Peru’s gambling market has taken off, and serious operators are taking notice. This newly-regulated jurisdiction isn’t just another Latam territory but one of the most exciting new opportunities for sportsbook and casino operators right now.

This article explains everything operators need to know, from licensing requirements to tax and compliance. If Peru is on your radar, keep reading because every competitive advantage in Peru starts with understanding what follows in this article.

Disclaimer

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.

A Brief History of Gambling in Peru

Gambling has long been more than a pastime in Peru. From informal card tables in colonial plazas to packed casinos on Lima’s coastline, wagering has threaded itself into the country's cultural and economic flow. What started as casual entertainment has matured into one of Latin America’s most structurally advanced gambling markets, driven by a pragmatic approach to regulation and an appetite for innovation.

The earliest forms of gambling in Peru trace back to the 19th century, with formal lotteries and rudimentary betting games appearing during the Republican era, but it wasn’t until the late 20th century that structured regulation took hold. In 1979, casinos were legalized under Decree-Law No. 22515, marking the first significant step toward a regulated industry. Key reforms followed in the 1990s, most notably Law No. 27153 in 1999, which regulated slot machines and introduced operational standards for casino venues.

Throughout the early 2000s, the land-based sector continued to expand, while online gambling remained largely unregulated but tolerated. Peru’s permissive stance during this period allowed international operators to thrive, albeit in a legal grey area. This leniency persisted until 2022, when policymakers began overhauling the system to bring clarity, fairness, and enforcement to digital betting.

By 2024, Peru had implemented one of the region's most complete national regulatory frameworks for online gambling. Licensing, taxation, player protection, and technical standards now fall under a clearly defined structure overseen by MINCETUR.

Today, public attitudes remain broadly supportive, shaped by the industry’s economic contribution and enhanced consumer protections. What was once informal and fragmented is now formalized, with Peru earning its place as a regional reference point for gambling regulation done right.

Timeline of Events and Legislation

From the legalization of casinos in the late 20th century to the launch of a nationally regulated online gambling market in 2024, the timeline below highlights the most important milestones that have defined Peru’s path toward becoming a structured and increasingly attractive gambling jurisdiction.

1979: Casinos legalized under Decree Law 22515 for the first time

1990: Structure for gaming tax introduced (Decree No. 608)

1999: Law 27153 regulates slot machines and casino operations

2006: Update of casino oversight and enforcement (Law 28945)

2008: First online gambling operator begins offering services in Peru

2012: Law 29829 modernizes the gambling industry and lowers taxes

2013: Unified monitoring system SUCTR launched for slot machines

2022: Online gambling & remote sports betting legalized (Law 31557)

2023: Tax and licensing changes to 31557/2022 (31806/2023)

2023: Supreme Decree 005/2023 sets tech rules and enforcement

2024: Implementation of the regulated online gambling market

Where Peru’s iGaming Market Stands Now

After years of gradual reform, Peru has stepped confidently into the era of regulated online gambling. What began as a collection of tolerated activities has been replaced by a clear, enforceable structure, transforming the country into a legitimate hotspot for iGaming across Latin America.

The turning point came in 2022 when Peru passed legislation formally regulating online gaming and betting. Since then, a flurry of regulatory developments has turned intention into implementation. As of 2024, licensed operators live under a fully regulated system. Today, both local and international brands are legally permitted to offer online sports betting, casino games, fantasy sports and esports betting to Peruvian players. Land-based gaming also remains well-established, with casinos and slot halls operating under separate but longstanding regulations.

Regulatory Gambling Authorities and Their Role

Behind Peru’s regulated gambling market stands a framework of interconnected authorities, each with direct implications for the business practices of industry operators. From licensing and fiscal registration to AML protocols, compliance demands attention at every level. Here are the primary regulators that operators will interact with in Peru:

Ministry of Foreign Trade and Tourism (MINCETUR)

MINCETUR is the executive body responsible for steering Peru’s gambling industry at the national level. While its remit spans tourism and international commerce, its role in gambling regulation has become increasingly prominent since the passage of Law No. 31557 in 2022. From this point onward, MINCETUR assumed direct responsibility for licensing, supervising, and enforcing online gambling and remote sports betting, placing it at the heart of the nation’s regulated iGaming framework.

It works in close coordination with sub-agencies, such as the Dirección General de Juegos de Casino y Máquinas Tragamonedas (DGJCMT), and is tasked with granting licenses, overseeing compliance, managing enforcement actions, and authorizing payment blocks and IP restrictions on illegal operators. Importantly, MINCETUR also supervises the registry of authorized service providers and ensures all operators meet stringent data protection and player verification requirements. For licensed operators, MINCETUR is the primary point of contact for administrative procedures, audits, and license renewals.

Directorate General of Casino Games and Slot Machines (DGJCMT)

The Dirección General de Juegos de Casino y Máquinas Tragamonedas, operating under MINCETUR, is Peru's central authority for regulating gambling activities. Established by Law No. 28945 on December 24 2006, the DGJCMT is tasked with formulating, proposing, supervising, and enforcing administrative regulations governing the operation of casinos, slot machines, remote gaming, and sports betting nationwide.

In its regulatory capacity, the DGJCMT issues authorizations for gambling operators, ensuring compliance with established standards. It maintains comprehensive oversight by supervising and inspecting gambling establishments and safeguarding adherence to legal and operational requirements. Further to this, the DGJCMT collaborates with other governmental bodies to address issues such as anti-money laundering and responsible gambling practices, reflecting its commitment to a well-regulated and secure gambling environment in Peru.

Superintendencia Nacional de Aduanas y de Administración Tributaria (SUNAT)

While MINCETUR manages licensing and technical oversight, SUNAT ensures that operators fulfill their tax obligations and contribute to the country’s tax base. Its influence is particularly significant in the early stages of market development, where financial discipline is considered a measure of credibility.

For licensed operators, it is the authority responsible for enforcing the tax obligations introduced under Peru’s 2022–2024 online gambling reforms, including the 12% tax on net winnings and the 1% selective consumption tax on wagers. International operators are required to register with SUNAT, submit monthly declarations, and maintain transparent records of all transactions. These obligations are backed by legislation and cross-agency cooperation, particularly with MINCETUR and the Financial Intelligence Unit (UIF), to support enforcement and prevent fraud.

Unidad de Inteligencia Financiera, UIF-Peru

Peru’s Financial Intelligence Unit (Unidad de Inteligencia Financiera, UIF-Peru), operating under the SBS (Superintendencia de Banca, Seguros y AFP), is the country’s frontline authority for anti-money laundering (AML) and counter-terrorist financing (CTF) enforcement. For iGaming operators, this means a direct regulatory relationship with an agency tasked with identifying and disrupting suspicious financial activity across the sector.

All licensed operators are classified as ‘obligated subjects’ and must comply with Peru’s AML policies. These policies include implementing internal risk controls, submitting Suspicious Transaction Reports (STRs), and appointing a compliance officer registered with the UIF. These obligations form part of the SPLAFT framework, a risk-based system that governs the prevention and detection of illicit activity in high-risk industries, including gambling.

In practical terms, UIF-Peru’s oversight compels iGaming licensees to be as operationally prepared for financial scrutiny as they are for technical and tax audits.

Regulations and Compliance Requirements for Sportsbooks

The Peruvian government has established specific legal requirements (Law No. 31557/2022, as amended by Law No. 31806/2023, and Supreme Decree No. 005/2023) that operators must meet to offer online gambling services legally. Here are the main requirements:

Licensing and Authorization

Operators intending to provide online gambling services in Peru must obtain a license from the Ministry of Foreign Trade and Tourism (MINCETUR). This process involves a thorough evaluation to ensure compliance with local laws and standards. Detailed information regarding the licensing procedure can be found on MINCETUR's official website:

Physical Presence and Legal Representation

International operators are required to establish a legal presence within Peru. This entails setting up a local office and appointing a legal representative domiciled in the country. These measures ensure that operators are subject to Peruvian jurisdiction and can be held accountable for their operations. Law No. 31557/2022 (Article 7) outlines specific stipulations regarding this requirement.

Technical Infrastructure

Operators are permitted to host their servers either within Peru or outside the country. However, these servers must be equipped with air conditioning, fire protection, uninterrupted power supply, and continuous accessibility, as stipulated in Law No. 31557/2022, Article 20.1–2. In addition, operators must provide MINCETUR with real-time access to their technological platforms, ensuring automatic daily transmission of consolidated economic and technical data to MINCETUR's Data Centre. (Supreme Decree No. 005-2023-MINCETUR)

Domain Usage

To operate legally within Peru, online gambling platforms must use a domain with the extension ‘.bet.pe’. This requirement is outlined in Article 7.6 of Law No. 31557/2022 and allows MINCETUR to clearly identify and regulate authorized operators in the country.

Taxation Obligations

Licensed operators are subject to a 12% tax on net winnings, defined as total bets minus total prizes paid out. A 1% Selective Consumption Tax is also levied on each bet placed. The National Superintendence of Customs and Tax Administration (SUNAT) monitors compliance with these tax obligations. Operators must register with SUNAT and adhere to all tax filing and payment schedules.

Anti-Money Laundering Compliance

Under Peru's anti-money laundering laws, operators are classified as 'obligated subjects'. They are required to implement comprehensive AML policies, including customer due diligence, transaction monitoring, and reporting of suspicious activities to the Financial Intelligence Unit (UIF-Peru).

Responsible Gambling Measures

Under Peru’s regulatory framework, all licensed online gambling platforms must offer tools that support responsible play. This includes the ability for users to set deposit and betting limits (Article 13.7) and options for self-exclusion on a temporary or permanent basis (Article 13.8). These requirements are clearly outlined in Supreme Decree No. 005-2023-MINCETUR, making RG compliance not just a best practice but a legal requirement.

Advertising and Marketing Restrictions

Licensed operators in Peru are permitted to advertise their services, but there are clear rules in place to protect consumers. Gambling ads must not target or include minors, and only operators with a valid Peruvian license are allowed to promote online gambling or sports betting. Marketing materials must reflect a commitment to responsible gambling and avoid any content that could be considered misleading or socially irresponsible.

License Costs and Tax Considerations

Entering Peru's online gambling market involves several financial commitments that operators must consider. These include licensing fees, taxation, and ongoing compliance expenses. Understanding these costs is crucial for effective financial planning and legal operations.

Licensing Costs

To legally offer online gambling services in Peru, operators must obtain a license from MINCETUR. The required guarantee is the greater of 3% of the operator's annual net income or 600 UIT (equivalent to PEN 3,210,000 in 2025). Licenses are valid for six years and can be renewed upon expiry.

Taxation for Gambling Operators

Peru imposes a 12% tax on the net income of online gambling operators, calculated as total bets minus prizes paid out. Furthermore, a 1% Selective Consumption Tax (SCT) is applied to each bet placed. Operators should consult official publications from MINCETUR and the National Superintendence of Customs and Tax Administration (SUNAT) for comprehensive and up-to-date information on these taxation requirements.

Ongoing Compliance Costs

Beyond licensing and taxation, operators must budget for ongoing compliance expenses. These include implementing and maintaining anti-money laundering measures, adhering to responsible gambling policies, and ensuring compliance with advertising restrictions. Operators are required to provide tools for players to set betting limits, self-exclude, and access support resources.

In addition to this, like in most other jurisdictions with a regulated framework for gambling in place, advertising must not target minors or vulnerable populations and should promote responsible gambling.

Disclaimer

This section was prepared using only official Peruvian government sources and reflects the legal and regulatory environment as of April 2025. All figures, obligations, and interpretations are accurate as of the time of writing; however, legislation and enforcement practices are subject to change. Operators are strongly advised to consult the original legal texts or obtain local legal counsel before making commercial or licensing decisions in Peru.

Opportunities and Future Outlook

Peru’s iGaming market has entered a fascinating era. What began as a patchwork of tolerated retail activity has matured into a fully licensed, regulated online sector with strong appeal for international operators. With a population of over 33 million and widespread enthusiasm for digital sports betting, Peru offers both scale and strong bettor demand for fresh digital experiences.

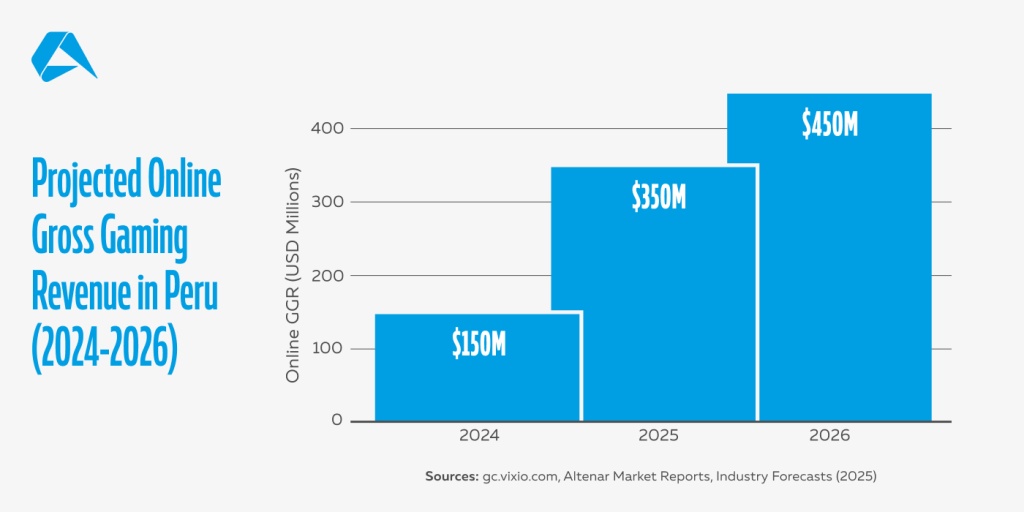

Further to this, industry analysts forecast that the country could generate over $350 million in online gross gaming revenue (GGR) by the end of 2025, an impressive figure considering that formal regulation only took effect in February of the same year.

This sharp rise in value reflects more than just demand. Peru’s legislative framework, anchored by Law No. 31557/2022 and its amendments, has brought clarity, accountability, and a level of predictability that some Latin American jurisdictions still lack.

Beyond the regulatory environment, Peru's economic indicators present a strong case for market entry. The nation's GDP has shown consistent growth, advancing a middle class with increasing disposable income. This financial stability translates into a population more inclined to engage in leisure activities, including online gaming. Moreover, the country's digital infrastructure has also seen significant advancements, with internet penetration rates surpassing 74% and smartphone adoption reaching 73% by 2025.

However, operators should be mindful of the competitive landscape. While the Peruvian online gambling market is expanding, it is also attracting many new domestic and international entrants. As in all expanding markets, differentiation through localized offerings, culturally resonant marketing strategies, and superior user experiences will be fundamental to capturing and retaining market share.

In short, Peru is shaping up to be one of Latin America’s most promising iGaming destinations. It is structured enough to provide confidence yet open enough to reward early movers.

Top Market Advantages and Disadvantages

Entering Peru’s iGaming market has benefits and drawbacks. Here’s a summary of the main trade-offs involved:

Market Advantages

Strong GGR Growth Trajectory

Peru is forecast to surpass $350 million in online GGR by 2025.

Clear Legal Framework

Operators benefit from a clearly defined regulatory structure that lays out the rules, responsibilities, and operational standards.

Untapped Digital Demand

High betting enthusiasm, especially in mobile sports betting, with low channelisation risk.

Tax Structure Favourable to Scale

Peru applies a 12% tax on net winnings and a 1% charge when funds are deducted to place a bet.

Balanced Market Segments

Peru's GGR is evenly split between online casinos and sports betting, allowing operators to effectively diversify their offerings.

Market Disadvantages

Mandatory Local Presence

Foreign operators must set up offices and appoint in-country legal representatives.

Strict Technical & AML Oversight

Operators face continuous scrutiny on real-time data access and risk monitoring.

How to Apply for a Gambling License in Peru

Acquiring a licence to operate online gambling services in Peru involves a structured process governed by MINCETUR. The following step-by-step guide outlines the necessary actions for operators based on official sources:

1. Understand the Legal Framework: Familiarise yourself with Law No. 31557/2022, which regulates remote gaming and sports betting in Peru. Supreme Decree 005/2023 and all other relevant laws for gambling operators.

2. Establish a Legal Presence in Peru: Operators must be legal entities incorporated in Peru or branches of foreign companies established in the country. This local presence is essential for compliance with Peruvian regulations.

3. Prepare the Application Documentation: Compile all necessary documents, including corporate details, descriptions of the technical platform, responsible gambling policies, and anti-money laundering procedures. A financial guarantee is also required.

Refer to MINCETUR's official site for detailed requirements.

4. Submit the Application to MINCETUR

To submit a licence application, new operators must contact MINCETUR directly to obtain the official requirements and forms. Applications are accepted on a rolling basis throughout the year, but operators must receive formal approval before launching any gambling services in Peru.

As of April 2025, the Ministry of Foreign Trade and Tourism does not provide a dedicated online portal for submitting gambling licence applications. Operators interested in obtaining a licence should contact MINCETUR directly through their official website for detailed guidance on the application process.

5. Pay the Licensing Fees

Once the application is submitted, operators must provide a financial guarantee equal to the greater of 3% of their projected annual net income or 600 UIT (approximately PEN 3.09 million in 2024).

6. Await Application Review

MINCETUR will assess the operator’s financial stability, platform capabilities, and internal controls. While no official timeline is guaranteed, processing times may vary depending on the completeness of the documentation and regulatory workload at the time of submission.

7. Comply with Technical Standards

Licensed operators must comply with Peru’s technical standards, which cover data integrity, identity verification, secure infrastructure, and real-time reporting to authorities. Platforms must be approved by authorised testing labs and support full visibility for SUNAT and MINCETUR. Full technical specifications are outlined in Supreme Decree No. 005-2023-MINCETUR and Law No. 31557/2022.

8. Register with the Relevant Authorities

In addition to obtaining a licence from MINCETUR, operators must register with:

-

SUNAT: For tax purposes, ensuring compliance with Peruvian tax obligations.

-

UIF: To adhere to AML regulations and reporting requirements.

9. Launch Operations in Compliance with Regulations

Once licensed, operators can commence operations, adhering strictly to Peruvian laws and regulations, including responsible gambling practices, AML measures, and advertising standards. Regular audits and reporting to MINCETUR and other relevant authorities are mandatory to maintain compliance.

Why Peru’s Just-Opened Market Deserves Attention

Peru is entering the regulated iGaming space at full stride, with clear legislation, defined tax rules, and an open licensing regime already in place. However, unlike more mature Latam markets such as Colombia or Brazil, Peru is still early in its growth curve. That presents a rare window of opportunity. Operators moving in now have the chance to establish strong brand equity and local partnerships before the market becomes saturated.

While the door to Peru’s gambling market is open, timing is everything. Book a demo with Altenar today and discover how our agile and compliant sportsbook solution can fast-track your launch in one of Latin America’s most promising markets.

Disclaimer

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Altenar does not accept any liability for its use.