Overview: Gambling Laws and Regulations in Costa Rica

Discover why Costa Rica remains a premier global hub for offshore iGaming operations in this comprehensive legal guide. We explore the unique regulatory nuances of establishing a betting business in a jurisdiction renowned for its cost-efficiency and rapid speed to market. Unlike traditional licensing frameworks, Costa Rica utilizes a specific data-processing model, allowing international operators to function legally via municipal permits without a formal federal gambling license, provided they strictly avoid targeting local residents.

This article breaks down essential operational requirements, from corporate incorporation and server residency to strict Anti-Money Laundering (AML) compliance enforced by the Costa Rican Drug Institute. You will also gain valuable insights into the territorial tax regime, which exempts foreign-sourced revenue from corporate taxation, offering significant financial advantages for startups. Whether you are navigating banking restrictions or seeking a strategic launchpad for Latin American markets, this overview provides the expert clarity needed for informed decision-making.

Read the full blog below and get expert insights on navigating Costa Rica’s iGaming landscape!

If this market has caught your attention, the chances are you’re weighing Costa Rica’s value as an operational base for your iGaming business. Maybe you’ve heard about its speed to market and low costs. Or perhaps you’re trying to separate fact from outdated forum commentary. Either way, this guide offers expert guidance beyond the usual chatter. You’ll find clear, expert insight on the real conditions, obligations, opportunities, and risks, written for operators who want to make informed decisions.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

Brief History of Gambling in Costa Rica

You might not guess it today, but Costa Rica’s connection with gambling runs deep, and not just in the offshore online world. The earliest records date back to the late 1800s, when card games, dice, and informal betting circulated through cafés and social clubs in San José. As the 20th century progressed, these games moved behind the doors of hotels, often as low-key draws for visiting elites and tourists.

In 1922, lawmakers sought to regulate the activity, introducing Law No. 3/1922, which defined games of chance and prohibited gambling unless explicitly permitted. The aim was moral clarity, but the effect was a patchwork of rules put together that would shape the gambling industry in Costa Rica for decades to come.

Public sentiment towards gambling activities has long reflected this tension. A nation proud of its social stability, wary of vice, but also pragmatic about revenue. That pragmatism emerged again in 1991, when Decree No. 20224-G legalized casinos, but only as amenities within licensed hotels. In this context, the thinking was clear. Gambling could exist, but not as the public face of entertainment.

A fundamental shift occurred with the advent of the digital age. In the late ’90s and early 2000s, Costa Rica, with its tech-friendly environment, ease of business formation, and lack of formal online gambling laws, attracted a wave of offshore operators. By some counts, around 300 companies still base themselves here, operating call centres and data hubs for international markets.

To bring structure, Law No. 9050/2012 and Decree 39231-MSP-MH/2015 introduced taxation and licensing for casinos and processing firms. Yet the core tension remained and while local players were barred, international-facing operators thrived in a legal grey area.

Timeline of Events

The following timeline charts the key laws, changes, and milestones in Costa Rica’s gambling history, tracing the country's evolution from early regulation to its current status as a central hub for international online operators.

1880s: First recorded evidence of gambling in Costa Rica

1922: Law No. 3/1922 prohibits chance-based gambling activities

1991: Decree No. 20224-G allows hotel-based casino licensing

1990s: First offshore online gambling firms arrive in Costa Rica

2001: AML Law No. 8204/2001 was passed, targeting financial crime

2009: Law No. 8718 grants lottery / sports betting monopoly to JPS

2012: Law No. 9050 introduces a gambling taxation framework

2015: Decree No. 39231-MSP-MH formalizes tax regime for casinos

2018: Costa Rica becomes an offshore base for iGaming

2021: JPS launches pilot for regulated online gambling concessions

2025: Pilot remains pending - the legacy offshore model continues

Current Situation for iGaming

As the earlier history shows, Costa Rica’s gambling market today remains one of contrast, with parts regulated and parts informal, yet it remains a hub for international online operators.

Land-based casinos operate legally, but only inside licensed venues. The Ministry of Public Security fully regulates these venues and pays taxes on revenue and gaming devices. There is no separate casino industry outside the hotel sector, and no standalone gaming halls.

Online gambling follows a different path. No formal iGaming license exists. Instead, a well-established offshore base runs international gambling sites from Costa Rica under a general business and data-processing model. These operators must be registered locally at the municipal level. However, they are not permitted to accept players living in Costa Rica, as stated in Article 1, Law No. 3/1922.

Lottery and sports betting remain the exclusive domain of the state-run Junta de Protección Social (JPS). Residents can only legally bet via JPS products. Private bookmakers, online or retail, are not allowed to serve Costa Rican players.

Regulatory Gambling Authorities and Their Role

Gambling in Costa Rica operates under two distinct models. For domestic players, all lottery and sports betting services are controlled by JPS. Private casinos may operate within hotels under a license from the Ministry of Public Security.

Meanwhile, international online operators can legally base themselves in Costa Rica by obtaining a data-processing license, which is issued through a local municipality and not a central regulator, provided they serve only foreign markets. In total, there are 84 municipalities (cantons), each governed by its own mayor and council and individually responsible for issuing data-processing licenses for online gambling operators.

Ministerio de Seguridad Pública (Ministry of Public Security)

The Ministry of Public Security licenses and supervises hotel-based casinos alongside data-processing ‘call-connection’ firms. It approves operations, including slot machines and gaming tables, and maintains an updated registry of authorized venues. As the primary gambling regulator, it collaborates with municipalities on permits and handles inspections, changes, and closures of equipment.

The Ministry also enforces AML compliance, ensuring operators adhere to transaction reporting standards. For international operators, it is the gateway authority overseeing daily regulatory adherence under Costa Rican law.

Junta de Protección Social

The Junta de Protección Social holds exclusive control over lotteries and sports betting in Costa Rica, serving only domestic players. It administers ticket sales, prize distribution, and supplier registration, and manages concession processes. The agency collects revenue for social welfare and publishes official draws, as well as information on licensed vendors.

While private operators are excluded from the lotto and sports betting markets within Costa Rica, JPS manages its own digital sales channels and oversees approved innovations in lottery and sports betting formats.

Instituto Costarricense sobre Drogas (ICD) / Financial Intelligence Unit

The Costa Rican Drug Institute (ICD), Costa Rica’s central drug and financial crime agency, houses the Unidad de Inteligencia Financiera (UIF) tasked with enforcing AML obligations for gambling operators. It mandates rigorous customer due diligence, a minimum five-year data retention period, and the reporting of suspicious activity to the Financial Intelligence Unit.

Operators must also report cryptocurrency and cross-border transaction risks, areas flagged by the ICD as prone to illicit finance. As a result, ICD oversight forms a core component of compliance for any licensed casino or data-processing entity in Costa Rica.

Ministerio de Economía, Industria y Comercio (MEIC)

The MEIC plays a significant role in gambling regulation in Costa Rica, not by issuing licenses, but by ensuring fair play in the marketplace. Its Consumer Protection Directorate oversees marketing practices, verifying that all gambling advertisements are transparent, honest, and non-deceptive.

It also handles consumer complaints related to promotions, bonuses, or misleading offers under the Consumer Protection Law and its implementing regulations. Through public consultations and enforcement power, MEIC sets standards that operators, both land-based and online, must respect to build and maintain trust with Costa Rican consumers.

Requirements and Regulations for Offshore Operators

Although Costa Rica lacks a regulated framework for gambling, international operators must still comply with several key rules to secure a municipal data-processing license and operate from within the country. These cover AML, advertising, company setup, and operational conduct.

In 2025, the following rules and regulations must be observed:

1. Local Company Incorporation

You must incorporate a legal entity in Costa Rica, provide a legally registered address within the municipality you are applying for, designate a local legal representative or lawyer, and register with municipal authorities to qualify for a data-processing permit.

2. Data-Processing License

Apply to the relevant canton for a license allowing online gambling data operations. This license enables server hosting locally, but prohibits processing transactions involving Costa Rican players or banking institutions.

3. Server and Infrastructure Residency

Decree No. 39231-MSP-MH/2015 provides that electronic betting call-connection companies and data-processing firms must base their operational infrastructure within Costa Rica’s jurisdiction to qualify under the local taxation regime.

4. Prohibition on Serving Local Players

Strictly no services or marketing may target Costa Rican residents. Operators must geo-block local IPs and maintain policies to prevent domestic access.

5. Anti-Money Laundering (AML) Compliance

Operators must implement comprehensive AML and KYC procedures, including ID verification, transaction monitoring, suspicious activity reporting, and maintaining paper trails in audit-ready systems, to comply with Law No. 8204/2001.

6. Cryptocurrency and Banking Restrictions

Transactions cannot involve Costa Rican banking systems. Operators typically rely on offshore or cryptocurrency payment methods to avoid violating domestic financial restrictions.

7. Compliance with General Advertising Law

Marketing must adhere to MEIC’s consumer protection rules. This means advertisements must be truthful, non-misleading, and not directed at Costa Rican residents, as per Law No. 7472/1994.

8. Business Continuity and Record-Keeping

Operators are required to maintain transaction and customer records for at least five years and be prepared for AML inspections conducted by the Costa Rican Drug Institute / Financial Intelligence Unit.

License Costs and Tax Considerations

The following outlines the requirements for licensing, taxation, and ongoing obligations in Costa Rica.

Municipal Business Licensing Costs

Municipalities (cantons) handle data-processing or call-connection permits, which are typically issued on a scale of weeks, not months.

The cost for the core municipal data-processing permit ranges from US $5,500 to US $7,500, covering the license fee itself, without optional add-ons. Additional expenses include legal representation, registration of a legal address, and document preparation - all services that operators can scale according to their budget and the provider's offerings. Annual renewals are also significantly cheaper, often falling under a few thousand dollars. With no formal federal license fee, municipal approval remains the core upfront cost for offshore operators seeking a legal base in Costa Rica.

General Taxation

Costa Rica operates a territorial tax regime, meaning that income earned from customers outside the country is exempt from corporate tax. Offshore iGaming operators thus pay no tax on globally generated profits. VAT (13%) also applies only to domestic goods and services, not to offshore betting revenues.

However, dividends distributed to non-resident shareholders are subject to a 15% withholding tax, while interest or royalties paid abroad may incur a further 15% withholding tax, unless reduced by a tax treaty.

Ongoing Costs and Compliance

Post-launch, operators should budget for annual municipal license renewals and legal representative fees, typically handled by local firms. Compliance with AML regulations (Law 8204/2001) entails ongoing costs for Know Your Customer (KYC) systems, record-keeping, and reporting suspicious transactions.

While overall operating costs are modest, diligent reporting and strong municipal relationships are essential to maintain legitimacy and avoid unexpected enforcement actions.

Opportunities and Future Outlook

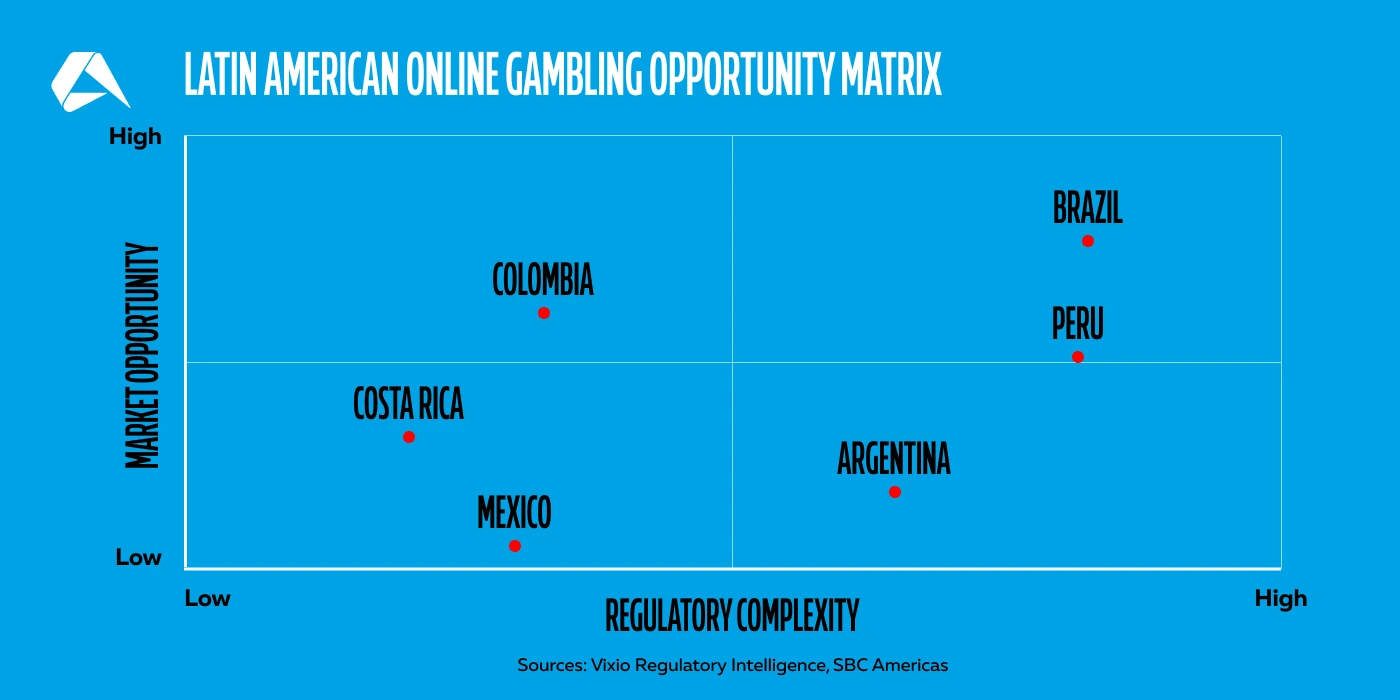

As a regional hub, Costa Rica remains one of the most efficient launchpads for iGaming operators in LatAm. It’s fast and low-cost. Operators must set up a local corporation, obtain a municipal data-processing license, and deployment is within weeks, not months.

A purely offshore model equates to no local gaming tax obligations on foreign-sourced revenues, no consumer-protection mandates, and AML and advertising as the sole serious regulator from day one.

Costa Rica enjoys a solid infrastructure, telecommunications are highly developed, and costs remain realistic. Operators targeting North American, Caribbean, or smaller LatAm markets will find a well-positioned operations center here.

Market Pros and Cons

Here’s a quick overview of the key advantages and disadvantages for operators considering market entry to Costa Rica, highlighting why many still choose it as a base, and the main drawbacks of the nation’s gambling market for international operators:

Market Advantages

Fast market entry

Quick municipal licensing: set up in days, not months.

Low operating costs

Minimal licensing fees and light tax burden.

Efficient corporate structure

Simple incorporation process for offshore operators.

No local gaming tax for online B2C

Offshore revenues are not taxed under domestic gambling law.

Proven offshore hub

Attracts over 300 operators, a trusted base for LatAm expansion.

Market Disadvantages

No local player access

The domestic market is closed to private online operators.

Banking challenges

Some international PSPs are wary of Costa Rica’s gray status.

Competitive field

Mature offshore market: New entrants face established rivals.

Book a live demonstration with Altenar today and see our advanced casino and sportsbook platform in action. Learn how it helps operators maintain high AML standards, deliver compliant player experiences, and manage responsible marketing practices across diverse markets.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.