Overview Gambling Laws and Regulations in Poland

Poland's gambling laws establish a structurally stable, yet restricted, market defined by state control and cautious regulatory practices. The industry has evolved significantly since its post-WWII prohibition under communism. Key reforms followed the 2009 "Black Jack Gate" corruption scandal, resulting in the Gambling Act that banned online casinos and established a state monopoly for gaming, anchored by Totalizator Sportowy.

Today, the market is tightly controlled by the Ministry of Finance. Private operators can obtain a six-year license to offer online fixed-odds sports betting. Compliance is rigorous, involving local server requirements, adherence to AML regulations, and real-time data archiving. A significant hurdle for entrants is the high 12% turnover tax on stakes. Despite these limitations, Poland offers considerable potential due to its large, sports-enthusiastic, tech-savvy population, allowing licensed brands to thrive within the regulated space.

This overview examines the complex history, current regulatory structure, and detailed requirements necessary for success in this demanding jurisdiction.

Poland’s gambling industry has undergone some significant changes in recent times, and there is the potential for further developments when it comes to the online casino sector.

In this article, we take a look at the current gambling laws in Poland, and what it takes to enter and comply in the regulated market.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

Brief History of Gambling in Poland

Poland’s relationship with gambling has always been defined by control of risk, of behavior, and of the state’s grip on the market. Long before regulation entered the picture, dice games and basic lotteries had established a quiet presence in Polish society. By the late 1800s, games of chance had become common enough to raise eyebrows from those concerned about their moral impact on society, yet they were scattered and small scale, with no formal governance to speak of.

Everything changed in the aftermath of World War II. Under the communist regime, gambling was effectively outlawed, framed as an elite indulgence incompatible with socialist ideals. But it never disappeared. Illegal slot machines, underground card rooms, and unlicensed betting continued to persist, fueling both public demand and an unspoken and tolerated black market.

The tide turned in 1989. As Poland reopened to capitalism, so too did its doors to legalized gambling. Casinos were reintroduced under state licensing and bookmaking followed soon after. By the early 2000s, the sector had gained a foothold, but oversight was lax, and political discomfort simmered beneath the surface.

That discomfort escalated in 2009, when a corruption scandal dubbed “Black Jack Gate” exposed alleged lobbying efforts surrounding gambling tax reforms. The political fallout was swift, and a new Gambling Act was passed within weeks. Suddenly, private operators were out, and a state monopoly, anchored by Totalizator Sportowy, was in. Online poker and casinos were banned outright. Betting and promotional lotteries were the only verticals left open to private firms, and even then, they were subject to strict control by the Ministry of Finance.

Further amendments in 2016, effective April 2017, gave regulators better tools for control in the realm of domain and payment blocking, stricter licensing standards, and new data archiving obligations. From that point forward, gambling in Poland was not only regulated but also policed.

Public attitudes have remained cautious ever since. There’s no cultural embrace of gambling as entertainment, as seen in most parts of Western Europe. Here, it’s treated more like a social risk to be managed, tolerated, taxed, but tightly kept in check.

Still, the foundations laid over the last 15 years have turned Poland into one of the most structurally stable, albeit restricted, markets in Central Europe.

Timeline of Gambling Regulation

Poland’s gambling laws have evolved slowly but decisively, with each reform shaped by cultural caution, political pressures, and public trust. Below is a concise timeline charting the key turning points that have shaped the Polish gambling sector we know today.

1945: Gambling prohibited under post-war communist state control.

1956: State-sanctioned lottery system reintroduced under national oversight.

1989: Collapse of communism opens the door to legal gambling activity.

1992: Totalizator Sportowy becomes a state-owned monopoly operator for the lottery.

2003: Private betting shops and casinos begin operating with local licenses.

2009: The corruption scandal (“Black Jack Gate”) sparks an urgent reform drive.

2009 (Nov 19): The Gambling Act is passed, banning online poker and casinos, and introducing a state monopoly on gaming.

2010 (Aug 27): Casino tender procedure rules published by the Ministry of Finance.

2016: Amendments expand the Gambling Act, introducing tighter controls and enforcement powers.

2017 (April 1): Amendments take effect; domain blocking and data rules come into force.

2018: New AML and data privacy acts come into effect for operators.

2023: Poland establishes a new gambling regulation unit within the Finance Ministry.

2025: Tender reform proposals and offshore affiliate blocking plan under discussion.

The Current Situation for Gambling

While Poland’s gambling laws have come a long way since the 2009 reforms, the present-day market still reflects the country’s cautious regulatory stance. What began as a response to scandal has evolved into a tightly controlled system that offers opportunities, albeit with clearly defined limits.

Polish players and bettors today can legally participate in land-based casino gambling, lotteries, sports betting, bingo, and promotional games. Online access, however, is more restricted. While Totalizator Sportowy holds the exclusive right to operate online casino games and e-instant lotteries, private operators can legally offer fixed-odds sports betting online, provided they are licensed domestically by the Ministry of Finance.

That distinction is important. Foreign (offshore) operators without a Polish license are barred from the market, with enforcement supported by ISP-level domain blocking and financial transaction restrictions. The Ministry maintains a publicly accessible Register of Illegal Gambling Domains.

Licensed operators must comply with local server requirements, AML and data protection legislation, and submit to rigorous auditing obligations. Taxation remains one of the heaviest burdens, with online sportsbooks subject to a 12% turnover tax, rather than a gross gaming revenue-based model.

Despite the obstacles, Poland’s market is not closed to opportunity. With a large, sports-enthusiastic population, strong brand recognition, and effective local partnerships, private operators can and have built viable positions in the regulated space. Fortuna, STS, and LV BET are among those who have done so legally, and their continued presence speaks to what is possible with the right approach.

Polish Gambling Authorities and Their Role

Poland’s regulatory structure is notably centralized, with the Ministry of Finance overseeing licensing, compliance, and enforcement through multiple departments under one roof. This integrated approach means operators deal with a unified system.

Ministry of Finance: Gaming Market Regulation and Tax Department

The Ministry of Finance sits at the top of Poland’s gambling hierarchy, and its Gaming Market Regulation and Tax Department is the central authority responsible for shaping the rules operators must follow. It governs every stage of gambling activity, from issuing licenses and permits to overseeing the tax regime and enforcing compliance. Under Article 1.2 of the Gambling Act, the department acts as both a regulator and a policy-maker, approving licensed operators and supervising their activities directly or through subordinate agencies.

It also manages tenders for land-based casinos, interprets legislation, and collaborates closely with the National Revenue Administration and other oversight bodies. Operators seeking to offer online betting or lotteries must work through this department to obtain legal clearance, as well as marketing permissions, advertising restrictions, and technical documentation. For any gambling business operating in Poland, this is the body where the process starts and where most key decisions are ultimately made.

National Revenue Administration (KAS)

The National Revenue Administration (Krajowa Administracja Skarbowa, or KAS) plays a central role in enforcing Poland’s gambling laws. Operating under the Ministry of Finance, KAS is tasked with overseeing compliance, licensing, and taxation within the gambling sector. Its responsibilities encompass issuing permits for various gambling activities, including promotional lotteries and bingo games, ensuring that operators adhere to the legal framework established by the Gambling Act.

KAS also conducts inspections and audits to detect and prevent illegal gambling operations. In 2023, for instance, KAS received 3,697 notifications for poker tournaments held outside casinos, highlighting its active role in monitoring gambling activities. Furthermore, KAS manages the Register of Illegal Gambling Domains, a tool used to block access to unauthorized online gambling sites. For operators seeking information on licensing procedures or compliance requirements, KAS provides resources and guidance through its official portal.

Office of Competition and Consumer Protection (UOKiK)

Although not a strict gambling regulator, UOKiK holds jurisdiction over commercial conduct in Poland, including how gambling operators market and sell their services. Its authority centers on competition law and consumer protection, two areas with growing relevance for the betting sector as scrutiny increases around advertising, promotions, and digital transparency.

Operators offering misleading promotions or failing to deliver advertised features may be subject to investigation or administrative proceedings. While it does not issue licenses, operators would be wise to view UOKiK as a regulator of behavior, especially where player trust, advertising claims, or terms and conditions are concerned.

General Inspector of Financial Information (GIIF)

The General Inspector of Financial Information (GIIF) serves as Poland’s Financial Intelligence Unit (FIU), operating within the Ministry of Finance. GIIF plays a significant role in safeguarding the integrity of the financial system by combating money laundering and terrorism financing, particularly within the gambling sector.

Gambling operators are subsequently mandated to implement comprehensive anti-money laundering (AML) measures. These include conducting risk assessments, applying customer due diligence (CDD) procedures, and reporting suspicious transactions to the relevant authorities.

Furthermore, they are required to establish internal procedures for anonymous reporting of AML violations and ensure staff training on AML obligations. Operators can access detailed information on their obligations and available resources through the Ministry of Finance’s official website.

Requirements and Regulations for Online Sportsbooks

Acquiring and maintaining a license to operate online sportsbook services in Poland involves traversing a tight regulatory framework. The primary challenge for new entrants lies in adhering to the comprehensive requirements set forth by the Polish Gambling Act of November 19, 2009, as amended, and its associated regulations. These stipulations encompass technical, financial, and operational aspects, all under the oversight of the Ministry of Finance.

Key legal steps include:

-

Obtain a License from the Ministry of Finance

Operators must secure a license specifically for mutual betting activities. This license is valid for six years and is non-transferable. The application process requires submission of detailed documentation, including game rules, age verification procedures, and technical specifications of the betting platform.

-

Establish a Physical Presence Recommended

While not explicitly mandated by law, establishing a registered office within Poland is widely considered beneficial. It strengthens regulatory trust, streamlines communication with local authorities, and may help facilitate the licensing process with the Ministry of Finance.

-

Use a Polish Top-Level (.pl) Domain

Online betting services must operate under a domain ending with ".pl". This requirement aids in the identification and regulation of authorized gambling websites.

-

Host Servers Within the European Economic Area (EEA)

All data processing and storage related to gambling activities must occur on servers located within Poland or another EEA member state. This ensures data security and compliance with EU regulations.

-

Implement Real-Time Data Archiving

Operators are obligated to archive all gambling-related data in real time. The archived data must be stored in a manner that allows for remote access by Polish regulatory authorities for a period of five years.

-

Comply with Anti-Money Laundering Regulations

As obligated institutions under the AML Act of March 2018, operators are required to implement comprehensive AML policies, conduct customer due diligence, and report suspicious activities to the General Inspector of Financial Information.

-

Pay the Gambling Tax

Operators are subject to a gambling tax, which is calculated based on the type of gambling activity conducted. For mutual betting, the monthly tax payable is 12% of the total stakes paid. (Articles 73 (1)(4) and 74 (7) of the Gambling Act)

-

Maintain Detailed Records and Submit Regular Reports

Licensed operators must keep comprehensive records of all gambling activities and submit quarterly reports to the Ministry of Finance. These reports should include financial statements and data on gambling operations.

-

Ensure Responsible Gambling Measures

Operators are required to implement measures to promote responsible gambling, including age verification systems, self-exclusion options, and providing information on gambling addiction support services. (Article 15i of the Gambling Act).

-

Adhere to Advertising Restrictions

Advertising of gambling services is subject to strict regulations. Operators must ensure that their marketing practices do not target minors or misrepresent the nature of gambling activities. (Article 29 of the Gambling Act)

Disclaimer

This summary is intended as a general outline for informational purposes only. Gambling regulations are subject to change and often require professional interpretation. For a comprehensive understanding of these requirements, operators should consult the full text of the Gambling Act of 19 November 2009, as amended.

License Costs and Tax Considerations

For betting operators, breaking into the Polish market comes with a price tag, and it’s not just the license fee. Between annual benchmarks, turnover taxes, and compliance deposits, operators must budget wisely and stay ahead of shifting regulations.

Licensing Costs

The fee for granting a betting operating permit is calculated as a percentage of the base amount, which is defined annually by the Central Statistical Office.

Specifically, the fees are as follows:

-

2,000% of the base amount for the betting operating permit

-

An additional 50% of the base amount for each betting point (physical location)

-

2,000% of the base amount for arranging betting via the internet

-

5,000% of the base amount for each website used for arranging betting

NOTE: These fees are subject to change based on the annually determined base amount. Operators should consult the latest figures published by the Central Statistical Office to calculate the exact fees applicable.

Taxation Obligations

Operators holding a sports betting permit in Poland are subject to a gambling tax, which is calculated based on the turnover generated from betting activities. The tax rate for betting is set at 12% of the turnover, regardless of whether the bets are placed online or at physical locations.

This turnover-based tax model means that the tax is applied to the total amount wagered by players, not on the operator's gross gaming revenue. As a result, operators must carefully manage their margins to maintain profitability.

In addition to the gambling tax, operators are required to provide financial security deposits to cover potential tax liabilities. For online betting, the required deposit is PLN 480,000, while for each physical betting point, the deposit is PLN 40,000. (Article 63 and 71)

Ongoing Compliance and Supervision

In Poland, holding a betting license is only the beginning. Maintaining it requires operators to meet a wide range of active obligations. Chief among these is the need for constant communication with the Ministry of Finance, which oversees betting activity and can audit operators at any time.

Operators must retain detailed records of every wager and outcome for a minimum of five years, as required by the data archiving regulation applicable to online gambling. These records must be stored securely in Poland and made readily accessible to authorities upon request.

In addition, compliance with Poland’s AML and CTF framework is mandatory. This includes customer due diligence, ongoing monitoring, and immediate reporting of suspicious transactions to the General Inspector of Financial Information (GIIF). Failure to comply can lead to enforcement action under both the Gambling Act and the Act on Counteracting Money Laundering and Terrorist Financing.

To mitigate risk, many licensed operators appoint local compliance officers, integrate real-time monitoring tools, and conduct regular internal audits to ensure compliance. In this jurisdiction, a reactive approach won’t suffice. Regulators expect systems that preempt problems before they emerge.

Opportunities and Future Outlook

For operators weighing entry into the Polish market, the opportunity is no longer theoretical. It’s already unfolding and gaining pace. Poland, with a population of 38 million and a high digital penetration rate, sits at the crossroads of growing consumer demand and a maturing regulatory environment. The online gambling sector, once constrained by cautious legislation and a dominant state monopoly, is now showing signs of evolution. In 2024, for instance, state-owned Totalizator Sportowy saw its revenues rise by 32%, with over two-thirds of the total driven by digital operations.

But here’s the catch: total casino revenues still account for only around 30% of Poland’s online gambling turnover. That leaves a sizable share of the market that is unlicensed, untapped, or underserved. The sportsbook vertical, however, is where private operators have room to move. Licenses are available. Brands like STS and Fortuna have established strong local presences, demonstrating that operators who adhere to the rules can scale. The tax on sports betting remains a challenge but operators with strong margin management and tailored risk models can still thrive, particularly if they invest in localization and mobile-first experiences.

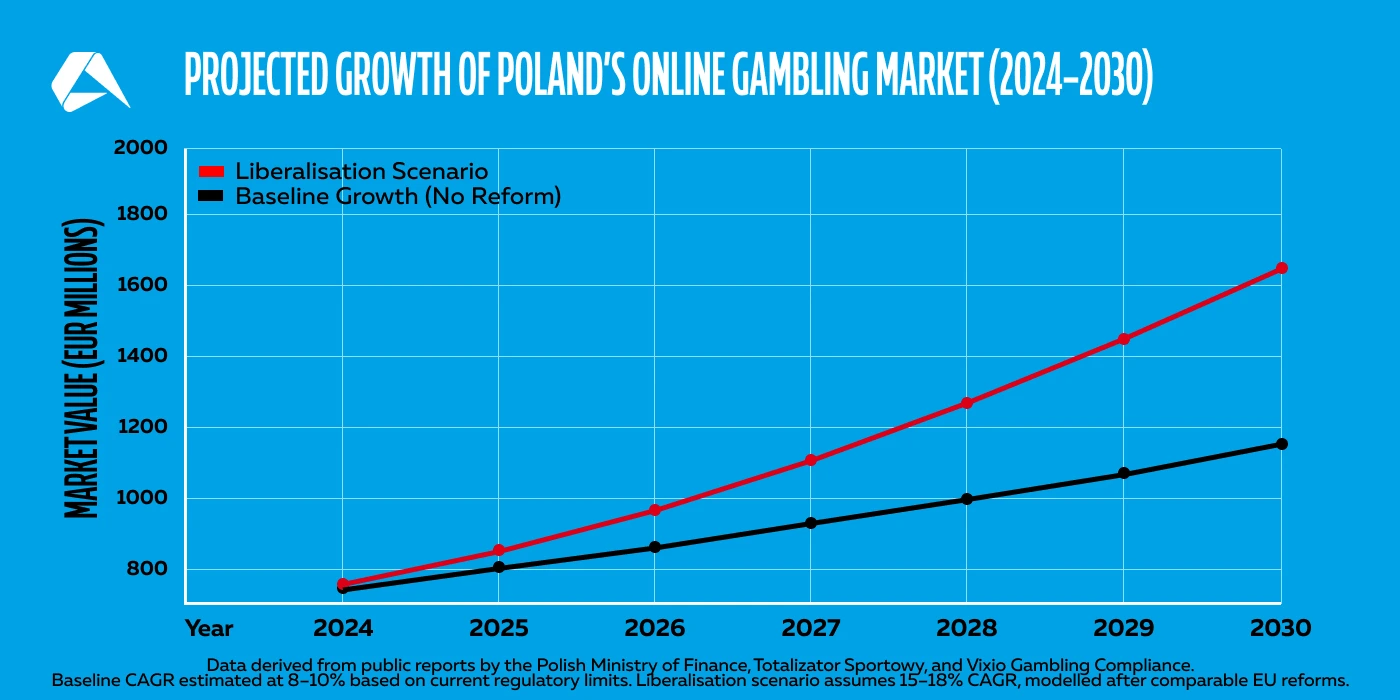

Two Possible Futures: Baseline vs Liberalization Growth Scenarios (2024 - 2030)

Even so, regulatory hurdles in Poland are not incidental. They’re hardwired into the legal framework. The 12% turnover tax on betting remains one of the most demanding in Europe, creating pressure on margins and disincentivizing high-volume play. Casino licenses, meanwhile, are still off-limits to private operators, with the sector reserved exclusively for the state monopoly.

What this means in practice is that sports betting operators must approach the market with a clear strategy that balances growth ambitions with an acceptance of structural limitations. Success here depends not just on regulatory compliance, but on shaping operations to fit the rules without compromising performance.

Looking ahead, there’s growing momentum behind calls to liberalize the online casino sector. While no immediate change is expected, the pressure is building from market analysts, local politicians, and even former regulators. Should reform come, Poland could shift rapidly from a semi-closed system to one of Europe’s most exciting emerging opportunities.

Key Market Advantages and Limitations

Poland’s regulated betting market offers scale, structure, and potential, but it’s not without limitations. Here is a quick overview of the advantages and disadvantages facing operators in Poland.

Market Advantages

Large, tech-savvy population

With nearly 38 million residents and high internet usage, Poland presents a significant market for online betting brands.

Strong consumer appetite

Poles are among the most active bettors in Central Europe, especially in football and esports.

Predictable regulatory environment

Operators can plan long term with confidence in legal continuity.

Limited local competition

Only a handful of licensed sportsbooks operate legally, offering room for well-prepared entrants.

Growing legal market share

The regulated sector continues to expand as enforcement against offshore sites tightens.

Market Disadvantages

High turnover tax

A 12% tax on stakes (not revenue) limits margins and can impact pricing strategy.

Casino sector closed to competition

Only the state-run Totalizator Sportowy may legally operate online casinos.

How to Apply for a Gambling License in Poland

Securing a betting license in Poland requires thorough preparation, local expertise, and precise documentation. Here is a general overview of the process, from application to approval:

1. Submit a Formal Application to the Ministry of Finance

To apply for a betting license in Poland, operators must submit their application, either by post or by email, to the Gambling Market Regulation and Gambling Tax Department of the Ministry of Finance.

All documents must be submitted in Polish, and certified translations should accompany any materials in a foreign language. Applications can be sent to:

Postal Address:

Ministerstwo Finansów

Departament Podatków Sektorowych, Lokalnych oraz Podatku od Gier

ul. Świętokrzyska 12

00-916 Warszawa

Poland

Email: [email protected]

Documentation:

The documentation to present includes:

-

A detailed business plan

-

Company registration documents (showing incorporation in the EU or EEA)

-

Evidence of a Polish tax identification number (NIP)

-

Technical documentation of the betting system

-

AML and CTF policy documentation

-

Proof of financial guarantees (bank deposit or insurance)

-

Draft terms & conditions for players

-

Description of internal control and responsible gambling measures

2. Provide Proof of System Compliance

Operators must demonstrate that their online platform meets Polish technical and regulatory standards, including:

-

Data archiving in accordance with the Regulation on the Method of Archiving Data in Online Gambling

-

Secure hosting of servers within the territory of Poland

-

Capability for real-time reporting to the Ministry of Finance

-

Internal control systems that monitor suspicious activity

This step often involves engaging third-party IT auditors to verify system integrity and readiness.

3. Await Review and Decision

Once submitted, the Ministry of Finance evaluates the application on both legal and technical grounds. If the documentation is incomplete, the Ministry may request clarification or additional evidence to support its review. Decisions can take several months, depending on the complexity of the application and the completeness of the initial submission.

4. Fulfill Financial Security Requirements

To activate the license, the operator must lodge a financial security deposit with the tax authorities:

-

PLN 480,000 for online betting

-

PLN 40,000 per land-based betting outlet (if any)

These deposits secure tax obligations and can be withheld in the event of non-payment.

5. Register Website and IP Addresses

All domains used for online betting must be registered with the Ministry. Operators must also ensure that their websites are not listed on the Register of Illegal Gambling Domains.

Note

Operators are strongly advised to work closely with local legal counsel and compliance experts throughout the application process, as even minor administrative errors can delay or jeopardize approval.

The Right Tech for the Most Regulated Markets

Poland rewards structure and precision. So do we.

Our iGaming platform is designed with regulatory frameworks like Poland’s in mind. From certified data systems to built-in reporting tools, Altenar provides operators with the legal and technical foundation needed to enter highly regulated markets with confidence.

Book a product demonstration now and see what a compliant and future-proof entry strategy really looks like.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.