If you’re looking for the story in Thailand right now, it isn’t the big-ticket Muay Thai matchups on Saturday night. It’s the midweek trickle of small esports bets placed around live moments in RoV, Dota 2, and PUBG Mobile from internet cafes and university halls. Esports has taken root, and it’s the clearest growth pattern in youth wagering.

Spend a week near those cafes, and a pattern emerges. Bet small, and bet often. One small bet at draft, another when a map swings, these are micro-stakes that add up. The number that really moves is frequency. Esports is wagered on all week, then it peaks on the weekend with football and Muay Thai.

The Shape of the Sports Handle

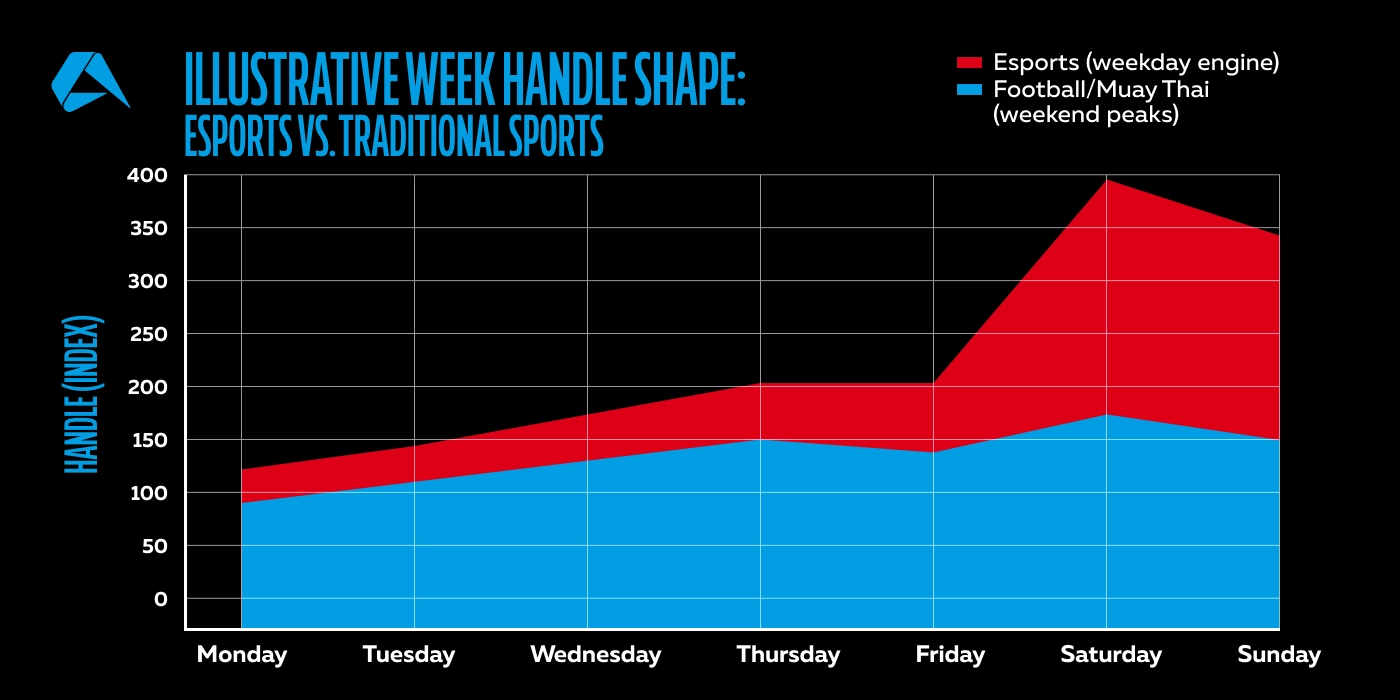

So what’s happening? If you take a look at the trajectory, you’ll see it builds momentum throughout the week. Instead of one big spike, you get a steady weekday line that widens around key esports fixtures, then a familiar rise on the weekend for football and Muay, showing handle built on layers.

The chart is illustrative. Figures are estimated for explanatory purposes to reflect observed patterns, with esports forming a steady weekday base via micro-stakes and traditional sports (football/Muay Thai) peaking on weekends. It is not a direct export of any single data set. Sources: DataReportal Digital 2025, Garena RoV Pro League (Thailand), Esports Charts, PUBG Mobile National Championship Thailand, Oddin.gg — 2024 esports betting trend reports (live/in-play share; title growth).

What creates those layers? Match series formats. A best-of doesn’t give you one betting moment, it gives you several. There’s a pre-map read, an in-map swing, and a reset at the interval. Thai youth use those resets as betting moments. One small slip at draft, another when momentum flips, a tidy cash-out when chaos hits. The ticket size remains modest, but the overall amount increases.

In this model, pre-match money still happens, but the energy moves to the live betting arena. Draft surprises, tactical pauses, eco-round steals, and late-game spikes are just a few of the triggers. If your live prices appear at the pace the stream feels live, you catch that energy. If markets gray out or accept slowly, the moment is gone, and the handle goes elsewhere.

Time of day slots also matter, but not in the old way. You’ll see shallow activity spread through late afternoons and evenings as students move between classes, cafes, and home, then sharper activity occurs when popular Thai rosters or campus teams play. To this extent, playoffs and mall-hall finals add short, yet predictable spikes.

What Triggers a Bet (and how to be there on time)

Bets tend to cluster at three moments: before play, during a swing, and between games.

-

Before play: when lineups are confirmed and strategies revealed, users place small ‘confidence’ bets.

-

During a swing: when momentum clearly shifts (early lead, big mistake, turning point), in-play bets surge.

-

Between games in a series: the short break acts like a mini-reset; fresh bets arrive as teams adjust.

To capture these key moments, betting odds need to keep pace with the action in real time. Keep a small set of always-on markets (winner, handicap, totals) visible, and don’t gray out unless the action is truly unreadable. Refresh next-game prices during breaks. Make cash-out feel fair when momentum changes direction. Brief, predictable suspensions are better than total lockouts. Deliver at those three points consistently, and you’ll be present exactly when decisions happen.

Who’s Betting and How

Think of students and early-career adults, mostly 18–29, who are predominantly on their phones. They watch on one screen and place small bets on another. It’s not about big money, it’s the frequency of a few baht here, a few there, several times a week that matters in this market. They move in groups. Private chats and campus circles act like small clubs. In this environment, people compare picks, share screenshots, and nudge each other to join the next bet. Social proof matters more than ads. If friends trust a price or a payout, others will follow.

Discovery is straightforward. Short clips, creator explainers, campus posters, and stream overlays are ways you will find your audience. Conversion happens when difficulty is low regarding fast sign-up, small minimums, and confirmed bet acceptance. Drop-offs, on the other hand, occur when markets gray out, accept slowly, or when cashing out feels like a challenge.

Loyalty is local. Thai-led teams, familiar personalities, and university squads reliably capture attention. Weekdays are for steady activity, weekends are for bigger moments in football and Muay Thai. People will switch between sports when the experience feels like a single account and a unified wallet, and not two different products.

Payments are small and frequent. Users expect quick top-ups, visible status on withdrawals, and reasonable checks when they scale up. Heavy verification at the wrong time will kill momentum in this market.

Side-by-Side With Traditional Thai Betting Sports

When comparing esports with the two biggest Thai betting sports, prioritize player behavior. Esports, Muay Thai boxing, and football reward form and momentum, but diverge on betting tempo, pricing tolerance, and integrity risk. It is these areas that should shape a product.

What’s the same:

Fans back form, momentum, and familiar names. Local loyalty matters, and social circles drive participation in stadium aisles for fights, group chats for esports, and pub or cafe talk for football.

What’s different:

Timing and inventory. Football and Muay Thai offer consistent main event fixtures. Esports offers dense schedules and series play, creating many small decision windows. That supports frequent, low-value betting rather than a few big moments.

Data and priceability. Football has mature betting models. Muay Thai pricing depends on expertise and concise information. Esports sits in between. It has rich live data but quick reversals that move prices. Winning here means dependable core markets and fast bet acceptance.

Latency tolerance. Stadium betting tolerates human lag, and football broadcasts are stable. Esports viewers expect prices that feel aligned and accurate with a live stream. If markets behave late, usage drops quickly.

Venue vs feed. Muay Thai’s atmosphere converts emotion into on-site wagers. Esports converts chat energy into in-app action. The UX, not the venue, is the sales floor.

Integrity profile. Football has global oversight. Muay Thai has a strong tradition but uneven transparency outside top stadiums. Esports risk has greater exposure in lower tiers and minor tournaments.

Cross-sell reality. Esports bettors will try football and Muay Thai if it feels like a unified product and wallet, with consistent cash-out logic and familiar local cues across sports. The reverse is limited. Without esports literacy, most traditional bettors won’t wager on esports.

Working conclusion:

Treat Muay Thai and football as peak drivers and esports as the habit builder, then design one experience across all three. Prioritize speed, reliability, and clear exits in esports. Lean into event-led storytelling for fights and football. Do that, and the segments reinforce each other instead of competing.

Integrity & Risk

A quick reality check. Online gambling is illegal in Thailand, and much observed activity rests offshore. That shapes the risk profile. Youth exposure occurs in social groups, and lower-tier esports carries a higher risk of manipulation than top leagues.

What actually matters to track

The following controls reduce exposure, protect brand trust, and keep you ready if policy ever shifts toward a regulated model that promotes consumer protection:

Where risk concentrates: tier-2/3 events, sudden lineup changes, last-minute format tweaks, unusual money on niche markets.

Data quality: prefer official feeds; timestamp price changes.

Market hygiene: offer fewer markets, but keep them available and stable throughout a match or event. Cap limits on fragile markets.

Fairness signals: brief, predictable suspensions during chaotic plays are preferable to blanket lockouts. Avoid pricing that lags with the stream.

Audience safeguards: avoid contexts involving those under 18. Keep language factual, and clearly outline limits and time-outs.

Thai Gambling Policy: What Changes First (if it changes)

In relation to the potential liberalization of the Thai betting market, the question most tend to ask is less ‘Will it legalize tomorrow?’ and more ‘If anything changes, what moves first, and how should we prepare without overreaching?

The most plausible first steps aren’t dramatic. They’ll look like consumer-protection measures. That’s to say, more explicit age-gating rules, firmer ad standards around youth audiences, stronger payment oversight (on-ramps and off-ramps), and data/audit requirements for anyone involved in wagering. You may also see study committees or limited pilot programs long before any official authorization.

Early signals worth watching are government task forces or white papers, payment-provider guidance on blocking/monitoring, public health consultations on youth exposure, and any move to formalize responsible-gambling standards (time/limit tools, age verification, transparency in odds). If those appear, operators can be reasonably confident that the center of gravity is moving toward a regulated market.

A standard view is that there’s a fair chance Thailand will first edge toward tighter consumer-protection frameworks and only then explore narrow on-shore channels. The full liberalization of sports betting seems unlikely in the near term.

Regional Lens: Esports and Legal iGaming in Asia

Across south-east Asia, the picture looks similar despite varying rules and regulations. Young fans live on their phones, esports runs every week, and policy ranges from tightly managed to hands-off. That mix rewards live pricing that feels truly live, a small set of markets that never disappear, and protections that people can see and understand. For operators seeking expansion in Asia, it is typically better not to chase every market, but pick a few places, learn from them, and keep what works. When the window opens elsewhere, you’re not starting from zero but importing a blueprint.

Philippines. The most open door in south-east Asia, as far as sportsbooks and iGaming is concerned. Licensing exists, regulators speak the same language as operators, and esports has a real calendar (arenas, malls, campus circuits). The commercial ground is straightforward, which is to build in-play that feels live, keep a tight core of markets (winner, handicap, totals), and pair it with visible safeguards (age gates, limit tools, audited data). Distribution runs through creators and mall events, with payments leaning toward mobile and e-wallet. Compliance and integrity are not virtue signaling; they’re the product.

Singapore. Highly structured, low-key environment with a state betting operator and strict advertising rules. Think partnerships, not platforms: education-first content, prediction products, and activations that respect the framework. If you work here, you’re building trust assets (clear odds education, live data explainers, and latency discipline) that transfer well to other markets.

Malaysia. Demand exists, but the operating climate swings with enforcement cycles. That pushes sensible brands toward content, data, and events, and not wagering. Esports is vibrant (malls, campuses, creator ecosystems), so the near-term opportunity is responsible fan products, such as schedule tools, match explainers, prediction games, and creator-led ‘how live odds move’ segments. Treat payments and KYC guidance as public-service content, not calls to action.

Vietnam. Big mobile audience, disciplined regulators, growing esports (PUBG Mobile, MOBA titles). Realistic near-term opportunities for data partnerships (official feeds), production and integrity services for events, and education layers (simple market mechanics, fair cash-out logic, stream-paced pricing) delivered via creators and venues. If pilots around sports wagering expand, the brands already demonstrating integrity will benefit.

The takeaway is about practicality. Prove speed, fairness, and responsibility where you’re allowed to do so. If you are new to Asian markets, choose two moves you can execute efficiently, such as a live-pricing pilot in the Philippines, a short trust-content series in Singapore, fan tools in Malaysia, or data/integrity support in Vietnam. Track the basics and build the habit now so you’re ready when new opportunities present themselves.

Curious to know how stream-paced pricing and fast cash-out feel in practice? Book a live demo of Altenar’s esports lobby and stress-test it against your targets across Asia.