Kansas may not be a state that dominates the headlines when it comes to gambling, but its approach to sports betting is set to attract significant attention over the next few years.

This article examines the current market situation in Kansas, the requirements for entry, and where potential changes may be emerging.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

The Measured Rise of Regulated Gambling

Kansas didn’t rush into gambling. Its early attempts were cautious, rooted in traditional pastimes like betting at county fairs and horse races in the late 19th century. For most of the 20th century, the state maintained a measured stance, shaped by conservative values and public skepticism toward commercial gaming.

The first meaningful event toward legalization came in 1974, when voters approved a constitutional amendment permitting charitable bingo. It was a small but symbolic step. A more decisive change followed in 1986 with the passage of the Kansas Lottery Act, introducing state-run draw games and setting a precedent for state-managed gambling. Parimutuel wagering was legalized a year later through the Kansas Parimutuel Racing Act, although all licensed racetracks would close by 2008.

In 2007, the situation changed dramatically with the Kansas Expanded Lottery Act. This legislation authorized the state to own four casino properties, each managed under contract by private operators. These "lottery gaming facilities" formed the structural basis of modern gambling in Kansas through a licensing and revenue model that placed regulatory control firmly in state hands.

This momentum continued into the digital age. Senate Bill 84, signed into law in May 2022, legalized both retail and mobile sports betting. The first legal wagers were placed in September that year, with each state-owned casino allowed to partner with up to three online sportsbook operators. Oversight responsibilities were shared between the Kansas Lottery and the Kansas Racing and Gaming Commission.

By 2025, however, Senate Bill 125, a budget amendment preventing contract renewals until 2027, had complicated matters. While existing operators remain active, long-term stability now depends on how Kansas chooses to proceed.

Timeline of Key Moments and Events

From constitutional amendments to mobile sportsbook launches, these are the defining moments in Kansas's journey toward a regulated market.

1974: Voters approve constitutional Amendment for charitable bingo

1986: Kansas Lottery Act legalizes state-run draw and instant games

1987: Parimutuel Racing Act permits live and simulcast race betting

1995: Federal approval given for four tribal-state gaming compacts

2007: Revised Lottery Act with four contracts for state-owned casinos

2008: All licensed racetracks cease operations across Kansas

2015: Fantasy sports exempted from gambling restrictions via HB 2155

2022: SB 84 is signed into law, legalizing sports betting statewide

2022: Kansas soft-launches mobile and retail sports betting

2022: Launch of online sportsbooks (FanDuel, DraftKings, BetMGM)

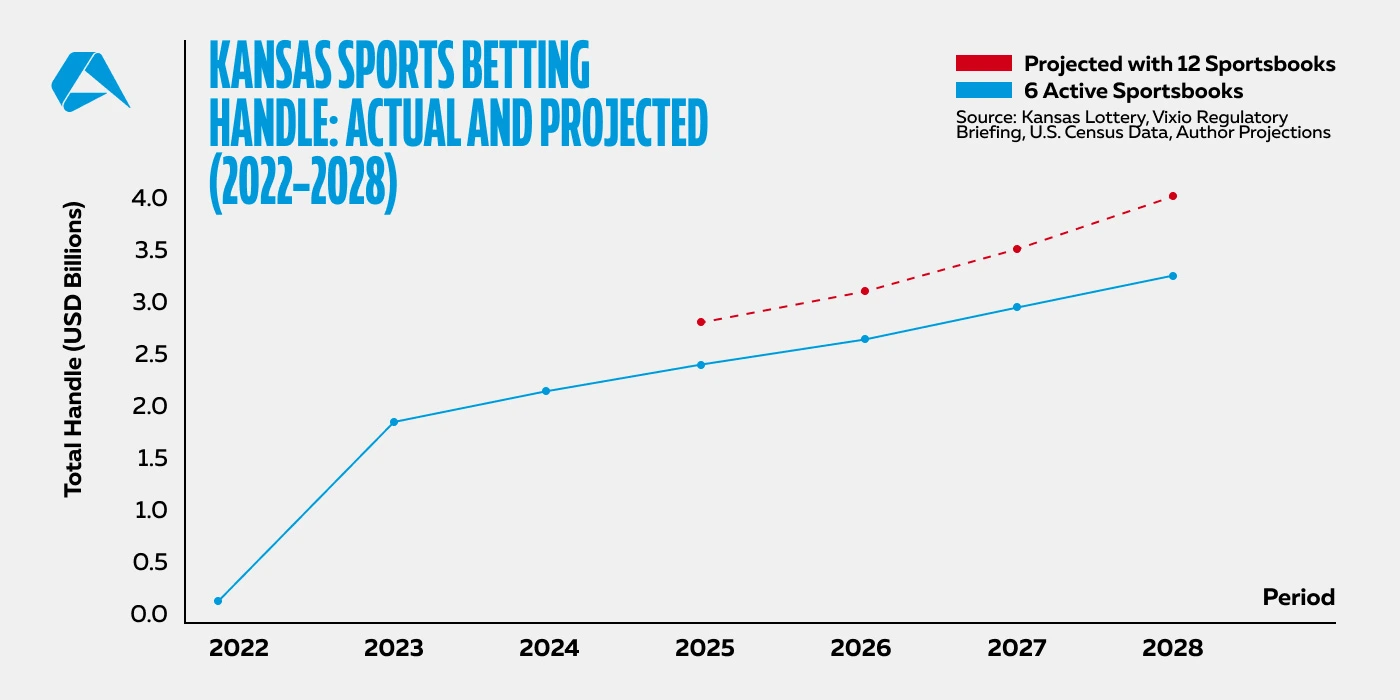

2023: Kansas Lottery reports $1.8 billion in total wagers during first year

2025: SB 125 blocks sports betting contract renewals through FY2026

The Current Situation for iGaming in Kansas

Building on decades of legislative caution and measured expansion, Kansas now operates a controlled but commercially active gambling market shaped by its unique regulatory framework. Since the introduction of state-owned casinos in 2007 and the legalization of mobile sports betting in 2022, Kansas has transitioned from traditional lottery offerings to a more diverse model without extending into full-scale iGaming.

As of 2025, Kansas permits several forms of regulated gambling. These include lottery games operated by the Kansas Lottery with four destination-style casinos managed under contract by private firms, tribal gaming under federally approved compacts, charitable gaming such as bingo and raffles, and most notably, retail and online sports betting, which went live in September 2022. Each of the four state-owned casinos may partner with up to three online sportsbook operators, enabling brands such as DraftKings, FanDuel, Caesars, ESPN Bet, and BetMGM to offer betting via licensed platforms within the state legally.

Fantasy sports contests remain exempt from gambling prohibitions under HB 2155 (2015), while other online gambling activities, such as digital casino gaming or peer-to-peer poker, are not currently authorized under state law. Social casinos, loot boxes, and esports betting fall into regulatory gray areas and remain unregulated.

While the market remains active, future expansion is temporarily on hold. A legislative freeze introduced under SB 125 has suspended the state's ability to negotiate, extend, or renew sports wagering contracts until the end of the fiscal year 2026. Current agreements, most of which run through to 2027, remain in effect, allowing licensed operators to continue their activities. However, with only six of the 12 permitted sportsbook partnerships currently in place (as of 2025), the market retains the capacity for growth if the moratorium lifts.

The Key Authorities Governing the Gambling Framework

Kansas's controlled gambling environment owes much to the interplay between several state agencies, each with defined jurisdiction over casino licensing, online sportsbook contracts, gaming compliance, and enforcement against unauthorized activity.

Kansas Racing and Gaming Commission

The Kansas Racing and Gaming Commission (KRGC) plays a direct, hands-on role in the daily operations of the state's gambling sector. For licensed operators, it's the agency they deal with most, handling everything from initial certification and background checks to audits, game approvals, and internal control reviews. It also works closely with the Kansas Lottery to oversee sportsbook partnerships and enforce regulatory compliance. Whether approving new platform tech, inspecting security systems, or investigating misconduct, the KRGC acts as the state's gatekeeper and watchdog for regulated gambling.

Kansas Lottery

The Kansas Lottery holds the cards when it comes to gambling rights in the state. It owns all state-licensed gambling infrastructure, including retail casinos and sportsbook rights, and controls who operators partner with. While the KRGC handles compliance, the Lottery manages operator contracts, monitors revenue, and approves sportsbook launches. Every legal sports bet in Kansas flows through this agency's system. For betting operators, no platform goes live without the Lottery's oversight.

Kansas State Gaming Agency

The Kansas State Gaming Agency (KSGA) is the state's lead regulatory body for Class III tribal gaming. It represents Kansas in enforcing tribal-state compacts and directly oversees compliance across seven tribal casinos. KSGA works closely with tribal regulators, conducting audits, licensing background checks, and technical inspections. It does not regulate commercial casinos but plays a vital role in upholding compact conditions and coordinating with federal and state agencies to maintain lawful, secure operations.

Office of the Kansas Attorney General

The Kansas Attorney General's Office is the state's legal safety net in gambling enforcement. While not a day-to-day regulator, it investigates illegal gambling, prosecutes unlicensed operators, and advises agencies like the KRGC and Kansas Lottery on statutory interpretation. It also handles compliance around advertising, fraud, and consumer protection. For operators, this agency steps in when rules are broken or lines are blurred. Fundamentally, its oversight reinforces Kansas's legal framework behind the scenes.

Licensing and Compliance Requirements for Sportsbook Operators

Only four state-owned casinos hold contracting power for sportsbook operations, and those relationships are currently frozen under Senate Bill 125 until FY 2027.

The following are the essential requirements for operators to prepare for if contract negotiations resume.

1. Operate Under a Casino Partnership Model

Online sportsbooks must contract with one of the four casino managers licensed by the Kansas Lottery. No standalone licenses are issued to operators. (Senate Bill 84 - Kansas Legislature)

2. No iCasino or Poker Authorization

Kansas does not permit online casinos or peer-to-peer poker operations. Sports betting—retail and online—is the only digital product permitted under state law.

3. State-Managed Oversight Structure

The Kansas Lottery must approve contracts and is subject to enforcement by the KRGC, which oversees technical standards, audits, and enforcement actions. (KRGC - Gaming Regulations)

4. Compliance With Technical and Security Standards

Operators must meet GLI-certified requirements for platform integrity and reporting. This includes mandatory system testing, continuous data logging, and the ability to support real-time regulatory access.

5. Server and Data Location Requirements

While there is no explicit mandate for in-state hosting, Kansas Regulation K.A.R. 112-203-5 emphasizes that sportsbook systems, servers, databases, backups, etc., must be fully accessible for KRGC inspection and capable of delivering continuous, audit-grade data logs and real-time reporting as per KRGC protocols.

6. Anti-Money Laundering and SAR Filings

Operators must implement AML policies, perform KYC checks, and file Suspicious Activity Reports (SARs) where necessary. Cooperation with law enforcement is mandated under KRGC regulations.

7. Taxation and Financial Obligations

A 10% tax on gross gaming revenue applies to all sportsbook activity, plus a 0.25% federal excise tax on handle. Operators also pay contractual privilege fees to casino partners, although amounts vary.

8. Responsible Gambling Requirements

Operators must support the KRGC’s voluntary exclusion program, restrict betting for individuals under 21, display RG resources prominently, and implement time and spending limits on accounts. Further to this, operators are strictly prohibited from providing lines of credit to individuals for the purpose of sports wagering. (Kansas State Legislature)

9. Advertising Regulations

The KRGC mandates that all advertising related to sports wagering must not target minors, problem gamblers, or other vulnerable populations. Advertisements must include the identity of the manager and any interactive sports wagering platform involved. More information can be found here.

Market Entry Costs and Tax Obligations

There is no standard cost structure for entering Kansas. Between state-owned licenses, private contracts, and layered tax obligations, operators face a distinctive model that rewrites the usual rulebook for sportsbook entry.

Privilege Fee and Contractual Payments

For online sportsbooks, there’s no standalone license waiting at the end of a Kansas application. Instead, operators must strike a deal with one of the state’s four authorized casino managers. The financial arrangements between the operator and the casino manager are determined through private negotiations and are not publicly disclosed. These agreements typically include recurring contractual payments made by the operator to the casino manager for the right to operate under their license.

In addition to these negotiated terms, operators are also responsible for covering costs associated with the casino manager’s obligations to the Kansas Lottery and the Kansas Racing and Gaming Commission. These may include expenses tied to the central computer system, slot management systems, and other regulatory and compliance infrastructure. These costs are outlined in the Kansas Lottery's Casino Gaming Revenue and Fund Distribution report.

Taxes and Tax Considerations

Kansas imposes a 10% tax on the GGR generated from sports wagering activities. The Kansas Lottery collects and distributes this tax among various state funds, including allocations for problem gambling and addiction grants, local governments, and the state treasury. The distribution of these funds is again detailed in the Kansas Lottery's Casino Gaming Revenue and Fund Distribution report.

In addition to this, operators are subject to a 0.25% federal excise tax on the total handle, which is the total amount wagered by bettors. This federal tax is separate from state obligations and must be accounted for in financial planning.

Operators must also comply with Kansas income tax withholding requirements on gambling winnings. If federal withholding is required on a gambling payout, Kansas law mandates a 5% state income tax withholding on the net winnings (the amount won less the amount wagered). Details on these requirements can be found in the Kansas Department of Revenue's Withholding Tax Guide.

Securing Market Access to Kansas Through Casino-Backed Partnership

Operators seeking to enter Kansas won’t apply for a traditional license. They’ll need to partner with a licensed facility manager operating on behalf of the Kansas Lottery. In this model, the Kansas Lottery is the legal operator of all sports wagering, and contracted casinos (formally known as lottery gaming facility managers) are authorized to manage sports betting under that agreement.

Access to the market flows through these four approved casinos, but all platforms must still be approved by the Executive Director of the Kansas Lottery, with background checks carried out by the Kansas Racing and Gaming Commission (KRGC). Each facility manager may partner with up to three interactive sports wagering platforms, as outlined in Senate Bill 84.

With limited partnerships available and a formal moratorium on new agreements in place until FY2027, preparation now is essential. The following action points outline how to position your brand for consideration when negotiations resume:

Target the Right Casino Partner

Each of the four authorized casinos—Boot Hill, Kansas Star, Hollywood Casino, and Kansas Crossing — has its own strategy, customer profile, and existing partnerships. Step one is to understand their operational footprint, market reach, and brand alignment. Study their current sportsbook relationships. If one partner is tied closely to a national brand, look for gaps or regional synergies in another. This is less about scale and more about strategic fit.

Tailor Your Proposition

Don’t come in with a generic pitch. Casinos will look for operators who can strengthen their portfolio, not just fill a slot. Highlight your tech stack, promotional tools, and player engagement strategy. Think co-branded campaigns, localized UX, or in-play features tied to Kansas sporting events. Every detail that shows you understand their customer base helps.

Prove You're a Low-Risk, High-Reward Partner

Kansas is cautious by design. That means showing maturity. Demonstrate a clean compliance record, full GLI certification, and readiness to meet KRGC reporting standards. Back it with your financials, fraud prevention systems, and commitment to responsible gaming, including integration with the KRGC's self-exclusion program.

Be Ready to Support the Deal

Casino managers carry the regulatory burden in Kansas. Offer to assist with system integrations, compliance audits, or marketing operations. Streamline the onboarding process and reduce the admin overhead. This effort could tip the scales in your favor.

Opportunities and Future Outlook

Not so long ago, Kansas barely registered on the national gambling radar. Today, it’s a different story. Since mobile sports betting went live in September 2022, the state has quietly racked up more than $2.5 billion in handle in 2024, a 20% increase compared to the amount wagered in 2023. This is no small figure for a heartland state with under 3 million residents. And while the market isn’t wide open, it’s focused, digitally driven, and punching well above its weight.

And where’s the real action? Well, it’s not in retail. Over 96% of bets are placed online, mostly through heavy hitters like DraftKings, FanDuel, and BetMGM, who quickly anchored themselves to the four state-owned casinos. Each of those casinos can partner with up to three sportsbooks, but while legislation allows for 12 online sportsbook partnerships, only six are currently active. The remaining slots can’t be filled until the state lifts its contract moratorium in 2026, effectively closing the door to new entrants for now, even if space technically remains.

Still, with contracts set to expire in 2027, operators are already eyeing the horizon and those who are prepared when the door reopens will have the advantage.

Advantages and Disadvantages of Market Entry

Market Advantages

-

High online adoption rates: Over 96% of wagers are placed online, and mobile-first behavior is already the norm.

-

Untapped licensing potential: Only half of the 12 sportsbook slots are activated; future space remains.

-

Favorable tax structure: At 10% GGR, Kansas offers one of the lighter sportsbook tax burdens in the United States.

-

Collaborative regulatory structure: A clear operational division between KRGC and Kansas Lottery enhances accountability.

Market Disadvantages

-

Limited brand differentiation space: A compact market with a small number of casino partners restricts platform variety.

-

No online casino or poker legalization: iCasino and online poker remain off the table, narrowing digital growth opportunities.

Ready to Learn More?

If you are thinking of entering the Kansas market if the opportunity arises, preparation is key. See how our sportsbook platform gives you the regulatory confidence, technical agility, and operational edge needed to move fast when the doors reopen.

Book a personalized demo and discover how Altenar’s advanced sportsbook software can help you meet KRGC standards.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use