Walk down any street in one of Thailand’s major city centers, whether it be Bangkok, Pattaya, or Chiang Mai, and the evidence is everywhere. Red Liverpool shirts drying on balconies. Billboards flashing weekend fixtures from London to Madrid. Café televisions and sports bars tuned to matches that kick off long after midnight.

For operators, this signals more than a casual fanbase. It’s a commercial indicator. Soccer is fast becoming an unofficial second religion in Thailand, and its center of gravity is European. Every late-night match watched and every in-play wager placed points to a culture already primed for advanced sportsbook experiences. The opportunity today has moved on from creating broad interest. For industry operators seeking regional expansion, the focus is more about how to channel it.

The Popularity Equation — European Leagues vs Thai League 1

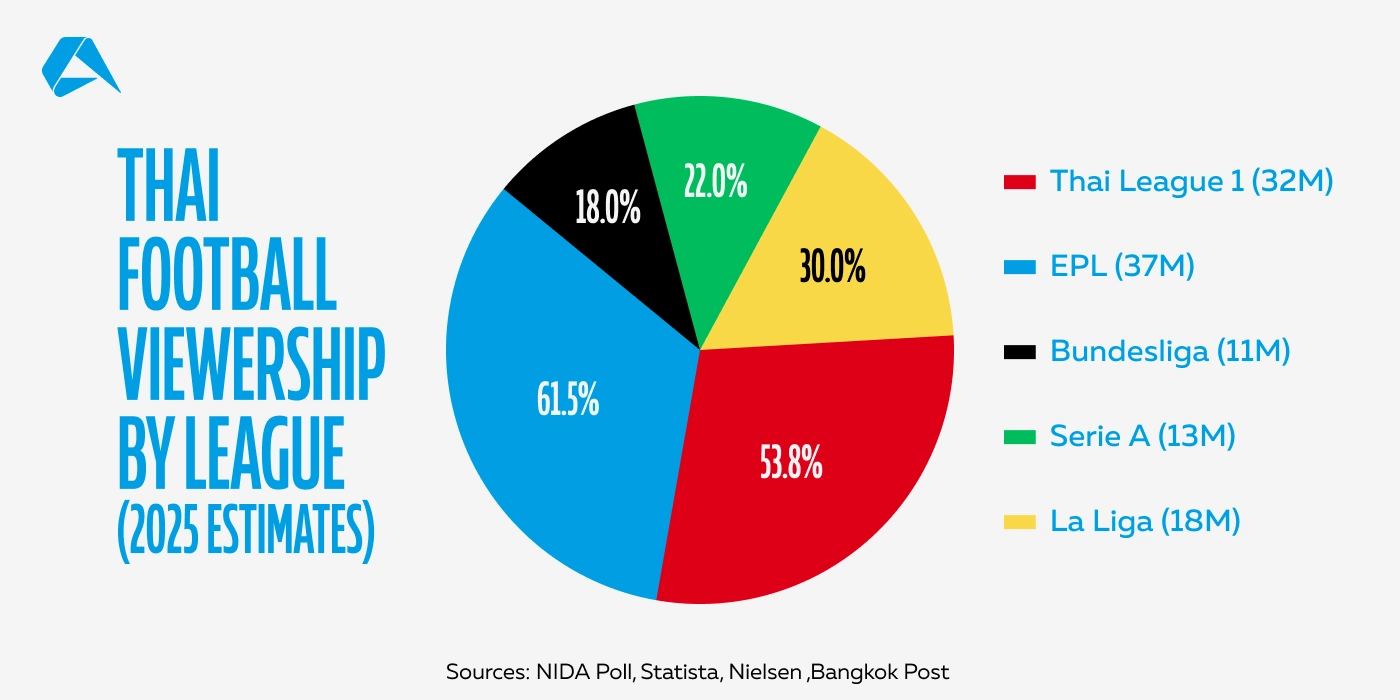

In 2025, recent surveys indicate that Thailand’s soccer loyalties are split between home pride and foreign glamour, but the scoreboard still leans heavily toward Europe. Surveys by NIDA Poll suggest around 61 percent of Thai adults follow the English Premier League in some form, compared with 53 percent for Thai League 1. That translates to millions of people tracking Premier League teams, highlights, or results, even if only a fraction stay up for the late-night kickoffs. The overlap is significant, with many Thai supporters splitting their loyalties between a hometown club and a European favorite.

Local sides such as Buriram United or Port FC command passionate regional support, but the domestic game remains modest in scale. By contrast, the Premier League, along with other big European leagues, offers global drama, elite players, and betting markets that feel limitless. For Thai punters, Europe delivers prestige and soccer that already feels local through constant broadcasts and social engagement.

The contrast is not merely cultural. It’s commercial. Broadcast rights for the Premier League in Thailand now top US$90 million a year, while the domestic market is valued at a fraction of that. For operators, these numbers mark where sustained engagement and handle potential already lie. That’s to say, in the competitions Thai bettors treat as their own, even when the stadiums are half a world away.

Approximate Support for European Football Clubs Vs Thai Clubs

Rank Club ≈ No. of Thai Fans 1 Manchester United ≈ 21 M 2 Liverpool ≈ 19 M 3 Chelsea ≈ 4.3 M 4 Manchester City ≈ 3.4 M 5 Arsenal ≈ 3.2 M 6 Real Madrid ≈ 2.4 M 7 Barcelona ≈ 2 M 8 Juventus ≈ 1.2 M

| Rank | Club | ≈ No. of Thai Fans |

|---|---|---|

| 1 | Buriram United | ≈ 22 M |

| 2 | Port FC | ≈ 7.5 M |

| 3 | Muangthong United | ≈ 7 M |

| 4 | Bangkok United | ≈ 3 M |

| 5 | Chiang Rai United | ≈ 2.4 M |

| 6 | BG Pathum United | ≈ 2.1 M |

| 7 | Ratchaburi FC | ≈ 1.8 M |

| 8 | Chonburi FC | ≈ 1.2 M |

Source: NIDA Poll 2023 via Hua Hin Today; Bangkok Post; population base ≈ 60 million adults (15 +)

A Nation That Bets Beyond Soccer

While soccer dominates the spotlight, Thailand’s appetite for betting stretches across a broader range of popular betting sports. In Bangkok and Chiang Mai, Muay Thai arenas still generate informal wagers placed between spectators. Horse racing, though confined to a few venues, remains a nostalgic presence for an older audience. Moreover, the government lottery, sold in every town and village, reaches deeper than any sportsbook ever could, with over 90 percent of Thai people buying tickets at least occasionally.

Meanwhile, younger sports fans are carving out their own space through esports and mobile-based prediction games, where social connection and digital wallets merge into a new form of casual betting. Together, these worlds show that gambling in Thailand isn’t confined to one sport or platform. In conclusion, soccer may be the most scalable entry point, but it sits within a much larger culture of wagering.

| Rank | Sport / Activity | Form of Betting | Estimated Engagement | Notes |

|---|---|---|---|---|

| 1 | Football (European & Domestic) | Online & informal cash betting | Very High | Dominates all age groups. EPL drives peak volumes. |

| 2 | Lottery (Government & Underground) | Legal + illegal draws | Extremely High | 90%+ of adults buy tickets. Informal lottery thriving. |

| 3 | Muay Thai | In-person & informal | High | Bets placed ringside and through local brokers. |

| 4 | Esports | Online & mobile apps | Medium–High | Rapid growth among 18–35 year-olds. |

| 5 | Horse Racing | In-person (RBSC) & small online markets | Medium | Heritage betting sport, declining but persistent. |

| 6 | Basketball (NBA & local) | Online & offshore sites | Medium | Popular with younger bettors. Driven by US coverage. |

| 7 | Badminton | Online & niche local betting | Low–Medium | National sport status, but limited betting infrastructure. |

| 8 | Volleyball | Online & casual pools | Low–Medium | Women’s national team success keeps interest steady. |

The Economics of Passion

Like other gaming justifications worldwide, soccer in Thailand isn’t just about entertainment, but a thriving economic environment that spans merchandise, media, and the informal betting market. Every weekend, millions of viewers tune in to Premier League coverage, and not just to watch but to participate financially in the outcome. The broadcast rights for the league in Thailand exceed US$90 million per season, and local brands pour millions more into sponsorships, replica kits, and viewing events.

While the official betting market remains restricted, the scale of informal wagering reflects that passion’s purchasing power. Industry analysts estimate that billions of baht circulate weekly through unregulated soccer bets. That energy extends online, where international operators report Thailand among their top 10 Asian markets by active user volume, even without local licensing.

It’s a pattern familiar across Southeast Asia: strong sporting allegiance translating directly into measurable economic behavior. In Thailand’s case, soccer acts as the country’s most consistent engagement driver, a product that commands attention all year-round and crosses every social bracket.

For industry professionals, these numbers tell a clear story. Thailand doesn’t need to be introduced to soccer betting, it’s already a mature environment, missing only legal clarity. If and when regulation eventually formalizes the market, the infrastructure of passion, loyal audiences, digital fluency, and cross-sport betting habits will already be in place. Those who prepare early, with the right local content and soccer-first products, will be best positioned to capture a fan base that’s been economically active for years.

How Thai Fans Bet and Watch

For Thai fans, a soccer match night often begins long before kick-off, with the bet itself becoming part of a ritual. Friends gather in cafés, rooftop bars, or small viewing spaces, each with a phone in hand, half-following the ball and half-tracking live odds. Most bettors use their smartphones as a second screen, flipping between match streams, social chats, and betting interfaces in near real time.

Social validation drives much of this behavior. LINE and Telegram groups function like digital betting circles, where screenshots of winning slips are shared. This peer network keeps bettors engaged, replacing the anonymity of global platforms with something that feels local, human, and immediate.

Bonuses and live features tend to matter more here than in complex markets. Thai bettors respond well to timed offers, such as a free bet at half-time or instant cash-outs, which fit within the flow of a match rather than outside it. And loyalty rarely stops at soccer. Many users drift to Muay Thai, esports, or even lottery apps between fixtures, treating wagering as a flexible, weekend habit rather than a single event.

Betting Culture, Regulation, and the ASEAN Ripple Effect

In today's market, Thailand’s betting culture is positioned in a legal gray zone shaped by tradition, technology, and proximity to more permissive neighbors, in a region where shared habits and changing laws influence cross-border activity faster than reform itself.

The Social Fabric of Thai Betting

Betting activities have always been more social than solitary in this part of the world. That’s to say, the act of placing a wager leans toward a shared moment rather than an event in isolation. In small towns, bets are exchanged verbally in social situations among friends. In urban environments, they’re commonly passed through social media messages or settled quietly at the end of a match.

These informal networks create a betting culture that operates on trust and proximity. People rarely gamble alone, and winning is celebrated together. Even without licensed sportsbooks, the community itself functions as one and is self-sustaining, adaptive, and constantly learning new digital tricks.

That social continuity is what industry operators often underestimate. Any platform entering the Thai market must feel communal, conversational, and credible. Much less a corporate interface, and more of an extension of how people already share risk and reward.

Regulation Grey Zone and the Hint of Change

Thailand’s gambling laws are full of contradictions. On paper, almost all betting is prohibited under the Gambling Act of 1935, except for horse racing and the state lottery. Yet in practice, sports betting thrives in plain sight both online through informal agents and across borders via offshore platforms licensed in the Philippines, Cambodia, or Curaçao.

Enforcement tends to come in waves, usually tied to major tournaments or political cycles, but it rarely alters long-term behavior. When websites are blocked, new ones appear. When arrests are made, local agents change names and reopen. For most bettors, these fluctuations register as background distractions, not deterrence.

Still, the tone of regulation is beginning to shift, even if public opinion hasn’t followed yet. A 2025 NIDA Poll found nearly 60 percent of respondents opposed legalizing casinos or online betting, despite growing government discussion about capturing revenue lost to offshore operators. Policymakers are studying models from the Philippines and Singapore, but public caution remains a powerful brake on reform.

Operators are watching for what happens next. Thailand’s population, digital literacy, and cross-sport betting culture make it one of Asia’s largest untapped markets. The question at this time appears not to be whether regulation will evolve, but how quickly.

The ASEAN Ripple Effect

What happens in Thailand rarely stays there. Betting behavior across Southeast Asia has always been interconnected, meaning fans, operators, and even payment channels move easily between borders. While Thailand still wrestles with its legal boundaries, its neighbors are showing what the next phase might look like.

In the Philippines, sports betting operates under PAGCOR’s regulatory umbrella, generating billions in state revenue and setting a precedent for transparent taxation. Cambodia continues to issue licenses for physical and online sportsbooks, mainly aimed at foreign users. Vietnam has cautiously opened pilot programs for sports wagering tied to domestic operators. Each of these markets influences Thailand by proximity and by proof, demonstrating that regulation, rather than prohibition, can be commercially and politically sustainable.

Thai bettors already cross these borders digitally. Many use offshore accounts licensed in Manila or Phnom Penh, connecting through e-wallets and mirror sites that project local familiarity.

For operators with regional ambitions, this is where opportunity takes shape. ASEAN’s (Association of Southeast Asian Nations) shared enthusiasm for soccer, mobile-first engagement, and flexible digital payments creates a connected corridor of demand. Should Thailand eventually legalize its market, the infrastructure - from player habits to payment flows - will already resemble that of its neighbors.

Soccer’s Digital Future in Southeast Asia

Operators positioning for Thailand or eyeing up the broader ASEAN market shouldn’t just focus on volume. The key across this region is to master player engagement with sports betting tech that can handle the speed at which Asian bettors interact. Soccer, in this context, isn’t simply the biggest sport, but the most interactive, where every goal, corner, or substitution becomes a moment to bet.

Responsiveness to the unique needs of bettors in this region is another major factor. Mobile optimization, localized odds feeds, and real-time settlements are expected. Bettors in Thailand switch between chat groups, live streams, and betting screens with ease, so a platform that lags feels dated.

Across ASEAN, this demand is mirrored by jurisdictions already regulating online betting. The Philippines, Cambodia, and to a lesser extent Vietnam, are building systems around fast data, flexible APIs, and tailored front ends. Operators watching Thailand’s evolution know they’ll need technology that can scale regionally yet feel local.

Thailand, in essence, is a digitally-fluent audience hungry for soccer-first experiences, waiting for platforms smart enough to move at their speed.

Building for the Speed of Asian Soccer Betting

Soccer betting is becoming more granular in all markets, meaning that it is more about the moments within a match than the final score. Asian bettors, perhaps even more so than in other regions, want interaction at every turn, like a next-goal bet, a penalty call, a booking in stoppage time. This micro-betting mindset, already visible in Thai esports communities, is reshaping soccer engagement into something continuous, fast, and social.

That’s where technology comes into play. Altenar’s sportsbook platform is built to respond in milliseconds, with live data integration and instant settlements that make in-play betting feel effortless. Its architecture supports micro-markets across leagues, offering flexibility in odds and timing so bettors can wager in the moment and not behind it.

Features such as Bet Builder, early payout, and zero-margin promotions give operators creative control over how those interactions happen, blending local familiarity with speed. Moreover, Altenar’s collaboration with Opta brings credibility to that experience, feeding real-time stats, player props, and live match trackers that keep bettors informed while deepening the emotional tie to each event.

For markets in Asia, which are similarly digitally fluent, soccer-obsessed, and enthusiastic for micro-moments, Altenar’s soccer technology meets these needs head-on with streaming technology fast enough for live play, local enough to feel personal, and proven across the region.

For operators ready to meet Asia’s bettors in the moment, Altenar provides the edge where it matters most.

Book a live demonstration to see Altenar’s sportsbook platform in action and explore the soccer features shaping tomorrow’s success in Asian markets.