channels.

Licensing and Market Entry

Pennsylvania’s licensing structure is among the most extensive in the United States, reflecting both the state’s broad regulatory framework and its intent to capture significant revenue from every vertical. All gambling activity is licensed and overseen by the PGCB, with online operators required to tether their platforms to an existing land-based casino license. This centralized model ensures consistency, but it also makes market entry costly and competitive.

Casino and iGaming Licenses

Interactive gaming certificates are issued to land-based casinos, with each certificate holder allowed to partner with multiple online skins. This gives flexibility for brand variety, but the casino’s name must remain visible, keeping tethering transparent. Initial licensing fees were set at $10 million for a package covering slots, table games, and poker. Individual vertical licenses were offered at $4 million each.

Although some licenses remain unsold, the barrier to entry is still high when combined with compliance costs and technology investment.

Sports Wagering Licenses

Pennsylvania’s sports betting framework mirrors the tethered approach. Only licensed casinos may hold a sports wagering certificate, and each certificate requires a $10 million fee. Both retail sportsbooks and mobile platforms fall under this certificate, with mobile operations generally dominating revenue. With a 36 percent tax rate on gross revenue, margins are slim, and operators must weigh carefully whether the potential scale offsets the cost of licensing.

Other Verticals

The licensing framework extends into daily fantasy sports contests, video gaming terminals (VGTs) at qualified truck stops, and Category 4 mini-casinos, which are satellite facilities capped at between 300 and 750 slot machines, with table games permitted in smaller numbers. Each of these verticals carries its own rules, but the unifying theme is strict state oversight and significant upfront cost.

Supplier and Affiliate Approvals

Vendors, platform providers, and affiliates face their own licensing requirements in this state.

How to Secure a Sports Wagering License in Pennsylvania

Pennsylvania’s sports wagering framework is established under the 2017 Expanded Gaming Act (4 Pa.C.S. § 13C). The law requires that only land-based casinos holding a Category 1, 2, or 3 license can apply for a sports wagering certificate, and outside operators must partner with one of these certificate holders to access the market.

Basic steps to licensing include:

1. Basic Preparation

Operators must demonstrate strong finances, detailed compliance programs, and transparent corporate governance before applying. This ensures applicants meet Pennsylvania’s rigorous suitability and operational readiness requirements.

2. Application to PGCB

Operators submit their application directly to the PGCB, using official application forms available on the regulator’s website. Applications must include corporate ownership details, financial disclosures, proposed internal controls, agreements with platform providers, and proof of readiness to meet Pennsylvania’s strict regulatory standards.

3. Licensing Fee

Casino licensees who wish to conduct sports wagering must apply for a sports wagering certificate and pay a one-time fee of $10 million. The license must be renewed every five years, at a cost of $250,000, with no option for phased payments or reductions.

4. Background Investigations

PGCB investigators will vet company officers, shareholders, affiliates, and service providers to ensure suitability, focusing on integrity, criminal history, financial transparency, and links to unlicensed markets.

5. Technical Certification

In addition to basic preparation, iGaming platforms must demonstrate full compliance with PGCB technical standards, covering geolocation, AML, KYC, transaction reporting, cybersecurity protocols, and responsible gambling functionality prior to launch in accordance with PGCB Regulations: 58 Pa. Code Chapter 1400a.

6. Conditional Launch

Approved operators complete a live test launch under PGCB oversight, monitoring systems, player protections, and settlement processes before authorization for statewide operations is granted.

7. Ongoing Compliance

After launch, operators must file monthly tax reports, remit 36% of gross revenue, run annual compliance audits, maintain self-exclusion programs, and update internal controls.

This is a basic overview of the licensing process. For more information, visit the licensing section of the PGCB website.

Market Entry Costs and Taxation

Running a sportsbook or online casino in Pennsylvania is not for the faint of heart. The state has built one of the most expensive entry regimes in the country, and operators need to plan carefully before committing to the process.

Licensing

For casinos and iGaming, interactive gaming certificates were initially priced at $10 million for a complete package covering slots, table games, and poker, or $4 million each if taken individually. After this, five-year renewals come in at $250,000.

For sports betting, the entry cost is equally challenging. A $10 million one-time licensing fee to secure a certificate, which is also renewable for $250,000 every five years.

Taxation

These costs are only the start. Operators also have to contend with some of the nation’s highest gambling taxes:

-

Online slots: taxed at 54% of revenue.

-

Online table games and poker: taxed at 16%.

-

Sports betting: taxed at 34%, plus an additional 2% local share assessment.

When added together, it means operators in Pennsylvania face margins far thinner than in most other jurisdictions. For some, the scale of the market (Pennsylvania consistently ranks near the top nationally for online casino revenue) makes the investment worthwhile. But for others, the combination of high license fees and heavy taxation can be a real barrier to entry.

Ultimately, Pennsylvania offers volume, but at a high price. Success here depends on deep pockets, careful cost modeling, and a long-term view of profitability.

NOTE: Licensing fees and renewal rates are set by the Pennsylvania Gaming Control Board and published in its official Schedule of Fees. Operators should always check the PGCB website for the most up-to-date information.

Opportunities and Future Outlook

Pennsylvania has reached a point where scale is no longer in question. The market passed a symbolic milestone in May 2025 when regulated gambling revenue topped $600 million in a single month, with iGaming alone consistently bringing in $200-230 million. Those figures put the state alongside New Jersey as one of the two most valuable online casino jurisdictions in the US. For operators, the numbers speak loudly, but the underlying story is somewhat more complex.

The central challenge remains the state’s tax model which leaves operators little room to maneuver. As Legal Sports Report highlighted in July 2025: “Pennsylvania sportsbooks issued $16.6 million in promotional credit on $655.4 million in handle, meaning promotional costs and taxes together squeeze net hold well below national averages.” For operators, this underlines the reality that Pennsylvania is a volume market. You don’t enter to chase easy margin, but to prove your brand can sustain operations under the toughest conditions.

There are also signs of fresh opportunity. Pennsylvania moved to join the Multi-State Internet Gaming Agreement (MSIGA) in 2025, opening the door for pooled liquidity in online poker. The impact may be modest at first, but poker has strategic value in terms of driving engagement and cross-sell opportunities into casino, and to a lesser extent, sportsbook verticals. For operators already balancing margins, even incremental retention tools can matter.

But steady gains in poker do little to offset the wider reality facing smaller operators, with some mid-tier brands already showing signs of decline. With steep taxes, high licensing costs, and limited access, operators without deep pockets or cross-market scale often focus resources elsewhere. That leaves Pennsylvania increasingly dominated by market leaders, with little room for challenger brands to thrive without external backing.

Looking ahead, the market seems poised for consolidation. Larger brands such as FanDuel, DraftKings, BetMGM, and Caesars dominate the market, while smaller skins face mounting pressure from compliance demands and high revenue-sharing deals with casino partners. Political debate over taxation has so far been muted, but still, comparisons with neighboring states such as New Jersey and Michigan, where tax rates are far lighter, could eventually trigger calls to revisit Pennsylvania’s model.

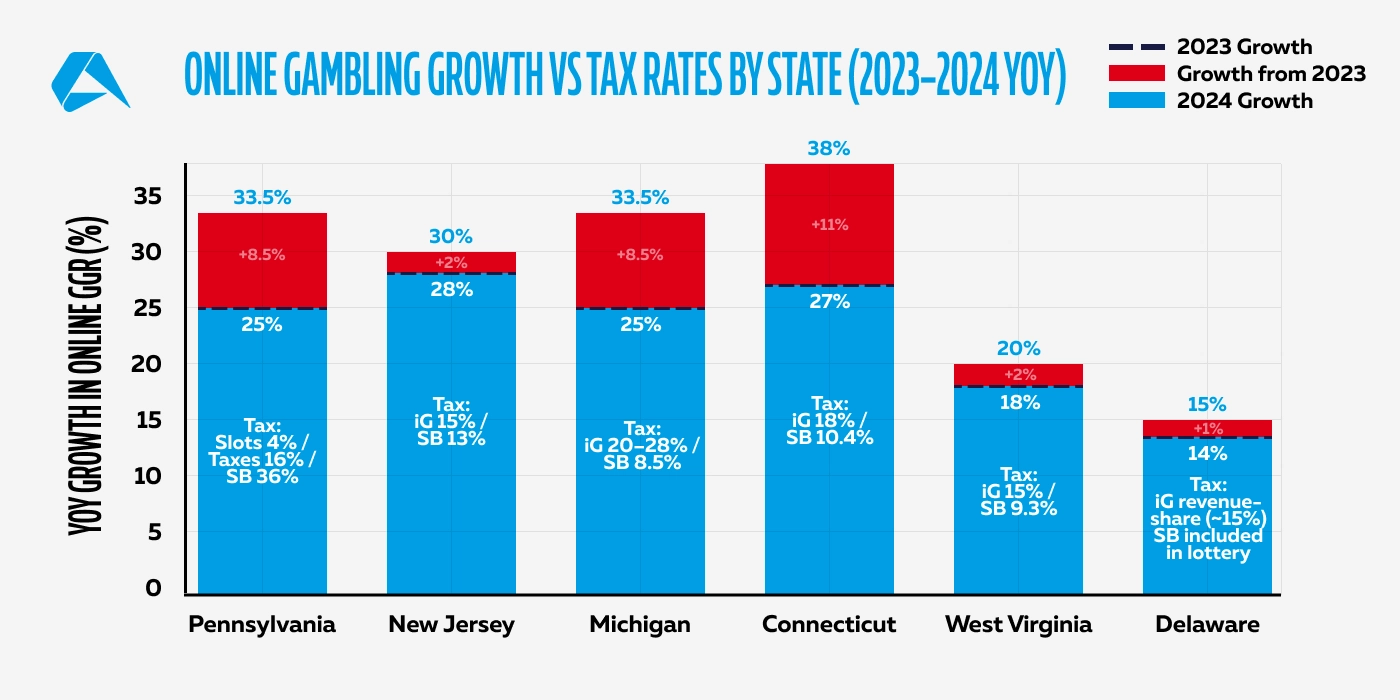

Sources: Figures reflect 2023–2024 regulator data; tax rates are based on state statutes and regulatory codes. Pennsylvania Gaming Control Board, New Jersey Division of Gaming Enforcement, Michigan Gaming Control Board, Connecticut Department of Consumer Protection, West Virginia Lottery, Delaware Lottery.

If operators can show that friendlier regimes are drawing away capital and innovation, lawmakers may face questions over whether Pennsylvania’s heavy burden is sustainable in the long term. For now, the state presents operators with a dilemma - a market rich in scale, yet expensive to sustain, lucrative for those already inside, and formidable for newcomers hoping to enter.

Market Pros and Cons for Operators

Pennsylvania is one of the largest and most mature regulated gambling markets in the US, but it is also one of the most expensive to access. For independent operators, the equation looks like this:

Market Advantages

-

Scale and stability: Consistently ranks among the top three US states for iGaming revenue.

-

Full product offering: Licensed online casinos (slots, poker, table games), mobile sportsbooks, video gaming terminals, fantasy contests, and a state-run lottery.

-

Regulatory credibility: The PGCB is among the most experienced regulators in the country, and a license here carries weight nationally.

-

Strategic location: The state’s size (over 12 million residents) and proximity to New Jersey, New York, and Ohio make it a significant base for regional expansion.

-

Poker liquidity: Pennsylvania’s 2025 decision to join the MSIGA offers future upside for operators offering online poker.

-

Strong political backing: Gambling expansion has been consistently supported in Harrisburg since Act 71 (2004), providing operators with long-term stability.

-

Data-rich environment: Detailed PGCB reporting makes the state a valuable testing ground for player analytics, retention tools, and cross-sell strategies across states.

Market Disadvantages

-

High tax rates: Among the highest nationally, which can significantly compress margins.

-

Upfront costs: Sports wagering and iGaming certificates require substantial one-time licensing fees, plus costs for partnerships and renewals.

-

Tethered system: Market access requires partnering with a land-based casino licensee. Most established properties are already tied to major national brands.

-

Big brand domination: FanDuel, DraftKings, BetMGM, and Caesars capture the majority of volume, leaving little space for challengers without deep resources.

-

Regulatory intensity: Active enforcement and frequent fines for compliance breaches raise operating costs and demand significant investment in technical gambling controls.

Building Success in Pennsylvania’s High-Stakes Market

Pennsylvania isn’t just another stop on the US map. It’s the ultimate test. Operators who enter here face tax rates that crush margins, licensing fees that demand long-term commitment, and highly experienced operators with substantial market control. Yet those same hurdles explain why success in Pennsylvania carries unmatched potential.

This market boasts proven volume, poker is experiencing a resurgence through MSIGA, and consumer adoption rates are among the highest in the country. It’s also a market where only the most efficient operations survive. Those with compliance built into every process, cost discipline hardwired into their models, and the technology to extract value while keeping margins intact, have the chance to turn one of the toughest states into a foundation for national growth.

Altenar helps operators not only adapt, but build lasting advantage in highly competitive jurisdictions like Pennsylvania. Book your private demo today and see for yourself how we deliver that edge.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.