Disclaimer

This information is not intended as legal advice and is solely gathered from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

Indiana’s gambling market is full of opportunities compared to many US jurisdictions, and it’s no surprise you’re here to learn more. This Midwest state isn’t just keeping pace with the national gaming industry—it’s leading the way. With online sports betting revenues soaring and House Bill 1432 hinting at even bigger developments ahead, the state of Indiana is providing significant opportunities for ambitious operators.

In this guide, we’ll explore the local legal framework, licensing, regulations, market entry costs, and future prospects. So, let’s dive in and discover why Indiana could be the location for your next major move.

From Riverboats to Online Platforms – Indiana’s Gambling Evolution

Indiana’s journey through the maze of gambling legislation offers a fascinating insight for iGaming professionals eager to understand the state’s regulatory landscape. In the early 19th century, gambling occupied a legal grey area, allowing informal betting activities to flourish in communities across the state. This unregulated period reflected societal norms of the time, where such activities were neither fully sanctioned nor outright banned.

The turning point came in 1851 with the Constitution’s sweeping prohibition of lotteries. Courts extended this ban to general gambling, reflecting the era’s dominant moral and religious attitudes. This approach prevailed for decades, shaping a conservative outlook on gaming.

By 1988, however, a cultural and legal shift had taken hold. Indiana voters approved a constitutional amendment lifting the lottery ban, resulting in the creation of the Hoosier Lottery. This move signaled a broader acceptance of state-regulated gambling, opening the door for subsequent developments.

The 1990s brought further changes with the passage of the Indiana Riverboat Gaming Act in 1993. This legislation authorized riverboat casinos, issuing licenses along Lake Michigan and the Ohio River. The initiative revitalized waterfront economies, combining entertainment with economic development. Around the same time, the legalization of pari-mutuel wagering led to the establishment of Harrah's Hoosier Park in 1994 and Indiana Downs in 2002. These venues later evolved into racinos, integrating horse racing with casino gaming to expand the state’s gambling options.

In 2019, Indiana strengthened its position as a leader in the US gambling sector by legalizing sports betting across retail and online channels. This landmark move aligned the state with the growing national market, attracting operators eager to capitalize on a forward-thinking regulatory framework.

Indiana’s gambling ecosystem now features a diverse mix of state-regulated lotteries, casinos, racinos, and sports betting platforms. The regulatory environment continues to evolve, constantly adapting to technological advancements and shifting public attitudes. This balance ensures a thriving yet controlled marketplace, highlighting Indiana’s role as a leader in the US gaming industry.

Timeline of Key Events

Here are the key moments that shaped Indiana’s gaming landscape:

1851: Indiana Constitution bans lotteries, effectively outlawing gambling.

1988: Constitutional amendment approved to establish the Hoosier Lottery.

1989: Pari-mutuel wagering legalized, introducing horse race betting.

1993: Indiana Riverboat Gaming Act authorizes riverboat casinos.

1994: Harrah's Hoosier Park opens as the state’s first racetrack.

1995: First riverboat casinos begin operations on Indiana waterways.

2002: Indiana Downs racetrack opens, expanding pari-mutuel wagering.

2007: Legislation allows slot machines at racetracks, creating racinos.

2011: New rules tighten oversight of casino operations and licensing.

2013: Initial discussions on online gambling regulation emerge.

2018: Supreme Court overturns PASPA, paving the way for sports betting.

2019: Sports betting legalized, covering both retail and online markets.

2022: New initiatives proposed for online casino legalization in Indiana.

2025: House Bill 1432 introduced to formalize online casino legislation.

Legal Gambling Options Permitted Today

Indiana has developed a comprehensive framework accommodating various forms of gaming, both offline and online.

As of early 2025, Indiana permits several regulated gambling activities:

-

State Lottery: The Hoosier Lottery offers traditional draw games and scratch-off tickets.

-

Casino Gaming: Indiana has multiple land-based and riverboat casinos, offering a variety of table and slot games.

-

Racinos: Racinos that combine horse racing with casino gaming operate at designated racetracks.

-

Sports Betting: Legalized in September 2019, sports wagering is available through both retail sportsbooks and online platforms.

The legalization of sports betting marked a significant expansion in Indiana's gaming industry. Residents can place bets on a wide array of sports, including football, basketball, baseball, hockey, and motorsports like the Indianapolis 500. The state's regulatory body, the Sports Wagering and Paid Fantasy Sports Division, oversees these activities to maintain integrity and consumer protection.

Looking ahead, Indiana is exploring the potential legalization of online casino gaming. Discussions are underway to assess the economic benefits and regulatory requirements of expanding iGaming offerings. This progression aligns with trends in other states that have embraced online gaming to enhance revenue streams and meet consumer demand.

Compared to other states, Indiana demonstrates a balanced approach to gambling legislation. While some states have more restrictive policies, Indiana's willingness to adapt its laws reflects a commitment to nurturing a liberalized gaming environment. This adaptability positions the state as an attractive market for gaming operators and a diverse market for sports betting enthusiasts.

Market Entry Requirements for Commercial Sportsbook Operators

Establishing an online sportsbook operation in Indiana requires compliance with specific regulations set forth by the Indiana Gaming Commission (IGC). The IGC oversees all sports wagering activities within the state and ensures integrity and adherence to the law.

Key Licensing Requirements:

-

Sports Wagering Vendor License: To legally offer mobile sports betting, online sportsbook operators must obtain a Sports Wagering Vendor License (SWV) from the Indiana Gaming Commission (IGC). Before applying, applicants must secure a formal partnership with a licensed land-based casino or racino. The IGC conducts a thorough background investigation to assess financial stability and compliance. All required fees must be submitted.

-

Geolocation Compliance: All online sports wagers must be placed within Indiana state lines. Operators are required to implement stable geolocation technologies to ensure compliance and prevent out-of-state betting activities.

-

Responsible Gaming Requirements: Under 68 IAC 27-13-1, licensed operators must display a responsible gaming logo linking to a dedicated page, provide access to self-exclusion programs, feature a helpline message, and include links to IndianaGamblingHelp.com and other IGC-designated resources.

-

Data Security and Server Location: Indiana law mandates that sports wagering operators must physically locate their servers within the state to ensure regulatory oversight and compliance with state gaming laws (68 IAC 27-6-2).

-

Certified Platform Standards: To ensure fairness and security, operators must use platforms and systems certified by an independent testing laboratory approved by the IGC.

-

Advertising and Marketing Compliance: Indiana’s advertising standards, which focus on transparency and responsible gambling, must be followed in all promotional activities.

Distinctive Aspects of Indiana's Regulatory Framework:

-

Limit on Online Skins: Each licensed casino or racetrack in Indiana can partner with up to three individually branded online sportsbook platforms, commonly referred to as “skins.” This provision allows for a diverse market while maintaining regulatory oversight.

-

Taxation and Fees: Indiana imposes a tax rate of 9.5% on adjusted gross receipts from sports wagering activities. If a sports wagering certificate holder (casino/racino) uses a vendor to conduct sports betting, they must include in their internal controls a description of how revenue will be reported to the certificate holder and how the certificate holder will remit taxes as required by the law.

License Costs and Tax Considerations

Indiana offers various licenses, including the casino owner's license, supplier's license, and sports wagering vendor license. Online sportsbook operators must obtain the latter to legally operate in the state, requiring partnerships with licensed casinos or racetracks. Each license category involves strict regulatory oversight by the IGC, ensuring compliance with state laws.

This text focuses on the financial costs associated with online sportsbook operations.

Application Costs for Online Sportsbook Operators

Securing a Sports Wagering Vendor License in Indiana begins with a non-refundable application fee of $100,000, payable to the Indiana Gaming Commission. Applicants undergo an extensive background check to confirm financial stability and operational integrity, which is also included in this initial fee. Furthermore, operators must provide evidence of their partnership with a state-licensed casino or racetrack. These upfront costs are necessary to enter Indiana’s lucrative online sports betting market.

Annual Renewal and Maintenance Fees

Online sportsbook operators must renew their license annually, incurring a $50,000 renewal fee, due one year after initially rendering services for the certificate holder and on each annual anniversary date thereafter. This fee secures continued regulatory compliance and oversight. Operators are also required to submit annual financial and operational reports to the IGC. In addition, applicants should factor in periodic audits conducted by the IGC to assess adherence to state regulations, which will ultimately incur additional costs.

Taxes and Ongoing Costs

Indiana imposes a 9.5% tax on adjusted gross receipts (AGR) from sports wagering activities. This tax rate is typically lower than those imposed on gambling operators in other US states and is collected monthly. Beyond taxes, operators will incur ongoing costs such as geolocation technology, data security enhancements, and compliance initiatives like responsible gaming programs. Such requirements are deemed necessary for maintaining a competitive and compliant sportsbook operation in Indiana.

Primary Gambling Regulators in Indiana

Effective regulation is the backbone of Indiana’s gambling sector, providing operators with clear guidelines and inspiring a stable environment for growth. Here are the regulators with the most significant influence on gambling operations in the state:

Indiana Gaming Commission

Established under Title 4, Article 33 of the Indiana Code, the IGC supervises the state's riverboat casinos, land-based casinos, racinos, and charitable gaming activities. The commission, which comprises seven members appointed by the governor, is responsible for licensing, regulatory compliance, and enforcement actions, including imposing fines and revoking licenses for non-compliance.

The Indiana Gaming Commission enforces rules through audits, inspections, and investigations, with the authority to impose fines or revoke licenses for non-compliance. By working closely with other regulatory bodies and stakeholders, the IGC creates a stable environment for operators to thrive while prioritizing consumer protection and industry transparency.

Sports Wagering and Paid Fantasy Sports Division

The Sports Wagering and Paid Fantasy Sports Division, operating under the IGC, regulates sports betting and paid fantasy sports in Indiana. Established following the legalization of sports wagering in 2019 through the House Enrolled Act 1015-2019, the division ensures that all sports betting activities comply with state laws and uphold the integrity of sporting events. The division also provides detailed guidelines and licensing requirements for gambling operators to encourage a transparent and fair environment for operators and bettors.

In addition, the division collaborates with other regulatory bodies to maintain a cohesive framework for oversight, addressing issues such as responsible gambling and consumer protection. Operators are expected to adhere to the division's standards, and non-compliance can result in disciplinary actions, including fines or license revocation.

Indiana Horse Racing Commission

The Indiana Horse Racing Commission (IHRC) is the regulatory authority overseeing pari-mutuel wagering on horse racing in Indiana. It is responsible for licensing racetracks and ensuring compliance with state racing laws, thereby contributing to the integrity and growth of the industry. The IHRC provides comprehensive guidelines and resources for industry participants, including licensing information and breed development programs.

For operators, the IHRC provides a clear route to licensing and a stable environment for introducing modern betting solutions. Ultimately, this creates opportunities to attract a wider audience and drive growth in pari-mutuel wagering.

Opportunities and Outlook for Gambling in Indiana

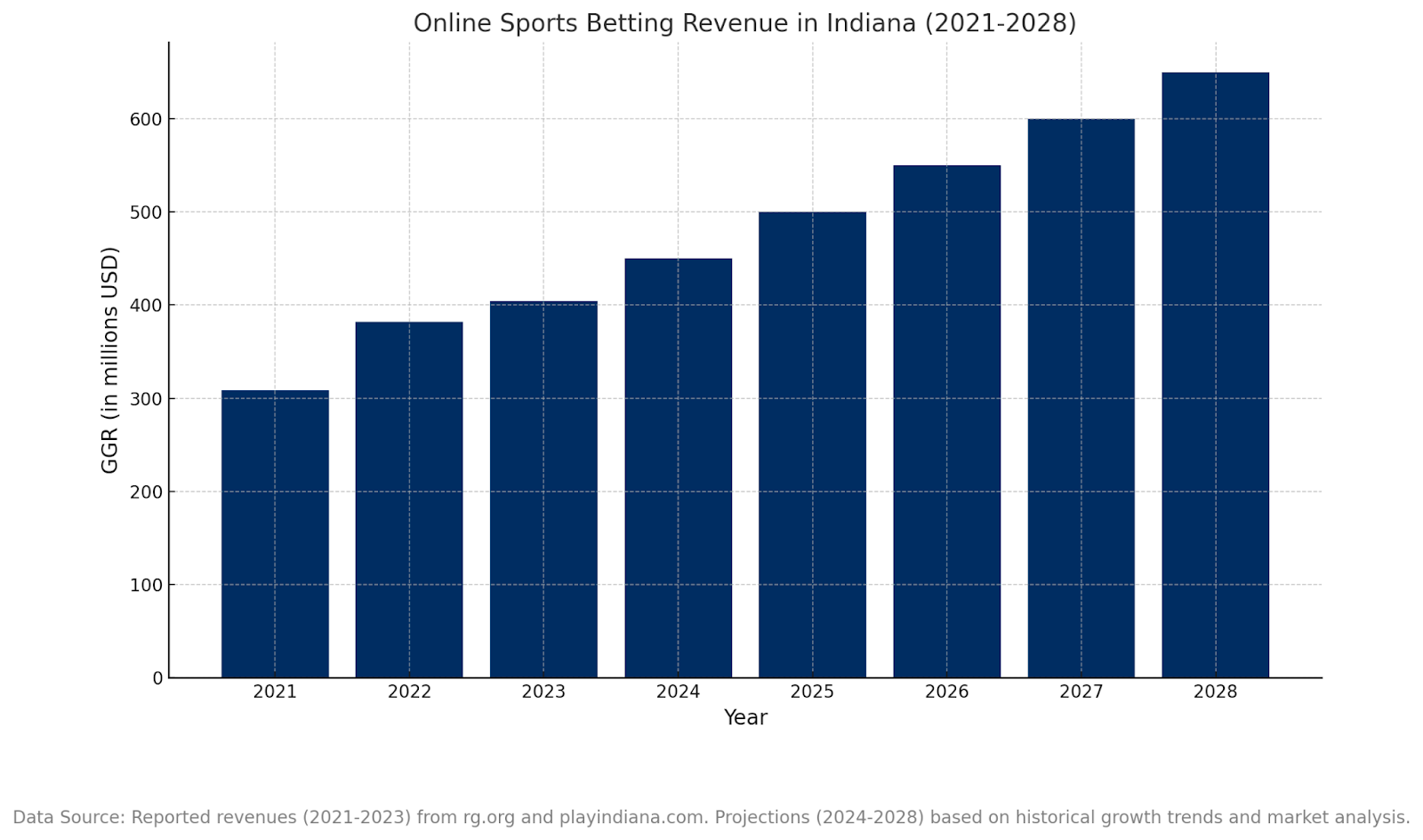

Indiana’s gambling market is proving to be one of the most intriguing players in the US gaming arena, capturing the attention of operators eyeing the Midwest. Since the state threw its hat into the sports betting ring in 2019, the numbers have been impressive. What began with a modest $41.6 million in Gross Gaming Revenue (GGR) exploded to over $300 million in 2021, reflecting Indiana’s knack for knowing how to play the cards it’s dealt.

With a population of nearly 6.8 million, the state isn’t the largest in the union, but what it lacks in size, it more than makes up for in enthusiasm. Online sports betting has hit its stride here, with monthly revenues topping $30 million as of mid-2024. It appears that this market doesn’t just dabble — it delivers.

Industry leaders have expressed optimism about Indiana's potential. Sarah Green, director at Midwest Gaming Research, concluded:

The momentum in Indiana's gaming sector is undeniable,

and the state's initiatives could serve as a model for others to follow.

What sets Indiana apart is its readiness to expand its gaming portfolio with forward-looking legislation like House Bill 1432. This proposal signals the state’s intent to embrace the lucrative potential of online casinos, creating new opportunities for operators to tap into an engaged and growing market. Indiana’s legislative momentum offers a compelling case for investment in a state with a proven track record of gaming success for those looking to establish a foothold in the Midwest.

But it’s not all smooth sailing. Indiana’s legislative process has hit bumps in the road, with political hiccups like the 2023 conspiracy scandal slowing progress. Still, with the reintroduction of online casino legislation in 2025, the state seems back on track, poised to expand its offerings to offer further opportunities for ambitious online iGaming operators.

While House Bill 1432, which aimed to legalize iGaming and iLottery, made early progress in the 2025 session, it ultimately failed to pass the House Ways and Means Committee. This setback has temporarily stalled Indiana’s push toward online casino expansion, though industry advocates remain optimistic about future legislative attempts.

Meanwhile, Senate Bill 43 (SB 43) has gained traction, focusing on the potential relocation of existing casinos and racinos. The bill, approved in the Senate by a 33-16 vote, directs the Indiana Gaming Commission (IGC) to contract an independent market research firm to identify three regions in the state that could support a casino relocation. The study will assess potential gaming revenues, tax contributions, out-of-state visitor impact, and effects on local tourism.

Further to this, the bill requires an evaluation of the horse racing industry and the implications of a tribal casino opening in Indiana. A previous proposal to relocate Full House Resorts’ Rising Sun Casino northward was tabled, but SB 43 signals renewed interest in optimizing Indiana’s gaming footprint. If approved, the findings could lead to significant market shifts and new regional opportunities for operators.

Market Advantages and Drawbacks

Advantages

-

Engaged Player Base: A highly enthusiastic population of 6.8 million with a growing interest in online gaming.

-

Legislative Momentum: Progressive laws like House Bill 1432 pave the way for online casino expansion.

-

Established Infrastructure: Proven track record in sports betting with a stable regulatory framework.

-

Steady Revenue Growth: Online sports betting revenues are consistently climbing, offering lucrative opportunities.

-

Midwest Hub: Its central location attracts players and operators from neighboring states.

-

Scalable Tax Environment: Tiered tax rates designed to balance operator profitability and state revenue.

Disadvantages

-

Market Competition: Established operators dominate, creating challenging entry conditions.

-

Moderate Market Size: Indiana's smaller population limits the overall market scale compared to larger states.

How to Apply for a Gambling License in Indiana

Applying for a Sports Wagering Vendor License (SWV) in Indiana involves a structured process overseen by the Indiana Gaming Commission (IGC). Operators must meet stringent suitability and compliance requirements before they can legally offer sports betting services in the state.

Step 1: Determine Eligibility

Before applying, potential license holders must ensure they meet IGC suitability criteria, which assess financial stability, operational integrity, and compliance history. To enter the sports wagering market, Sports Wagering Vendors must partner with a licensed casino, racetrack, or sports wagering operator.

Step 2: Submit the SWV License Application

Applicants must complete and submit the Sports Wagering Vendor License Application, which requires:

-

Corporate disclosures, including business structure, ownership details, and operational history.

-

Financial documentation demonstrating fiscal responsibility and the ability to meet regulatory requirements.

-

Compliance and security measures ensuring adherence to state laws, geolocation requirements, and responsible gaming standards.

-

A non-refundable application fee of $100,000 is payable to the IGC.

Step 3: Key Persons & Substantial Owners – Personal Disclosure (PD-1) Submission

All Key Persons (executives, board members, and senior management) and Substantial Owners (individuals with significant control over the company) must submit a Personal Disclosure Form-1 (PD-1) for a suitability investigation. This process includes:

-

A $1,000 application fee per PD-1 submission.

-

Fingerprinting for background checks to verify the integrity and compliance history of individuals.

-

Additional documentation as requested by the IGC to assess the applicant’s eligibility.

IGC staff will assist applicants in identifying which Key Persons and Substantial Owners are required to submit a PD-1.

Step 4: Background Investigation & Suitability Review

The IGC conducts an extensive background check on both the applicant and all associated Key Persons. This review assesses financial standing, legal history, and adherence to regulatory standards.

Step 5: Await IGC Review & Decision

Once the investigation is complete, the IGC evaluates the application and suitability findings before issuing a licensing decision.

Step 6: License Approval & Compliance Obligations

If approved, the Sports Wagering Vendor License is issued, allowing the operator to begin offering services under Indiana’s regulatory framework. Annual renewal fees of $50,000 apply. Licensees must:

-

Submit regular financial and operational reports to the IGC.

-

Comply with responsible gaming initiatives, including self-exclusion programs.

-

Adhere to advertising and marketing regulations to ensure transparency and fair play.

For detailed information, application forms, and updates, visit the Indiana Gaming Commission's official website.

Amplify Your iGaming Strategy in Indiana

Indiana’s licensing and operational requirements can be challenging, but Altenar can help licensees once they are ready to go. Contact us today to learn how our reliable sportsbook and casino solutions can transform your operations and support your success in this thriving market.

Disclaimer

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability concerning its use.